A covered call is one of the most popular and straightforward options strategies, widely used by investors to generate additional income from stocks they already own. If you've ever wondered how to make your stock portfolio work harder for you, this strategy is an excellent place to start.

This guide will break down exactly what a covered call is, how it generates income, its risk-and-reward profile, and when you should use it. We'll walk you through a step-by-step example using Microsoft ($MSFT) and show you how to set up your first trade with the power of MarketXLS in Excel.

What Are Covered Calls?

A covered call is an options strategy where you sell (or "write") a call option against a stock that you already own. To execute this strategy, you must own at least 100 shares of the underlying stock for every one call option contract you sell.

This strategy consists of two key components:

A Long Stock Position: You own at least 100 shares of a particular stock.

A Short Call Option: You sell a call option on that same stock, which gives the buyer the right (but not the obligation) to purchase your 100 shares at a predetermined price (the strike price) on or before a specific date (the expiration date).

Because you already own the shares, the call option is "covered." If the option buyer decides to exercise their right to buy your stock, you can deliver the shares you already hold. This makes it a much lower-risk strategy than selling a "naked" call, where you would have to buy the shares on the open market to deliver them.

How Covered Calls Make Money

The primary way a covered call generates money is through the premium you receive for selling the call option. When you sell an options contract, the buyer pays you a premium upfront. This amount is yours to keep, no matter what happens to the stock price or the option.

Think of it like renting out a property you own. The stock is your property, and the premium is the rent you collect. The buyer is paying you for the right to buy your stock at a set price in the future.

This premium does two things:

Provides Immediate Income: The cash is deposited into your brokerage account as soon as the trade is executed.

Lowers Your Cost Basis: The premium you collect effectively reduces the net price you paid for your shares, providing a small cushion against a potential decline in the stock's price.

The Risk vs. Reward Profile of a Covered Call

Every investment strategy has a unique risk and reward profile. A covered call is generally considered a conservative, income-generating strategy because it caps your potential profit in exchange for reducing your overall risk.

The Reward (Your Potential Profit)

Your maximum profit on a covered call is limited. It's calculated as:

Max Profit = (Strike Price - Your Stock Purchase Price) + Option Premium Received

You achieve this maximum profit if the stock price is at or above the strike price at expiration. In this case, your shares will be "called away" (sold to the option buyer), and you'll realize the gains on the stock up to the strike price, plus you get to keep the entire premium.

The Risk (Your Potential Loss)

The main risk of a covered call is a significant drop in the price of the underlying stock.

Downside Risk: While the premium you receive offers a small buffer, you still retain all the downside risk of owning the stock. If the stock price falls dramatically, the loss on your shares could easily exceed the premium you collected. Your breakeven point is your stock purchase price minus the premium per share you received.

Opportunity Cost: The other "risk" is that the stock price soars far above your strike price. Your upside is capped at the strike price. You'll miss out on any gains beyond that point because you are obligated to sell your shares at that price. This is why the strategy is not ideal if you are extremely bullish on a stock.

When to Use Covered Calls

The covered call strategy is most effective in specific market conditions and aligns best with a certain investor outlook.

You should consider using a covered call when you are neutral to moderately bullish on a stock you own. This means you expect the stock price to:

- Rise slightly

- Remain flat or trade sideways

- Decline by a small amount

This strategy works best with stable, high-quality stocks (often those with a beta of 1 or less) that you wouldn't mind holding for the long term. It's generally not recommended for extremely volatile stocks, as a sharp price decline could lead to significant losses, while a massive price surge would lead to major missed profits.

Your First Covered Call Trade (A Step-by-Step Example)

Let's walk through a practical example of setting up a covered call trade on Microsoft ($MSFT) stock using MarketXLS. For this example, assume you own 100 shares of MSFT.

Step 1: Get the Current Stock Price

First, we need to know the current trading price of MSFT. In MarketXLS, you can use a simple function to pull this data directly into your Excel sheet.

In a cell, type: =Last("MSFT")

Let's say this returns a price of $165.52. Our 100 shares are currently worth $16,552.

Step 2: Find Available Call Options

Next, we need to find a suitable call option to sell. We're looking for an "Out of the Money" (OTM) option, meaning its strike price is higher than the current stock price.

In MarketXLS, select the cell with your ticker ("MSFT") and navigate to the Utilities menu in the MarketXLS tab. From there, select "Get Option Chains" and choose "Option Chain Out of The Money."

(Note: Accessing options data requires a QuoteMedia data subscription with MarketXLS.)

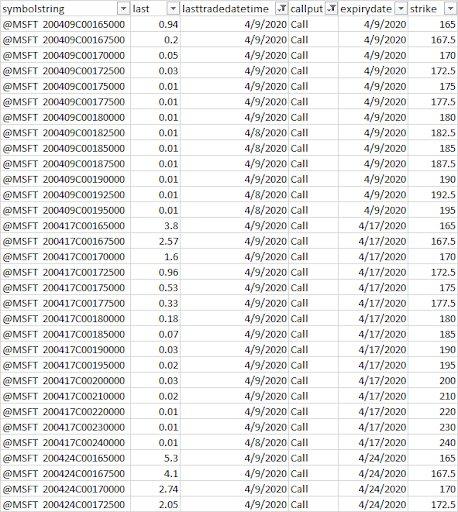

This will load a detailed table of available options. You can use Excel's filter tools to focus on "Call" options and sort by expiration date to find a contract that fits your timeline.

