Table of Contents

- Introduction

- What is Monte Carlo Simulation?

- Who invented Monte Carlo Simulation?

- Is Monte Carlo Simulation relevant for todays Stock Market?

- What are the 5 steps in a Monte Carlo simulation?

- How to generate simulated data in Excel?

- How to run Monte Carlo Simulation data in Excel with MarketXLS?

- Summary

Introduction

Are you looking to make smarter financial decisions under uncertainty? Imagine having a crystal ball for the stock market, helping you foresee possible future outcomes. With Monte Carlo Simulation in Excel, you can do just that! This article will guide you through the basics of Monte Carlo Simulation and show you how to leverage MarketXLS to run powerful simulations. Get ready to dive into a simple yet effective way to enhance your investment strategies!

What is Monte Carlo Simulation?

Monte Carlo Simulation is a quantitative technique used to understand the impact of risk and uncertainty in financial models, including those for the stock market. By generating thousands of possible future price paths for a stock, it helps in estimating the probability of different outcomes. This simulation uses random sampling and statistical modeling to address the unpredictable nature of markets. Traders and portfolio managers employ it to forecast future stock prices and assess potential returns. It helps them make informed decisions under uncertainty. Additionally, it accounts for different variables like volatility, correlations, and time horizon, providing a more comprehensive analysis.

Who invented Monte Carlo Simulation?

Monte Carlo Simulation was invented by mathematician Stanislaw Ulam during World War II while working on nuclear weapons projects at Los Alamos. He initially developed it to solve complex physical problems. Later, economists and financial analysts adapted the technique for the stock market. It helps them evaluate the probabilities of different investment outcomes. By simulating thousands of scenarios, it allows investors to assess risk and return more accurately. The method revolutionized financial modeling, providing a robust tool to handle market uncertainties.

Is Monte Carlo Simulation relevant for todays Stock Market?

Monte Carlo Simulation remains highly relevant in today’s stock market. It offers a robust method for assessing risk and uncertainty. Investors leverage it to predict future asset prices by running numerous random scenarios. This helps in making informed decisions. Portfolio managers use it to understand potential returns and risks. It provides a probabilistic approach rather than deterministic forecasts, thus accommodating market complexities. Moreover, Monte Carlo Simulation assists in stress testing portfolios against extreme market conditions. Despite its advantages, it requires accurate input data to be effective. However, its computational demands are manageable with modern technology. Overall, it is a valuable tool in contemporary financial analysis and strategy.

What are the 5 steps in a Monte Carlo simulation?

A Monte Carlo simulation involves five key steps. First, define the problem or system to be studied. Next, construct a mathematical model to represent the system. Then, determine the inputs and their possible ranges and distributions. After that, generate a large number of random samples within the defined input ranges and run the model for each sample. Finally, analyze the results to make inferences or decisions. This method helps in understanding the impact of uncertainty and variability in complex systems.

How to generate simulated data in Excel?

Generating simulated data in Excel is straightforward and efficient. Begin by deciding the type of data needed, whether it’s numeric, categorical, or a mix of both. Utilize Excel functions like RANDBETWEEN for random integers or RAND for random decimal numbers. For categorical data, create a list and use the CHOOSE function alongside RANDBETWEEN to select random categories. You can also use the Data Analysis Toolpak, which offers advanced statistical functions. Custom formulas combining these functions can create more complex data sets. Always verify the generated data to ensure it meets your specified criteria and distributions. Excel’s flexibility makes it ideal for quickly generating varied and useful simulated data.

How to run Monte Carlo Simulation data in Excel with MarketXLS?

Preparation Steps

1. Install MarketXLS Add-in:

Ensure that the MarketXLS add-in is properly installed and integrated into your Excel application. If not done already, refer to the MarketXLS installation guide available in your account or support documentation.

2. Prepare Your Data:

Collect the historical data of the stock or any other asset you want to perform the Monte Carlo Simulation on. This could include prices, returns, or other relevant financial metrics.

Steps for Running Monte Carlo Simulation

• Step 1: Data Collection**

– Use MarketXLS functions to pull historical data.

=Close_Historical("AAPL")• Step 2: Calculate Daily Returns**

– Calculate the daily returns from the historical prices.

= (Price Today - Price Yesterday) / Price Yesterday• Step 3: Calculate Statistical Measures**

– Calculate mean and standard deviation of the daily returns.

Mean: =AVERAGE(Returns)Standard Deviation: =STDEV(Returns)• Step 4: Generate Random Values (Using Normal Distribution)**

– Generate random scenarios using Excel’s built-in normal distribution function.

=NORMINV(RAND(), Mean, Standard_Deviation)• Step 5: Simulate Future Prices**

– Create simulations for a future period. For each day, simulate a price change using the random values generated in the previous step.

