Introduction

Investment is a critical part of securing one’s future. As investors, we seek strategies that can enhance the performance of our portfolios while also managing risk. One such method is portfolio rebalancing. In this blog post, we’ll explore how MarketXLS, a leading tool for stock market analysis, can aid in the process.

Understanding Portfolio Rebalancing: An Essential Investment Strategy

What is Portfolio Rebalancing?

Portfolio rebalancing is an investment strategy designed to maintain an optimal mix of assets in a portfolio. It ensures that the portfolio remains aligned with the investor’s ideal investment plan.

Why Rebalance Your Portfolio?

The aim of rebalancing is to adjust the asset mix to conform to a predefined target asset allocation. It involves purchasing or selling investments considering withdrawal strategies and associated fees. Without regular rebalancing, the portfolio’s asset class weightings can drift from targeted allocations due to market trends, asset class price movements, and transactions.

The Discipline of Rebalancing

Rebalancing should be an ongoing, disciplined process, even when market fluctuations and emotions come into play. It should be carried out in accordance with an investor’s risk tolerance and target mix, weighing both potential rewards and risks.

When to Rebalance?

The frequency of rebalancing is contingent on market conditions. If a market rebound is expected after sharp declines, investors might defer rebalancing for some time. The cost of rebalancing the portfolio should be compared with potential gains from the new asset allocations.

The Benefits of Rebalancing

Rebalancing a portfolio can offer numerous benefits, including lower risk, minimized losses, better returns, increased profits, and improved asset allocations. It presents an opportunity to reduce risk tolerance and increase expected returns by reallocating more assets to investments less susceptible to market volatility.

The Role of Tax Benefits

Rebalancing also provides an avenue to leverage tax-loss harvesting and other tax benefits.

The Considerations in Rebalancing

Rebalancing a portfolio requires discipline and expertise. Market conditions, risk tolerances, and market values should be evaluated when considering rebalancing. The types of transactions needed to align the asset allocations with the desired target should also be determined. Risks, costs of rebalancing, and alternative investment approaches should be considered.

