Get RealTime Updated Option Prices

Get Real-Time Updated Option Prices

Options are financial derivatives that represent a contract between two parties, a buyer and a seller. An Option gives the buyer the right, but not the obligation, to buy or sell an asset at a specified price on or before a specified date. Options trading can be a great way for investors for capitalizing on their investment strategies and mitigating risk. The choice of getting real-time updated option prices gives the investor potential for understanding and react to the current status of the market.

Factors Affecting Option Prices

The price of an option changes constantly, as determined by the market, and is influenced by several variables. These variables include the underlying stock’s price, the strike price of the option, the time remaining until expiration, and the option’s volatility. A rise or fall in price that is greater than what is expected due to the market changes is known as Implied Volatility (IV). Investors can use IV to their advantage to gauge how safe or risky a particular option or strategy may be.

Options Strategies

Options Strategies involve the combined purchase and/or sale of different options that can help you gain more out of your investment in the stock market. One of the most popular of these is the Long Straddle Strategy. This strategy involves buying both a call and a put option for the same asset, with the same strike price, and the same expiration date. This strategy can be used to benefit from both an increase and decrease in the asset’s price by the expiration date.

More complex strategies involve combining a series of options such as the Covered Call and Bull Call Spread to often create a more profitable strategy with less risk.

Calculating Profit/Loss

Options traders need to know the potential profit/loss for a given option in order to make an informed decision about their investment. There are several factors that are taken into consideration when calculating profits, including initial premium, ratio of options purchased/sold, stock price on the expiration date, and more.

The Options Profit Calculator provided by MarketXLS can be a helpful tool in calculating potential profit/loss. This calculator takes into consideration all the variables in order to provide an accurate estimate of any profit/loss that may be realized from an option trade.

The Benefit of MarketXLS

MarketXLS is designed to be an all-in-one tool for traders looking for an edge in the market. Whether you are new to options trading, or a professional, MarketXLS can help you to maximize your potential profits with its suite of tools and services. The Implied Volatility Long Straddle tool provides real-time updated option prices and the Options Profit Calculator helps you to determine the potential profit or loss of a given option.

You can learn more about MarketXLS and its services at https://marketxls.com/implied-volatility-long-straddle/ and https://marketxls.com/options-profit-calculator/

Regardless of your level of sophistication as a trader, MarketXLS provides tools and services that can give you an edge in your options trading. With features such as real-time updated option prices and the options profit calculator, it is possible to make better informed decisions and improve your investment strategies.

