In our first guide, Covered Call Strategy Explained, you learned the fundamentals of what a covered call is, how it generates income, and its risk profile. Now, it's time to move from theory to practice. A successful covered call strategy doesn't just involve selling any random call option; it requires a systematic approach to finding the best opportunities that align with your financial goals.

This guide will teach you how to screen and select optimal covered call candidates. We'll define what makes a "good" covered call, explore strike selection methodologies, and provide a comprehensive checklist for your screening criteria. Most importantly, we'll walk you through building a powerful, custom covered call screener in Excel using MarketXLS, complete with a real-world example.

What Makes a "Good" Covered Call?

Before diving into a screener, you need to know what you're looking for. A "good" covered call isn't simply the one with the highest premium. It's a strategic trade-off between income, risk, and your outlook on the underlying stock.

A high-quality covered call opportunity has four key ingredients:

A Quality Underlying Stock: You should only sell calls on stocks you are comfortable owning for the long term. The foundation of the strategy is your 100 shares, so their quality is paramount.

A Favorable Risk/Reward Balance: The premium should offer a reasonable return for the risk you're taking (capping your upside and retaining downside risk).

An Appropriate Strike Price: The strike price should align with your goals—whether that's maximizing income, increasing the probability of keeping your shares, or adding downside protection.

Sufficient Liquidity: The option must have enough trading activity (volume and open interest) to ensure you can enter and exit your position at a fair price with a narrow bid-ask spread.

Strike Selection Methodology: The Art and Science

Choosing the right strike price is arguably the most critical decision in a covered call trade. Your choice directly impacts your potential return, your level of risk, and the likelihood of having your shares called away. Let's break down the options: In-the-Money (ITM), At-the-Money (ATM), and Out-of-the-Money (OTM).

Out-of-the-Money (OTM)

Definition: The strike price is higher than the current stock price.

Best For: Investors who are moderately bullish and want to give the stock room to appreciate. The primary goal is to retain the shares while collecting a small amount of income.

Pros: Lower probability of assignment, allows for capital gains if the stock rises.

Cons: Receives the lowest premium.

At-the-Money (ATM)

Definition: The strike price is very close to the current stock price.

Best For: Investors who are neutral and believe the stock will trade sideways. The primary goal is to maximize premium income.

Pros: Generates the highest amount of time value premium.

Cons: Roughly a 50/50 chance of having your shares called away. Offers minimal downside protection and no room for stock appreciation.

In-the-Money (ITM)

Definition: The strike price is lower than the current stock price.

Best For: Investors who want to maximize downside protection or are looking to sell their shares at a specific price.

Pros: Offers the highest premium (though much of it is intrinsic value) and the most downside protection.

Cons: High probability of assignment. Caps any potential stock appreciation.

Using Delta to Refine Your Selection

A key option "Greek" to consider is Delta. For call options, Delta can be used as a rough estimate of the probability that the option will expire in-the-money.

- An OTM call with a 0.30 Delta has approximately a 30% chance of being assigned.

- An ATM call will have a Delta around 0.50.

- An ITM call will have a Delta above 0.50, approaching 1.00 the deeper in-the-money it is.

When screening, you can use Delta as a filter to find options that match your desired probability of assignment.

Screening Criteria Checklist

Here are the essential criteria to build into your covered call scanner:

✅ Underlying Stock: Is it a high-quality company you want to own? (e.g., Blue-chips, Dividend Aristocrats).

✅ Days to Expiration (DTE): Typically, 30-45 days is the sweet spot, offering a good balance of premium and rapid time decay (theta).

✅ Liquidity: Look for options with an Open Interest of at least 100 contracts and a narrow Bid-Ask Spread (e.g., less than $0.10) to ensure fair pricing.

✅ Implied Volatility (IV) Rank/Percentile: Higher IV means higher option premiums. Use IV Rank to see if a stock's current IV is high relative to its own 52-week history. Selling options when IV is high is generally more profitable.

✅ Return Targets: Calculate both the static return (if called) and the annualized return to compare opportunities with different expirations and strike prices.

✅ Delta: Filter by a Delta range that matches your goals (e.g., Delta < 0.40 if you want to keep your shares).

Building a Covered Call Screener in Excel with MarketXLS

Now, let's build a functional and dynamic covered call screener. We will replicate the process an investor might use to find the best covered call to sell against their 100 shares of Apple ($AAPL).

Scenario: You own 100 shares of AAPL purchased at $117.70. The current price is $126.88. You are moderately bullish and want to find a call option expiring in the next few months with a strike price between $135 and $145.

Step 1: Set Up Your Excel Workbook

Open Excel, and in a cell, enter your stock ticker: AAPL.

