**Introduction **MarketXLS is a community of professional and institutional option traders who use the platform for analysis, monitoring and journaling. The active members regularly share their winning strategies, best-in-class tools and learning opportunities within the community.

In a recent survey the members discussed the best news sources that options traders trust. The members considered factors such as relevance of content, credibility, timeliness, depth of analysis, and ease of access.

##Key takeaways- Bloomberg, CNBC, and Investing.com stand out for their real-time news updates and data analysis. This makes them indispensable resources for traders needing to make quick, informed decisions.

-

Reuters, WSJ, and Financial Times offer extensive coverage across a variety of asset classes. Financial Times’ global coverage is also highly regarded, giving traders a comprehensive overview of international markets.

-

Bloomberg Terminal and TV, WSJ’s deep analysis, Financial Times’ editorial content, and Seeking Alpha’s crowd-sourced insights offer unique perspectives to their audience, enriching their decision-making process.

-

Investing.com and Yahoo Finance provide seamless navigation and customizable features that cater to the dynamic needs of traders, making information access swift and convenient.

-

Bloomberg, Reuters, WSJ, CNBC, and Yahoo Finance have a significant audience, indicating their vast reach and influence.

-

All these sources are highly credible and enjoy top rankings in their respective categories, underscoring their popularity and trust among users.

-

Bloomberg, Reuters, CNBC, MarketWatch, and Yahoo Finance offer affordable subscriptions without compromising on the quality of information.

-

Investing.com’s economic calendar, Seeking Alpha’s portfolio management tools, and Yahoo Finance’s personal finance resources provide additional value to options traders, helping them make holistic financial decisions.

##Top 10 News Sources for Options Traders Ranked1. Bloomberg

-

Reuters

-

The Wall Street Journal

-

CNBC

-

Financial Times

-

MarketWatch

-

Investing.com

-

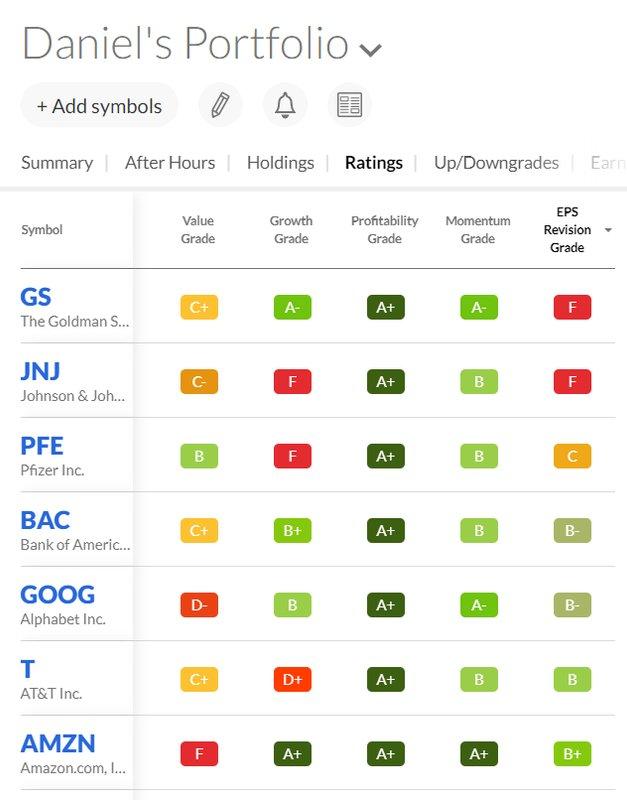

Seeking Alpha

-

Barron’s

-

Yahoo Finance

##Detailed Overview of Each News Source###**1. Bloomberg **

Live TV - Bloomberg

Bloomberg is like a goldmine for options traders, offering the latest business news, market data, and specialized analysis. Here’s why you should think about using it:

-

Real-Time News and Data Analysis: Bloomberg provides up-to-the-minute business news and market data, with expert analyses from industry leaders. This makes it a comprehensive resource for options traders to keep track of global trends and make informed decisions.

-

Bloomberg Terminal and TV: These unique offerings not only present a vast array of real-time data and analytical tools but also feature live interviews with key market players, offering a wealth of insights to subscribers.

