Real-time Option Greeks functions – New Release 9.3.6

Meet The Ultimate Excel Solution for Investors

- Live Streaming Prices Prices in your Excel

- All historical (intraday) data in your Excel

- Real time option greeks and analytics in your Excel

- Leading data in Excel service for Investment Managers, RIAs, Asset Managers, Financial Analysts, and Individual Investors.

- Easy to use with formulas and pre-made sheets

Real-time Option Greeks functions – New Release 9.3.6

We hope you are doing well. With great excitement, we announce the release of MarketXLS Version 9.3.6 today (May 10th, 2024). This latest version has the following updates.

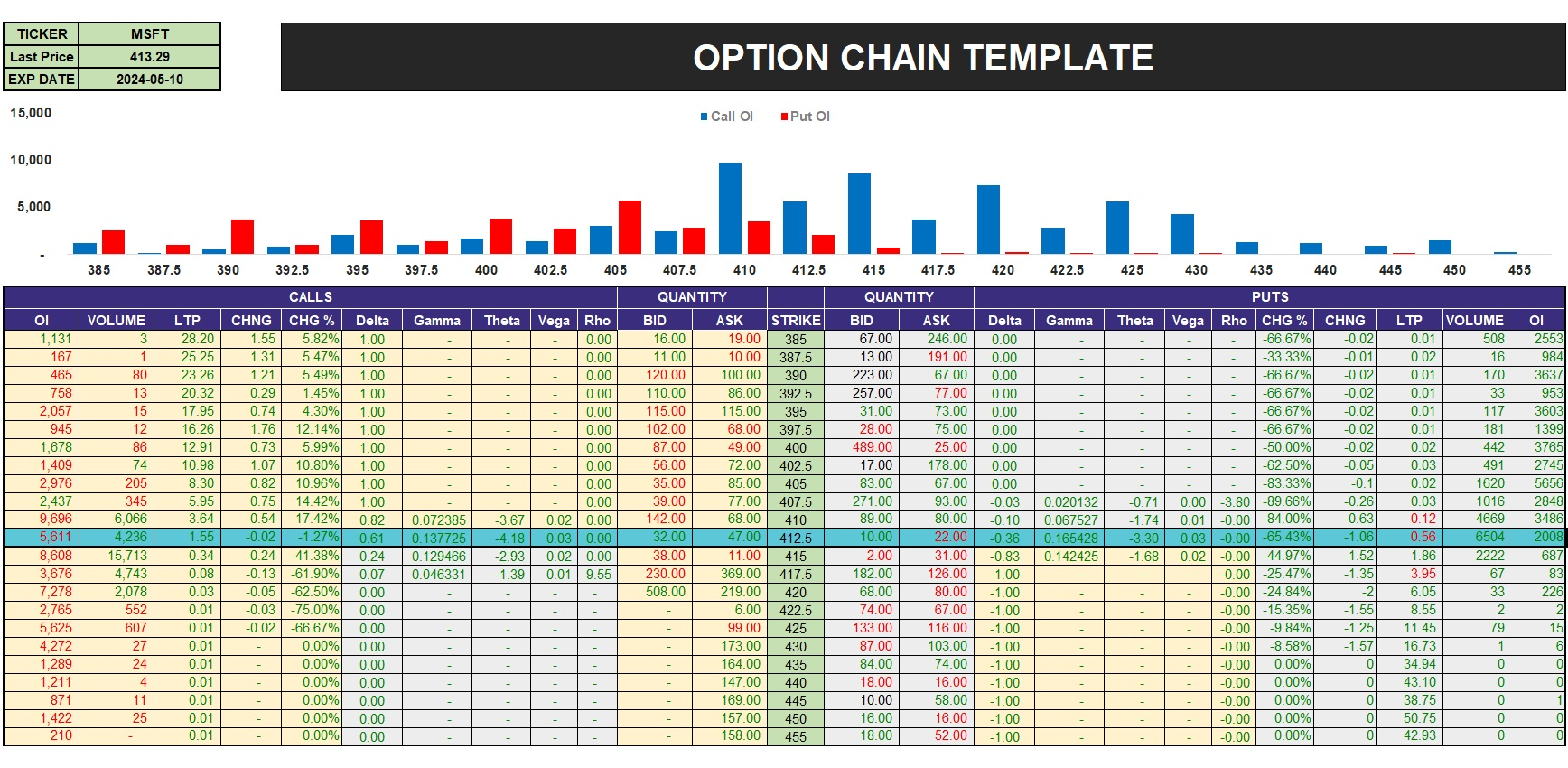

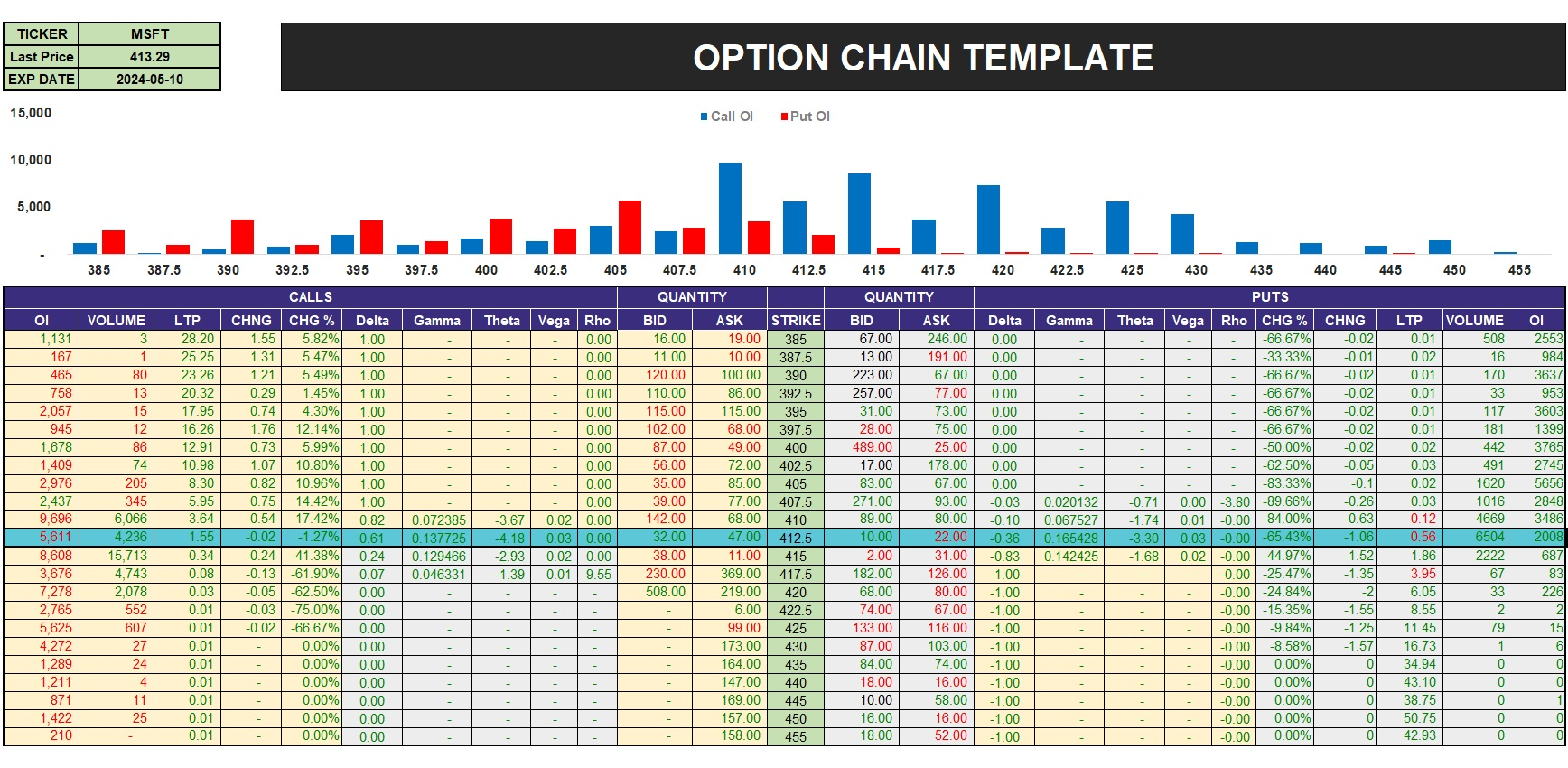

1. Custom Real-time / EOD Greeks for Options

In our latest 9.3.5 update, we introduced new ‘opt’ functions for option traders (details on our blog). We’ve added customizable Real-time Option Greeks functions to this series, enabling you to conduct ‘what-if’ scenarios. These scenarios allow you to explore how Greeks would adjust if variables like price or risk-free rate changed, helping you assess how sensitive an option’s price is to changes in the underlying stock price.

These function’s calculates the Greeks of an option based on your inputs.

