Credit Spread Vs Debit Spread are the strategies used in options; it is a defined-risk strategy that lets you make bullish or bearish speculative trades. Investors looking to make the best returns in today’s market can opt for a better trade options strategy. Let’s understand which is the better strategy credit spread or debit spread.

What Is a Credit Spread?

A credit spread is an option contract that includes purchasing one option and selling a second similar option with a different strike price. The second option is in the same class and also shares the same expiry date. In this instance, the new investor gets a net credit for entering this position.

A credit spread involves selling, writing, a high-premium option, and buying a lower premium option. The premium received from the written option is greater than the premium paid for the long option, resulting in a premium credited into the trader or investor’s account when the position is opened.

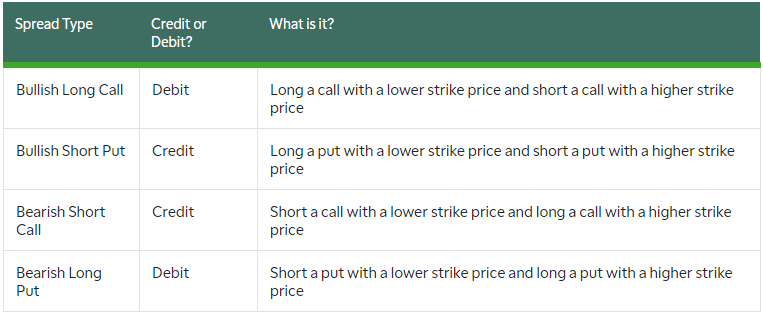

The most common credit spreads are the Bull Put Spread and the Bear Call Spread.

Advantages of Credit spread

- Spreads can lower your risk substantially if the stock moves dramatically against you.

- The margin requirement for credit spreads is substantially lower than for uncovered options.

- It is impossible to lose more money than the margin requirement held in your account when the position is established. With uncovered options, you can lose substantially more than the initial margin requirement.

- Spreads are versatile. Due to the wide range of strike prices and expiration that are typically available, most traders can find a combination of contracts that will allow them to take a bullish or bearish position on a stock.

Disadvantages of Credit spread

- Your profit potential will be reduced by the amount spent on the long option leg of the spread.

- Because a spread requires two options, the commission costs to establish and close out a credit spread will be higher than the commissions for a single uncovered position.

What Is a Debit Spreads?

Involves buying an option with a higher premium and simultaneously selling an option with a lower premium, where the premium paid for the spread’s long option is more than the premium received from the written option.

The debit spread results in a premium debited, or paid, from the trader’s or investor’s account when the position is opened. Debit spreads are primarily used to offset the costs associated with owning long options positions. The long leg is ITM, while the short leg is OTM.

Advantages of Debit spread

- One of the most significant advantages is that they help with trade planning, as it’s possible to predetermine the maximum potential loss and the full potential profit.

- There is also the fact that the losses are effectively limited to your initial cost when creating them.

- The knock-on effect of that fact is the third advantage – they don’t require trading on margin and can therefore be used by traders who can’t necessarily trade on margin.

- They can offer a greater return on investments than other strategies when there are moderate price movements.

Disadvantages of Debit spread

- The main disadvantage is the fact that there is a limit to how much profit you can make.

- Predicting a moderate price movement in specific security and use a debit spread to try and profit from that, you will miss out on the potential profit you could have made from an outright position if the security moves significantly in the direction you predicted.

- Limiting your losses comes with the cost of restricting your profits too.

- The investor must put up money to begin the trade. The higher the debit spread, the greater the initial cash outflow the trader incurs on the transaction.

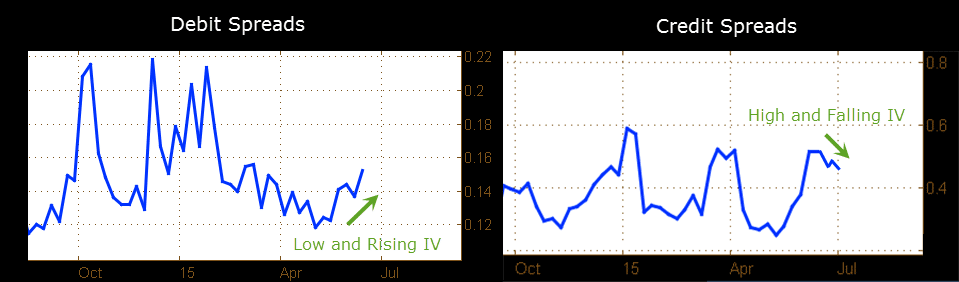

The Better Strategy: Credit Spread Vs Debit Spread

In deciding between credit spread vs debit spread which works better for you, consider the time value involved. If you know a stock or underlying will move in a particular direction, and you know what price a debit spread can result in more profit. On the other hand, if all you know is stock will move in one direction or not much, you can place your trade differently. With a credit spread, if the stock does not move, you still make money.

Basically, we are talking about two sides of the same coin. A debit spread for one option trader is a credit spread for another.