-

Popularity and Engagement: Bloomberg attracts a vast audience with 310,000 subscribers and 55,700,000 site visits. The platform’s bounce rate of 55.10% suggests that a significant portion of the audience engages with multiple pages during their visit.

-

Top-Ranking Source: As the 37th ranked news & media publisher in the US, Bloomberg’s position underscores its reputation as a trusted and widely-used source of financial news.

-

Value for Money: Priced at $149 per year, Bloomberg’s subscription plan offers great value for traders seeking comprehensive market information and insights. To subscribe, please use the following link: Bloomberg Subscriptions | Digital, All Access, Corporate & Student." ###**2. Reuters **

News & media | Thomson Reuters

Reuters is a globally recognized and widely respected source of real-time financial data, news, and trading tools. For options traders, it is a very useful platform, offering insights that can help enhance trading strategies and investment decisions.

Here is why Options traders love Reuters:

-

Speed and Accuracy: Reuters, with its 2 million subscribers, is renowned for its fast and accurate global financial news. Its timely reporting is key for options traders who require up-to-the-minute market changes.

-

Extensive Coverage: It provides a broad range of asset classes coverage, like commodities, currencies, bonds, and equities. This diverse content is crucial for options traders to monitor the wider market that could influence options pricing.

-

Detailed Market Data and Analysis: Reuters offers detailed market data and in-depth technical analysis. This empowers options traders to base their trading strategies on comprehensive data.

-

Global Reach: With a substantial website traffic of 86.6 million, Reuters ensures traders globally are updated with financial events and trends from across the world, especially vital for those dealing with options on international markets.

-

Subscription and Ranking: Despite a bounce rate of 69.4%, it maintains a high ranking of 28 among news & media publishers in the US. The subscription plan of $34.99 per month provides traders with access to a wealth of valuable market insights. To register, please use the following link: Start your journey with Reuters | Reuters" ###**3. The Wall Street Journal **

The Wall Street Journal & Breaking News, Business, Financial and Economic News, World News and Video

The Wall Street Journal, abbreviated as WSJ, is a globally acclaimed financial publication renowned for its intensive coverage of international business, economics, and financial markets. For options traders, the WSJ can serve as an indispensable tool offering timely insights and data necessary to optimize trading strategies.

Options traders place a high value on WSJ as a news source for a multitude of reasons:

-

Comprehensive Coverage and Deep Analysis: WSJ delivers exhaustive financial news, market trends, and economic indicators. It also provides in-depth analysis and expert commentary on options trading, vital for traders seeking detailed insights to make informed decisions.

-

High Reach and User Engagement: With 2.9 million subscribers and 87.1 million website visitors, the WSJ has an impressive audience. Its bounce rate of 61.51% reflects the quality of its content.

-

Respected and Value-Added Subscription: With its renowned reputation for quality journalism, the WSJ is ranked 19th among news & media publishers in the US, indicating high credibility. The subscription plan, priced at $38.99 per month, offers a wealth of comprehensive financial information, providing substantial value for its cost. To register, please use the following link: Log In (dowjones.com)" ###**4. CNBC **

Stock market reversal shows shift in sentiment that will be difficult to weather, says Katie Stockton

CNBC is a gold mine of financial information, specifically tailored for professional options traders. Options traders often lean towards CNBC as a trusted news source for the following reasons:

-

Audience Reach: With 3 million YouTube subscribers and 141 million website traffic, CNBC has a massive audience reach, making it a popular platform among options traders for receiving financial updates.

-

Timely Updates and Broad Coverage: CNBC is known for its quick news updates and televised broadcasts, allowing traders to stay informed about real-time market changes. It provides a diverse array of content, including in-depth analysis, expert interviews, and market trends, equipping options traders with a multifaceted perspective.

-

User Engagement: The high level of user engagement maintained by CNBC is evident from its ranking as the 15th among news and media publishers in the US.

-

Accessible Knowledge: It offers a mix of free and premium content, allowing traders of all levels to gain knowledge and improve their trading strategies.

-

Value for Money: Its subscription plan, priced at $34.99 per month, offers access to exclusive content and insights, further empowering traders in their decision-making. To register, please use the following link: CNBC Pro – Premium Live TV, Stock Picks and Investing Insights and click subscribe in the dropdown pro menu.

