Table of contents

- 1. Covered call/ Naked Call Option Strategy

- 2. Bull- Call Spread Option Strategy

- 3. Protective Put Option Strategy

- 4. Bear- Put Spread

- 5. Strip Option Strategy

- 6. Iron Condor Option Strategy

- 7. Long Straddle and Short Straddle

- 8. Long Strangle and Short Strangle

- 9. Momentum Option Strategy

- 10. Scalping Option Strategy

- Summary

Discover the ultimate option strategy, perfect for beginners. With these proven techniques, you can confidently navigate the world of options trading and make profitable decisions. Don’t miss the opportunity to take your investment game to the next level—try these strategies today!

Here are the top 10 options trading strategies for new learners:

1. Covered call/ Naked Call Option Strategy

Two of the few popular strategies are the Naked call option and the Covered call or buy-write. With the naked call option, you buy the option to purchase a stock at a future date. A covered call involves owning the stock and selling a call option, generating income, and reducing some risks.

2. Bull- Call Spread Option Strategy

Bull-Call Spread is a trading strategy where you buy an ATM call option and sell an Out-Of-The-Money call option on the same asset with the same expiration date. It is profitable when the asset’s price goes up but there may be losses if the stock price falls.

3. Protective Put Option Strategy

In a Protective Put, an investor buys an asset, such as shares of stock, and buys put options for an equal number of shares. A put option gives the holder the right to sell the stock at a specific price, known as the strike price. Each contract represents 100 shares. This approach can protect the investor against potential losses when holding the stock and It works similarly to an insurance policy, creating a price floor in case the stock’s value drops significantly.

4. Bear- Put Spread

The Bull Put Spread, a type of Credit Spread, is used by traders expecting a moderate rise in the underlying asset’s price. It involves selling a put option and buying another with a lower strike price. This strategy profits from theta decay, as the value of the sold put option decreases faster. Ideal for capitalizing on daily value gains due to theta decay, it’s considered an effective option buying strategy.

5. Strip Option Strategy

The Strip Strategy is used when investors anticipate high volatility but are bearish on market direction. It involves buying 2 lot of ATM Put Options and 1 lot of ATM Call Options on same underlying with same expiration. This strategy, a bearish take on the Long Straddle, can lead to significant gains if the underlying asset moves sharply, especially downward, by expiration.