1) CurrentStockPrice: Input the current price of the underlying stock.

2) MarketOptionPrice: Enter the current market price of the option.

3) ExpiryDate: Specify the expiry date of the option.

4) OptionType: Choose the type of option you are analyzing. Options include: “Call” for call options,“Put” for put options.

5) StrikePrice: Input the strike price of the option you are evaluating.

6) Risk Free Rate: The default rate is set to 4%, but it can be changed as the user wants.

Example: =opt_Delta(420,12,”09-05-2024″,”Call”,4%)

List of Functions:

=opt_Delta(“CurrentStockPrice”,”MarketOptionPrice”,”ExpiryDate”,

“OptionType”,”RiskFreeRate”)

=opt_Gamma(“CurrentStockPrice”,”MarketOptionPrice”,”ExpiryDate”,

“OptionType”,”RiskFreeRate”)

=opt_Theta(“CurrentStockPrice”,”MarketOptionPrice”,”ExpiryDate”,

“OptionType”,”RiskFreeRate”)

=opt_Vega(“CurrentStockPrice”,”MarketOptionPrice”,”ExpiryDate”,

“OptionType”,”RiskFreeRate”)

=opt_Rho(“CurrentStockPrice”,”MarketOptionPrice”,”ExpiryDate”,

“OptionType”,”RiskFreeRate”)

=opt_ImpliedVolatility(“CurrentStockPrice”,”MarketOptionPrice”,

“ExpiryDate”,”OptionType”,”RiskFreeRate”)

2. Previous Earning report date & time

In our latest update, we’ve introduced two new functions to enhance earnings season analysis:

- =previousEarningsReportDate: Returns the date of a company’s last earnings report, helping investors track earnings history.

- =previousEarningsReportTime: Provides the time of the last earnings announcement, aiding investors in scheduling their market watch.

Example:

=previousEarningsReportTime(“AAPL”) will report After Market

3. StrikeNext new functionality

We have enhanced our StrikeNext fucntion in this update.

=StrikeNext(“ticker”, “near_value”): Returns the nearest strike price to the specified value for the given ticker, enabling precise option strategy planning.

For example, =StrikeNext(“msft”,”near_303″) retrieves the closest strike price to 303 for Microsoft options which is 305.

Our team has performed minor optimizations to run MarketXLS (Buy Now) smoothly. Please email us at support@marketxls.com with any concerns or issues you face.

Click here to join our Discord community and engage with other MarketXLS (Buy Now) users.

MarketXLS (Buy Now) focuses on delivering the best Excel experience to its users; help us improve MarketXLS (Buy Now) by sharing your feedback.

I invite you to book a demo with me or my team to save time, enhance your investment research, and streamline your workflows.