Option Chain Excel Sheet (SPY Example)

Description

Obtain a comprehensive options chain that meticulously organizes put options on one side and call options on the other, facilitating a clear and efficient comparison between the two. Supplement this data with valuable indicators like the put-call ratio and the open interest (OI) ratio. These ratios serve as key measures of market sentiment and can provide insights into investors' expectations of future price movements. For an even more granular study, capture critical price details, like the last traded price, the ask price, and the bid price. These figures can lend perspective on the market's supply-demand dynamics and unveil potential trading opportunities. Additionally, examine the implied volatility (IV), a predictive factor that gives a sense of the likelihood of price fluctuations. Paired with the associated Greek values that measure the sensitivity of the option's price to various factors, this information can help in devising sophisticated trading strategies. Acquiring and analyzing such a detailed set of data about options helps traders to make well-informed decisions based on a deep understanding of the market. This, in turn, can maximize profits, minimize losses, and greatly improve overall trading performance.

Template Screenshots

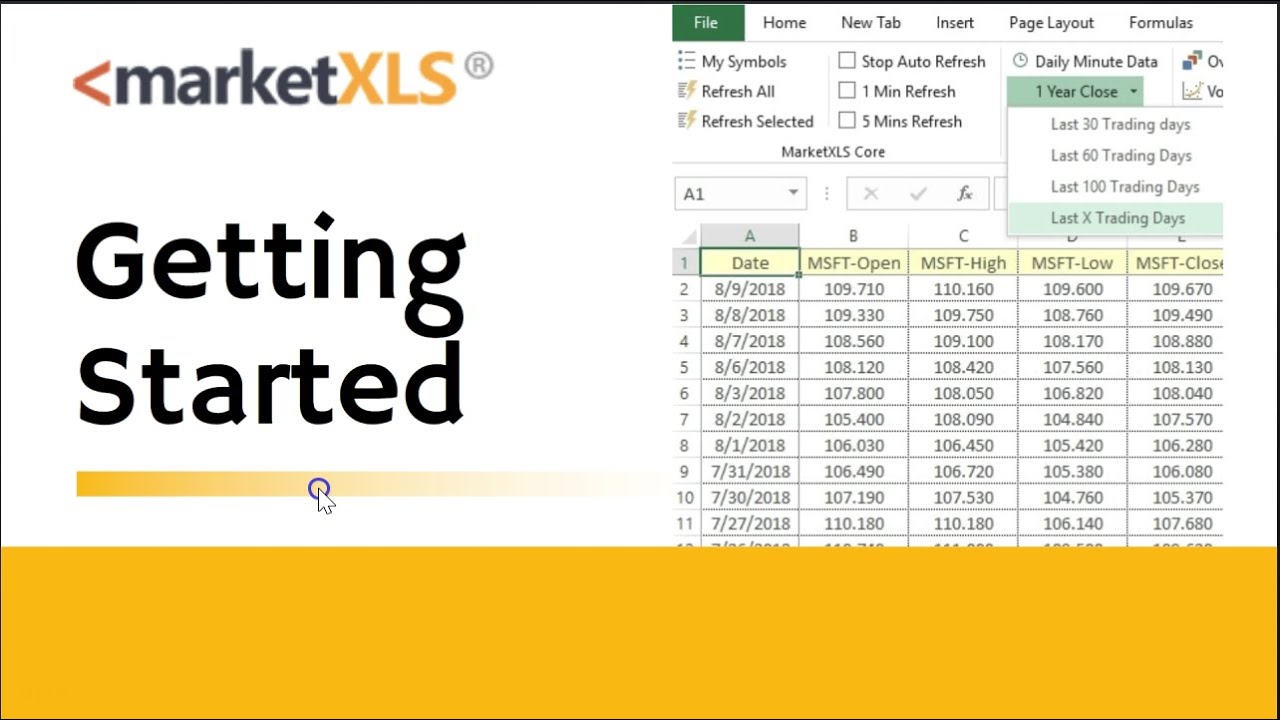

Get Access to 1 Billion Usable Market data points IN YOUR EXCEL SHEETS WITH EASY TO USE EXCEL FUNCTIONS

Get started today

Similar Templates

No similar templates found