Investing In Indian Stocks

Overview: Investing In The Indian Stock Market

India permitted foreign investments into the country in the 1990s. The adaptation of globalization policies flooded the gateways of the Indian economy at two junctures: Foreign Direct Investment (FDI) and Foreign Portfolio Investment (FPI). India stands as one of the leading economies in the world today. It is attracting more and more investors with each passing day in the USA and other such strong economies. India is the “I” in BRICS, which consists of the strongly growing economies of Brazil, Russia, India, China, and South Africa. India’s economy has grown exponentially over the past 20 years, and the country could be a great place to invest for the next 20 years as well. After globalization, investing in foreign markets has become relatively easy. Several instruments and ways are now available in the market to start investing in Indian markets.

The stock markets in India are dominated by its largest exchanges: the Bombay Stock Exchange (BSE) and the smaller National Stock Exchange (NSE), which are both based in Mumbai (formerly known as Bombay). All stock exchanges in India have to submit to oversight by the Securities and Exchange Board of India (SEBI).

Methods to Approach the Indian Stock Market

There are several ways to enter the Indian stock market from a foreign standpoint. To proceed further, the foremost requirement is to have an international broker that has access to these markets or open an account with an Indian stockbroker in India if you live outside of India. Make sure the Indian stockbroker has oversight from the SEBI. If you select a foreign broker, then you should make sure that it’s overseen by a major regulator, such as the U.S. Securities and Exchange Commission (SEC) or the U.K. Financial Conduct Authority (FCA).

The four prominent ways to invest in Indian stocks is as below:

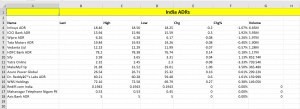

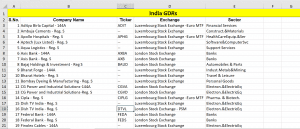

- Investing with the help of ADRs (American Depository Receipts) and GDRs (Global Depository Receipts) – Some of the largest publicly held companies in India list their shares on U.S. and U.K. exchanges through these depositary receipts. You could buy these depositary receipts through a commission-free broker like Webull or Robinhood, which offer free stock trading. Indian ADRs are listed on the New York Stock Exchange (NYSE) and the NASDAQ exchange, while GDRs traded on the London Stock Exchange (LSE). Some Indian stock ADRs trade on the over-the-counter market (OTCQX) in the United States.

You could also buy the stocks directly from an Indian exchange in an international account, through brokerages like Fidelity Investments or Charles Schwab. You’ll pay additional commissions and possibly currency conversion costs. You might also end up with foreign exchange risk if you live outside of India since stocks are generally priced in Indian rupees on India’s exchanges.

- Open an Account with an International Broker – Among the various international brokers, U.S.-based Interactive Brokers has a presence on the NSE and offers to trade in Indian shares, indices, futures, and stock options listed on that exchange. They also offer specific account structures for non-resident Indians (NRIs) living abroad, as well as for Indian residents in India. These accounts allow Indian traders to access NSE stocks and derivatives depending on their location.

Indians living abroad must meet the requirements for an NRI and have a Permanent Account Number card (PAN) issued by the Indian Tax Authority to qualify for these accounts. After verifying all of the applicant’s information, Interactive Brokers performs a one-time Know Your Client (KYC) interview, which is a condition imposed by SEBI for anyone trading in the Indian markets.

Interactive Brokers also offers a Demat Account for clients to hold Indian securities electronically. A Demat account is an account at a depository agency that issues a unique account number used for trading purposes. The Demat account is where your Indian securities are held in a paperless digital format.

- Invest in Indian Stock ETFs – Another excellent way to invest in Indian stocks is through ETFs. These funds combine the qualities of mutual funds with the flexibility of stock trading. Furthermore, unlike mutual funds that have to be purchased from a fund company and are priced at the end of the day, ETFs trade throughout the day like stocks. Another major advantage of buying shares in an ETF is that you can purchase them through reputable brokers, such as Interactive Brokers, E*TRADE, and TD Ameritrade for a low commission cost. You can also purchase them through digital wealth management firms like Betterment or Wealthfront for a 0.25% management fee.

Some of the top ETFs that include Indian stocks are:

- iShares India 50 ETF (INDY)

- iShares MSCI India ETF (INDA)

- WisdomTree India Earnings ETF (IXSE)

- Franklin FTSE India ETF (FLIN)

- Invesco India ETF (PIN)

- iPath MSCI India ETN (INPTF)

- First Trust India NIFTY 50 Equal Wtd ETF (NFTY)

- WisdomTree India ex-State-Owned Entrprs (IXSE)

- Open an Account with an Indian Stockbroker – You can also open an account with a SEBI-regulated broker in India. Depending on the amount of money you plan to invest in India, you may have to register with SEBI as a Foreign Institutional Investor (FII). You must first register for a PAN card that allows Indian tax authorities to track your investments and tax liabilities. You will also need to open a bank account in India since one is required to transfer funds to your broker in order to buy Indian stocks and to deposit money in after you have sold your stocks. You will also be required to open a Demat account.

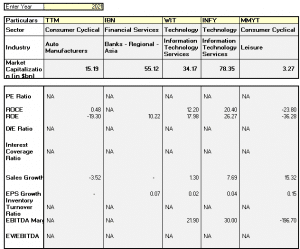

Choosing Your Best Possible Investment Options Using MarketXLS

MarketXLS provides a variety of stock screening options for its customers to evaluate various stocks and take efficient investing decisions. Below is one such template called the ‘Quantitative Ratio analysis’ method that you can use to evaluate various Indian stocks on the American stock market and take an appropriate investing decision accordingly. It will provide up to 400 options to choose from for filtering the investment options available in the market.

*How to use: Enter Year in cell E7 and Stock Ticker in cell E9, E11, E13 E15 & E17 of this sheet to get the result summary.

*Link to the template: https://marketxls.com/template/quantitaive-analysis-of-stocks/

*What to work with: Below is a list of a few top Indian ADRs, GDRs, and ETFs to choose from at the NASDAQ.

Key Takeaways:

Technology and tech startup stocks have exploded in India over the last 5 years, attracting more than $20 billion in investments. India has also attracted large investments from the United States, Japan, the United Arab Emirates, France, and Canada, and the country shows great promise for both individual and institutional investors.

Nevertheless, India still suffers from stifling bureaucratic rules and regulations, corruption, inadequate infrastructure, and underdeveloped institutions, all of which can present challenges, as well as opportunities for future improvement and growth.

Investing in India is easy and highly accessible to anyone who can trade ETFs and ADRs. Doing so does not need to be prohibitively expensive either, especially if you use some of the newer commission-free brokerages.

Finally, since Indian stock markets have a low correlation to other major world markets, they offer a good opportunity for investors outside of India to diversify their investment portfolios and provide exposure to attractive foreign equity markets.

Disclaimer

None of the content published on marketxls.com constitutes a recommendation that any particular security, portfolio of securities, transaction, or investment strategy is suitable for any specific person. The author is not offering any professional advice of any kind. The reader should consult a professional financial advisor to determine their suitability for any strategies discussed herein. The article is written for helping users collect the required information from various sources deemed to be an authority in their content. The trademarks if any are the property of their owners and no representations are made.

References

I invite you to book a demo with me or my team to save time, enhance your investment research, and streamline your workflows.