6. Iron Condor Option Strategy

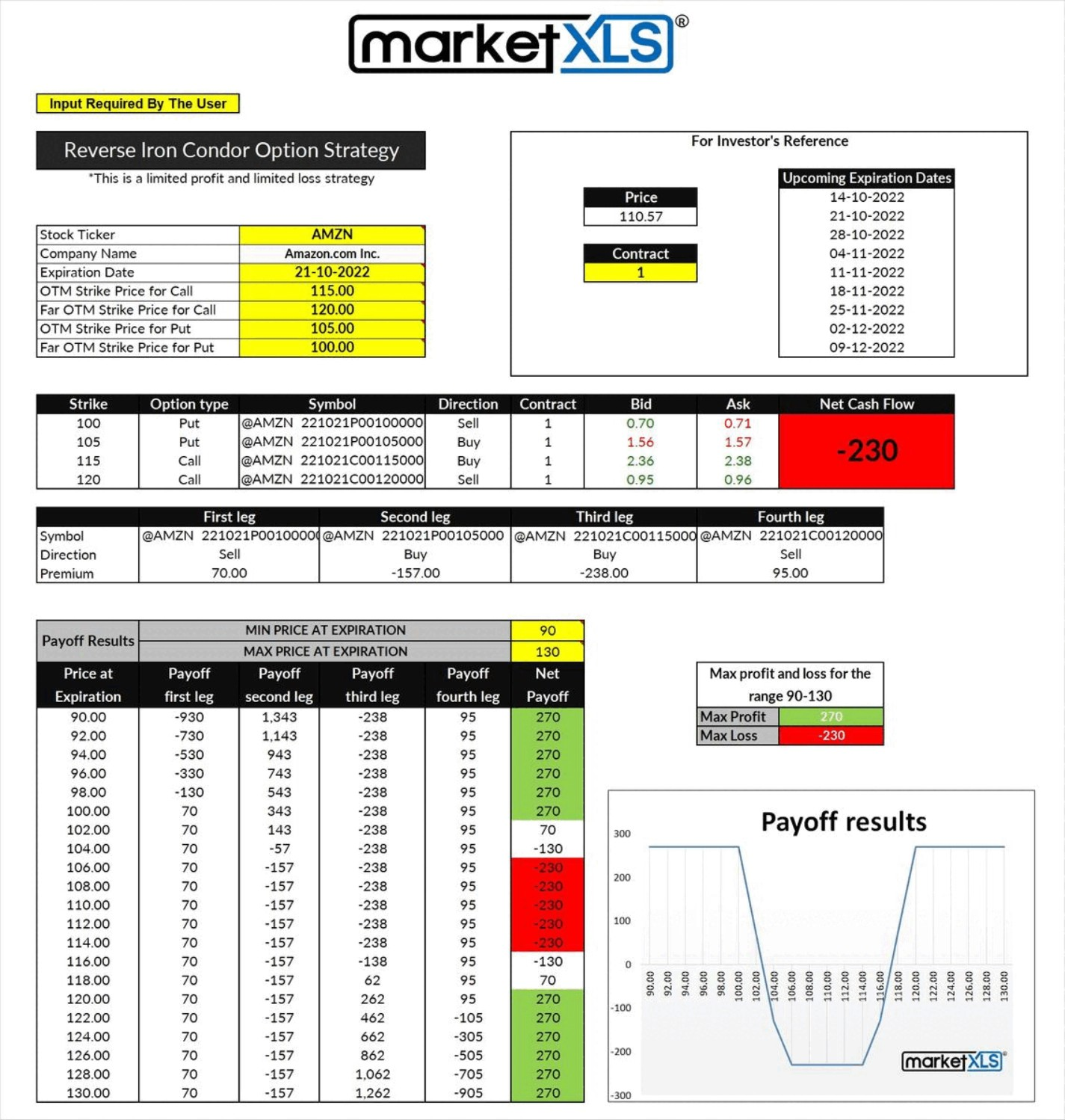

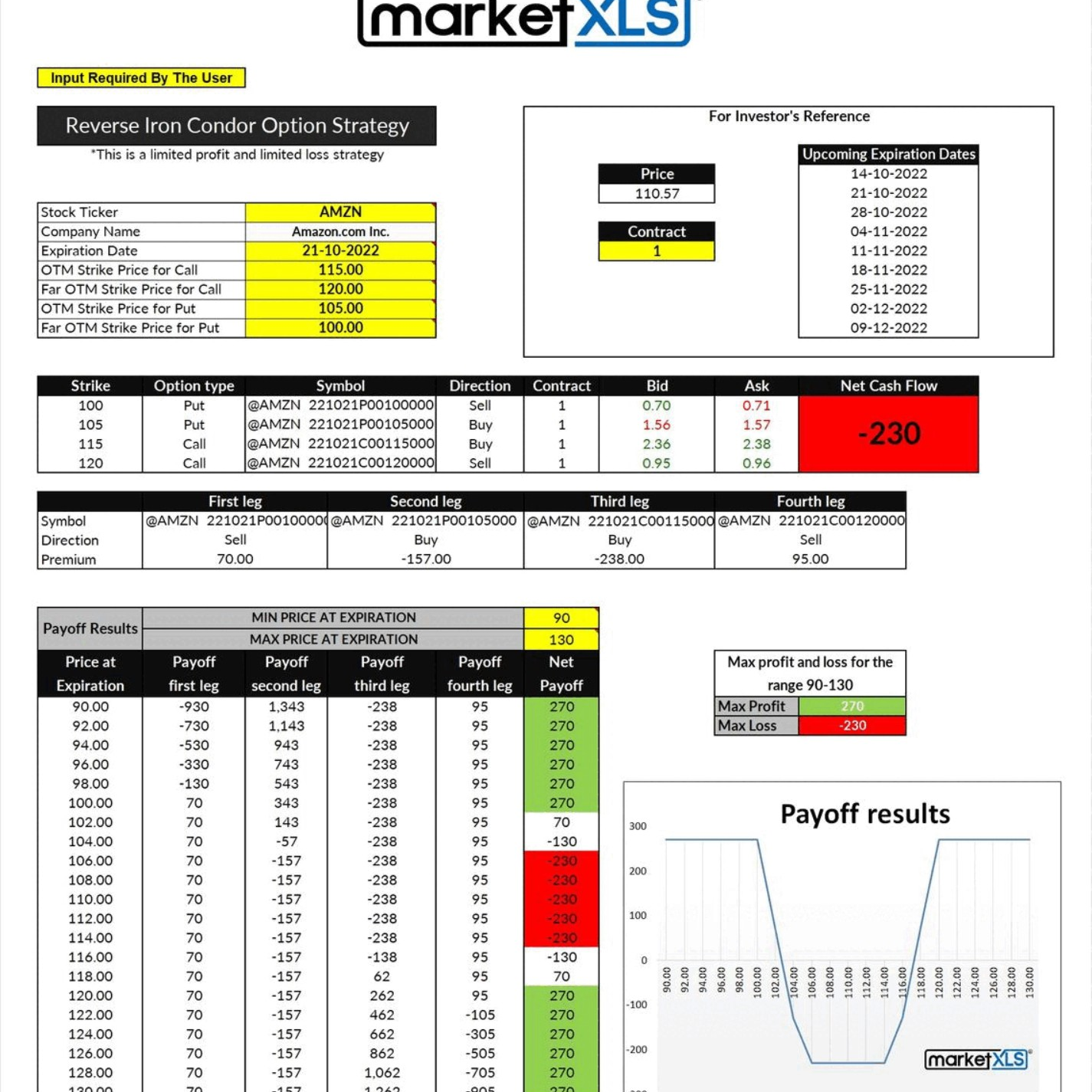

The Iron Condor strategy involves selling an (OTM) put, buying a lower-strike OTM put, selling an OTM call, and buying a higher-strike OTM call. This low-volatility strategy aims to earn a net premium with a high probability of modest gain. The maximum profit is when the stock stays within a specific range. The loss can be much higher if the stock price moves significantly beyond either strike.

7. Long Straddle and Short Straddle

Long Straddle is a market-neutral option strategy that is ideal when traders anticipate high volatility but are unsure of the market direction. It involves buying both a call and a put option on the same underlying expiration date and strike price. This strategy profits from significant price movements in either direction, making it a flexible approach for unpredictable markets.

The Short Straddle is used in low-volatility market conditions and entails selling a call and a put option on the same asset with identical expiration dates and strike prices. This strategy aims to profit from the premium received for selling the options, betting that the market will remain stable or exhibit minimal volatility. However, it carries a higher risk if the market makes a significant move.

8. Long Strangle and Short Strangle

The Long Strangle options strategy involves buying (OTM) calls and put options on the same underlying asset with the same expiration date. It is a trading strategy for high-volatility situations where the trader is uncertain of the price movement direction. It offers unlimited profit potential if the asset makes a substantial move in either direction, with a risk limited to the total premium paid for both options.

The Short Strangle strategy entails selling one OTM call option and one OTM put option on the same underlying asset, aiming to profit from the premium from selling these options. This strategy bets on the market price staying within a certain range, resulting in low volatility. The maximum profit is limited to the premiums received, while the potential loss is unlimited, making it riskier than the Long Strangle, as significant market movements can lead to substantial losses.

9. Momentum Option Strategy

