Investing In Canadian Stocks & Etfs

Canadian Stock Exchange

Canadian stocks altogether had a worth of $3.2 trillion as of December 2020, accounting for about 4% of worldwide market capitalisation. Canada features a disproportionate number of world-leading companies grouped in three critical sectors – financials, energy and materials. Most of those companies have sound management, solid balance sheets, and a long-term record of growth and profitability. The benchmark TSX Composite index has approximately 250 stocks, and a sub-set of this index – the TSX-60 – consists of the best Canadian blue-chips.

Investors can buy Canadian stocks and bonds with a few alternative ways. Canadian stocks and bonds are often purchased directly on the Toronto stock market (TSX), the Canadian Securities Exchange (CSE, formerly the Canadian National Stock Exchange), or on other Canadian stock exchanges.

Investors can also easily gain exposure to Canadian stocks and bonds through exchange-traded funds (ETFs) or American depositary receipts (ADRs) on U.S. exchanges.

Venturing on Canada

Canada is one of the wealthiest nations in the world with a nominal gross domestic product of approximately $1.7 trillion. While the service industry dominates its economy, the country’s extensive natural resources control its exports. These factors have made Canada one of the premier global investment destinations, particularly for U.S. investors.

Canada is considered to be one of the safest countries in the world, with a stable monetary policy and a strong natural resource base. It is a healthy state with a low budget deficit.

Investors may want to consider the country’s strong ties to the U.S. which can lessen the beneficial effects of diversification. The country’s natural resources sector makes it prone to often volatile commodity price movements.

Avenues of Investing in TSX Equities

▪ Interlisted stocks : Interlisted stocks are those that are dually listed on a Canadian exchange like the TSX and on a U.S. exchange such as the New York Stock Exchange or Nasdaq. The interlisted stocks can be purchased in U.S. dollars, which is a major benefit to the U.S. investors. In fact, many of the interlisted stocks have the same ticker symbols on both Canadian and U.S. exchanges. Around 180 Canadian stocks are interlisted on U.S. exchanges.

▪ Exchange-traded funds and mutual funds : Mutual funds and ETFs are another popular methods of investing in a basket of TSX securities. They provide the diversity of an index with the simplicity of equity. Investors can invest in Canadian ETFs to gain exposure to the country’s entire economy, specific industries, or even certain asset classes. For example, the iShares MSCI Canada ETF is a $3.6-billion ETF that has been around since 1996. This ETF’s investment aim is to track the investment results of an index composed of Canadian equities. The ETF has an expense ratio of about 0.48%, making it an efficient way to invest in TSX shares.

Some of the popular Canadian ETFs are:

• Canada Energy Income ETF (NYSE: ENY)

• MSCI Canada Index Fund (NYSE: EWC)

• Market Vectors Junior Gold Miners (NYSE: GDXJ)

• Market Vectors TR Gold Miners (NYSE: GDX)

• Silver Miners ETF (NYSE: SIL)

• Uranium ETF (NYSE: URA)

• IQ Canada Small Cap ETF (NYSE: CNDA)

• S&P/TSX Venture 30 Canada ETF (NYSE: TSXV)

▪ American Depository Receipts (ADRs) : Investors seeking more direct exposure to Canadian companies can consider American Depository Receipts (ADRs). These securities trade on U.S. stock exchanges and represent a specific number of shares in a foreign corporation. Unlike a Canadian ETF, these ADRs represent a single company instead of a basket of stocks.

Some of the popular Canadian ADRs include:

Bank of Montreal (NYSE: BMO)

Bank of Montreal provides diversified financial services primarily in North America. The company’s personal banking products and services include credit cards, checking and savings accounts, financial and investment advice services, mortgages and commercial banking products and services comprise business deposit accounts, commercial credit cards, etc. for small business and commercial banking customers. It also offers wealth advisory services and investment to high net worth investors.

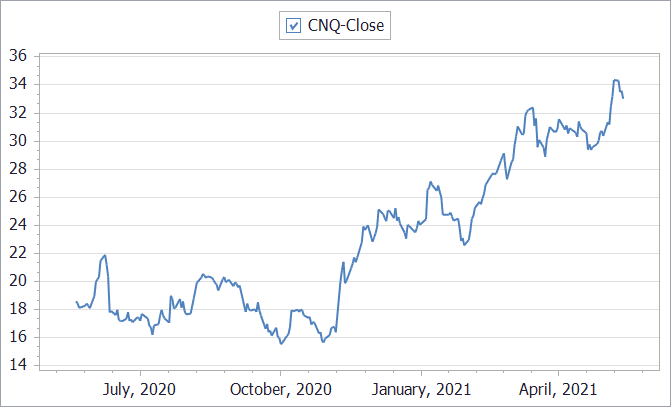

Canadian Natural Resource Ltd. (NYSE: CNQ)

Canadian Natural Resources Limited explores, acquires, produces, develops, markets, and sells natural gas, crude oil and natural gas liquids (NGLs). The company offers light and medium crude oil, synthetic crude oil (SCO), bitumen (thermal oil), Pelican Lake heavy crude oil and primary heavy crude oil. Its mainstream assets include two crude oil pipeline systems; and a 50% working interest in an 84-megawatt cogeneration plant at Primrose.

