Table of Contents

- Introduction

- What is the best source of historical options data?

- How is historical options data used in backtesting of option strategies?

- Can historical options data help in predicting future market movements?

- What is the typical cost of obtaining historical options data?

- What are some common challenges in analyzing historical options data?

- Are there any free sources of historical options data?

- how do I get the Historical Options Data in MarketXLS?

- how do I get the Historical Options Data for expired options?

- Why would you use MarketXLS to analyze historical stock options?

- Summary

Introduction

When you venture into the world of options trading, having accurate and comprehensive historical data is crucial. Imagine being able to look back in time at the performance of options and use that information to refine your trading strategies. Sounds like a time machine, right? In this article, we will explore the best sources for historical options data, their costs, and how this data impacts your trading decisions. From renowned institutions like OptionMetrics and Bloomberg to free sources like Yahoo Finance, we will help you navigate your choices. We will also delve into how historical data aids in backtesting strategies, predicting market movements, and the challenges you might face in data analysis. Additionally, we will guide you through obtaining historical options data, specifically in MarketXLS. Ready to gear up your trading strategies? Let’s dive in!

What is the best source of historical options data?

The best source of historical options data depends on your need for accuracy, range, and cost. For comprehensive and reliable data, institutions like OptionMetrics or Bloomberg are excellent choices. These sources offer extensive historical data, analytics, and professional support. If you’re looking for a more affordable or free option, websites like Yahoo Finance or the CBOE (Chicago Board Options Exchange) provide good alternatives. However, these free sources might lack the depth and historical range found in paid services. It’s essential to weigh the trade-offs between cost and data quality when choosing a source.

How is historical options data used in backtesting of option strategies?

Historical options data plays a pivotal role in backtesting option strategies. Traders and analysts use this data to simulate past market conditions. They apply their strategies to see how they would have performed over time. By doing this, they can identify potential strengths and weaknesses in their approaches. The data includes past prices, volatility, and other essential metrics. It’s crucial for refining and optimizing trading methods. Accurate historical data helps in making more informed decisions. Ultimately, it reduces the risk of unexpected outcomes when deploying strategies in live markets.

Can historical options data help in predicting future market movements?

Historical options data can provide valuable insights for predicting future market movements. Traders analyze past price trends and volatility to identify patterns. By examining factors like open interest and trading volume, they gauge market sentiment. Long-term data helps in understanding how certain stocks react to events. Algorithms often use this data to forecast future prices. However, markets are influenced by unpredictable events as well. Thus, while historical data is informative, it’s not foolproof. Combining it with other analysis methods improves accuracy. Overall, historical options data is a useful but limited tool in market prediction.

What is the typical cost of obtaining historical options data?

The cost of obtaining historical options data can vary widely. Several factors influence the price, such as the data provider, the range of dates requested, and the level of detail. Major financial data providers like Bloomberg or Thomson Reuters may charge thousands of dollars per year. Some specialized firms offer packages that bundle different types of data, often making it more affordable. For specific, limited datasets, prices might range from a few hundred to a few thousand dollars. Academic institutions sometimes have access to these datasets at a reduced cost or for free. It’s also worth noting that some platforms offer free basic data, though it usually lacks the depth and breadth of paid services.

What are some common challenges in analyzing historical options data?

Analyzing historical options data presents several challenges. One major issue is data quality and completeness. Incomplete records or erroneous entries can skew results and lead to incorrect conclusions. Another challenge is the sheer volume of data, which can make computation intensive and time-consuming. Additionally, market conditions and economic variables change over time, complicating the extraction of meaningful trends. Misalignment in time zones and trading hours across different exchanges also poses synchronization problems. Finally, adapting historical data to today’s trading algorithms requires careful consideration and adjustment for market changes.

Are there any free sources of historical options data?

Finding free sources of historical options data can be challenging, but there are some available. Websites like Yahoo Finance offer basic historical options data, though it may not be comprehensive. The CBOE (Chicago Board Options Exchange) provides some historical data, but it is often limited to certain time frames. Financial forums and communities occasionally share snippets of historical options data. For more extensive datasets, you might need to turn to educational institutions or public libraries. However, truly in-depth and detailed historical options data usually requires a subscription or purchase.

how do I get the Historical Options Data in MarketXLS?

To get historical options data in MarketXLS, you can use several functions specifically designed to retrieve various historical options metrics such as implied volatility, the Greeks (Delta, Gamma, Vega, Theta, Rho), and historical bid/ask prices. Here are some key functions you can utilize:

1. Historical Implied Volatility:

– Function: =opt_ImpliedVolatilityHistorical("Option Symbol", Date)

– Description: Returns the implied volatility (IV) for an option on a specific date.