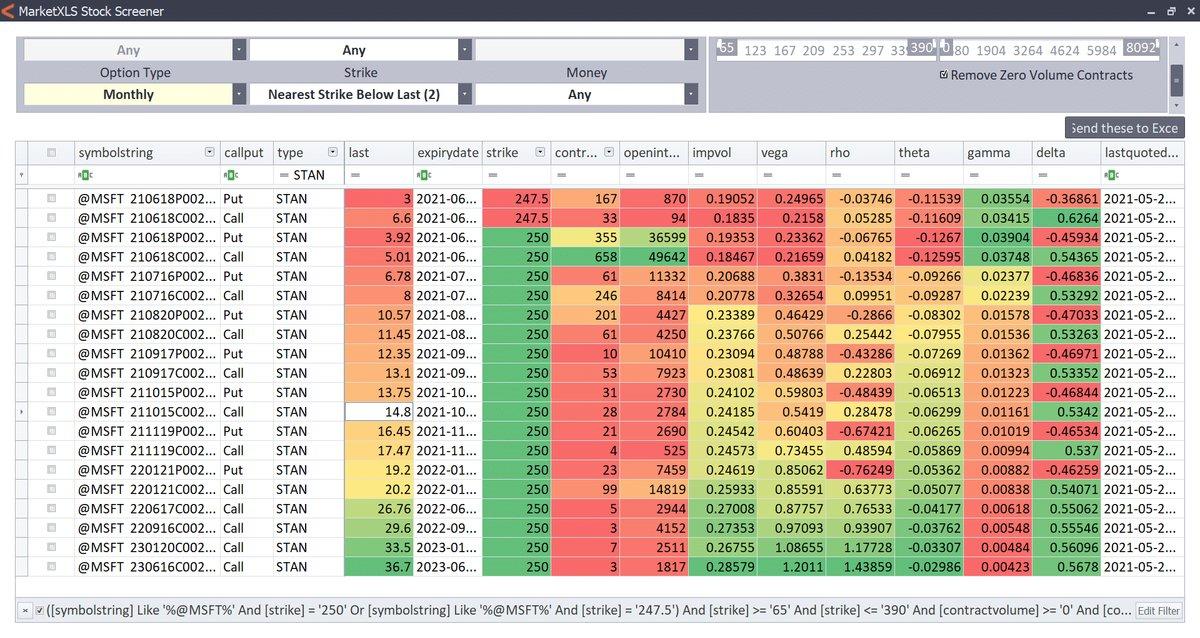

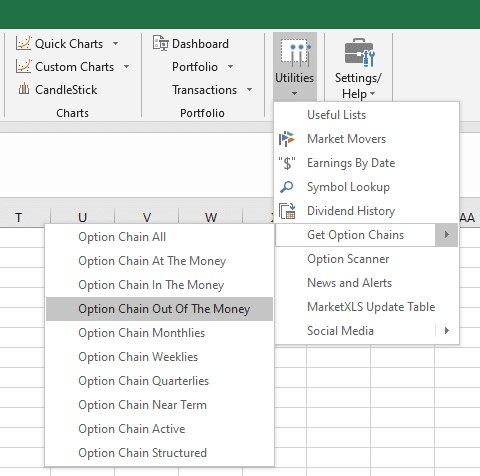

Step 2: Launch the MarketXLS Option Scanner

Select the cell containing "AAPL". Navigate to the MarketXLS tab on the Excel ribbon, click on Utilities, and select Option Scanner from the dropdown menu.

MarketXLS Option Scanner setup

Step 3: Filter the Option Chain

The Option Scanner window will appear. To narrow down the thousands of possible contracts, we will apply filters:

- In the "Calls or Puts" dropdown, select Calls.

- Click the Edit Filter button.

- Set the Strike Price range from a minimum of 135 to a maximum of 145.

Filter editor for option scanner

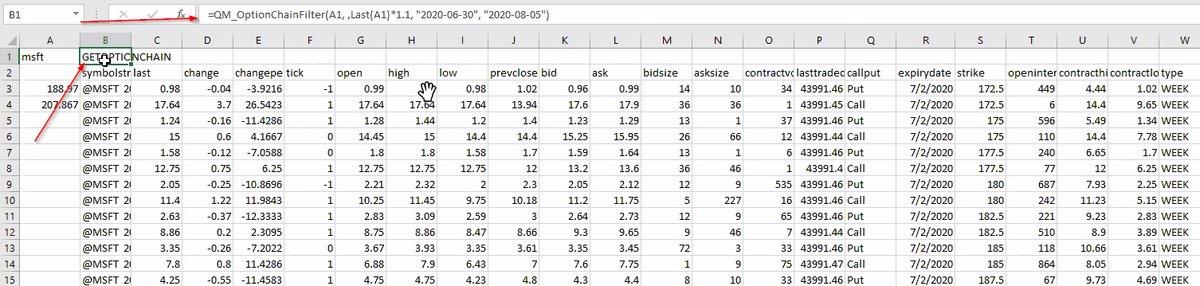

Step 4: Send the Data to Excel

Click the "Send these to Excel" button. MarketXLS will now pull all the AAPL call options that meet your criteria directly into a new worksheet in your Excel file.