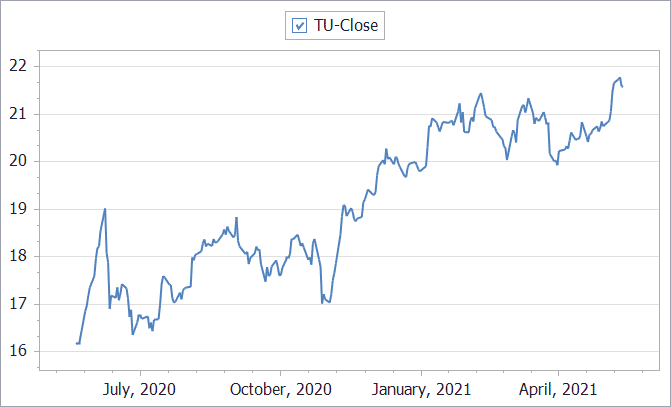

TELUS Corporation (NYSE: TU)

TELUS Corporation, along with its subsidiaries, provides information technology products and services and a range of telecommunications services in Canada. It operates through Wireline and Wireless segments. Its wireless products and services include equipment sales from mobile technologies and network revenue comprising data and voice. The Wireline segment includes data services revenues, such as television, internet protocol, cloud based services, managed information technology, hosting and many other telecommunications services.

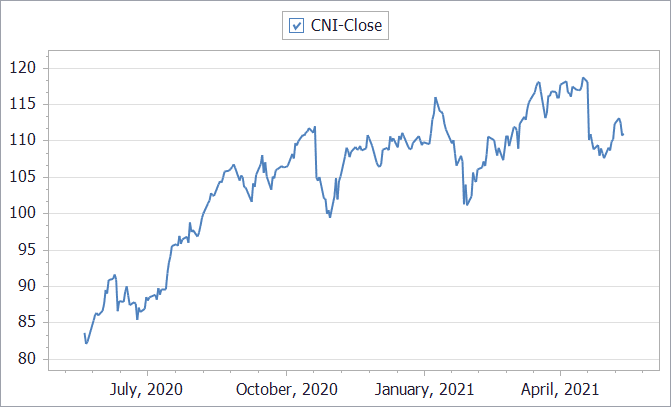

Canadian National Railway (NYSE: CNI)

Along with its subsidiaries, CNI engages in the rail and related transportation business. Its portfolio of goods includes coals, metals and minerals, petroleum and chemicals, grain and fertilizers, intermodal, forest products, and automotive products serving importers, exporters, retailers, manufacturers and farmers. It also provides transloading and distribution, vessels and docks, automotive logistics, and freight forwarding and transportation management services.

Brookfield Office Properties Inc. (NYSE: BPO)

BPO is a privately owned real estate investment firm. The firm engages in the ownership, management and development of premier commercial properties and also invests in core office buildings. It also provides ancillary real estate service businesses, such as amenities and tenant services. It primarily invests in development sites predominantly office buildings.

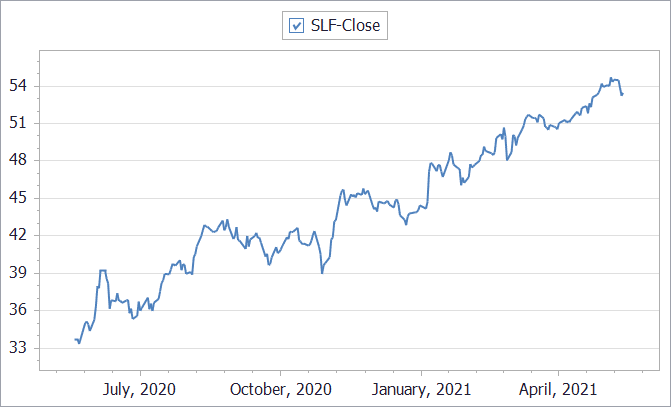

Sun Life Financial Inc. (NYSE: SLF)

Sun Life Financial Inc., a financial services company that provides wealth and asset management, insurance solutions to corporate clients and individuals worldwide. It offers term and permanent life, as well as dental, health, critical illness, long-term care, and disability insurance products. The company also provides investment counseling and portfolio management services, reinsurance products, mutual funds and segregated funds, merchant banking services, trust and banking services; real estate property brokerage and appraisal services.