###**5. Financial Times **

How to submit a letter to the editor | Financial Times

The Financial Times is widely regarded as an excellent source of news for options traders due to several factors:

-

Wide-ranging and Global Coverage: Financial Times not only provides a broad spectrum of financial details, including market data, personal finance advice, and opinion pieces, but also offers expansive international business news. This depth and breadth empower options traders with a comprehensive overview of global markets, enabling informed decisions.

-

Insightful Editorial Content and Credibility: Known for its enriching editorials and a strong reputation for trustworthiness, the Financial Times grants options traders deep insights into market dynamics and factors influencing them.

-

Accessibility and User Engagement: With a readily available print and digital format, Financial Times retains its audience’s attention, reflected in a bounce rate of 61.20%.

-

Popularity, Reach, and Ranking: Boasting 1 million subscribers and 32.6 million website traffic, the Financial Times stands as a leading source of financial news. Its ranking of 3 among US finance publishers further attests to its vast reach and popularity.

-

Value for Money: At a subscription rate of $69 per month, traders gain access to a wealth of global financial information, reinforcing its status as a value-for-money resource.

###**6. MarketWatch **

"We're

MarketWatch is a one-stop-shop for financial news, from stock market trends to economic updates. It is highly valued by options traders for several key reasons:

-

Extensive Coverage and Detailed Data: MarketWatch is acknowledged for its inclusive financial news coverage and comprehensive stock market data. This range of information aids options traders in staying updated with market trends and making informed trading decisions.

-

Accessible and Insightful Content: The platform offers insightful commentary and a user-friendly interface that ensures traders can quickly find and understand the information they need.

-

Credibility, Reach and Affordability: MarketWatch has a strong reputation for accuracy and timeliness, with 71,300 YouTube subscribers and 56.9 million website visits reflecting its popularity. Its subscription plan, priced at just $1 per week, makes it an affordable source of valuable market insights.

-

Strong Market Position: With a bounce rate of 59.78%, MarketWatch secures the 3rd position among ‘finance – other’ publishers in the UK, demonstrating its high standing among users.

###**7. Investing.com **

"/p

Investing.com is famous for its live data, economic calendar, and detailed analysis of various financial tools. It is a resource that is highly appreciated by options traders for several reasons:

-

Real-Time Data and Wide Range of Instruments: Known for its real-time data, Investing.com offers extensive insights on a wide array of financial instruments. This includes in-depth information on options, commodities, indices, and cryptocurrencies, serving as a diverse tool for the 20,400 subscribers on its YouTube channel.

-

Economic Calendar and Analysis: Featuring an economic calendar and meticulous market analysis, this platform plays an integral role for options traders to stay informed about market trends and significant financial events.

-

User-Friendly Interface: Esteemed for its user-friendly interface, Investing.com allows options traders to seamlessly navigate the platform and access necessary information swiftly and conveniently.

-

Community Engagement: With a substantial web traffic of 158 million, Investing.com fosters a robust community of traders and investors. This provides options traders with a platform to exchange insights, discuss strategies, and learn from other experienced traders.

-

Reliability and Accessibility: Investing.com is recognized for its reliable and accurate information, vital for options traders who need trustworthy data for their trading decisions. The platform offers a monthly subscription plan of $19.99, making its wealth of information easily accessible.

-

High Ranking: With a bounce rate of 52.71%, Investing.com maintains a high ranking of 11 in the Finance-Investing category in the US, underscoring its popularity and trust among users.

###**8. Seeking Alpha **

Seeking Alpha's New Portfolio Experience | Seeking Alpha

Seeking Alpha stands out because it has unique content from financial experts and enthusiasts. Here’s why options traders might appreciate Seeking Alpha:

-

Crowd-Sourced Content: With its unique approach of crowd-sourced content and a community of 6 million subscribers, Seeking Alpha offers a wide range of insights to options traders. The diversity of viewpoints from financial experts and enthusiasts enables a more well-rounded decision-making process.

-

Earnings Call Transcripts and Portfolio Management Tools: Seeking Alpha’s wealth of resources such as earnings call transcripts and portfolio management tools are valued by options traders for in-depth company performance insights and effective investment management.

