Using Covered Calls to Shield Your Long Positions

An Overview of Covered Calls

Investors use covered calls as an options trading strategy to generate extra income from their existing stock holdings. This strategy involves selling call options on a security held in the investor’s portfolio. The investor keeps the option premium but sacrifices any upside beyond the strike price of the call option. Covered calls are a popular way to generate extra income while limiting downside risks. Moreover, selling covered calls can protect an investor’s positions by reducing the impact of potential price declines. This makes it a valuable strategy for long-term investors to consider, as they can earn extra income while potentially mitigating losses.

Using Covered Calls to Hedge Long Positions

Investors often employ various strategies to mitigate risks associated with long positions in the stock market, and covered calls are one such popular strategy. Derivatives are financial instruments that derive their value from underlying assets, and by using derivatives, investors can protect their gains by offsetting potential losses with a corresponding position in the opposite direction. Specifically, using covered calls to protect your positions can be a useful strategy to minimize risks in the market. For example, a long portfolio of stocks can be hedged with a short position in future options or a put option. This hedging strategy allows investors to reduce their exposure to market risk and maximize their return on investment. By utilizing covered calls to hedge long positions, investors can protect their portfolios and limit their downside risks, particularly during a market downturn.

How can MarketXLS help with covered calls to protect your positions?

MarketXLS is a powerful Excel-based tool that provides traders, investors, and professionals with the tools and insights they need to make better investment decisions. So. this platform offers real-time financial news and reports, access to technical analysis features, stock and fundamentals data, screening tools, and more.

Moreover, with MarketXLS, investors can create custom formulas and analysis to assess the performance of their holdings, execute sound portfolio strategies, and customize their own reports. Additionally, the platform provides comprehensive financial data, analytical tools, and actionable insights that empower you to make smarter investment decisions. Overall, MarketXLS is a one-stop-shop for all your investment needs, offering a comprehensive suite of features to help you achieve your investment goals.

Relevant MarketXLS Functions on Covered Calls

Additionally, MarketXLS provides several functions related to covered calls, which can help investors execute sound portfolio strategies and generate extra income from their existing stock holdings. These functions include:

| Function Title | Function Example | Function Result |

|---|---|---|

| Short % of Float | =ShortSharesPercent(“MSFT”) | Percent of company’s shares that are being shorted. This information may be delayed because of the rules around reporting. |

| Volume Average Fifty Days | This function calculates the average volume for the past X calendar days in the given period. This value is updated everyday at around 5PM EST. | |

| Volume Average Hundred Days | This function calculates the average volume for the past X calendar days in the given period. This value is updated everyday at around 5PM EST. |

To fully utilize the features and benefits of MarketXLS, it’s important to use the AI-driven search for all functions on the platform, which can be found at https://marketxls.com/functions

In addition, MarketXLS offers a sample spreadsheet created with the platform’s powerful Spreadsheet builder, which can be downloaded from the link provided.

It’s important to note that the sample spreadsheet will pull the latest data if you have MarketXLS installed, and if you don’t, you may want to consider subscribing here to the platform’s services, which offer valuable tools and insights for investors.