The Momentum Intraday capitalizes on market momentum by selecting stocks poised for significant movement due to trends, news, takeovers, or earnings announcements. Traders quickly buy or sell these securities based on their analysis of imminent changes. This approach requires rapid decision-making to profit from price fluctuations. It’s considered a highly effective strategy for intraday trading.

10. Scalping Option Strategy

The Scalping trading strategy focuses on earning profits from minor price movements, making it a popular approach among intraday traders, especially those involved in high-frequency trading. This strategy prioritizes price action over comprehensive fundamental or technical analysis. Traders should select stocks that are both liquid and volatile to facilitate quick entry and exit. Importantly, setting a stop loss for all orders is crucial to manage risks effectively.

MarketXLS is an innovative investment research platform that revolutionizes the way professional and retail traders analyze financial markets. It enhances user experience by integrating advanced algorithms and templates for calculating payoffs, maximum gains, and losses, among other financial metrics. Designed to be a cornerstone tool for traders, MarketXLS facilitates a deeper understanding of investment strategies, valuation, and risk management through its built-in Excel functions. Offering a unified view of investment data, MarketXLS stands out as an essential tool for investors who rely on Excel for daily analysis.

Summary

Options Strategies offers a wide range of strategies to handle different market situations, making it a great tool for investors and traders looking to get more involved in the market. Although learning how to trade options can be tough at the start because it’s complex, it’s worth it. Options strategies allow you to set prices in advance, reducing the chance of losing money and managing risk. Option strategies like covered calls, married puts, straddles, and strangles can help manage risk and take advantage of market changes. Options strategies can be used with various investments, such as stocks and commodities.

Learn More About:

- NSE Live Option Chain: https://marketxls.com/nse-option-chain-excel-real-time

- Real-time Stock Prices: https://marketxls.com/how-to-get-indian-stock-prices-in-excel-real-time-historical