Step-by-Step Guide: Portfolio Rebalancing with MarketXLS

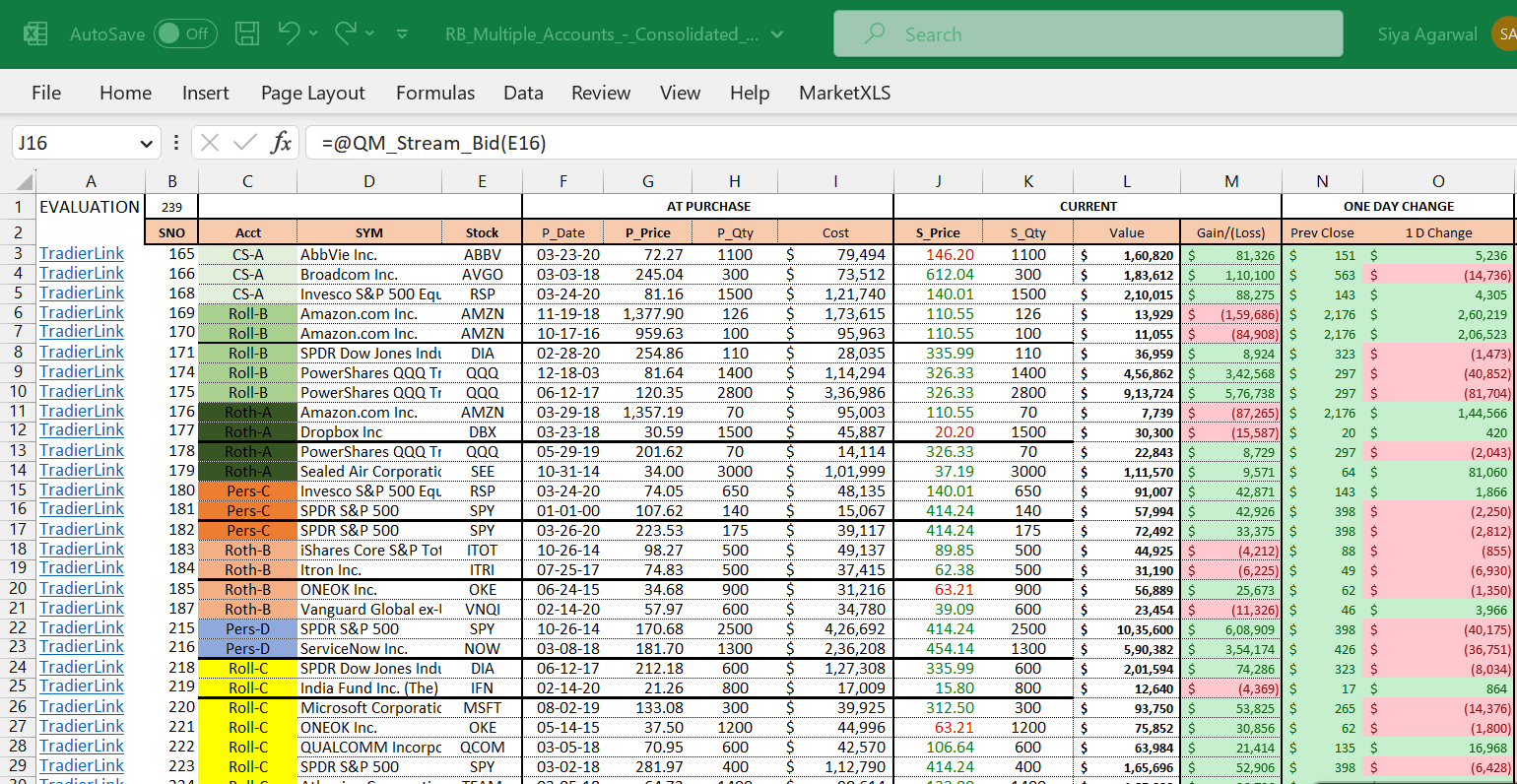

Step 1: Setting Up Your Portfolio in MarketXLS

Initiate this process by diligently entering the specifics of your current portfolio into MarketXLS. This should comprise all your asset holdings, indicating the respective quantities of shares and their acquisition prices. With these data inputs, MarketXLS will skillfully calculate the current value of your portfolio using real-time price data. Furthermore, it will ascertain the relative weightage of each stock in your portfolio using a straightforward, built-in formula.

Step 2: Defining Your Desired Asset Allocation

Your next step involves specifying your ideal asset allocation, a decision that hinges on your risk tolerance and investment objectives. Depending on your unique situation and time horizon for investment, your allocation can span anywhere from aggressive to conservative.

A key feature of MarketXLS is its ‘Portfolio Efficient Frontier’ function. This advanced tool reflects your investment strategy and exposes the corresponding risk levels. It offers a visual portrayal of your portfolio’s risk and return dynamics, providing invaluable aid when considering rebalancing decisions. By utilizing this function, you can adjust your portfolio to better match your risk comfort level, thus enabling more strategic and informed asset allocation. This tool is crucial for customizing your investments to more effectively meet your financial goals.

Step 3: Calculating Asset Allocation Deviations

Take advantage of MarketXLS’s real-time data and robust analytics to pinpoint any discrepancies between your existing asset allocation and your pre-set targets. In instances where certain assets have seen considerable growth, they might now command a more prominent share of your portfolio than initially planned.

To track your portfolio’s progression over time, you can employ the =WealthIndex(Portfolio, Periods) function provided by MarketXLS. This function creates a historical wealth index, premised on a starting investment of $10K. This index serves as a valuable tool, offering key insights into your portfolio’s performance trajectory. It assists in making informed decisions regarding necessary portfolio adjustments to align better with your investment goals.

Step 4: Rebalancing Your Portfolio with MarketXLS

After calculating the deviations, proceed to execute informed trades to rebalance your portfolio. This usually means selling off shares from overrepresented assets and buying more from those underrepresented. By actively employing this strategic realignment, you maintain your portfolio’s balance in line with your target asset allocation.

Step 5: The Importance of Regular Portfolio Reviews

Rebalancing your portfolio isn’t a solitary task; rather, it demands consistent monitoring and review. Given the volatility of market conditions and the unique nature of your investment strategy, it’s recommended to conduct portfolio reviews at regular intervals—this could be on a quarterly, semi-annual, or annual basis.

Additionally, you can assess the performance of your portfolio by calculating historical monthly returns for adjustable periods using the =MonthlyReturns(Portfolio, Periods) function in MarketXLS. This leverages the most precise price data to give you an accurate measure of your portfolio’s performance.

By adhering to a regular review schedule and tracking your portfolio’s returns, you can ensure your portfolio stays aligned with your investment objectives, adapting as necessary to the ever-evolving market landscape.

The Advantages of Rebalancing with MarketXLS

Portfolio rebalancing with MarketXLS offers a multitude of benefits to both novice and seasoned investors, by integrating advanced technology with smart investment strategies. This powerful software not only helps maintain your desired risk level but could also provide a significant boost to your portfolio’s performance. Let’s delve into the specific advantages of using MarketXLS for portfolio rebalancing:

Informed Decision Making

MarketXLS is a treasure trove of real-time data and robust analytics that offers invaluable insights into market trends and the performance of various asset classes. These insights allow you to make data-driven decisions, rather than basing them on speculation or guesswork. It enables investors to understand how their assets are performing relative to market benchmarks and to identify the right time for rebalancing.

Streamlined Investment Process

Using a comprehensive platform like MarketXLS significantly streamlines the investment process. It eliminates the need for manual calculations and the use of multiple tools for different tasks. All your portfolio management needs – from tracking current portfolio composition and analyzing market trends to executing trades for rebalancing – can be met within one platform. This consolidation of tasks not only saves time but also reduces the possibility of errors, ensuring a smoother and more efficient investment process.

Enhanced Portfolio Performance

Portfolio rebalancing with MarketXLS can potentially enhance portfolio performance. By maintaining your desired asset allocation, you’re ensuring that your portfolio continues to align with your risk tolerance and investment goals. Overrepresented assets, which may be riskier, can be sold, and underrepresented ones, which may be safer or present new growth opportunities, can be bought. This realignment could result in improved returns over the long term.

Wealth Growth

With its powerful capabilities and ease of use, MarketXLS supports the ultimate goal of all investors: wealth growth. By allowing for informed decisions, a streamlined investment process, and optimal portfolio performance, MarketXLS sets a solid foundation for consistent wealth creation.

To learn more about how to maximize your portfolio performance with efficient frontier and how to set up a balanced stock portfolio with optimal asset allocation with MarketXls, please follow the links: Utilizing Backtesting for Building Better Stock Portfolios, Maximize Your Portfolio Performance with Efficient Frontier, and Setting up a Balanced Stock Portfolio with Optimal Asset Allocation with MarketXls.

Conclusion: Achieving Investment Goals with Portfolio Rebalancing and MarketXLS

Portfolio rebalancing can be a great strategy for achieving investment goals when used properly. Utilizing MarketXLS, investors can easily rebalance their investments and ensure that their portfolio holdings match their target asset allocation. With MarketXLS, investors maintain discipline, capitalize on market movements, tailor their investments, buy and sell shares, calibrate risk and return profiles, and monitor portfolio weightings as markets fluctuate. In addition, investors can take advantage of various rebalancing strategies, such as threshold approach to maintain their financial goals which often involve reducing risk, increasing tax efficiency, or reinvesting profits.

Through the tools offered by MarketXLS, investors can maintain a targeted asset mix and evaluate their investments with more accuracy and less human oversight than traditional methods. MarketXLS also provides helpful resources such as research, relationship summaries, figures and tables which can help investors to better understand their portfolio value, future returns, and potential tax liability due to their investments. By better understanding their assets, the markets, and market fluctuations, investors can learn how to more confidently make decisions and take action in their investments and navigate smoothly through the ups and downs of market timing to ensure the success of their investment plans.

For further information, please visit Utilizing Backtesting for Building Better Stock Portfolios, Maximize your Portfolio Performance with Efficient Frontier, Setting up a Balanced Stock Portfolio with Optimal Asset Allocation with MarketXLS, and Unlocking the Benefits of Portfolio Rebalancing.

Use AI driven search for all functions on MarketXLS here: https://marketxls.com/functions

Download from the link below, a sample spreadsheet created with MarketXLS Spreadsheet builder

https://mxls-templates.s3.us-west-2.amazonaws.com/MarketXLS-Model-ID-17CTGL.xlsx

Note this spreadsheet will pull latest data if you have MarketXLS installed. If you do not have MarketXLS consider subscribing here

Relevant blogs that you can read to learn more about the topic

Utilizing Backtesting for Building Better Stock Portfolios