– Example Usage: =opt_ImpliedVolatilityHistorical("AAPL210917C00145000", TODAY()-1)

2. Historical Greeks:

– Delta:

– Function: =opt_DeltaHistorical("Option Symbol", Date)

– Example Usage: =opt_DeltaHistorical("AAPL210917C00145000", TODAY()-1)

– Gamma:

– Function: =opt_GammaHistorical("Option Symbol", Date)

– Example Usage: =opt_GammaHistorical("AAPL210917C00145000", TODAY()-1)

– Vega:

– Function: =opt_VegaHistorical("Option Symbol", Date)

– Example Usage: =opt_VegaHistorical("AAPL210917C00145000", TODAY()-1)

– Theta:

– Function: =opt_ThetaHistorical("Option Symbol", Date)

– Example Usage: =opt_ThetaHistorical("AAPL210917C00145000", TODAY()-1)

– Rho:

– Function: =opt_RhoHistorical("Option Symbol", Date)

– Example Usage: =opt_RhoHistorical("AAPL210917C00145000", TODAY()-1)

3. Historical Bid and Ask Prices:

– Bid:

– Function: =Bid_Historical("Option Symbol", Date)

– Example Usage: =Bid_Historical("AAPL210917C00145000", TODAY()-20)

– Ask:

– Function: =Ask_Historical("Option Symbol", Date)

– Example Usage: =Ask_Historical("AAPL210917C00145000", TODAY()-10)

4. Options Volume and Open Interest:

– Historical Vol/OI:

– Function: =opt_Vol_OI_Historical("Symbol", Date)

– Description: Returns the volume to open interest ratio for a specific date.

– Example Usage: =opt_Vol_OI_Historical("AAPL", TODAY()-10)

5. Historical Option Chain:

– Function: =opt_HistoricalOptionChain("Ticker", "Date")

– Description: Retrieve past option chains for a specified expiration date for comprehensive backtesting and analysis.

– Example Usage: =opt_HistoricalOptionChain("AAPL", "2022-09-17")

These functions allow you to analyze historical options data with precision, which can be instrumental for backtesting trading strategies and performing in-depth options analysis .

If you need further assistance on how to implement these functions in your Excel worksheet or require more detailed examples, feel free to ask!

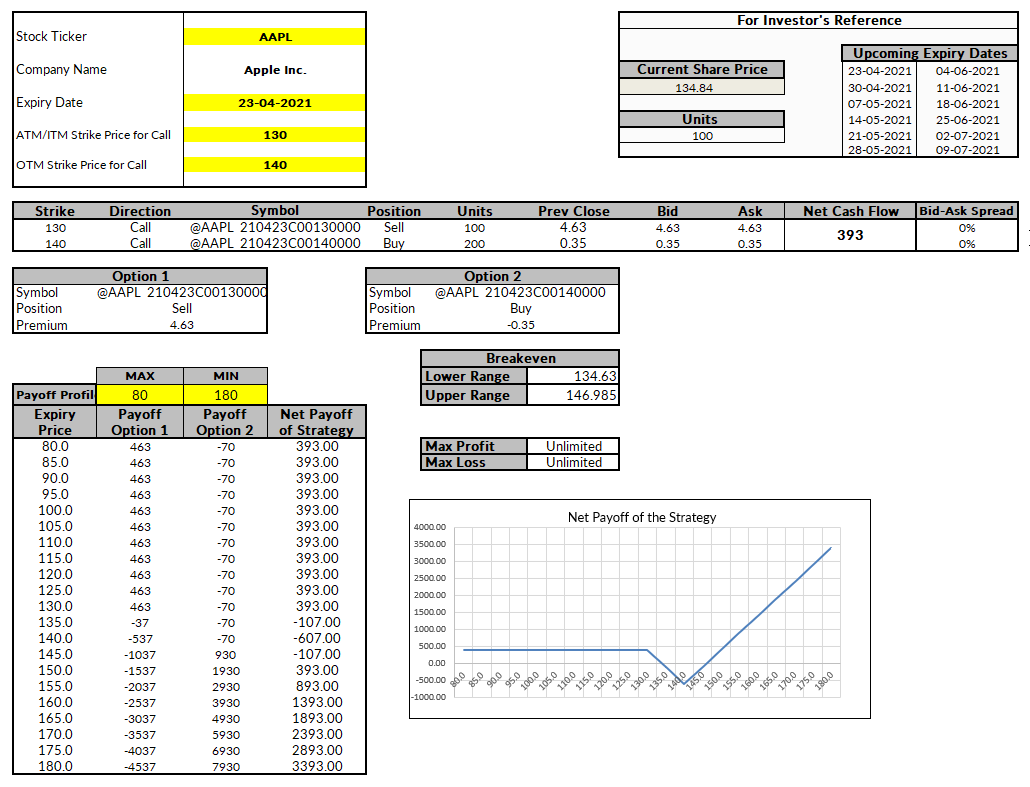

Here is the template you might want to check out and MarketXLS has 100s of templates to get you started easily and save you time.

• Template Name**: Historical IV Calculator – MarketXLS

• Link to Template**: [Historical IV Calculator](https://marketxls.com/marketxls-templates/263/historical-iv-calculator)

• Image URL**:

This template helps investors gauge the risk exposure of an option with a given strike and expiry date.

how do I get the Historical Options Data for expired options?