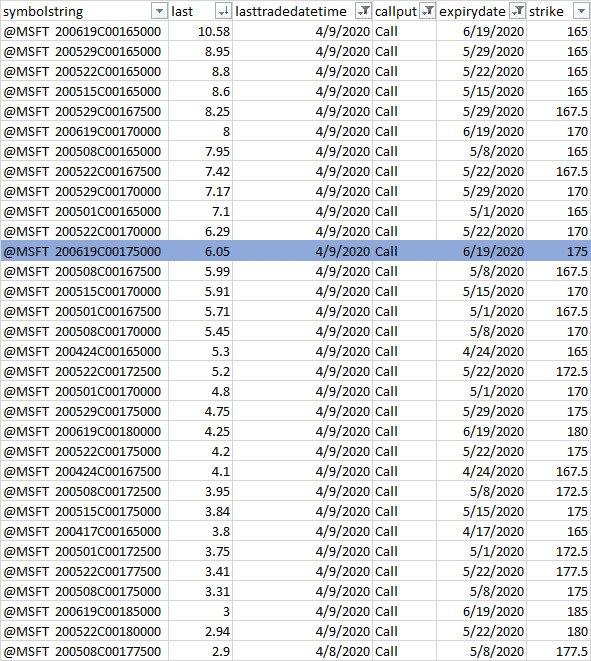

Option chain data

Step 5: Add Your Custom Calculation Columns

This is where the magic happens. We will add three new columns to the right of the imported data to analyze each option's potential return.

Days to Expiry: This column calculates the number of days until the option expires. The formula is:

= [Expiry Date Cell] - TODAY()

Return: This calculates the total potential return if your shares get called away. The formula is based on your acquisition cost:

= ([Last Price Cell] * 100) / ([Your Acquisition Cost per Share] * 100)

(For our example, the acquisition cost is $117.70 per share or $11,770 total).

Note: Some traders prefer using the 'Bid' price for a more conservative estimate, which can also be pulled with MarketXLS.

Annualized Return: This standardizes the return over a one-year period, making it easy to compare options with different expiration dates. The formula is:

= ([Return Column Cell] / [Days to Expiry Cell]) * 365

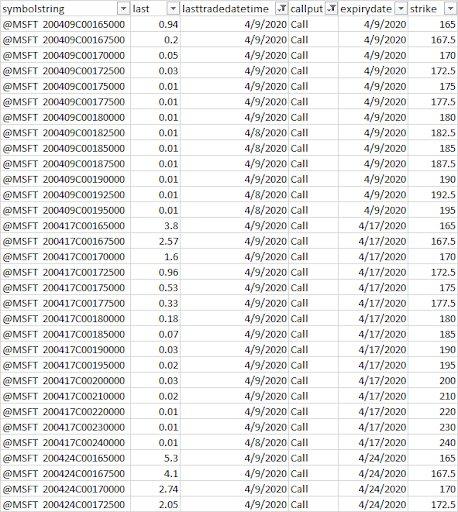

Step 6: Analyze the Results

After adding these formulas, sort your table by Annualized Return from largest to smallest. Your spreadsheet should now look something like this:

Option chain with calculated fields

As expected, the options with the $135 strike price offer the highest annualized returns. This is because they are closest to the current stock price, carrying more risk of assignment, and thus command a higher premium.

However, our goal was to find a comfortable balance. Let's filter or scan down to the $140 strike price.

We can see several appealing options:

- 19Nov$140 Call: An excellent 8.38% annualized return, but it's six months away, tying up our shares for a long time.

- 15Oct$140 Call: A very solid 7.81% annualized return.

- 17Sep$140 Call: A respectable 7.39% annualized return.

For a covered call writer who averages around 6%, the 15Oct$140 call stands out. It offers an attractive premium ($3.60 per share, or $360 total) for a holding period of about four months. This trade meets our criteria: a quality stock, a comfortable strike price, and a compelling annualized return.

Final option selection

Once this template is built, you can save it. The next time you want to screen for opportunities, simply change the ticker, run the Option Scanner, paste in the new data, and your analysis columns will update automatically!

Best Stocks for Covered Calls

While you can write covered calls on any optionable stock you own, certain types of companies are better suited for this strategy.

Blue-Chip Stalwarts

Companies like Microsoft ($MSFT), Johnson & Johnson ($JNJ), and Apple ($AAPL) are popular because of their stability and liquidity. Premiums are reasonable, and catastrophic price drops are less likely.

