Introduction

MarketXLS is a community of professional and institutional option traders who use the platform for analysis, monitoring and journaling. The active members regularly share their winning strategies, best-in-class tools and learning opportunities within the community.

In a recent survey, members discussed the best trading strategies used by options traders. The choice of trading strategy among the members depends on factors such as risk tolerance, market outlook, the need for income generation versus capital appreciation, the complexity of the strategy, available capital and time horizon.

Key Takeaways

-

The Long Call strategy is a favorite among traders for its simplicity and the potential for unlimited profits.

-

The Long Put and the Covered Call strategies are popular for their risk management benefits.

-

Traders who anticipate little to no price movement in the underlying security favor the Butterfly Spread and Iron Condor strategies.

-

A majority of our traders utilize a mix of these strategies, depending on their risk tolerance and market expectations.

Top 10 option strategies used by option traders

Below you’ll find the favored strategies our members employ for their trades. Remember, we haven’t ranked these in any specific order.

-

Long Call

-

Long Put

-

Covered Call

-

Protective Put

-

Bull Call Spread

-

Bear Put Spread

-

Strangle

-

Iron Condor

-

Straddle

-

Butterfly Spread

Unique Features and Benefits of Each Trading Strategy

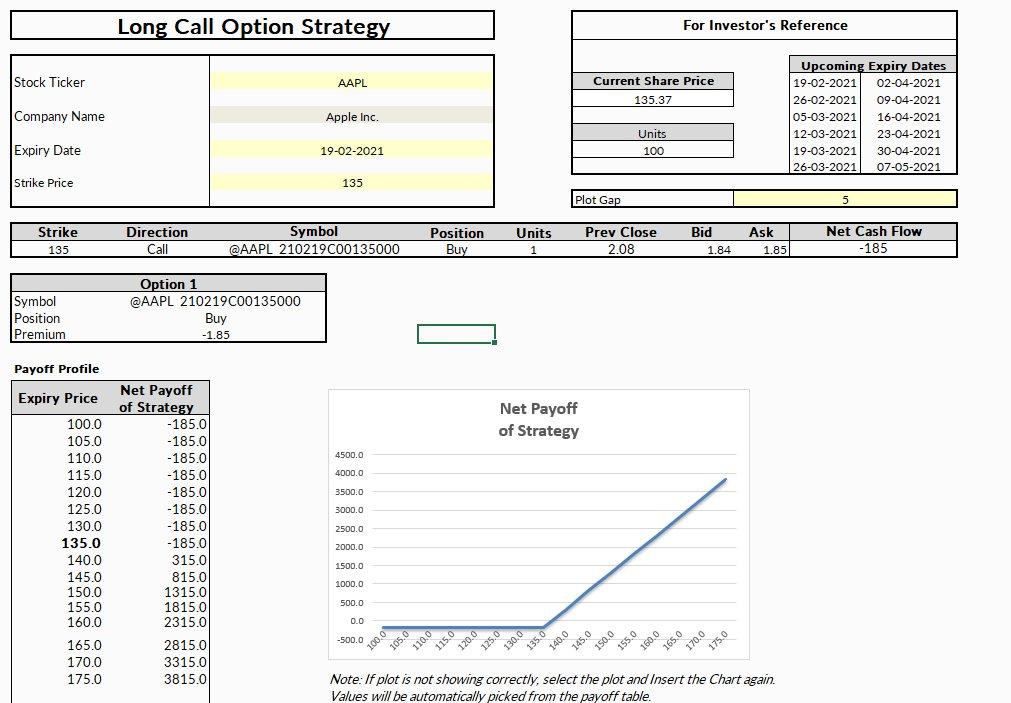

Long Call: Betting on Rising Prices

Long Call Option Strategy - MarketXLS

A long call is a popular investment strategy in options trading, where an investor purchases a call option with the hope that the price of the underlying asset will increase.

Here’s an in-depth look at the long call strategy, based on various important factors:

-

Risk Tolerance: A long call strategy carries moderate risk. The maximum loss an investor can face equals the amount spent on the call option premium.

-

Market Outlook: In a bullish market outlook, a long call strategy works best. It’s the strategy of choice for investors expecting a considerable price increase of the underlying asset before the expiry date of the option.

-

Income Generation vs. Capital Appreciation: The focus of a long call strategy is more on capital appreciation rather than generating income. The strategy provides a potentially unlimited upside if the price of the underlying asset increases.

-

Strategy Complexity: Newcomers to options trading will find the long call strategy relatively simple to understand and implement, making it an excellent starting point.

-

Available Capital: A long call strategy requires only the cost of the option premium, which is significantly lower than the cost of purchasing the underlying asset outright. This feature makes it an accessible strategy for traders with different capital sizes.

-

Time Horizon: A medium-term investment horizon suits long calls best. However, as the option nears its expiry date, time decay can impact the option’s value negatively, especially if the underlying asset’s market price stays the same or decreases.

The MarketXLS template can be downloaded from the website itself using the link Long Call Option Strategy – MarketXLS.

For more details please read the corresponding blog post Long Call Options Trade/Strategy-How To Manage And Track – MarketXLS

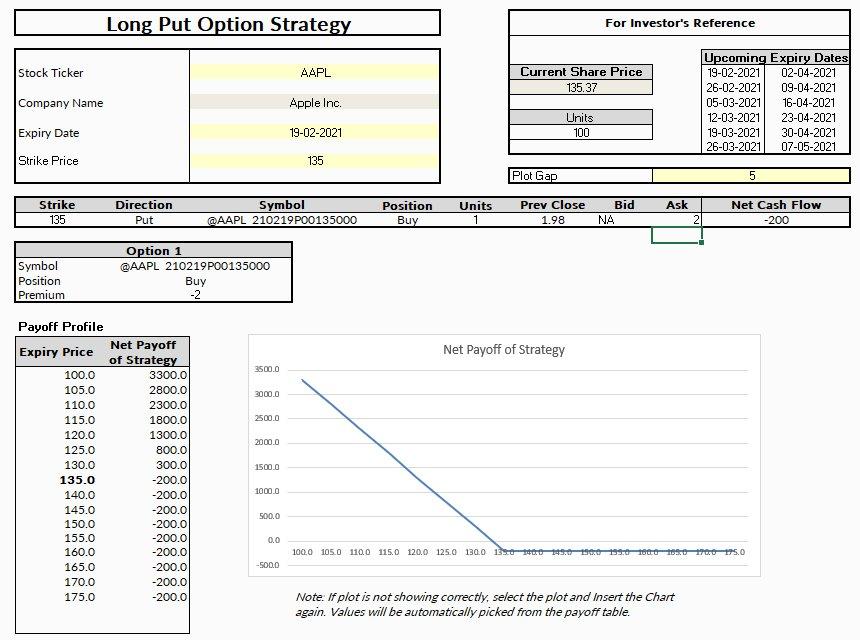

Long Put: Capitalizing on Market Tumbles

Long Put Option Strategy - MarketXLS

A long put is a key trading strategy in the options market, where a trader buys a put option with the expectation that the price of the underlying asset will decrease.

Let’s discuss several factors that pertain to this strategy:

-

Risk Tolerance: A moderate risk accompanies a long put strategy. The maximum loss a trader can face is the amount paid for the put option premium.

-

Market Outlook: In a bearish market scenario, a long put strategy shines. Traders opt for this strategy when they foresee a significant drop in the underlying asset’s price before the option expires.

-

Income Generation vs. Capital Appreciation: The long put strategy leans towards capital appreciation. It presents potentially unlimited gains if the underlying asset’s price falls. Unlike options selling strategies that generate upfront income through premiums, long puts do not.

-

Strategy Complexity: Understanding and implementing a long put strategy is relatively simple. This approach, which involves merely buying a put option on an underlying asset, serves as an excellent entry point for newcomers to options trading.

-

Available Capital: The capital needed for a long put strategy equals the cost of the option premium, significantly less than the cost of selling the underlying asset short. This affordability makes the strategy appealing to traders with various capital amounts.

-

Time Horizon: Traders usually consider long puts as a medium-term investment strategy. However, time decay can hurt the option’s value as it nears expiry, especially if the market price of the underlying asset remains unchanged or rises.

The MarketXLS template for the Long Put strategy can be downloaded from the following link: Long Put Option Strategy – MarketXLS.

For more detailed information, consider reading the corresponding blog post: Long Put Option Strategy-Tracking And Managing(With Excel Template) – MarketXLS.

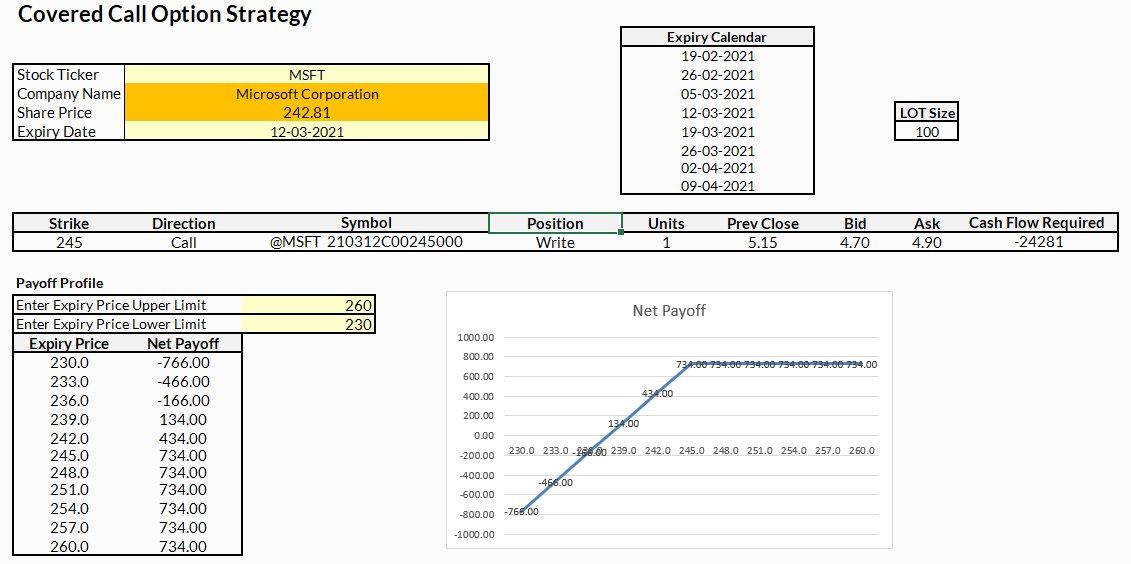

Covered Call: Diminishing Risk amid Bull Markets

Covered Call Option Strategy - MarketXLS

A covered call is a well-known strategy in options trading, where an investor sells a call option on an asset they already own.

Here’s a comprehensive examination of the covered call strategy based on various crucial factors:

-

Risk Tolerance: The covered call strategy carries a relatively low level of risk, making it suitable for conservative investors. The risk arises if the underlying asset’s price falls significantly, but the income from selling the call can partially offset this loss.

-

Market Outlook: The covered call strategy is typically implemented in a neutral to slightly bullish market. Investors use this approach when they believe the price of the underlying asset will remain stable or increase moderately before the option’s expiry date.

-

Income Generation vs. Capital Appreciation: The primary goal of a covered call strategy is income generation. The strategy produces income through the premium received from selling the call option, regardless of whether the underlying asset’s price goes up or down.

-

Strategy Complexity: A covered call is a straightforward strategy, making it an excellent choice for those who are new to options trading. It involves owning or buying the underlying asset and then selling a call option on that asset.

-

Available Capital: The capital required for a covered call strategy is higher than for simple buying strategies, as the investor must own the underlying asset. However, selling the call option generates income, which can offset some of this cost.

-

Time Horizon: Covered calls are best suited for a medium to long-term investment horizon. They can be a way to generate regular income from a long-held asset. However, the obligation to sell if the option is exercised means the investor needs to be willing to part with the underlying asset.

The MarketXLS template for the Covered Call strategy can be downloaded from the following link: Covered Call Option Strategy – MarketXLS.

For more in-depth information, consider reading the corresponding blog post: Covered Calls – What They Are & How You Can Profit – MarketXLS.

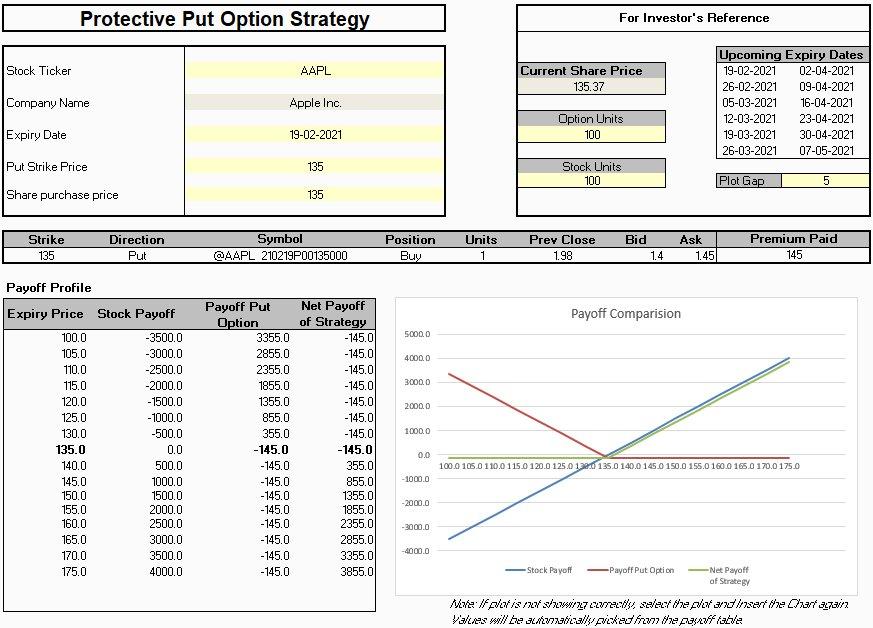

Protective Put: Safeguarding Your Stock Investment

Protective Put / Synthetic Long Call Option Strategy - MarketXLS

A protective put is a widely used strategy in options trading where an investor purchases a put option for an asset they already own.

Here’s a comprehensive examination of the protective put strategy, based on various pivotal factors:

-

Risk Tolerance: The protective put strategy involves limited risk. Investors with low to medium risk tolerance find it suitable as the maximum loss equates to the put option premium and any potential loss in the underlying asset down to the strike price.

-

Market Outlook: Investors often use a protective put strategy when the market outlook is uncertain or mildly bearish. They implement this strategy if they foresee a possible price decline but still want to hold onto the asset due to its long-term prospects.

-

Income Generation vs. Capital Appreciation: The primary focus of the protective put strategy is capital preservation, not income generation or capital appreciation. It aims to guard the existing investment against significant value decreases.

-

Strategy Complexity: The protective put strategy is fairly straightforward to implement. It requires purchasing a put option for an asset already owned. Hence, it’s suitable for options trading beginners.

-

Available Capital: To execute a protective put, the investor needs the capital to buy the put option, alongside owning the underlying asset. They can view the put option’s cost as an insurance premium providing protection.

-

Time Horizon: Investors usually use protective puts with a medium to long-term investment horizon. They provide a buffer against short-term price drops in an asset, while allowing the investor to benefit from long-term appreciation.

The MarketXLS template for the Protective Put strategy can be downloaded from the following link: Protective Put / Synthetic Long Call Option Strategy – MarketXLS.

For more detailed information, you might want to read the corresponding blog post: Option Trading With Ms Excel-Protective Puts Strategy – MarketXLS.

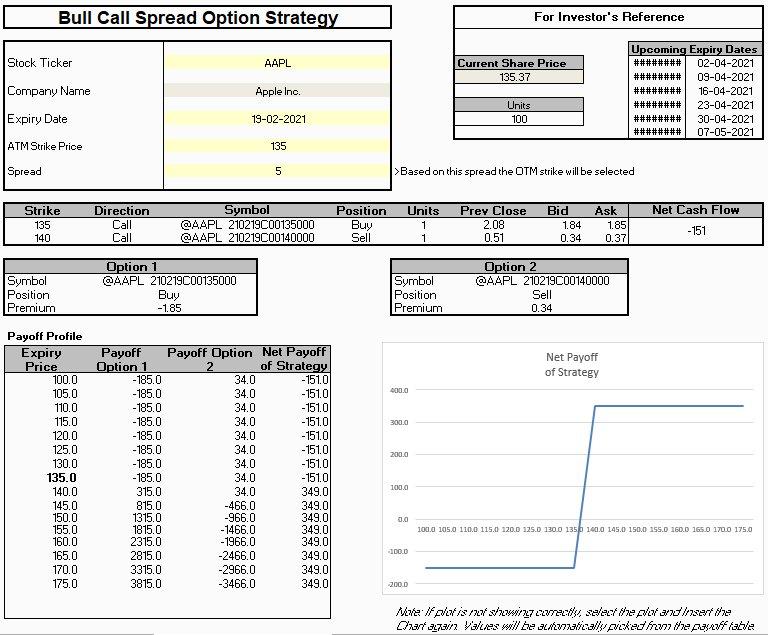

Bull Call Spread: Optimizing Gains in a Rising Market

Bull Call Spread Option Strategy - MarketXLS

A bull call spread is a common strategy in options trading where an investor simultaneously buys a call option and sells another call option (with a higher strike price) on the same underlying asset and expiry date.

Let’s delve deeper into the bull call spread strategy, considering various essential factors:

-

Risk Tolerance: With the maximum loss limited to the net premium paid for the options, a bull call spread strategy fits investors with medium risk tolerance.

-

Market Outlook: Investors generally use this strategy in a moderately bullish market. They implement this strategy when anticipating a modest increase in the asset’s price before the expiry of the options.

-

Income Generation vs. Capital Appreciation: A bull call spread strategy primarily seeks capital appreciation over income generation. Profits arise from the difference in the strike prices of the purchased and sold call options, less the net premium paid.

-

Strategy Complexity: The bull call spread, involving buying and selling call options, is somewhat more complex than basic options strategies. Therefore, it might better suit intermediate or advanced options traders.

-

Available Capital: The capital required for a bull call spread is the net premium paid. Since this cost is generally lower than outright buying a call option, it accommodates traders with varying capital sizes.

