#1 Options Trading Plugin For EXCEL

Join 2,500+ options traders who use MarketXLS to improve their trading strategies with real-time data updates, correct Greeks calculations, and innovative options functions in Excel.

"As an options trader, I needed reliable options data and effective models to validate my strategies. MarketXLS delivers enterprise-grade options analytics directly in Excel, allowing me to apply my own models to market data efficiently."

Michael Chen

Options Trader

See Real-Time Options Data in Excel

Watch how MarketXLS brings live options chains, Greeks, and advanced analytics directly into Excel. Experience the power of real-time data and seamless analysis.

Get access to 1 Billion+ Stock Options Data Points in your Excel with easy to use functions

Our Excel plugin delivers powerful options data tools designed for traders who need accurate, timely information to make profitable decisions.

Streaming Real-time Option Pricing

Never lose track of your trades with our real-time streaming prices in Excel. The numbers that you see on your Excel will change by themselves and will match your trading platform Bid/Ask prices so you can make profitable decisions real-time.

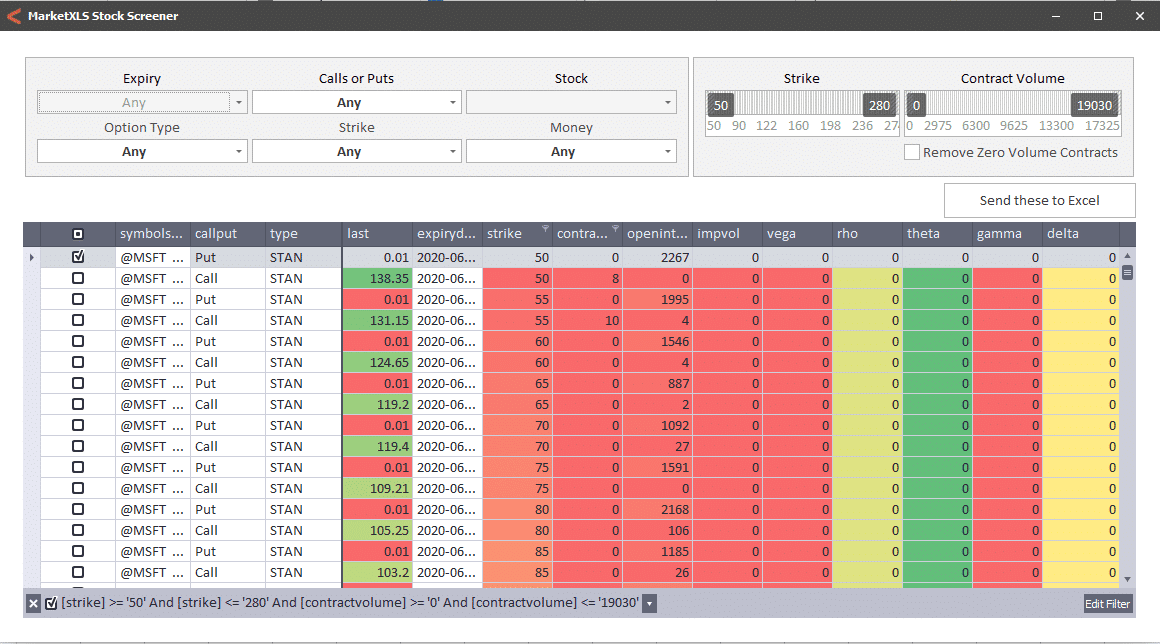

Advanced Options Filtering

Use our innovative easy to use functions to filter option contracts as per your own criteria. For example, find me all options for TSLA that expire between x date and y date and those that have strike price between x and y.

