The Fundamentals of Option Pricing

The Fundamentals of Option Pricing

Options are one of the most liquid and popular derivatives traded in the market. They offer traders and investors the opportunity to take advantage of different types of trading strategies and profit from the volatility of the markets, especially the stock market. Investing in options is an art – and understanding the fundamentals of option pricing is a core element of trading success.

Option Theories

Options pricing is derived from different theories. In order to draw a better understand how option prices works, two of the most prominent theories are the Black-Scholes Model, and the Binomial Option Pricing Model. The Black-Scholes Model is the go-to model for pricing European style options, while the Binomial Model is predominantly used to value American style options and offers a more accurate way to assess option values.

The Options Market

An options market includes buyers, sellers, options brokers, clearing and settlement firms and options exchanges. Aside from being able to buy and sell options, investors use options to hedge their portfolios and profits, or to implement specific trading strategies such as covered calls, debit or credit spreads, and straddles or strangles.

Greeks (Delta, Theta, Gamma, etc)

Options traders use the “greeks” or different option characteristics to position themselves for profitability. By understanding the impacts of delta, theta, gamma, vega and rho on option pricing, traders can strategically position themselves to benefit from changes in the option premiums. Calculating these greeks requires an understanding of the pricing components, such as the underlying stock prices, the option’s strike price, volatility, time to expiration and the options premium.

Volatility and Options Premium

Volatility is important because it impacts option prices. High levels of volatility often result in higher premiums and the corresponding greeks may suggest more profitable trading opportunities. For example, if the implied volatility of an option increases, then the option’s delta will increase, which could possibly result in more profitable trades.

Options Trading Strategies

Options offer investors sophisticated strategies for hedging and generating trading profits. The beauty of options trading is that investors can customize options positions to achieve a desired risk/reward profile. Most trading strategies can be implemented using a variety of option positions, including call, put and spread positions.

Options Pricing Factors

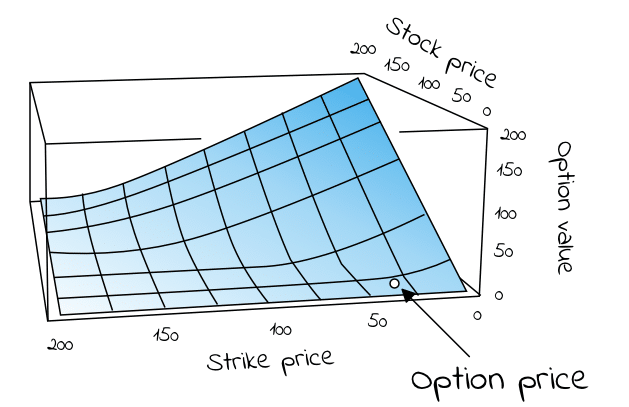

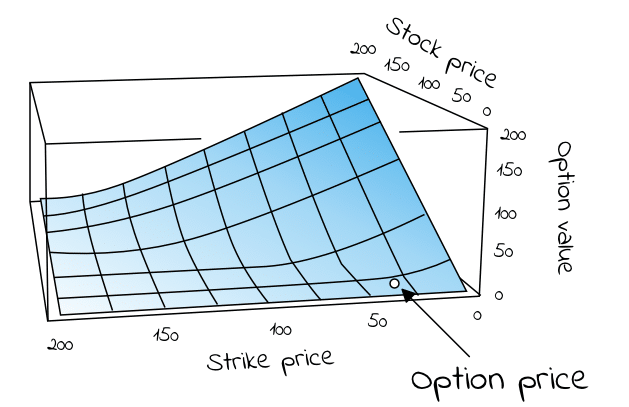

When an investor is trading options, there are certain factors to consider. These include the implied volatility, the intrinsic value of the options, the time residual value for the options and the time decay of the options.

Implied volatility is the current estimate used in the options pricing model (Black-Scholes) to reflect the expected price of the underlying stock over the specified period of time. The intrinsic value of an option is the difference between the underlying asset’s price and the option’s strike price. The time residual value represents the premium of the option at expiration, and the time decay of an option is its decreasing value as it approaches expiration.

Option Pricing Models

In order to fully grasp the complexities of option pricing, it is important to understand the various option pricing models. The Black-Scholes Model is the most commonly used model for European-style options, and is used for pricing risky call and put options. While the Binomial Option Pricing Model is generally used for pricing American-style options and offers more accurate pricing of options with high-volatility.

Time Value of Options

Options are derivative instruments that go “out of the money” or “in the money” depending on the direction the underlying stock moves. As expiration nears, the time value of an option will decline because the market expects less movement in the underlying stock. As a result of this decline in the time value of an option, buyers can receive an attractive return on their investment.

MarketXLS and Option Trading

MarketXLS is an Excel based solution that provides investors and traders with the opportunity to analyze options trading strategies and quickly identify profitable opportunities. With MarketXLS, traders can use options screener to identify option trades with the highest profits, calculate option prices, and monitor REAL TIME quotes. MarketXLS can provide traders with the tools they need to identify and capitalize on options trading opportunities and build a diversified portfolio using options.

To get started with options trading, be sure to

Here are some templates that you can use to create your own models

Search for all Templates here: https://marketxls.com/templates/

Relevant blogs that you can read to learn more about the topic

How Are Options Priced?

Get RealTime Updated Option Prices

A Comprehensive Look at Option Symbols

YieldBased Options: What You Need to Know

Use of Options to Hedge Market Risk

I invite you to book a demo with me or my team to save time, enhance your investment research, and streamline your workflows.