Here are some templates that you can use to create your own models

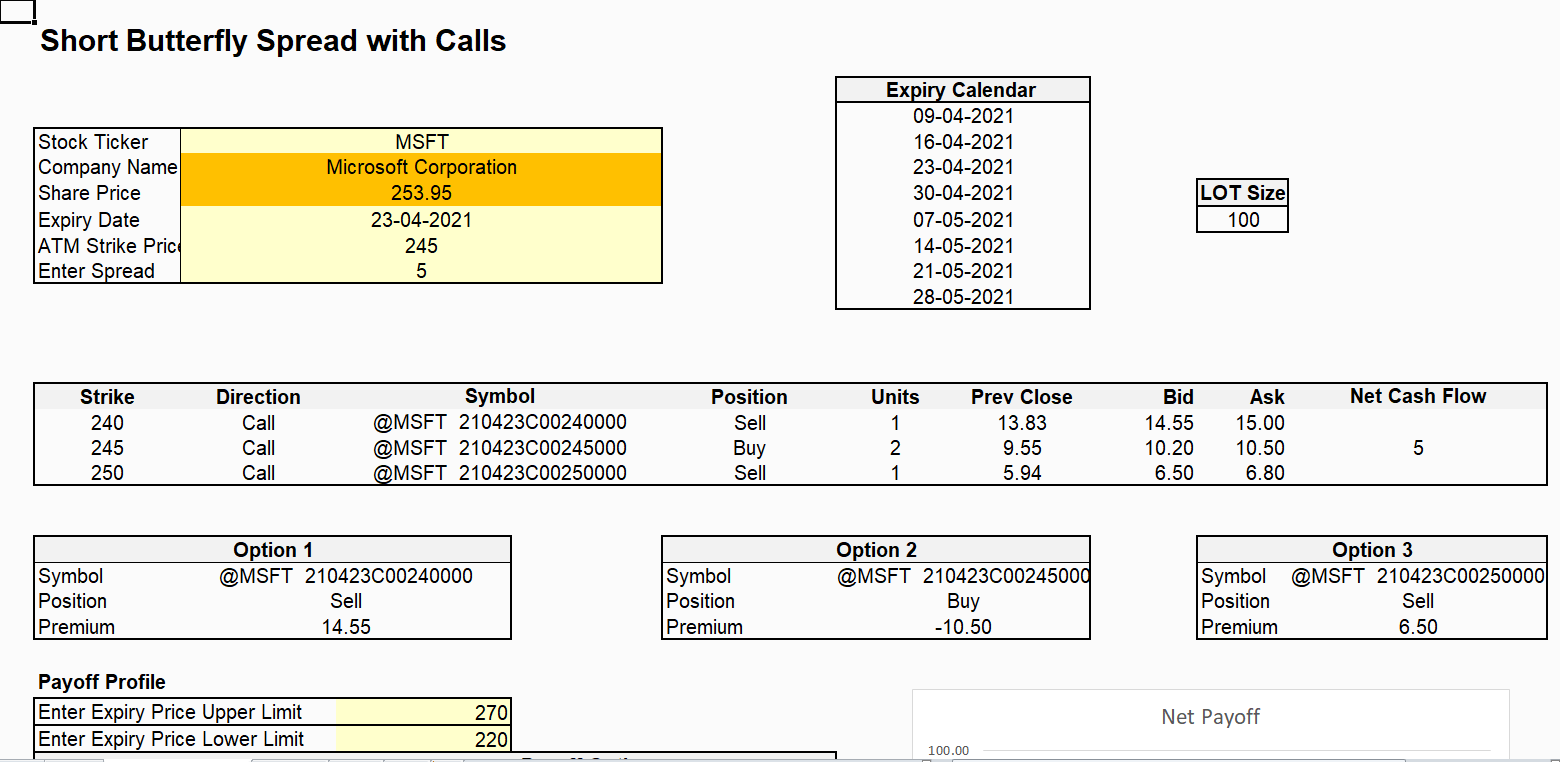

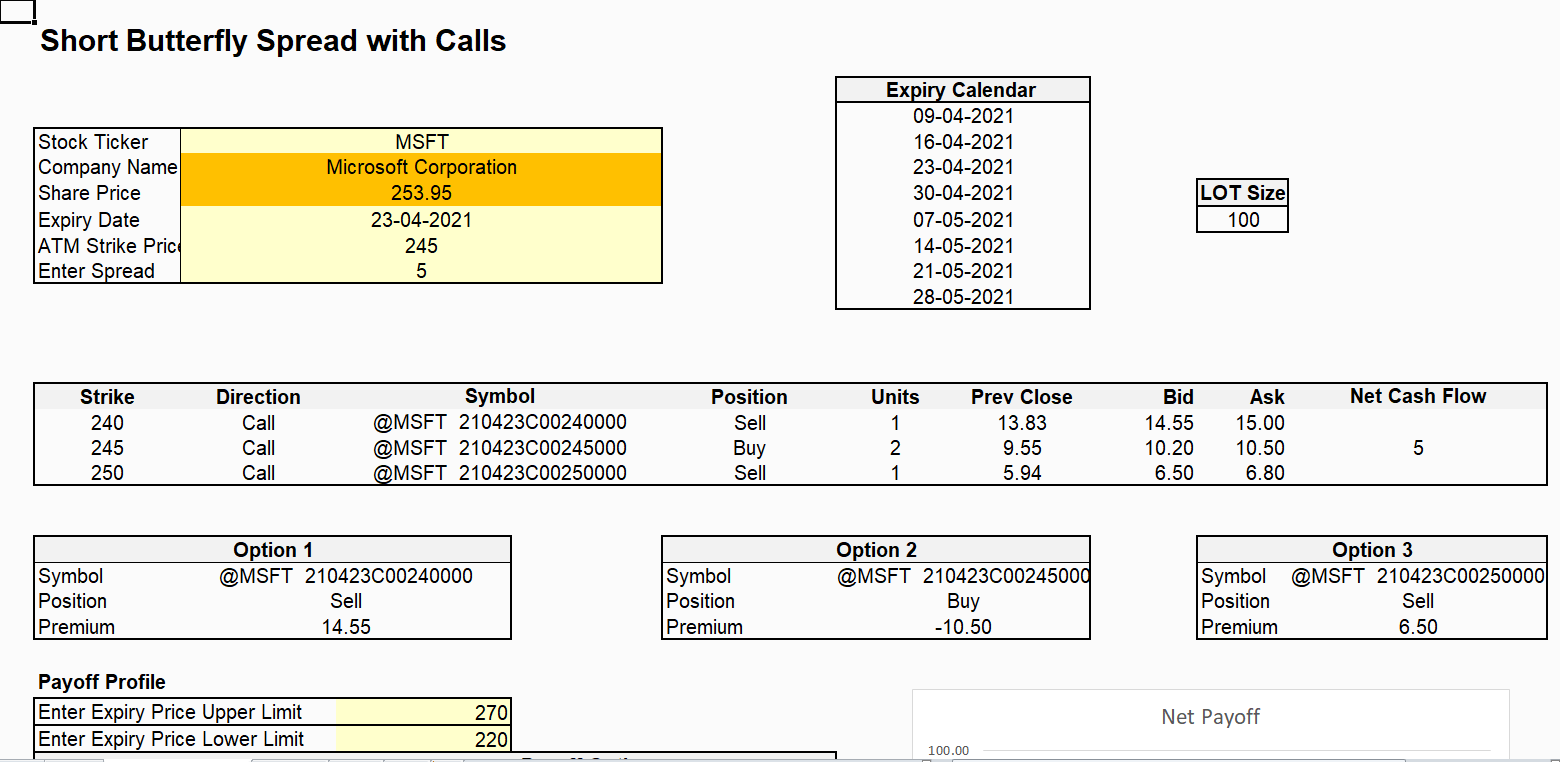

Short Butterfly Spread

Short Straddle Option Strategy

Strap Straddle

Strip Straddle

Search for all Templates here: https://marketxls.com/templates/

Relevant blogs that you can read to learn more about the topic

How Are Options Priced?

Using Marketxls To Find The Best Cash-Secured Put Option To Sell

Using Marketxls To Find The Best Covered Call Option To Sell, Based On Your Situation

Historical Option Prices

Real Time Stock Option Pricing In Excel (Any Version)

Get Market data in Excel easy to use formulas

- Real-time Live Streaming Option Prices & Greeks in your Excel

- Historical (intraday) Options data in your Excel

- All US Stocks and Index options are included

- Real-time prices and data on underlying stocks and indices

- Works on Windows, MAC or even online

- Implement MarketXLS formulas in your Excel sheets and make them come alive

- Save hours of time, streamline your option trading workflows

- Easy to use with formulas and pre-made templates

I invite you to book a demo with me or my team to save time, enhance your investment research, and streamline your workflows.