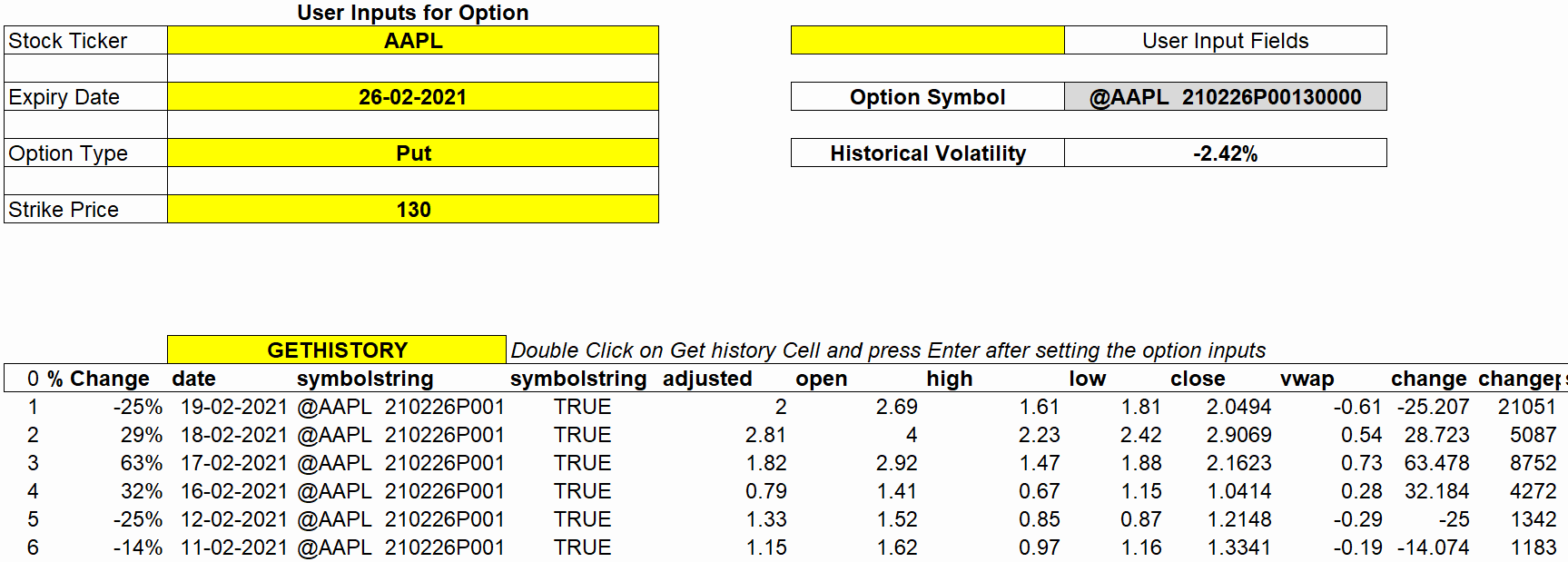

Options History

See how your option's prices changed overtime in History. Get End of the day or Intra-day (minute by minute) history of all recently expired and active contracts.

Options Ranking and Strategy Selections

Rank Option Contracts with multiple factors like premiums, spreads etc. Define your weights on various factors of option contracts and then see the best ones that meet your criteria the best.

Get Started Quickly with Our Open Templates

Get started in not more than five minutes with our ready-to-use Option templates. All templates are open code, reusable and can be adjusted quickly for your own requirements.

