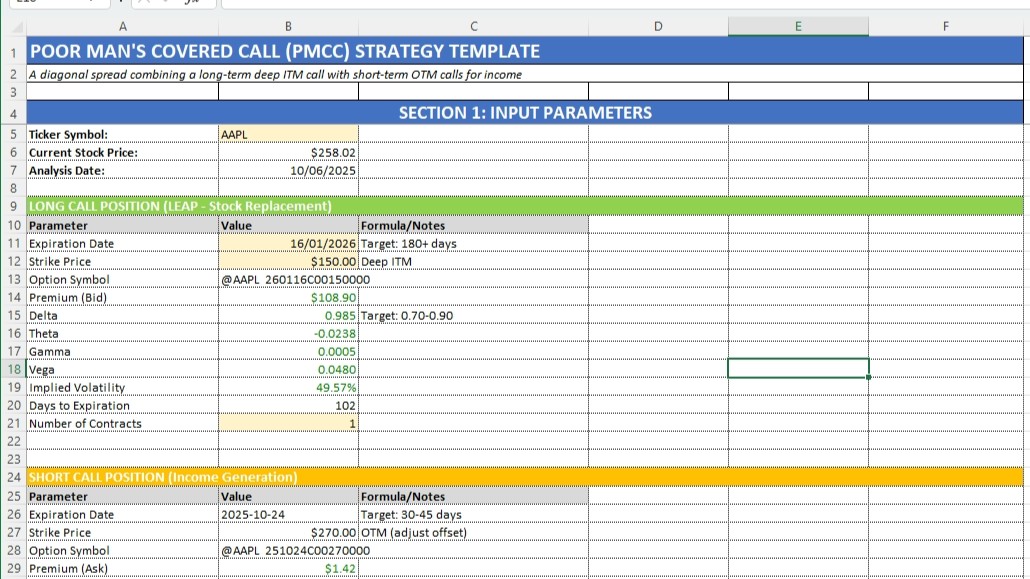

Poor Man's Covered Call (PMCC) - Advanced Options Income Strategy with Real-Time Greeks & Analytics

Description

The Poor Man's Covered Call (PMCC) is an advanced options strategy that simulates a traditional covered call position while requiring significantly less capital. By purchasing a deep in-the-money (ITM) LEAP call option as a stock replacement and selling short-term out-of-the-money (OTM) calls against it, traders can generate consistent income with defined risk.

This professional-grade Excel template leverages MarketXLS's real-time options data and streaming Greeks to provide a complete management solution for PMCC positions.

Key Features

Automated Position Setup

- Real-time stock price feeds via MarketXLS

- Automatic option symbol generation for long and short positions

- Dynamic strike price selection tools (opt_StrikeNext function)

- Automated expiration date management (ExpirationNext function)

- Live bid/ask pricing for accurate entries

Real-Time Greeks & Risk Metrics

- Streaming Delta, Theta, Gamma, and Vega for both positions

- Net position Greeks calculations (directional exposure)

- Daily P&L projections from theta decay

- Implied volatility tracking for both legs

- Position delta health checks (ensures proper setup)

Comprehensive Analytics

- Breakeven price calculations

- Maximum profit and loss scenarios

- Risk/reward ratio analysis

- Annualized return projections

- Return on risk metrics

- Position value tracking with unrealized P&L

Intelligent Roll Management

- Automated alerts when stock approaches short strike (within 5%)

- Suggested roll strikes and expirations

- Roll credit/debit calculations

- Exit condition monitoring (delta thresholds, DTE limits)

- Days-to-expiration tracking for optimal timing

Scenario Analysis

- 7 price scenario projections at short call expiration

- P&L calculations across -10% to +10% moves

- Theta decay profit projections (7, 14, 21, 30 days)

- Percentage return calculations for each scenario

- Visual identification of current price scenario

Trade Tracking & Documentation

- Complete trade entry log with dates and symbols

- Adjustment tracking table for rolls and modifications

- Net credit/debit tracking across all adjustments

- Notes section for trade rationale and decisions

- Current position valuation in real-time

Position Health Monitoring

- ✓ Long delta validation (target: 0.70-0.90)

- ✓ Short delta validation (target: 0.30-0.40)

- ✓ DTE spread confirmation (minimum 135 days)

- ✓ Net delta exposure check (target: 0.40+)

- Visual status indicators for quick assessment

Built-In Strategy Guide

- Complete setup guidelines and best practices

- Management rules for rolling positions

- Risk management protocols

- Advantages and disadvantages clearly outlined

- Step-by-step workflow instructions

Who Should Use This Template?

Ideal For:

- Options traders seeking income generation strategies

- Investors looking to reduce capital requirements vs. covered calls

- Traders comfortable with intermediate-level options strategies

- Portfolio managers implementing systematic income strategies

- Anyone seeking to leverage time decay (theta) for profit

Experience Level:

- Intermediate to advanced options knowledge recommended

- Understanding of Greeks (Delta, Theta) helpful but explained

- Requires active position management skills

- Best suited for traders who can monitor positions regularly

Strategy Requirements

Capital:

- Approximately 30% of the cost of 100 shares

- Example: $15,000-$25,000 for most major stocks vs. $50,000-$70,000 for shares

Time Commitment:

- Initial setup: 15-20 minutes

- Ongoing monitoring: 10-15 minutes daily

- Rolling management: 20-30 minutes every 30-45 days

Market Conditions:

- Best in neutral to bullish markets

- Profitable in sideways markets with theta decay

- Higher implied volatility increases premium income

Technical Specifications

MarketXLS Functions Used:

Last()- Real-time stock pricesOptionSymbol()- Generate OCC option symbolsopt_Bid()/opt_Ask()- Live option pricingqm_stream_delta()- Streaming delta valuesqm_stream_theta()- Streaming theta valuesqm_stream_gamma()- Streaming gamma valuesqm_stream_vega()- Streaming vega valuesopt_ImpliedVolatility()- IV calculationsExpirationNext()- Next available expirationsopt_StrikeNext()- Strike price selection

Excel Requirements:

- Microsoft Excel 2016 or later (Windows/Mac)

- MarketXLS Add-in installed and activated

- Active MarketXLS subscription with options data access

- Recommended: Dual monitors for optimal workflow

What's Included

Main Template Sections:

- Input Parameters (ticker, strikes, expirations)

- Position Analysis (Greeks, capital requirements, health checks)

- P&L Scenarios (price movements, theta decay projections)

- Roll Management (alerts, suggestions, exit conditions)

- Trade Log (entry tracking, adjustments, current values)

- Strategy Guide (setup, management, best practices)

Template Screenshots

Get Access to 1 Billion Usable Market data points IN YOUR EXCEL SHEETS WITH EASY TO USE EXCEL FUNCTIONS

Get started today

Similar Templates

No similar templates found