Option Pricing with Quotemedia

Learn how to use various Options Pricing functions with Quotemedia's options data in Excel.

Common Options Functions

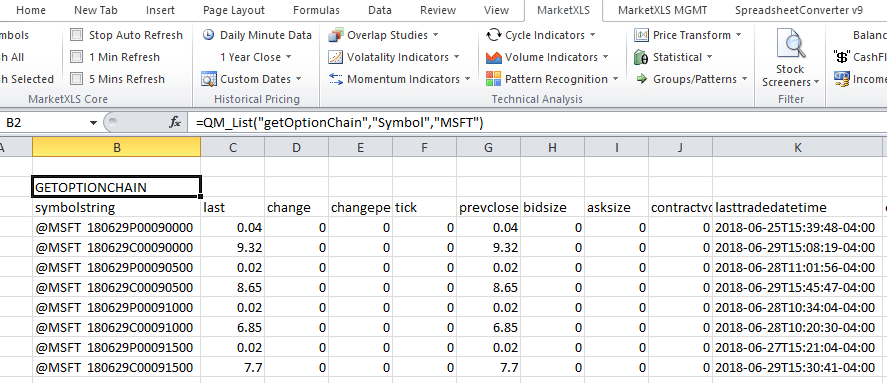

Get All Option Chains for a Stock

=QM_List("getOptionChain","Symbol","MSFT")

Get Last Price of an Option Symbol

MarketXLS internally understands both symbologies:

=QM_Last("@MSFT 180629P00090000")=QM_Last("MSFT180629P00090000")Quotemedia Option Symbol Structure

Example: 2011 Jan 22 $20.00 Call for Microsoft Corp.

Symbol: @MSFT 110122C00020000

@: All options begin with the "@" character

MSFT (with spaces): Six character option root symbol, left-justified, space-padded

11: Two least significant digits of contract year

01: Two-digit contract month

22: Two-digit contract day

C: "C" for CALL or "P" for PUT

00020: Five-digit whole portion of strike price (e.g., $26 = 00026)

000: Three-digit fractional portion (e.g., $26.50 = 500)

MarketXLS Also Supports Standard Format

Root Symbol + Expiration Year(yy) + Month(mm) + Day(dd) + Call/Put (C or P) + Strike Price

Get Expiry Date of a Contract

=QM_ExpiryDate("@MSFT 180629P00090500")=QM_ExpiryDate("MSFT180629P00090000")Check if Contract is Call or Put

=QM_CallPut("@MSFT 180629P00090500")Extract Strike Price

=QM_Strike("@MSFT 180629P00090500")Get Highest Price of Contract

=QM_ContractHigh("@MSFT 180629P00090500")Get Lowest Price of Contract

=QM_ContractLow("@MSFT 180629P00090500")Get Open Interest

=QM_OpenInterest("@MSFT 180629P00090500")Get In-the-Money Options

To get all option contracts that are In-the-Money:

=QM_List("getOptionChain","Symbol","FDX","money","In")