To get historical options data for expired options using the Close_Historical function in MarketXLS, follow these steps:

1. Syntax: The basic syntax for the Close_Historical function is:

=Close_Historical(Symbol, OnDate)Where:

– Symbol is the ticker symbol of the underlying security.

– OnDate is the historical date you’re interested in. Use the format YYYY-MM-DD.

2. Special Case for Weekends/Holidays: If the date you specify falls on a weekend or a holiday, you can use an additional argument to get the last trading day’s price before that date. The syntax would be:

=Close_Historical(Symbol, OnDate, "yes")3. Example Usage:

– To get the closing price of an expired AAPL option with a specific configuration and date, you can use:

=Close_Historical("@AAPL 211119C00130000", "2021-11-18")Ensure you use the appropriate format for the option symbol and the specific date for which you need the historical data .

Detailed Steps:

– Prepare Your Symbol: Include the option ticker symbol with the correct formatting (e.g., @AAPL 211119C00130000).

– Specify the Date: Provide the exact historical date you are querying for.

– Include Weekend Argument (if needed): Add the “yes” argument if your date might fall on a weekend or holiday to ensure you capture the last trading day’s price.

Applying in Excel:

1. Open Excel with MarketXLS installed.

2. Create a cell for your option symbol. For example, A1 with the value @AAPL 211119C00130000.

3. Create a cell for your date. For example, B1 with the value 2021-11-18.

4. In a new cell, input:

=Close_Historical(A1, B1)– Or, if accounting for weekends/holidays:

=Close_Historical(A1, B1, "yes")Using the Close_Historical function this way will provide you with the historical closing price data for expired options, essential for backtesting and historical analysis of options trading strategies .

Here is the template you might want to checkout and MarketXLS has 100s of templates to get you started easily and save you time.

Why would you use MarketXLS to analyze historical stock options?

Using MarketXLS to analyze historical stock options presents several advantages that can significantly enhance your trading and decision-making capabilities:

Comprehensive Historical Data Access

MarketXLS enables access to a vast array of historical data which is crucial for backtesting options strategies and understanding historical market behavior:

– Historical Option Data: You can retrieve extensive data points such as bid, ask, delta, gamma, vega, theta, and implied volatility for past dates. This allows for a thorough analysis of how options have performed historically.

– Historical Options Chain: The function =opt_HistoricalOptionChain("Ticker","Date") provides the entire option chain for a specified expiration date, facilitating in-depth historical data analysis and backtesting strategies.

– Specific Historical Metrics: Various functions are available to retrieve historical Greeks and other metrics, such as =opt_DeltaHistorical("Option Symbol",TODAY()-1) for historical delta and =opt_ImpliedVolatilityHistorical("Symbol","Date") for implied volatility .

Advanced Analytical Tools

MarketXLS offers sophisticated tools to analyze option data:

– Options Profit Calculator: This tool helps estimate potential profits or losses by considering factors such as the underlying stock price, strike price, and option expiration date. It supports up to 8 legs in a trading model and allows real-time tracking with Greeks.

– Black-Scholes Model Integration: The model used to calculate the theoretical value of options, helping identify under or overvalued options .

Market Scanning Functions

MarketXLS includes several market scanning functions designed to identify unusual market activities, crucial for options trading:

– Unusual Stock Options Activity: Identifies options with the highest volume to open interest ratio using the function =opt_UnusualStockOptionsActivity(5) .

– Options Volume and Open Interest Leaders: Functions like =opt_OptionsVolumeLeaders(5) and =opt_OptionsOILeaders(5) help identify options with the highest traded volume or open interest, which can be pivotal in spotting market trends .

Efficient Strategy Testing and Management

MarketXLS provides efficient tools to test and manage trading strategies:

– Strategy Backtesting: By retrieving historical options data, strategies can be backtested to verify their effectiveness under different market conditions.

– Custom Strategy Configuration and Analysis: The platform supports the configuration of complex options strategies, recording of historical configurations, and viewing payoffs under various market scenarios .

– Saving Configurations: Users can save their trade configurations and access them privately, publicly, or as a team, which improves collaboration and strategy refinement .

Streamlined Integration with Excel

One of MarketXLS’s core strengths is its integration with Excel, which allows users to leverage the familiar interface of Excel while accessing robust market data and analytical tools. This integration enhances usability and facilitates the custom manipulation of data according to user needs.

With these capabilities, MarketXLS stands out as a comprehensive tool for analyzing historical stock options data, executing informed trading strategies, and managing portfolios effectively. By leveraging these tools, traders and analysts can gain insights and make more informed decisions.

Here is the template you might want to checkout and MarketXLS has 100s of templates to get you started easily and save you time.

Summary

The article emphasizes the importance of historical options data in trading strategies. It covers sources, costs, and usage in backtesting and market prediction. Key points include: