Options Greeks

Access real-time options Greeks data to analyze risk and price sensitivity of your options positions.

Real-Time Plan Required

If you have the real-time data plan, you can use these streaming Greeks functions directly in Excel.

Available Greeks Functions

The following functions provide real-time options Greeks data:

=QM_Stream_Delta(symbol)=QM_Stream_Gamma(symbol)=QM_Stream_Theta(symbol)=QM_Stream_Rho(symbol)

Options Chain Integration

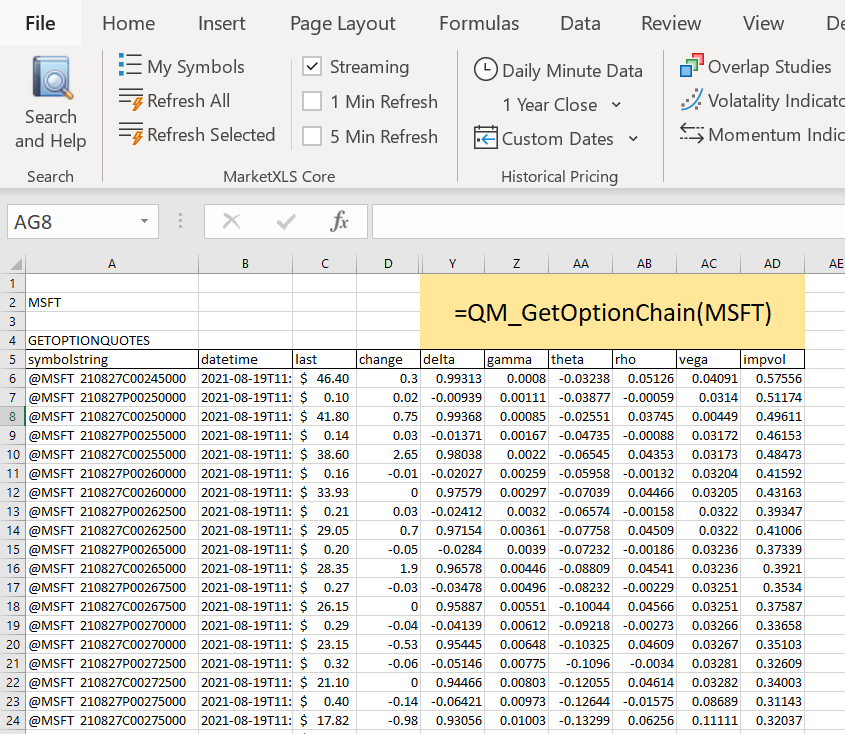

Greeks are also automatically included when you use the Options Chain function:

=QM_GetOptionChain(symbol)This function returns a comprehensive options chain with all Greeks calculated:

What Are Options Greeks?

- Delta: Rate of change in option price per $1 change in underlying stock

- Gamma: Rate of change in Delta per $1 change in underlying stock

- Theta: Rate of time decay - how much value the option loses per day

- Rho: Sensitivity to interest rate changes