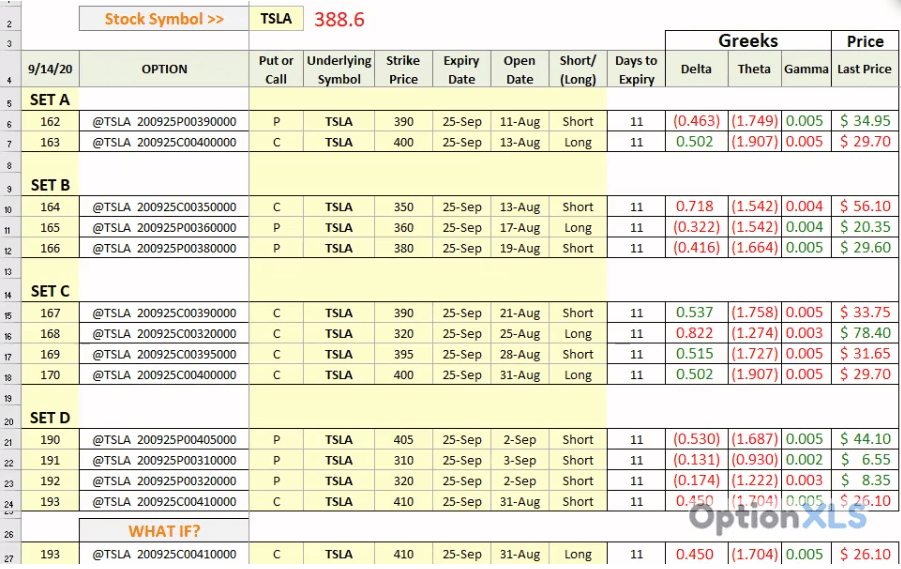

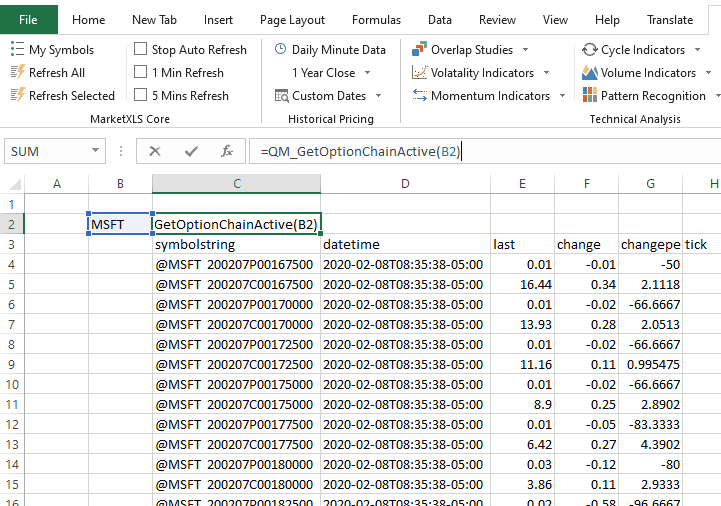

Get Option Chains in Excel

Make smart investment decisions utilizing our numerous functions to obtain option chains. Advanced filters allow you to scan by popular metrics such as Greeks, strike prices, expiry dates, call or put and much more.

Options Scanning

MarketXLS offers an Excel-based Option Scanner that allows you to choose up to 40 stock tickers, get all the option contacts for those stocks, and filter for the best options to trade. Compare different Options values, greeks, volumes, open interests, and more by using our Option Chain functions.

Powerful Excel Functions for Options Analysis

Get started quickly with our easy-to-use Excel functions for options data retrieval and analysis.

Basic Options Functions

| Use Case | MarketXLS Function |

|---|---|

| Get a specific option symbol | =OptionSymbol("stocksymbol","YYYY-MM-DD","CallorPut","StrikePrice") |

| Get all available weekly options | =QM_GetOptionChainWeekly("Stock Symbol") |

| Get all available 'in the money' option contracts | =QM_GetOptionChainInTheMoney("Stock Symbol") |

| Get all available expiring most near term | =QM_GetOptionNearTerm("Stock Symbol") |

| Get all the option contracts | =QM_List("getOptionChain","Symbol","FDX","money","In") |

Real-time Streaming Functions

| Use Case | MarketXLS Function |

|---|---|

| Get the real-time alpha for an options contract | =qm_stream_alpha("Option Symbol") |

| Get the Ask price | =qm_stream_ask("Option Symbol") |

| Get the Last price | =qm_stream_last("Option Symbol") |

| Get the real-time delta for an options contract | =qm_stream_delta("Option Symbol") |

| Get the Bid price | =qm_stream_bid("Option Symbol") |

A Complete Options Trading Tool for Serious Traders

Trusted by 2,500+ traders who use MarketXLS to improve their trading strategies with real-time data updates, correct Greeks calculations, and innovative options functions in Excel.

The MarketXLS Options Trader Package

Key Features:

- Get Market data in Excel easy to use formulas

- Real-time Live Streaming Option Prices & Greeks in your Excel

- Historical (intraday) Options data in your Excel

- All US Stocks and Index options are included

- Real-time Option Order Flow

- Real-time prices and data on underlying stocks and indices

- Works on Windows, MAC or even online

- Implement MarketXLS formulas in your Excel sheets and make them come alive

- Save hours of time, streamline your option trading workflows

- Easy to use with formulas and pre-made templates

Regular Price

$1240/year

$1116/year

Save 10% with code PROFIT

Quarterly Option Available

$450/quarter (Save $420 with annual plan)

✓ Instant delivery ✓ Full support ✓ Works on all platforms

Common Questions from Options Traders

Get answers to frequently asked questions about our Excel options data solution.

How does the options data update in Excel?

MarketXLS uses a fast data pipeline that updates prices and data throughout the trading day. The system is designed to keep your Excel running smoothly while providing real-time updates.

We use smart data loading to ensure you get current market data without slowing down your Excel.

What pricing models do you use?

We use the Black-Scholes model to calculate options prices and Greeks (Delta, Gamma, Theta, Vega, and Rho). This is the standard model used by traders worldwide.

Our Excel implementation lets you calculate these values quickly across multiple options.

Can I analyze complex options strategies?

Yes! You can analyze strategies with up to 8 options legs at once. This lets you model spreads like butterflies, condors, and your own custom combinations.

Our profit calculator shows you how your strategy performs at different prices and dates, helping you make better trading decisions.

Which markets do you cover?

We provide options data for all U.S. stocks and indices. Our system handles all the complex options symbols automatically.

Do you provide volatility analysis tools?

Yes! You get implied volatility data for all options, helping you analyze volatility patterns across different strikes and expiration dates.

This helps you spot trading opportunities and develop strategies based on volatility.

How do I use this with my existing Excel models?

Our Excel functions work just like standard Excel formulas. You can easily add them to your existing spreadsheets and combine them with your own formulas.

We provide detailed guides and example spreadsheets to help you integrate our tools into your analysis.

Improve Your Options Analysis in Excel

Join 2,500+ options traders who have transformed their Excel environment into a powerful options analysis platform

Active Options Traders

Customer Satisfaction

Options Analysis Functions

Use coupon code PROFIT to save 10% on your purchase