-

Time Horizon: Investors usually implement bull call spreads with a short to medium-term investment horizon. They can profit from a moderate increase in the asset’s price over a certain period.

The MarketXLS template for the Bull Call Spread strategy can be downloaded from the following link: Bull Call Spread Option Strategy – MarketXLS.

For more comprehensive information, consider reading the corresponding blog post: Bull Call Spread Option Strategy (Explained With Excel Template) – MarketXLS.

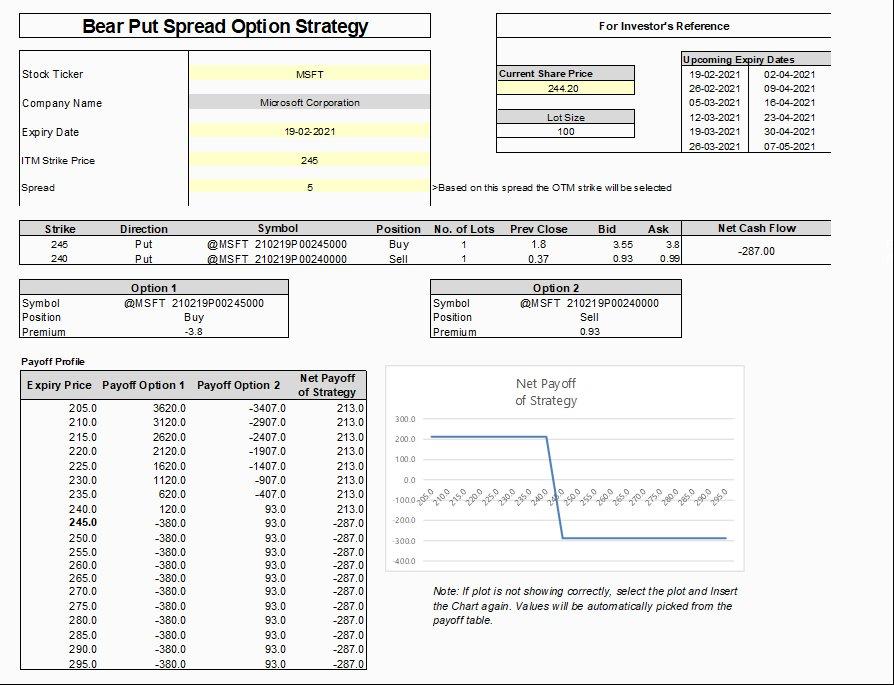

Bear Put Spread: Reaping Rewards from a Downturn

Bear Put Spread Option Strategy - MarketXLS

A bear put spread is a popular strategy in options trading. Here, an investor simultaneously buys a put option and sells another put option (with a lower strike price) on the same asset and expiry date.

Here’s a breakdown of this strategy considering essential factors:

-

Risk Tolerance: The bear put spread strategy has moderate risk. The maximum loss, capped at the net premium paid for the options, makes it appropriate for investors with medium risk tolerance.

-

Market Outlook: Investors typically use this strategy in a moderately bearish market. They implement this strategy when expecting a modest price drop in the asset before the options’ expiry date.

-

Income Generation vs. Capital Appreciation: A bear put spread strategy primarily targets capital appreciation over income generation. Profits arise from the difference in the strike prices of the purchased and sold put options, less the net premium paid.

-

Strategy Complexity: The bear put spread, requiring buying and selling put options, is slightly more complex than basic options strategies. Hence, it might be more suitable for intermediate or advanced options traders.

-

Available Capital: The capital needed for a bear put spread is the net premium paid. Since this cost is generally lower than outright buying a put option, it accommodates traders with various capital sizes.

-

Time Horizon: Investors typically use bear put spreads with a short to medium-term investment horizon. They can profit from a moderate decrease in the asset’s price over a certain period.

The MarketXLS template for the Bear Put Spread strategy can be downloaded from the following link: Bear Put Spread Option Strategy – MarketXLS.

For a more in-depth understanding, consider reading the corresponding blog post: Bear Put Spread Option Strategy (Explained With Excel Template) – MarketXLS.

