What is the Black Litterman Model?

The Black Litterman Model is a risk-adjusted return optimization tool and asset allocation decision support system developed by Fischer Black and Robert Litterman in the early 1990s. It is considered a “polyhedral process” for portfolio optimization and provides insight into portfolio selection, risk management, and investment decisions. This model is based on the Mean-Variance Optimization technique and Mean-Variance Portfolio Theory but incorporates several additional features such as Bayesian Estimation and Expectations-Based Modeling to provide more robust and accurate portfolio optimization.

How Can You Use It?

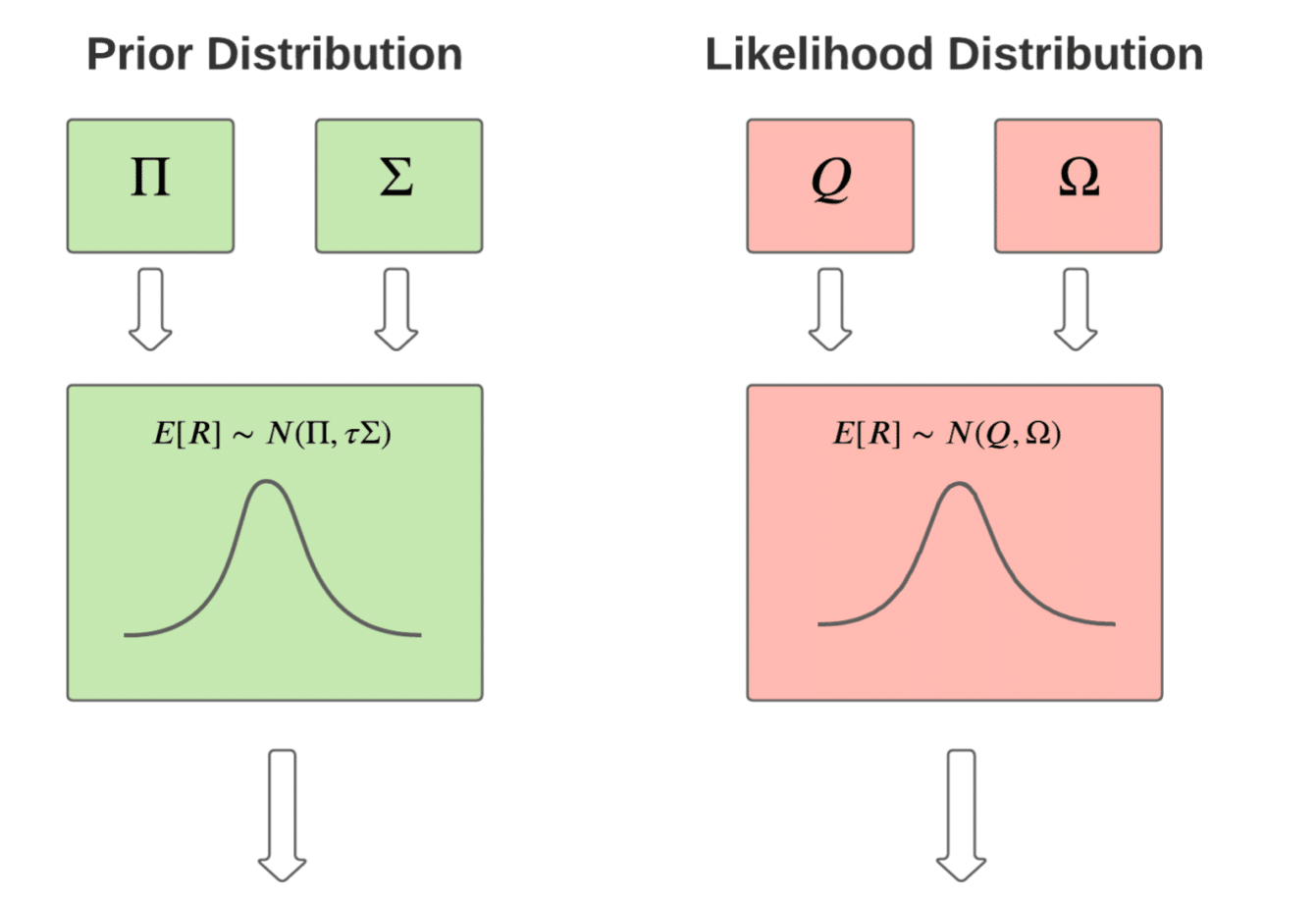

The Black Litterman Model can be used for portfolio optimization, risk management, asset allocation, and return optimization. The core of the model is based on the concept of Equilibrium Prices for each risk factor, which are influenced by investors’ opinion, sentiment and risk appetite, rather than just relying on historical returns and past data. The model also leverages a novel Bayesian estimation technique to create a fully integrated “expectations-based” approach to portfolio optimization and investment decision making, allowing you to take into account the investors’ outlook and current market conditions.

One of the major advantages of the Black Litterman model is its ability to incorporate both subjective views and objective data while simultaneously minimizing risk, ensuring that allocations adhere to the investors’ risk preferences. This can significantly improve the overall performance of a given portfolio and provide greater insights into the risk-reward profile of investments.

The Black Litterman Model can be used to evaluate and allocate both actively managed and passively managed portfolios, as well as providing insight into mitigation strategies for potential investment risks.

MarketXLS

MarketXLS is a powerful Excel-based software program for investment decision support and portfolio optimization. It includes a Black Litterman Model feature that makes it easy to incorporate subjective views and objective data into your portfolio optimization methodology, allowing you to obtain more accurate and reliable risk-adjusted returns. With MarketXLS, you can easily track portfolio performance, measure risk levels, and create asset allocation strategies that are tailored to your investment objectives.

Overall, the Black Litterman model is a powerful tool for portfolio optimization, risk management, asset allocation, and return optimization. With MarketXLS, you can accurately integrate both subjective and objective data into your portfolio decision making process and create sophisticated portfolios that are tailored to your investment goals. Get started with MarketXLS’ Black Litterman Model today!

Here are some templates that you can use to create your own models

Search for all Templates here: https://marketxls.com/templates/

Relevant blogs that you can read to learn more about the topic

Black-Litterman Model- Portfolio Allocation And Optimization