Options Rollover Strategy Example Template

Description

This is a comprehensive Rollover Option Strategy Template specifically designed for trading in stock options. The stocks are based on any underlying equity, annotated in this example as 'AAPL', trading at a given price (e.g., 176.65). The template strategically highlights the current short position of an options trader and clearly delineates parameters such as the Option Symbol, Underlying Stock, Dates till Expiry (DTE), Option Type, Strike Price, Expiry Date, Bid/Ask price, Delta (∆), Theta (Θ), Dollar Change (∆$), Total proceeds from the option trade ($Proceeds), and Daily Dollar Change ($/Day).

For instance, the current position row shows a 5-day till expiry Put Option for AAPL with a strike price of 175, expiring on 10th November, with a -0.36 delta indicating it moves in the opposite direction to the underlying stock. Total proceeds from this option amount to 134 dollars, with a daily rate of 25 dollars.

The template also excellently outlines potential rollover options for subsequent Fridays, targeting a roll over to a strike price of 280. It provides a list of Rollover Candidates for AAPL with different expirations dates and calculates their potential proceeds and daily rates accordingly, aiding traders in selecting an optimal rollover strategy. Each candidate is gauged using the same parameters as the current positions, allowing for a straightforward comparison.

This template serves as a valuable decision-support tool, enabling traders to systematically identify and execute the most beneficial rollover strategies. It offers a tactical approach to expand and sustain trading success within the realm of stock options.

Template Screenshots

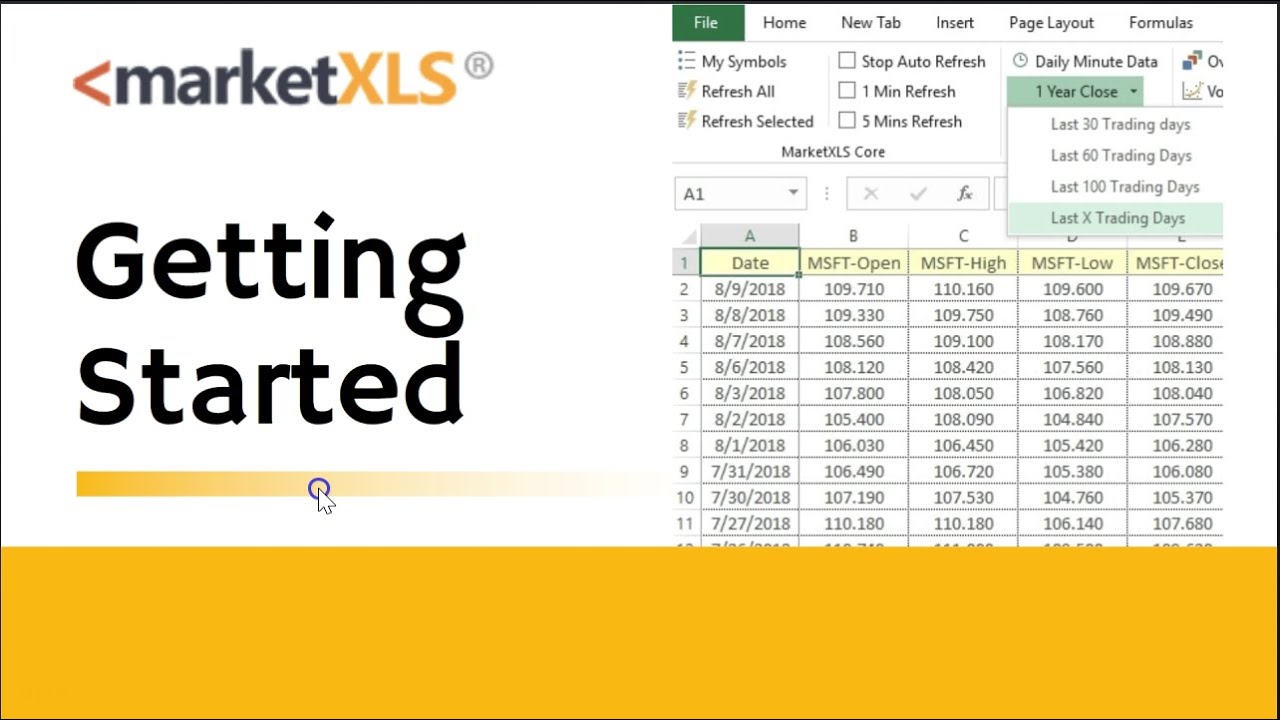

Get Access to 1 Billion Usable Market data points IN YOUR EXCEL SHEETS WITH EASY TO USE EXCEL FUNCTIONS

Get started today

Similar Templates

No similar templates found