-

Personal Finance Advice: Beyond trading information, Seeking Alpha’s personal finance advice helps options traders expand their financial knowledge and make informed decisions in various financial aspects.

-

Diverse User Base and High Traffic: The unique model of Seeking Alpha attracts a diverse user base and sees a high website traffic of 24.1 million. The broad perspectives and investment strategies available on the site enrich the content for options traders.

-

Subscription and Ranking: With a lowest bounce rate of 43.39%, Seeking Alpha stands out with a high ranking of 9 in the US finance sector. The annual subscription plan of $239 provides valuable market insights and resources for traders.

###**9. Barron’s **

Magazine - Latest Issue - Barron's

Barron’s is known for its investment insights, detailed market forecasts, and rankings of financial entities. It’s a great source for both beginner and experienced options traders. Here’s why options traders read Barron’s:

-

Weekly Financial News and Market Analysis: Barron’s delivers weekly financial news and market analysis, providing a regular pulse-check for options traders. Keeping up-to-date helps traders better time their trades.

-

Investment Insights: Barron’s is renowned for its in-depth investment insights. Understanding underlying investments gives options traders an edge when trading options contracts tied to those investments.

-

Detailed Market Predictions and Rankings: Barron’s detailed market predictions influence options trading strategies, as future trends directly impact the options market. Also, Barron’s rankings of financial entities offer a comparative view of market participants, giving options traders an additional perspective.

-

Subscriber Base and Web Traffic: With 1 million subscribers and website traffic of 10.7 million, Barron’s demonstrates a strong reach among finance enthusiasts and options traders alike.

-

Subscription Plans and US Ranking: With a bounce rate of 60.52%, Barron’s maintains a subscription plan of just $1 per week for a year, offering excellent value. It also holds a strong position, ranking 20th in the finance-investing category in the US.

###10. Yahoo Finance

Yahoo Finance,

Yahoo Finance is a go-to source for many options traders, and for several good reasons:

-

Comprehensive Coverage and Customizable Features: Yahoo Finance provides a mix of news, data, and commentary on a broad spectrum of financial topics, offering a holistic view to options traders. With customizable watchlists and real-time data feeds, it caters to the dynamic needs of traders, allowing them to track specific options and underlying securities and react promptly to market changes.

-

Personal Finance Resources and Accessibility: Besides market data, Yahoo Finance offers resources on personal finance, contributing to smarter investment decisions. The platform is user-friendly and versatile, with resources ranging from investment news to retirement planning, making it accessible to options traders of all experience levels.

-

Impressive Audience and Reliable Subscription Plans: Yahoo Finance boasts of over 1 million YouTube subscribers and 224.8 million website visits, indicating its wide reach and influence in the financial community. With a bounce rate of 55.96%, the platform maintains high engagement levels with its subscription plan priced at $24.99 per month, offering in-depth financial analysis and data.

-

Reputation and US Ranking: Ranked 8th among news and media publishers in the US, Yahoo Finance’s high standing signifies the trust and credibility it holds among its users, including options traders. This reputation makes it a go-to source for many in the trading community.

Conclusion

Given the volatile nature of options trading, staying updated with real-time news and market analysis is crucial. These top 10 news sources offer reliable, comprehensive, and timely information to help you stay ahead of the curve. Explore them, compare their offerings, and decide which ones align best with your trading style and needs.

Use AI driven search for all functions on MarketXLS here:

Download from the link below, a sample spreadsheet created with MarketXLS Spreadsheet builder

Note this spreadsheet will pull latest data if you have MarketXLS installed. If you do not have MarketXLS consider subscribing here

Relevant blogs that you can read to learn more about the topic

Top 10 Conferences for Option Traders – MarketXLS

Top 10 Option Strategies Used by Options Traders – MarketXLS

Use of Options to Hedge Market Risk

Common Mistakes In Options Trading And How To Avoid Them

Protective Call Options Strategy (With MarketXLS Excel Template)

Uncover the Secrets of Professional Options Traders

Technical Indicators For Swing Traders (Using Marketxls)

Double Diagonal Option Strategy

Stay Up to Date With Live Stock Quotes

Exploring Top Blue Chip Dividend Stocks in 2021