Future_Price = Today's Price * (1 + Simulated Return)• Step 6: Run Multiple Simulations**

– Set up to run multiple simulations (e.g., 10,000 simulations) to understand the range of possible future outcomes.

• Step 7: Analyze Simulation Results**

– Assess the results using statistical measures (e.g., average future price, value at risk, etc.).

• Additional Options in MarketXLS**

– MarketXLS provides many ready-to-use templates and functions which can simplify these processes.

Example Excel Setup

1. Column A: Historical Dates

2. Column B: Historical Prices

3. Column C: Daily Returns Calculation

C2: =(B2-B1)/B14. Column D: Random Values from Normal Distribution

D2: =NORMINV(RAND(), AVERAGE(C:C), STDEV(C:C))5. Column E: Simulated Future Prices

E2: =B2*(1 + D2)Tips

– Save your work frequently and ensure your data sources are accurate.

– Utilize MarketXLS support if you encounter issues while pulling data or using other features.

By following these steps, you can effectively run Monte Carlo simulations in Excel using MarketXLS. This allows you to forecast and analyze the potential future performance of your investments under different scenarios. If you need more details on the functions available, it is recommended to review the comprehensive guide and tutorials offered by MarketXLS.

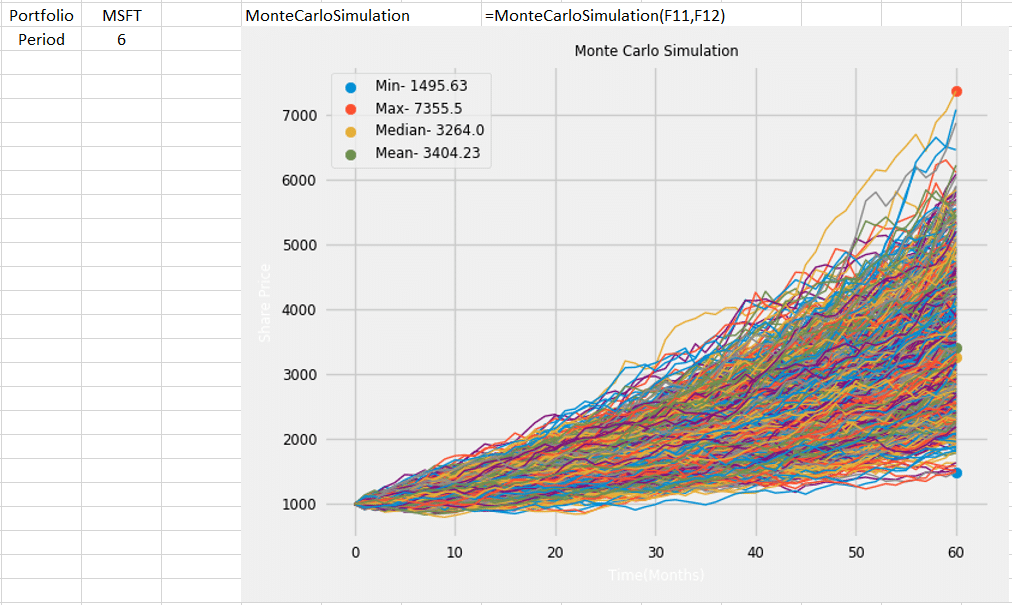

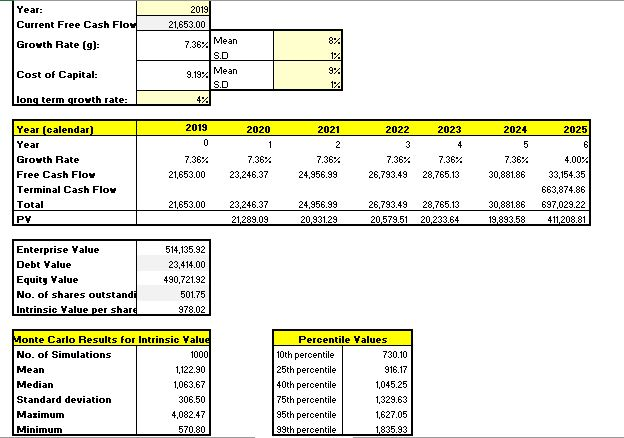

Here is the template you might want to check out and marketxls has 100s of templates to get you started easily and save you time.

Monte Carlo Simulation Template

– Monte Carlo Simulation – MarketXLS

This template will help you run Monte Carlo simulations directly in Excel with MarketXLS, making complex calculations and scenarios easier to manage and understand.

Summary

Monte Carlo Simulation in Excel helps forecast stock market outcomes. MarketXLS simplifies running these simulations. Follow these steps: