Introduction to Backtesting and MarketXLS

Backtesting your stock portfolio helps you to predict its performance and make sound decisions for the future. This process involves running simulations on past stock data to evaluate the expected outcomes of your trading strategy, asset allocations, and portfolio construction techniques. The results of a backtest of a stock portfolio can provide critical insights, helping you refine your investment strategies. These insights may lead to adjustments such as modifying your portfolio ratio or allocating different weights to various asset classes. Therefore, backtesting your stock portfolio is a valuable tool in optimizing your investment approach and enhancing your portfolio’s potential performance.

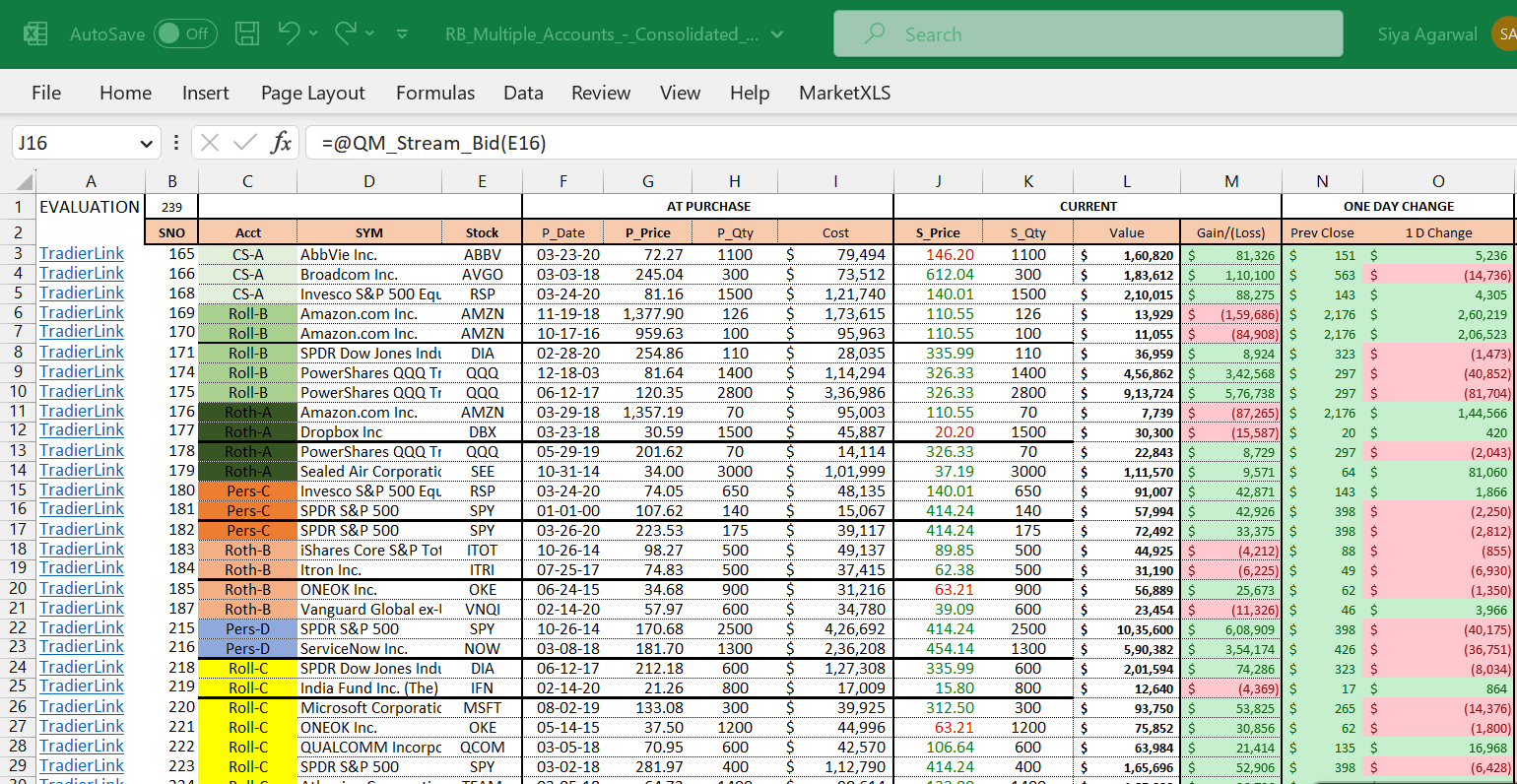

Portfolio backtesting can be conducted using specialized tools or free portfolio simulators like the Excel add-in MarketXLS. These tools allow you to input relevant data, such as stocks, ETFs, currencies and price data, to gain insight into potential portfolio returns. Depending on the tool, more advanced features may be available, such as portfolio simulations and style analysis, as well as readings that help evaluate the portfolio’s strength over a specified time horizon. Utilizing these capabilities can provide valuable understanding of the portfolio’s potential benefits, risks, and performance compared to industry standards.

The Importance of Backtesting Your Stock Portfolio

Backtesting your stock portfolio is an essential practice that offers several benefits. It allows investors to make more informed decisions and improve their investment performance. Incorporating backtest into stock portfolio management can yield the following benefits:

- Validate Investment Strategies: Backtesting your stock portfolio allows you to test the effectiveness of your investment strategies by simulating their performance using historical data. This process helps ensure the strategies you employ align with your financial goals and have a proven track record. Validating your strategies through backtesting helps build confidence in your investment approach, enabling you to make better decisions when allocating capital.

- Identify Strengths and Weaknesses: Backtesting your stock portfolio can reveal the strengths and weaknesses of your investment strategy. It helps identify the factors contributing to the strategy’s success or failure. This information can be invaluable for making informed adjustments to your strategy, such as modifying asset allocation or incorporating new risk management techniques. By addressing weaknesses and capitalizing on strengths, you can enhance your portfolio’s overall performance.

- Reduce Risk: Backtesting a stock portfolio allows you to identify high-risk investments or strategies that may expose your portfolio to substantial losses. Understanding potential risks associated with various investments helps you adjust your portfolio to minimize potential losses and protect your capital. This risk reduction process is critical for achieving long-term investment success as it aids in maintaining a well-diversified and balanced portfolio.

- Optimize Portfolio Performance: Analyzing results from backtesting your stock portfolio enables you to fine-tune your investment strategy. You can make necessary adjustments to optimize risk-adjusted returns. This may include rebalancing your portfolio, adjusting your stock selection criteria, or altering the weighting of different asset classes. By continually refining and optimizing your strategy based on backtesting results, you can improve your portfolio’s overall performance, achieving maximal returns while effectively managing risk.

How to Backtest Your Stock Portfolio with MarketXLS

MarketXLS streamlines the backtesting process, allowing you to test your investment strategies with ease. Follow these steps to backtest your stock portfolio using MarketXLS:

Step 1: Input Your Portfolio Details

Input the details of your current stock portfolio into an Excel spreadsheet using the MarketXLS add-in. This should include information for each stock in your portfolio, such as the stock’s name or ticker symbol, the number of shares you hold, the percentage allocation of that stock within the overall portfolio, the purchase price, and the date of acquisition. This comprehensive information serves as the foundation for your backtesting analysis, enabling accurate simulations of your portfolio’s historical performance.

Step 2: Access Historical Data

MarketXLS provides access to historical price data for stocks using its built-in historical functions. These functions enable you to retrieve relevant historical data directly into your spreadsheet. You can then use this data to simulate past performance and analyze how your portfolio might have behaved under different market conditions. This process allows you to calculate various performance metrics over time, offering a comprehensive understanding of your portfolio’s past behavior and aiding in projections of future performance. The historical functions that facilitate these calculations include, but are not limited to:

Book Value Per Share (Historical): “=hf_Book_Value_per_Share(“MSFT”,2022)”

Cash And Equivalents (Historical): “=hf_Cash_and_Equivalents(“MSFT”,2022)”

Step 3: Calculate Portfolio Performance Metrics

Using MarketXLS, calculate key portfolio performance metrics, such as returns, volatility, and risk-adjusted performance (e.g., Sharpe ratio). These metrics will help you evaluate the effectiveness of your investment strategy and determine whether it aligns with your financial goals and risk tolerance.

Step 4: Compare Your Portfolio to Benchmarks

Compare your portfolio’s performance to relevant benchmarks, such as market indices (e.g., S&P 500, Nasdaq Composite), to evaluate its effectiveness and identify areas for improvement. Comparing your portfolio to a benchmark allows you to determine whether your strategy is adding value or underperforming relative to the broader market.

Step 5: Analyze the Results

Review the results of your backtesting analysis to identify strengths, weaknesses, and potential adjustments to your investment strategy. This may involve examining the impact of specific stocks, asset allocation decisions, or risk management techniques on your portfolio’s performance. Use these insights to inform any necessary modifications to your investment approach.

Step 6: Implement Changes and Monitor Performance

Based on the insights gained from backtesting, make any necessary adjustments to your investment strategy, such as rebalancing your portfolio, modifying stock selection criteria, or implementing new risk management measures. Continuously monitor your portfolio’s performance to ensure that these changes are having the desired effect and to identify any further adjustments that may be needed.

By following these steps, you can use MarketXLS to backtest your stock portfolio effectively, gaining valuable insights into the performance of your investment strategies and making informed decisions to improve your investment outcomes.

Tips for Effective Backtesting with MarketXLS

To make the most of your backtesting experience with MarketXLS, it’s essential to adopt a meticulous and strategic approach. Here are some tips to ensure effective and efficient analysis:

- Use a Representative Sample of Historical Data: Make sure the historical data you use for backtesting covers a representative sample of different market conditions. This includes periods of bull and bear markets, times of high and low volatility, and various economic cycles. Including a diverse range of conditions in your backtesting can help ensure that your investment strategy is robust and can withstand different market environments.

- Consider the Impact of Taxes and Trading Costs: Taxes and trading costs can significantly impact your net investment returns. Therefore, it’s essential to factor these elements into your backtesting process. MarketXLS facilitates this by allowing you to customize templates to include these costs, offering a more accurate depiction of your net returns. This approach can help ensure realistic backtesting outcomes and prevent future disappointments resulting from unforeseen expenses.

- Incorporate Diversification and Asset Allocation Strategies: Diversification and asset allocation are key components of a successful investment strategy. They help mitigate risk and can enhance potential returns. When backtesting with MarketXLS, ensure that your portfolio reflects your desired level of diversification and adheres to your preferred asset allocation strategy. This can help you assess how well your portfolio is likely to perform under different market conditions.

- Regularly Review and Update Your Investment Strategy: Backtesting is not a one-off process. It’s important to regularly review and update your investment strategy based on new market information, changes in your financial goals, or shifts in your risk tolerance. MarketXLS facilitates ongoing backtesting, making it easy to keep your investment strategy current and optimized. This continuous process can help you stay agile and adapt to the evolving market landscape, potentially enhancing your investment performance over time.

Additional Portfolio Management Features of MarketXLS

With MarketXLS, you have an array of features to help manage your portfolio and make sound decisions for your investments. Leverage advanced algorithms, machine learning research, regression analysis, and comprehensive data sets to backtest various trading strategies. With this set of features, you’ll be able to simulate portfolios to research the potential returns and risks associated with potential investments. You can create and customize portfolios at both the asset class level and stock level and weigh them according to specific criteria.

Clients are able to view the portfolio’s performance over different time horizons, analyze its components on multiple risk parameters, and monitor how it changes under market dynamics. You can use the portfolio simulator to gain valuable insights into underlying stocks, ETFs and other asset classes. You can also use the portfolio allocation rules to optimize the portfolio by finding the best weight distribution that correlates with your investment goals and risk appetite. Moreover, Investors can view their portfolios against various industry benchmarks and use customized visuals to understand the asset class contributions, compare returns against inflation, and more.

With MarketXLS, you can make data-driven decisions by accessing powerful tools like portfolio screener to rank your holdings and ETF factor for a view of sector and industry allocation. You can also use the Portfolio Growth Chart to analyze performance in the context of other variables, or access the portfolio style analysis to measure and visualize risk and returns.To get started, explore the articles on How to Backtest Your Options Trading Strategies, Gaining an Edge with Covered Call Backtesting, with MarketXLS. With all of these features, you’ll have a better understanding of how to make the most of your investments and keep your portfolio managed with care.

Conclusion: Backtest Your Stock Portfolio with MarketXLS

An effective investment strategy is crucial for ensuring financial security and promoting long-term success. Knowing how to manage your assets optimally is an essential skill for any investor. MarketXLS offers a suite of tools that allow investors to allocate assets strategically, backtest stock portfolios and test various investment ideas to help them achieve their financial goals.

Its features include a portfolio simulator, screener, and backtesting functionality, enabling investors to balance their portfolio allocations and determine the most effective trading strategies for their assets. MarketXLS’s sophisticated algorithms assist investors in analyzing data, calculating portfolio performance, and evaluating volatility and risk.

Key features such as the portfolio growth chart, performance settings, portfolio visualizer, and risk parity value provide valuable insights. These tools enable users to make informed decisions about their investment strategies based on solid data.

Furthermore, the platform offers access to comprehensive sets of diversification optimization tools, allocation guidance, ETFs, funds, stocks, and price data. This wealth of information empowers investors to explore and research different investment strategies and outcomes.

By providing the ability to backtest stock portfolios, MarketXLS stands as an invaluable asset for investors. Its powerful, data-driven tools help investors maximize the effectiveness of their investment strategies, leading to potentially higher returns and better financial outcomes.

If you’re curious to learn more about backtesting and how it works, you can check out the following helpful links from MarketXLS: Gaining an Edge with Covered Call Backtesting, How to Backtest Your Options Trading Strategies, Live Stock Prices Explained: An Easy Guide with MarketXLS, Make the Most of Covered Calls with an Excel Calculator, and Best Years for Backtesting Equity Strategies: A Step-by-Step Guide.