Filter covered calls Excel

Step 3: Select a Strike Price and Expiration

Let's say we're looking for an option that expires in about two months. After filtering, we find the following contract:

- Option Code: @MSFT200619C00175000

- Type: Call

- Strike Price: $175.00

- Expiration Date: June 19, 2020

- Last Price (Premium): $6.05

Since options are traded in lots of 100, selling one contract would generate an immediate premium of $605 ($6.05 x 100).

Step 4: Analyze the Potential Outcomes

Now that we've set up the trade (long 100 shares of MSFT, short one $175 call), let's analyze what could happen by the expiration date.

Our breakeven point on the stock is now $159.47 ($165.52 purchase price - $6.05 premium per share). As long as MSFT stays above this price, the entire position is profitable.

Let's explore three scenarios:

Scenario 1: MSFT closes at $170 (Option expires worthless)

- The stock price went up, but not above the $175 strike

- The call option expires out-of-the-money and worthless

- You keep your 100 shares of MSFT

- You keep the $605 premium

- Your total profit is the gain on the stock plus the premium: ($17,000 - $16,552) + $605 = $1,053. This is $605 more than if you had only held the stock.

Scenario 2: MSFT closes at $175 (Max Profit)

- The stock price rises exactly to the strike price

- The option expires at-the-money

- Your shares are called away, and you sell them for $175 each

- You keep the $605 premium

- Your total profit is: ($17,500 - $16,552) + $605 = $1,553. This is your maximum possible profit.

Scenario 3: MSFT closes at $190 (Profit is Capped)

- The stock price rises far above the strike price

- The option is now deep in-the-money

- Your shares are called away at the strike price of $175

- You keep the $605 premium

- Your profit is still capped at $1,553. You miss out on the additional gains the stock made from $175 to $190.

This clearly illustrates the trade-off: in exchange for the premium income, you cap your potential upside.

Common Mistakes to Avoid

For beginners, a few common pitfalls can turn this simple strategy sour. Be sure to avoid:

Selling Calls on Stocks You Don't Want to Lose: Only write covered calls on stocks you are comfortable selling at the strike price. If you have a strong emotional attachment or believe the stock is poised for a huge breakout, this may not be the right strategy.

Ignoring Stock Quality: Selling covered calls on highly speculative or unstable stocks is risky. A sharp price drop can lead to major losses that the small option premium cannot offset. Stick with quality companies you believe in.

Chasing the Highest Premiums: Options with strike prices very close to the current stock price offer higher premiums, but they also have a much higher chance of being assigned. Don't let a juicy premium cloud your judgment about the probability of having to sell your shares.

Forgetting About Broker Commissions: The examples above do not include trading fees. Be sure to factor in your broker's commissions for both buying the stock and trading the option, as they will slightly affect your breakeven point and overall profitability.

Setting Up MarketXLS for Covered Calls

MarketXLS makes it easy to analyze and track covered call opportunities directly within Excel. Here are the key tools to get started:

Live Stock Prices: Use functions like =Last("TICKER") or =stockPrice("TICKER", "last") to get real-time stock data.

Full Option Chains: Use the Get Option Chains tool found under the Utilities menu to import entire chains for any stock, allowing you to easily sort and filter by strike, expiration, and premium.

Basic Profit/Loss Calculator: With live data flowing into Excel, you can set up simple formulas to calculate your breakeven price, max profit, and potential return on investment for any trade you are considering.

Frequently Asked Questions (FAQs)

Q: What does it mean if my stock gets "called away"?

If your covered call option is "in-the-money" at expiration (i.e., the stock price is above the strike price), the option holder will likely exercise their right to buy your shares at the strike price. Your broker will automatically sell your 100 shares at that price. This is known as assignment.

Q: Do I need exactly 100 shares to sell a covered call?

Yes. One standard options contract represents 100 shares of the underlying stock. You must own at least 100 shares for each call contract you wish to sell to be "covered."

Q: Can I still lose money with a covered call?

Absolutely. If the stock price falls by more than the premium you received per share, your overall position will be at a loss. The strategy reduces risk but does not eliminate it.

Q: What does "Out-of-the-Money" (OTM) mean?

For a call option, OTM means the strike price is higher than the current market price of the stock. For a put option, it means the strike price is lower than the current market price. OTM options are cheaper and have a lower probability of being exercised.

Ready to Find Your First Trade?

You now have a solid foundation for understanding the covered call strategy. You know what it is, how it works, and the key risks and rewards involved. The next step is to learn how to actively screen the market for the best opportunities.

Continue to our next guide to build a powerful screening tool in Excel: How to Find the Best Covered Calls: Excel Screening Guide