https://mxls-templates.s3.us-west-2.amazonaws.com/MarketXLS-Model-ID-rlDqFv.xlsx

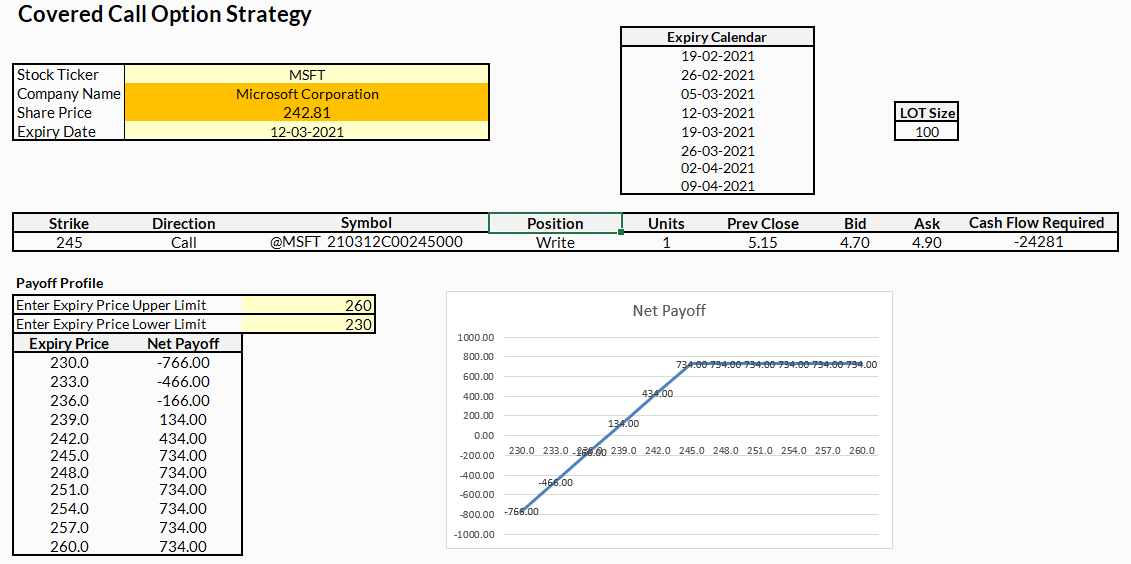

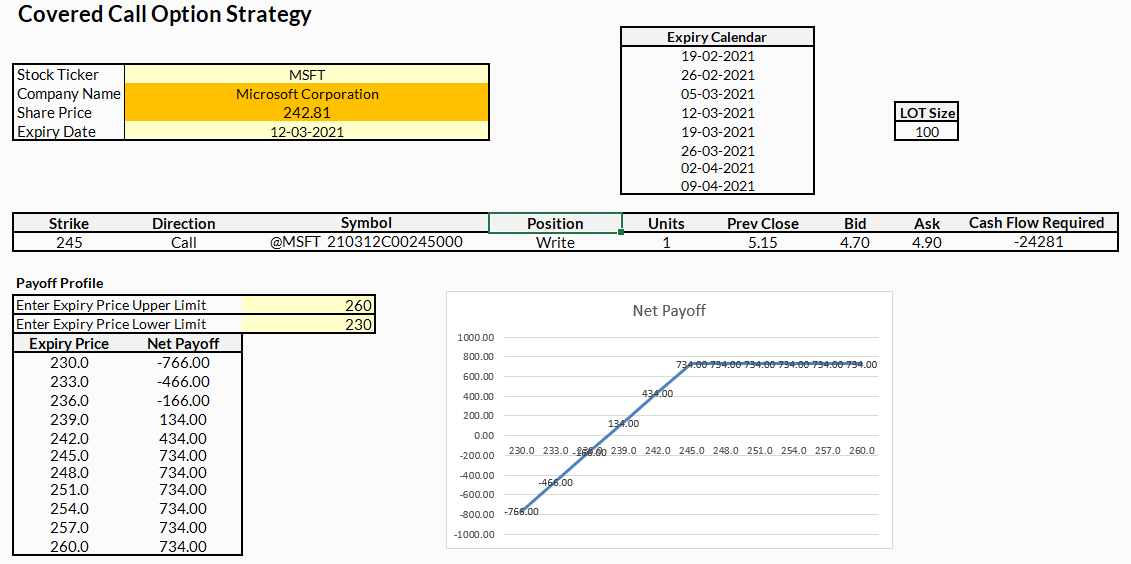

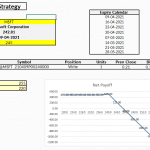

Moreover, MarketXLS offers several templates designed to help users implement covered call strategies, including some of the most relevant templates for covered calls.:

| Template Title | Template Link | Screenshot |

|---|---|---|

| Covered Call Option Strategy | https://marketxls.com/template/covered-call-option-strategy |  alt="Using Covered Calls to Shield Your Long Positions"> alt="Using Covered Calls to Shield Your Long Positions"> |

| Collar Option Strategy | https://marketxls.com/template/collar-option-strategy-3 |  alt="Using Covered Calls to Shield Your Long Positions"> alt="Using Covered Calls to Shield Your Long Positions"> |

| Covered Put | https://marketxls.com/template/covered-put |  alt="Using Covered Calls to Shield Your Long Positions"> alt="Using Covered Calls to Shield Your Long Positions"> |

| Covered Put | https://marketxls.com/template/covered-put-2 |  alt="Using Covered Calls to Shield Your Long Positions"> alt="Using Covered Calls to Shield Your Long Positions"> |

To help you further explore covered call strategies and gain a deeper understanding of the topic, MarketXLS offers several resources. Use AI-driven search to easily find all templates related to covered calls on the MarketXLS website at: https://marketxls.com/templates/

In addition, there are several relevant blog posts available on the MarketXLS website listed below:

Covered Calls: What They Are & How They Protect Your Investment

Covered Calls – What They Are & How You Can Profit (With Marketxls Data)

Mitigate Risk with Covered Calls

Gaining an Edge with Covered Call Backtesting

These resources provide valuable insights and information to help you make informed investment decisions and maximize your returns.

Get Market data in Excel easy to use formulas

- Real-time Live Streaming Option Prices & Greeks in your Excel

- Historical (intraday) Options data in your Excel

- All US Stocks and Index options are included

- Real-time prices and data on underlying stocks and indices

- Works on Windows, MAC or even online

- Implement MarketXLS formulas in your Excel sheets and make them come alive

- Save hours of time, streamline your option trading workflows

- Easy to use with formulas and pre-made templates

I invite you to book a demo with me or my team to save time, enhance your investment research, and streamline your workflows.