(The Stock Price charts of above ADRs have been created with the help of MarketXLS software)

Alternatively, investors can also purchase foreign shares on the Toronto Stock Exchange (“TSE“) or the TSX Venture Exchange (“TSX”). Since Canada has strong ties to the U.S., many popular U.S. brokerages can make trades on these exchanges without much legwork. However, legal and tax implications should be considered. One should also take into account the fees charged by different brokerage houses and then make an informed decision.

Extracting & Analysing Information With MarketXLS:

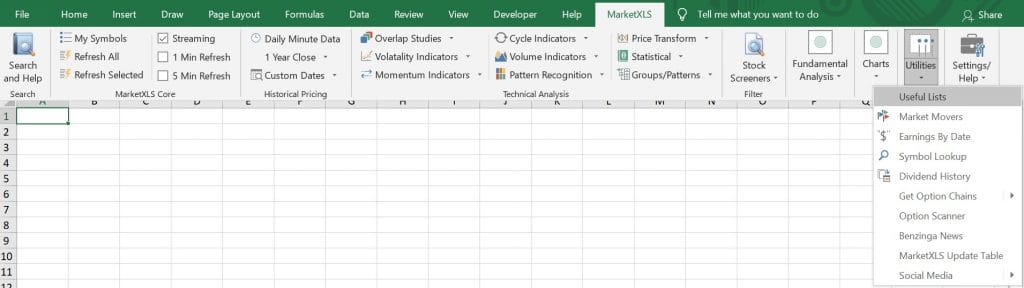

MarketXLS provides a one-stop solution to all your needs for trading in the financial markets. Keep your sheets updated with live Stock Quotes in Excel. Streaming market data for stocks, ETFs, options, mutual funds, currencies refreshed or refresh on-demand. You can get all the historical data (EOD, Intraday) you may need with MarketXLS functions or in a few clicks. Update the Excel tables dynamically and save your time in formatting those tables.

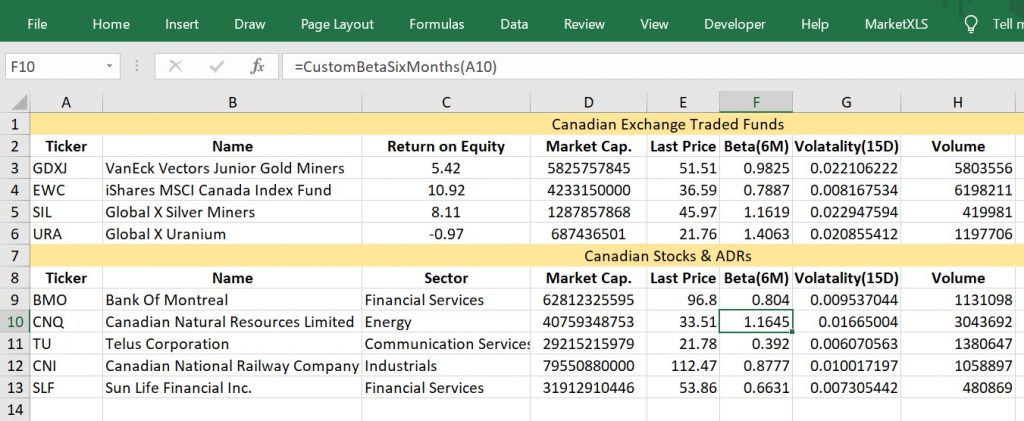

Investors can pull out the data of the Stocks, ETFs traded in U.S. & Canadian Markets with the help of MarketXLS formulas and functions. Investors can store the real-time data in Excel Sheets that are robust and can be in sync with the latest update. They can also get many technical and fundamental analysis data and the company’s financial statements as well.

