Common obstacles to business and investment success are behavioral biases. Even the most rational individuals are often subject to erroneous conclusions or emotional reactions to new information, which makes them vulnerable to making poor investment decisions.

Emotional Shortcuts and Errors influence our decision-making. We cannot set emotions aside, but we can always set these emotions and shortcuts in play to help in rational decision-making. We first need to understand and have the knowledge of cognitive and emotional shortcuts and errors. The knowledge about behavioral biases and behavioral finance guides us towards the correct use of these shortcuts and correction of cognitive and emotional errors on our way to satisfying our wants.

5 Ways To Overcome The Behavioral Factors In Decision Making

- Acquisition of Knowledge

Human-behavior ignorance should be replaced with knowledge. This doesn’t mean the behavior conforming knowledge such as focusing only on information that reinforces their opinions about an investment. The information has to be unbiased and hence for this there requires a readiness from the human to acquire the knowledge. Quite often, framing errors mislead investors to ‘price illusion’ that tempts them to buy a stock when its price falls or is cheaper compared to its peers. A well-known phrase, “don’t try to catch a falling knife,” is very well associated with entering a falling stock suggesting entering a market with a lot of downward momentum can be extremely dangerous—just like trying to catch an actual falling knife. With knowledge investors are more likely to take an informed and rational decision than just merely driven by sentiments.

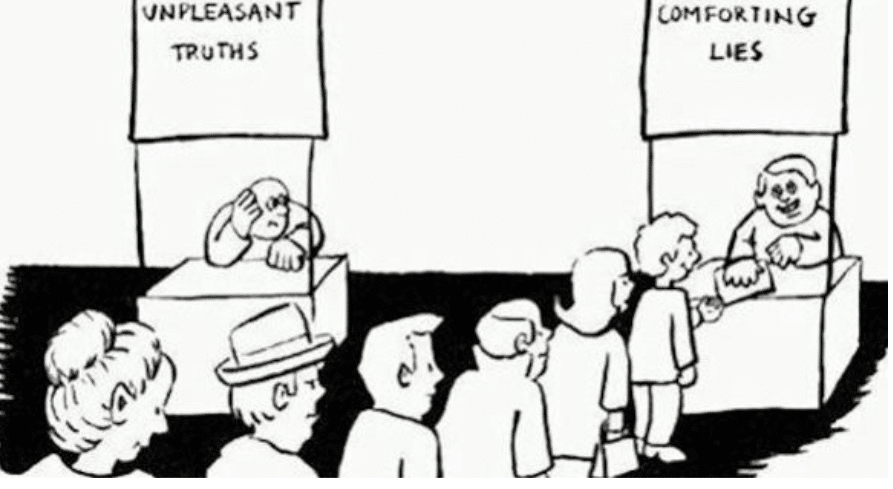

- Overcoming Overconfidence

Image Source: https://cartoonmovement.com/cartoon/overconfidence

Investors can make increasingly foolish financial choices because of overconfidence and it can also cause business managers to drive their corporations into the ground. Inflated views about our knowledge and abilities can be detrimental and is the main driver of overconfidence.

Individuals should avoid “Over Trading” by not entering into trading activities and instead, diversify their portfolios. They should give equal importance to any news that confirms or conflicts with their views. Investors should also not confuse their brains with a bull market!

- Never Get Attached To The Company

Image source: https://globfinserv.com/volatility-risk-in-equity-investments/

This is a very commonly found behavioral bias in many investors who get attached to the company and are not able to exit the position. These attachments may sprout from the company being your first ever investment or waiting for the right price, etc. Always keep in mind that a great company may not prove to be a great stock. It may happen that these great companies have expensive valuations and hence they might not be great stocks to be invested in!

- Don’t Chase The Trends

Image Source: https://www.trendfollowing.com/charts/

It is well said by Buffet: “Be fearful when others are greedy and greedy when others are fearful.” It is not a good idea to chase the trends as following the trends have rarely produced any significant gains for investors. Many times investors in the fear of missing out try to follow the trend and enter at very high levels hoping that the stock will continue to rise but it often reverts to long-term averages.

- Have A Stop Loss

Image Source: https://www.dreamstime.com/stock-illustration-businessman-stop-loss-illustration-holding-heading-image44948942

The best way to overcome the disposition effect, that is the tendency to sell off the good performers and hold on to the poor stocks in the portfolio, is to set a stop loss. The purpose of a stop loss is to minimize an investor’s loss on a position that moves unfavorably. A big failure to understand on the investor’s end is that when a security falls by 50% it has to gain 100% for it to come back to that very level and hence staying invested may not be very profitable if the downtrend continues. It is essential to “stitch in time to save nine” in the portfolio, is to set a stop loss order.

Behavioral Factors in Market Bubbles and Crashes Seen in the Past:

Image Source: https://nextcity.org/daily/entry/housing-in-brief-google-searches-show-fears-of-a-housing-market-crash

Let’s go on a historic tour of the great bubbles and crashes throughout history to understand the behavioral factors and try to categorize the biases and errors that lead to these bubbles.

The root of the housing bubble of 2008 is in the Dot-Com Bust that took place between 1996 – 2000. The Nasdaq equity index increased more than 8-fold, from 600 – 5,000 where thousands of companies went public despite no business plan and no earnings. It finally ended in 2000 and $5 trillion in market value of technology companies was wiped out between March 2000 and October 2002.

To inject growth into the economy The Federal Reserve embarked on a sustained series of rate cuts where interest rates fell from 6.00% to 1.75%

A “perfect storm” fueled subprime borrowing with interest rates at record lows and a bill mandating greater access to mortgage loans for “subprime” borrowers, whose credit history would previously have shut them out of the mortgage market.

Campaign Slogans like “The Ownership Society” made US consumers buy the concept that home ownership is the best way to build wealth. House prices soared as borrowers of all credit levels rushed to take advantage of the low mortgage rates, even lower teaser rates, subprime-friendly mortgage lenders, and the option to borrow 100% of the property price

The increasing number of borrowers, and the growing availability of loans, led to “cascades”, because of the availability heuristic in which house “flipping” became a national pastime and added to demand for real estate investments.

Mortgage lenders offloaded the risk by packaging the loans into “mortgage-backed securities” and sold them to Wall Street. Global investors weren’t worried about defaults, since the loans were backed by the real estate collateral: borrowers who could not pay would have their houses repossessed and sold to pay off the loan – and they believed that house prices never go down.

As greater numbers of global participants in the US housing market looked only for information that supported their view of ever-increasing house prices and thus the safety of their related investments they were subject to confirmation bias.

This Non-Regressive Prediction bias where in the context of financial markets we believe that a particular market will not see a correction, because of the perception that a correction has never happened before. led borrowers, lenders, investment bankers, and the international investing community to ignore subprime default risk.

The Bottom Line

Correcting one’s emotional and cognitive errors of biases is not usually easy but now with the knowledge it can be done. Part of human-behavior knowledge includes knowledge of wants, emotional shortcuts, and emotional errors. Investors should combine that knowledge with financial-facts knowledge to use emotional shortcuts and avoid emotional errors on their way to satisfying their own wants and being successful in their investment strategies.

Disclaimer

None of the content published on marketxls.com constitutes a recommendation that any particular security, portfolio of securities, transaction, or investment strategy is suitable for any specific person.

References:

6 Tips for Investors to Overcome Behavioral Bias | The Smarter Investor | US News

Overcoming Six Emotional Biases to Have a Successful Investing Experience