Gamma Exposure (GEX) Template

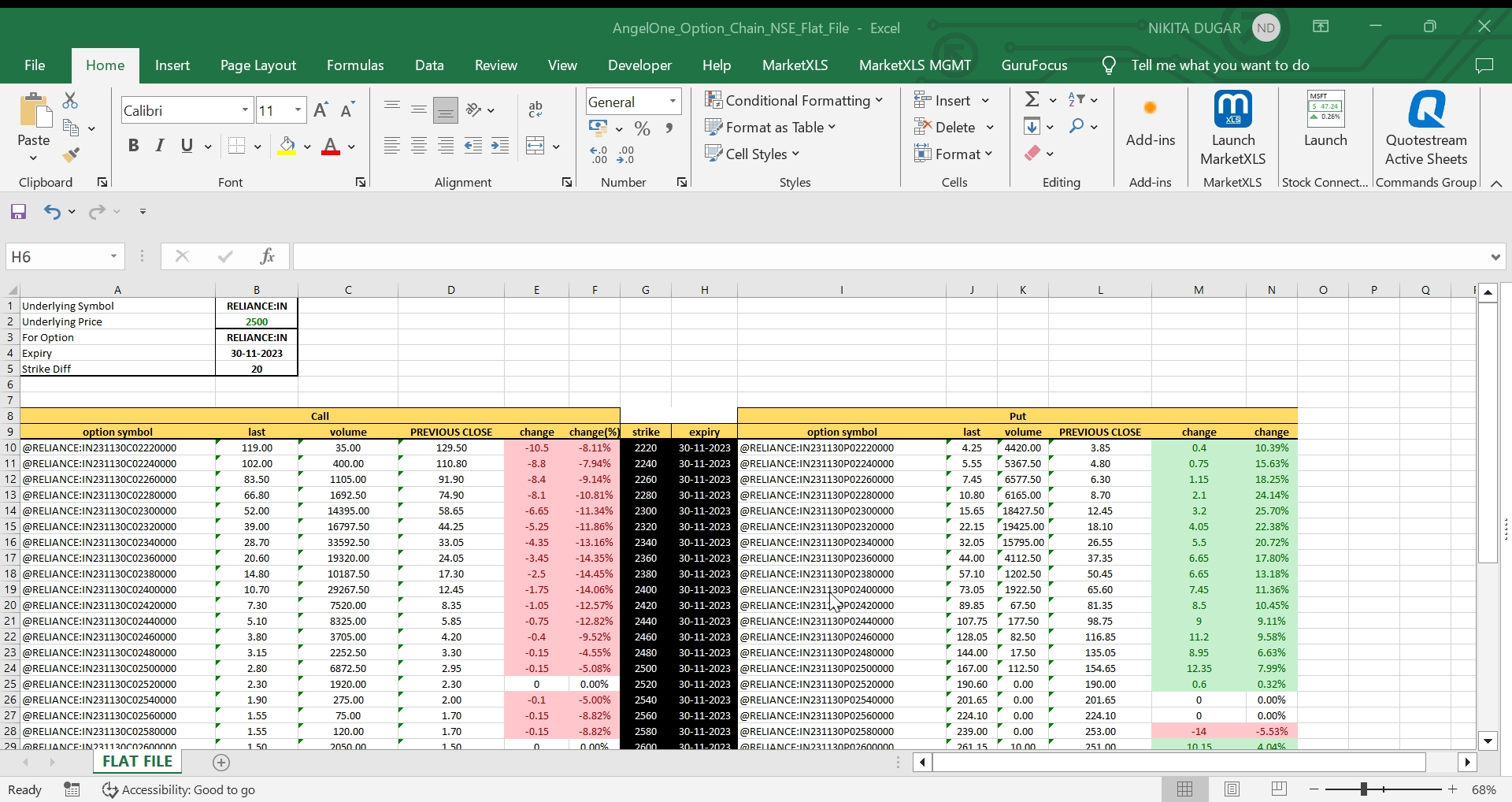

This is an Excel template designed for financial trade tracking, particularly focusing on options trading for specific underlying assets. Its core function is to track and analyze key trading parameters for specific stocks, in this case, the American Airlines Group Inc. - AAL.

In-use, one can input various data, such as the 'Underlying Price', 'Volume', 'Calls (Gamma Exposure)', 'Puts', and '%', to track the company's stock trading interactions. It also provides a provision for inputting data on 'Support & Resistance' levels, along with the respective 'Call Put Volume/Open Interest'. All these inputs enable the user to track and analyze the performance and trends associated with the concerned stock. A trader would find this template useful for several reasons. Firstly, it summarizes metrics such as price, gamma exposure, support and resistance levels, and call-put volume and open interest, hence enhancing trading efficiency. Secondly, it aids in making guided decisions by identifying key performance indicators like the underlying price, volume, and strike difference. Moreover, it allows for timely monitoring of any changes in these parameters, which is crucial in a dynamic market environment. Lastly, using this template can reduce the probability of errors that may occur when tracking these metrics manually, thus ensuring more accurate trading operations. For instance, with AAL, this template charts and tracks the underlying price for options, which currently stands at 11.4 with a call gamma exposure of 18,769,090 and puts at -5,507,477. It shows the support & resistance at given levels and the associated volumes. The Call and Put volumes along with open interest are also recorded. This is vital in predicting market trends and making informed trading decisions.

Created by: Ankur

Interested in building, analyzing and managing Portfolios in Excel?

Download our Free Portfolio Template

Call: 1-877-778-8358

Welcome! I'm Ankur, the founder and CEO of MarketXLS. With more than ten years of experience, I have assisted over 2,500 customers in developing personalized investment research strategies and monitoring systems using Excel.

I invite you to book a demo with me or my team to save time, enhance your investment research, and streamline your workflows.

I invite you to book a demo with me or my team to save time, enhance your investment research, and streamline your workflows.

Implement "your own" investment strategies in Excel with thousands of MarketXLS functions and templates.

MarketXLS provides all the tools I need for in-depth stock analysis. It's user-friendly and constantly improving. A must-have for serious investors.

I have been using MarketXLS for the last 6+ years and they really enhanced the product every year and now in the journey of bringing in AI...

MarketXLS is a powerful tool for financial modeling. It integrates seamlessly with Excel and provides real-time data.

I have used lots of stock and option information services. This is the only one which gives me what I need inside Excel.

Meet The Ultimate Excel Solution for Investors

Live Streaming Prices in your Excel

All historical (intraday) data in your Excel

Real time option greeks and analytics in your Excel

Leading data service for Investment Managers, RIAs, Asset Managers

Easy to use with formulas and pre-made sheets