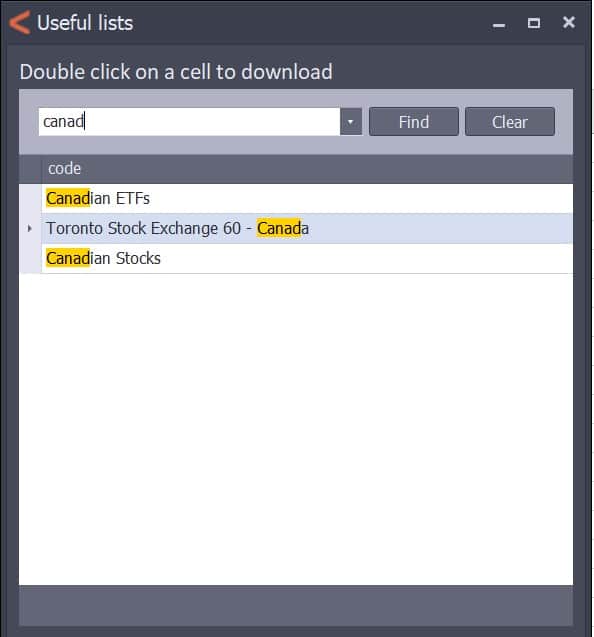

You can also download the list of Canadian ETFs & ADRs with the help of MarketXLS. Go to the MarketXLS tab in the ribbon. Go to the utilities section and click it. A list will pop out, select the option of useful lists from it. Search for the Canadian stock market-related lists.

Lists will appear with Canadian stocks, ETFs and TSX 60. Double click on any of the list to download it. You will find loads of information relating to every ticker. Use that to analyse your investments.

Benefits of Investing in Canada

Canada has an in depth natural resources base that ranges from precious metals to petroleum . These resources have allowed the country to export energy while sustaining itself at identical time. This provides the country a huge source of both current and potential wealth, while at a similar time it has developed a sophisticated skills-based economy like those within the U.S. and Europe.

Canada features a very stable rate of inflation, despite its enormous resource base. Natural resource-based economies are generally afflicted by fluctuating rates of inflation because of the volatility of energy prices. It can also be compared quite favorably with many European and Asian countries. This suggests a more manageable long-term outlook and monetary stability.

Though, the Canadian economy is renowned for its stability, the country’s financial, business and banking policies have also shielded its domestic economy from many of the worst excesses of the worldwide economy in recent decades.

Risks of Investing in Canada

Canada’s economy is strongly correlated to that of the U.S. which is its strongest trading partner. It means the country might not offer a lot of diversification for U.S. investors as other markets.

Canada’s economy derives much of its strength from natural resources commodities. The country doesn’t have much of a producing presence, nor a competitive level of research and development.

One more criticism of the TSX is that it’s too heavily weighted to cyclical stocks whose fortunes depend upon the domestic and global economies. With over 55% of the index consisting of those cyclical sectors, there’s merit to the claim that the TSX could also be overly vulnerable to swings within the economic cycle.

Is Now a Good Time to Invest in Canadian Stocks?

Canada offers investors a good opportunity to take a position in a robust economy with extensive natural resources. Those curious about adding Canadian exposure to their portfolios can do so with ETFs, ADRs, or direct foreign investments using preferred brokerage accounts.

Since Canada depends in large part on its extensive oil and gas industry, the slowdown within the global economy because of the COVID-19 pandemic has considerably impacted demand for such energy products. Although this was reflected within the Toronto stock exchange index and lots of individual stock prices in the Spring of 2020 when global stock markets tumbled, the TSX has since recovered all of its losses to post an all-time high in January 2021.

Another key economic factor is that the price of minerals mined in Canada and widely exported, including platinum, gold, titanium, nickel, cadmium, uranium, potash, cobalt, diamonds and other gemstones, graphite and salt will affect Canadian mining stock values. The Canadian stock exchange also lists many cannabis stocks, which have made significant gains over the previous couple of years.

So if you think that the long-term prognosis for the worldwide economy is positive, and economic progress will translate into rising demand for commodities, TSX stocks are certainly worth considering for inclusion in diversified portfolios.

Disclaimer

All trademarks referenced are the property of their respective owners. Other trademarks and trade names may be used in this document to refer to either the entity claiming the marks and names or their products. MarketXLS disclaims any proprietary interest in trademarks and trade names other than its own, or affiliation with the trademark owners.

None of the content published on marketxls.com constitutes a recommendation that any particular security, portfolio of securities, transaction, or investment strategy is suitable for any specific person. The author is not offering any professional advice of any kind. The reader should consult a professional financial advisor to determine their suitability for any strategies discussed herein. The article is written for helping users collect the required information from various sources deemed to be an authority in their content. The trademarks if any are the property of their owners and no representations are made.

Reference

https://in.finance.yahoo.com/

https://www.investopedia.com/articles/investing/090314/how-invest-toronto-stock-exchange-equities.asp

https://www.thebalance.com/invest-in-canada-buying-canadian-stocks-and-bonds-1979051

If you want to know more about Cannabis Stocks, click here.

Image Source

https://sbcamericas.com/2020/09/14/thescore-graduates-to-full-listing-on-the-toronto-stock-exchange/

I invite you to book a demo with me or my team to save time, enhance your investment research, and streamline your workflows.