Debit Spreads For Income

Meet The Ultimate Excel Solution for Investors

- Live Streaming Prices Prices in your Excel

- All historical (intraday) data in your Excel

- Real time option greeks and analytics in your Excel

- Leading data in Excel service for Investment Managers, RIAs, Asset Managers, Financial Analysts, and Individual Investors.

- Easy to use with formulas and pre-made sheets

What is debit spreads?

Let’s first begin with how options are traded. Just like trading stocks, it is all about minimizing risk and maximizing profits. To forge the ultimate strategy, a trader always indulges in buying and selling options at multiple strike prices. This is what spreads are, the range of the strike prices. However, unlike credit spreads, where you get money to open a trade, in debit spreads you actually pay to open a trade. This may leave you scratching your head but it will be clear in subsequent paragraphs.

This strategy can be applied in both upward and downward trends and accordingly it is divided into two parts:

• Bull call spreads: This is a bullish strategy. In this strategy, you buy a call option at a strike price and sell another at a higher strike in the same underlying at the same time.

• Bear put spreads: This is a bearish strategy. In this strategy, you buy a put option at a strike price and sell another at a lower strike in the same underlying at the same time.

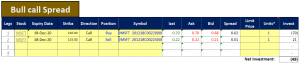

Trading with marketXLS

Below is a template provided by marketXLS to trade options. With this template, you can not only import option chains but also track your trades in real-time. This is an example of a bull call spread. In this example, a net debit spread of $49 is created as you can see in the net investment section. Here a spread of $5 is created between strikes of $220 and $225 but you can adjust them according to your own convenience. You can also adjust the expiry and the underlying and get the respective last, ask bid and spread values.