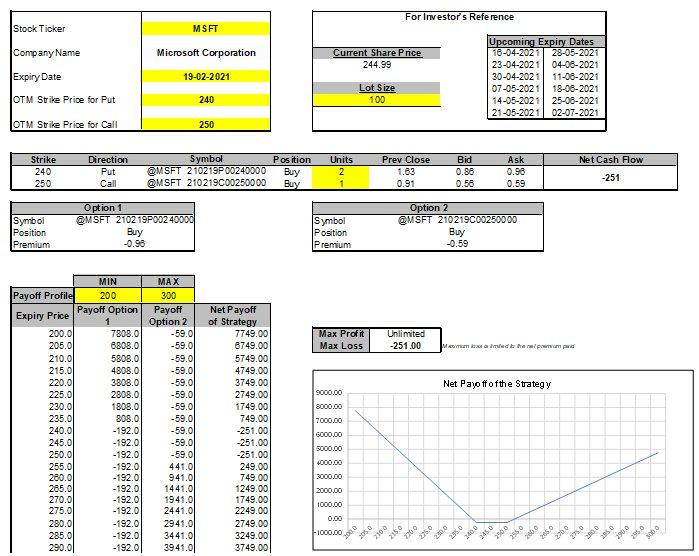

Strangle: A Cost-Effective Option in Volatile Markets

Strip Strangle - MarketXLS

A strangle is an advanced strategy in options trading where an investor simultaneously purchases a call and put option (with different strike prices) on the same underlying asset with the same expiry date.

Here’s a comprehensive look at the strangle strategy, considering various crucial factors:

-

Risk Tolerance: The strangle strategy carries a significant level of risk. The total premium paid for the call and put options forms the maximum loss. Thus, it’s better suited to investors with high-risk tolerance.

-

Market Outlook: Investors employ this strategy when they anticipate a large price movement in the underlying asset, but the direction is uncertain. So, it’s beneficial in a volatile market outlook.

-

Income Generation vs. Capital Appreciation: The strangle strategy focuses mainly on capital appreciation. Significant rises or falls in the price of the underlying asset generate the profit.

-

Strategy Complexity: The strangle strategy is more complex than basic options strategies as it involves two transactions – buying both a call and a put option. This strategy might be more suited to advanced options traders.

-

Available Capital: The capital required for a strangle is the cost of the premiums for both the call and put options. This makes the strategy more expensive to implement compared to strategies involving only one option.

-

Time Horizon: Strangles are typically used with a medium to long-term investment horizon. The strategy benefits from a significant price movement in the underlying asset over a specific period.

The MarketXLS template for the Strangle strategy can be downloaded from the following link: Short Strangle Option Strategy – MarketXLS.

For more comprehensive information, consider reading the corresponding blog post: Long Strangle Option Strategy (Using Excel Template) – MarketXLS.

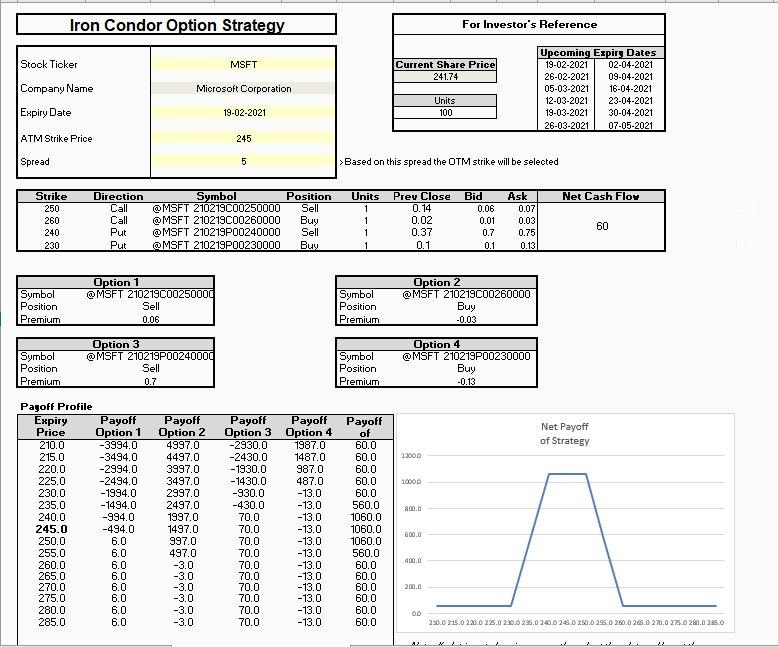

Iron Condor: Gaining in Steady Markets

Iron Condor Option Strategy - MarketXLS

An iron condor is a sophisticated strategy in options trading where an investor simultaneously holds a long and short position in two different strangle strategies.

Here’s an in-depth exploration of the iron condor strategy, based on various key factors:

-

Risk Tolerance: The iron condor suits investors with low to medium risk tolerance. The maximum loss is the difference between the long and short options’ strike prices, minus the net premium received.

-

Market Outlook: Investors typically use this strategy when they expect little price movement in the underlying asset, indicative of a neutral market outlook. This strategy can generate profits if the asset price stays within a particular range.

-

Income Generation vs. Capital Appreciation: The iron condor strategy primarily targets income generation over capital appreciation. Investors receive the net premium upfront and retain it if the price of the underlying asset stays within the designated range.