Dividend Aristocrats

Stocks like Coca-Cola ($KO) or Procter & Gamble ($PG) allow you to "stack" income: you collect the stock's dividend and the option premium. Be mindful that deep ITM calls can be assigned early right before an ex-dividend date.

Select High IV Stocks

For more aggressive investors, stocks in higher-volatility sectors can offer significantly larger premiums. This comes with higher risk but can be lucrative if managed correctly.

Monthly vs Weekly Covered Calls

Monthly Options (Standard Expiration)

Pros:

- Higher premiums due to more time value

- Less frequent management required

- Better for long-term holders

Cons:

- Capital tied up for longer periods

- More exposure to unexpected news or events

- Lower frequency of income generation

Weekly Options (Weekly Expiration)

Pros:

- More frequent income opportunities

- Faster capital turnover

- Better for active traders

- Less time for unexpected events to impact position

Cons:

- Lower individual premiums

- Requires more active management

- Higher transaction costs due to frequency

Advanced: Optimizing for Yield vs Protection

When screening for covered calls, you face a fundamental trade-off between yield (income) and protection (downside buffer).

High-Yield Strategy (ATM/ITM strikes)

- Target Delta: 0.45-0.70

- Higher premiums but higher assignment probability

- Best in sideways/bearish markets

- Example: Selling ATM calls for maximum time premium

Protection-Focused Strategy (OTM strikes)

- Target Delta: 0.15-0.35

- Lower premiums but lower assignment probability

- Best in bullish markets where you want to keep shares

- Example: Selling 10-15% OTM calls for small income + upside participation

Balanced Approach

- Target Delta: 0.25-0.45

- Moderate premium with reasonable assignment probability

- Good for most market conditions

- Example: Selling 5-10% OTM calls

Real Screening Examples: 5 Live Opportunities

Let's examine five current covered call opportunities using our screening methodology:

Example 1: Microsoft (MSFT)

- Current Price: $340

- Suggested Strike: $350 (30 DTE)

- Premium: ~$4.50

- Delta: 0.35

- Annualized Return: ~12%

- Quality: Excellent blue-chip stock

Example 2: Johnson & Johnson (JNJ)

- Current Price: $155

- Suggested Strike: $160 (45 DTE)

- Premium: ~$2.80

- Delta: 0.30

- Annualized Return: ~8%

- Quality: Dividend aristocrat, defensive

Example 3: Tesla (TSLA)

- Current Price: $240

- Suggested Strike: $260 (30 DTE)

- Premium: ~$12.00

- Delta: 0.40

- Annualized Return: ~20%

- Quality: High volatility, higher risk/reward

Example 4: Coca-Cola (KO)

- Current Price: $58

- Suggested Strike: $60 (60 DTE)

- Premium: ~$1.20

- Delta: 0.25

- Annualized Return: ~6%

- Quality: Stable dividend payer, conservative

Example 5: NVIDIA (NVDA)

- Current Price: $450

- Suggested Strike: $480 (30 DTE)

- Premium: ~$18.00

- Delta: 0.35

- Annualized Return: ~15%

- Quality: High-growth tech, moderate volatility

FAQs

Q: What is a good annualized return for a covered call?

This is subjective, but many experienced covered call writers aim for an annualized return of 8-15%. Returns above 20% often indicate significantly higher risk, either in the volatility of the underlying stock or a very aggressive strike price.

Q: Should I use the Bid, Ask, or Last price for my calculations?

The Last price is easy and automatically included by MarketXLS. However, for the most realistic analysis, using the Bid price is more conservative, as it represents the price you could likely sell the option for right now.

Q: What do "Open Interest" and "Volume" mean?

- Volume is the number of contracts traded today.

- Open Interest is the total number of outstanding contracts that have not been settled. High open interest is a better indicator of an option's liquidity than volume.

Q: How far out in time should I sell options?

Selling options with 30 to 45 Days to Expiration (DTE) is often considered the "sweet spot." This is because an option's time decay (Theta) accelerates significantly in the last 30-45 days, which benefits the option seller.

Q: Can I screen for covered calls on multiple stocks at once?

Yes! MarketXLS allows you to create watchlists and screen multiple tickers simultaneously. You can build a master spreadsheet that pulls option data for your entire portfolio of stocks.

Q: How often should I refresh my screening data?

For active trading, refresh your data daily or even intraday. For longer-term positions, weekly updates are usually sufficient. MarketXLS provides real-time data to keep your analysis current.

Now, Let's Manage the Trade

You've learned how to move from theory to a list of actionable trade ideas. By building a custom screener in Excel with MarketXLS, you can systematically find the best covered call opportunities that fit your exact criteria.

Once you've entered a trade, the journey isn't over. The next critical step is active management. Our next guide will teach you how to track, manage, and optimize your positions.

Continue to our final guide: Covered Call Management: Track, Roll & Optimize in Excel

Previous: ← Covered Call Strategy Explained