Max, min, breakeven

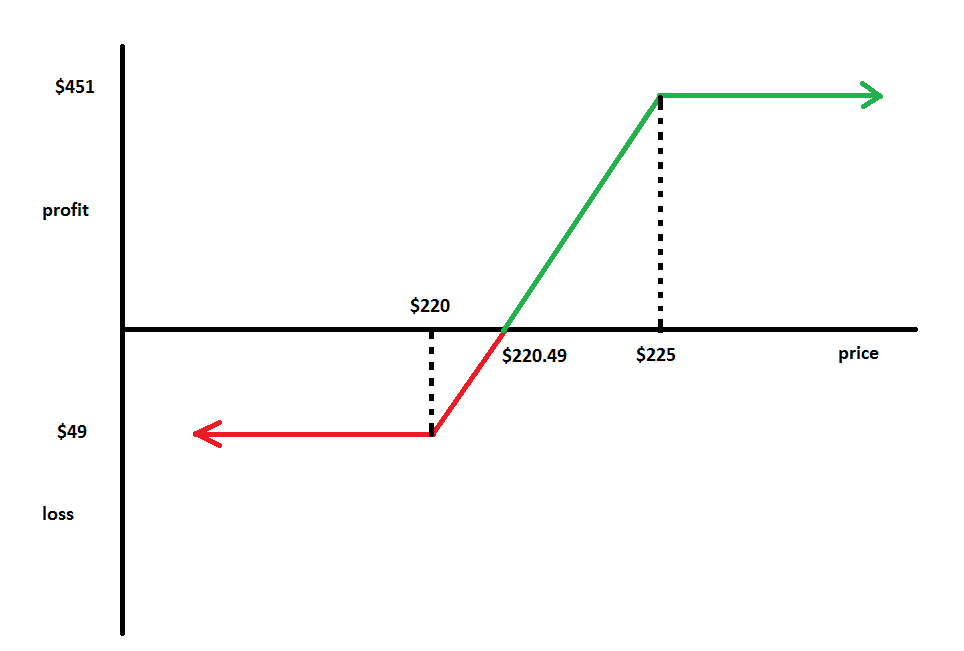

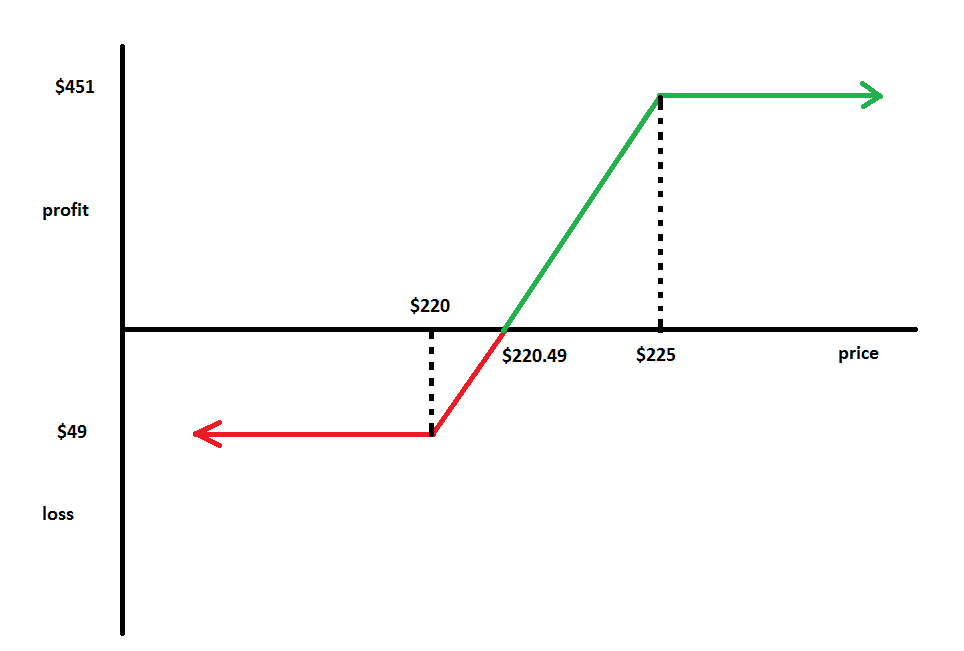

Let’s understand the different scenarios associated with the above example with the help of a graph. Here units mean contract (100 shares).

• Let’s say the stock price of Microsoft trades below $220. In this situation, both leg1 and leg2 will be deemed worthless and you pay $49 in the form of a premium. This is the maximum loss you will incur in this trade.

• Since you have a net debit of $49, you will have to earn at least $49 to breakeven which is possible only if the stock moves past $220 to $220.49.

• The maximum you can earn from this trade is $951. Here is the calculation:

($225-$220) * 100 minus premium ($49)

• After this point the profits will be constant as you will have to sell it at $225, irrespective of the current market price.

The bear put spread will also be similar with respect to positions, maximum profits, and losses. The only difference would be in the direction of trades. You would be making put trades in a bear put spread.

The bottom line

The risks and profits are both limited in this strategy. However, if you see in the above example, the maximum profit is about 10%. To sum up, this strategy is for traders who are risk-averse and are skeptical about a stock’s movement in the near future.

Disclosure

None of the content published on marketxls.com constitutes a recommendation that any particular security, portfolio of securities, transaction, or investment strategy is suitable for any specific person.

The author is not offering any professional advice of any kind. The reader should consult a professional financial advisor to determine their suitability for any strategies discussed herein.

the article is written for helping users collect the required information from various sources deemed to be an authority in their content. The trademarks if any are the property of their owners and no representations are made.

References

Images from marketXLS.com

More about debit spreads here

More about credit spreads here

More options strategies here

Get Market data in Excel easy to use formulas

- Real-time Live Streaming Option Prices & Greeks in your Excel

- Historical (intraday) Options data in your Excel

- All US Stocks and Index options are included

- Real-time Option Order Flow

- Real-time prices and data on underlying stocks and indices

- Works on Windows, MAC or even online

- Implement MarketXLS formulas in your Excel sheets and make them come alive

- Save hours of time, streamline your option trading workflows

- Easy to use with formulas and pre-made templates

I invite you to book a demo with me or my team to save time, enhance your investment research, and streamline your workflows.