-

Strategy Complexity: The iron condor strategy is complex as it involves four different options transactions. It may be more suitable for advanced options traders who are comfortable with managing multiple positions.

-

Available Capital: The capital required for an iron condor is the margin necessary to cover the maximum potential loss, minus the net premium received. This capital requirement can vary greatly depending on the specifics of the options chosen.

-

Time Horizon: Investors usually use iron condors over a short to medium-term investment horizon. They achieve maximum profit if the options expire worthless, which happens if the price of the underlying asset stays within the specified range until the options’ expiration date.

The MarketXLS template for the Iron Condor strategy can be downloaded from the following link: Iron Condor Option Strategy – MarketXLS.

For more comprehensive details, consider reading the corresponding blog post: Iron Condor (Excel Template) – MarketXLS.

Straddle: Benefitting from Large Movements in Either Direction

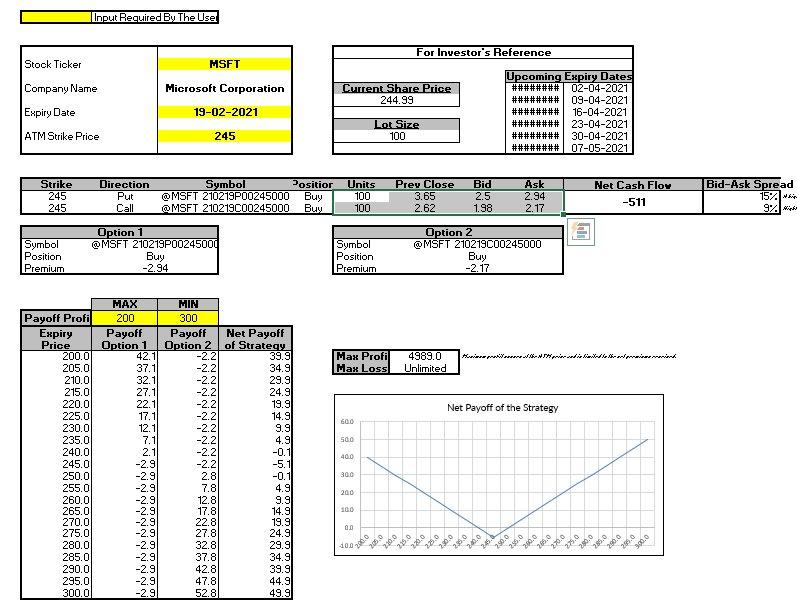

Long Straddle Option Strategy - MarketXLS

A straddle is an intricate strategy in options trading where an investor purchases a call and put option (with the same strike price) simultaneously on the same underlying asset with the same expiry date. Here’s a comprehensive examination of the straddle strategy, based on various vital factors:

-

Risk Tolerance: The straddle strategy involves a substantial level of risk. Investors could lose the total premium paid for the call and put options, making this strategy most fitting for those with a high-risk tolerance.

-

Market Outlook: Investors typically apply this strategy when they anticipate a significant price swing in the underlying asset but are unsure of the direction, making it ideal for a volatile market outlook.

-

Income Generation vs. Capital Appreciation: The straddle strategy mainly focuses on capital appreciation. Profits come from a significant rise or fall in the price of the underlying asset.

-

Strategy Complexity: The straddle strategy is relatively complex as it involves two simultaneous transactions – purchasing a call and a put option. This strategy might be better suited to advanced options traders.

-

Available Capital: The capital required for a straddle is the cost of the premiums for both the call and put options. This requirement makes the strategy more expensive to implement compared to strategies involving a single option.

-

Time Horizon: Straddles are typically used with a medium to long-term investment horizon. The strategy benefits from a substantial price movement in the underlying asset over a particular period.

The MarketXLS template for the Straddle strategy can be downloaded from the following link: Short Straddle Option Strategy – MarketXLS.

For more extensive understanding, consider reading the corresponding blog post: Strap Straddle Options Strategy (Using MarketXLS Template).

Butterfly Spread: Earning within a Price Band

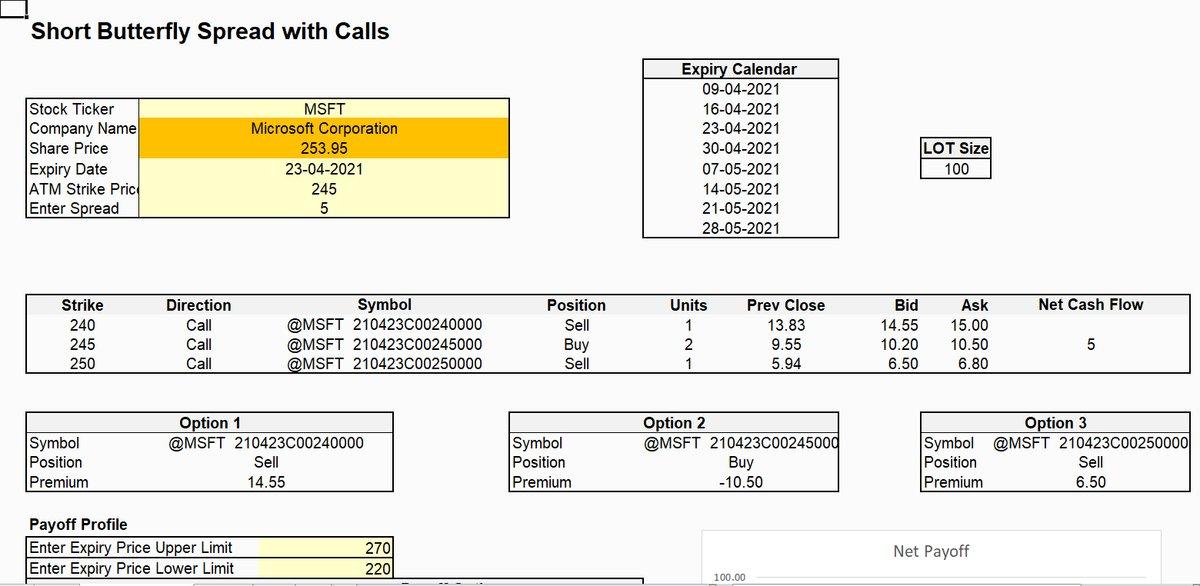

Short Butterfly Spread - MarketXLS

A butterfly spread is an advanced options strategy that an investor implements by simultaneously holding a long and short position in options of the same type (calls or puts) with different strike prices.

Here’s a comprehensive discussion of the butterfly spread strategy, considering various pivotal factors:

-

Risk Tolerance: The butterfly spread strategy poses a limited level of risk. The maximum loss equates to the initial cost of setting up the spread, making it suitable for investors with low to medium risk tolerance.

-

Market Outlook: Investors typically apply this strategy when they expect the price of the underlying asset to stay within a certain range, making it ideal for a neutral market outlook.

-

Income Generation vs. Capital Appreciation: The butterfly spread strategy focuses more on generating income than capital appreciation. When the underlying asset’s price equals the middle strike price at expiration, it delivers the maximum profit.

-

Strategy Complexity: The butterfly spread strategy is relatively complex as it involves three simultaneous transactions. It might be more suited to advanced options traders who are comfortable with multi-legged strategies.

-

Available Capital: You need initial capital equal to the cost of setting up the butterfly spread, or the net premium paid. This capital requirement is significantly lower than many other strategies.

-

Time Horizon: Investors typically use butterfly spreads over a short to medium-term investment horizon. If the underlying asset’s price matches the middle strike price at expiration, you can realize maximum profit.

The MarketXLS template for the Butterfly Spread strategy can be downloaded from the following link: Short Butterfly Spread – MarketXLS.

For a more comprehensive understanding, consider reading the corresponding blog post: Long Butterfly Spread With Puts (Using Excel Template) – MarketXLS.

Concluding Words: Selecting the Ideal Option Strategy

In conclusion, the top 10 options strategies used by traders depend on different risk profiles, market conditions, and investment goals. Each of these strategies has unique advantages and risks, tailored to various market scenarios and investor preferences. While some strategies are simple and suitable for beginners, others demand more understanding and are ideal for advanced traders.

Tools such as the MarketXLS templates can assist in managing and tracking your options trades. It’s crucial to conduct thorough research and possibly seek professional advice before delving into options trading. Remember, informed decisions lead to successful investments.

Use AI driven search for all functions on MarketXLS here:

Download from the link below, a sample spreadsheet created with MarketXLS Spreadsheet builder

Note this spreadsheet will pull latest data if you have MarketXLS installed. If you do not have MarketXLS consider subscribing here

Relevant blogs that you can read to learn more about the topic

Mastering the Art of Shorting Call Options

Exploring the Risk/Reward of Strangle Options Trading

Options Profit Calculator App

Common Mistakes In Options Trading And How To Avoid Them

Strap Strangle Options Strategy (Using MarketXLS Template)

Strip Strangle Options Strategy (Using MarketXLS Template)

Strap Straddle Options Strategy (Using MarketXLS Template)

Reverse Iron Butterfly Options Strategy (Using MarketXLS Template)

Short Call Synthetic Straddle Options Strategy (Using MarketXLS Template)

Strip Straddle Options Strategy (Using MarketXLS Template)