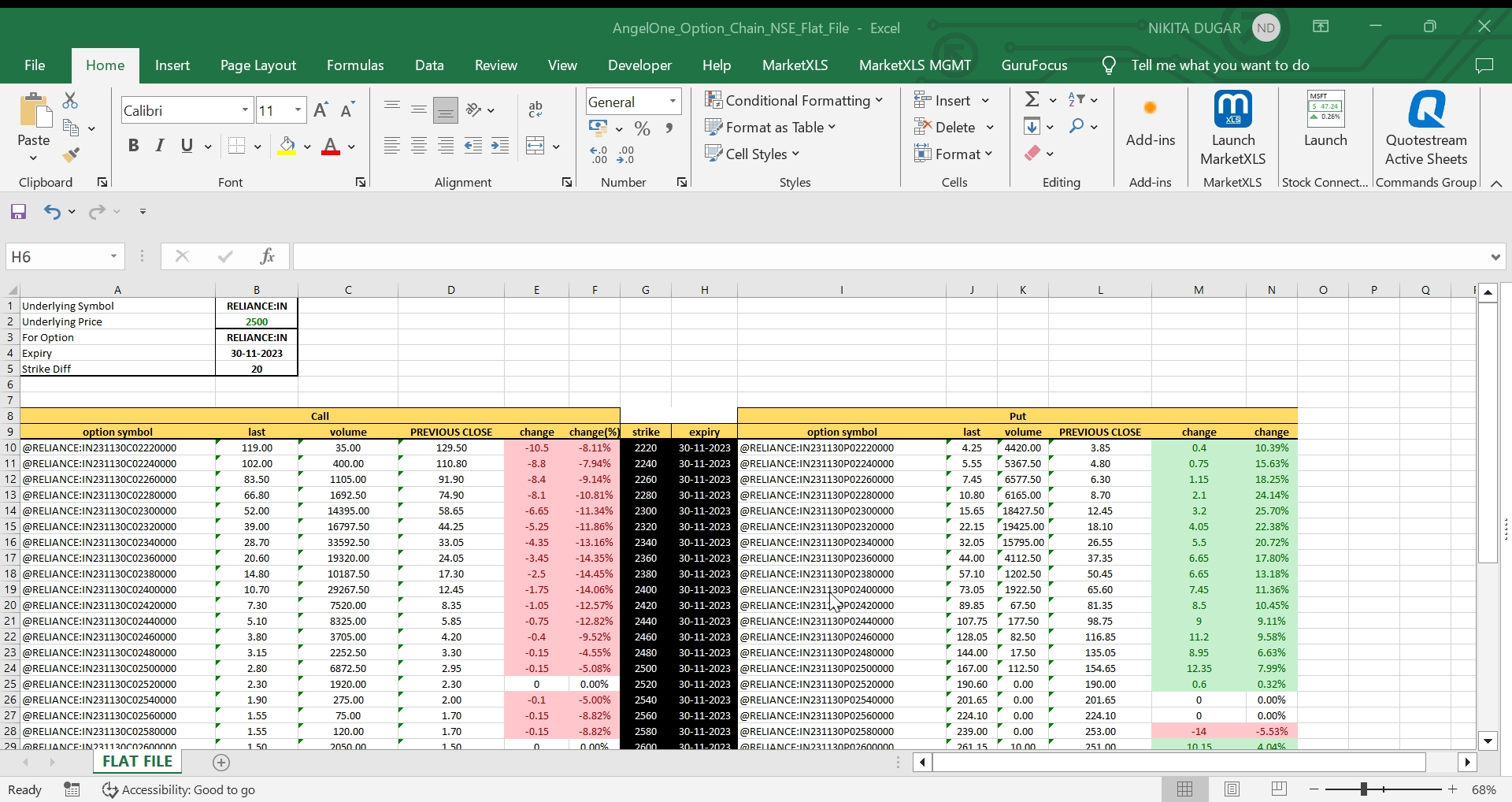

Nifty Call Put Option Price Live

This all-inclusive spreadsheet is a goldmine of extensive details, assembled from a range of call and put options relevant to Nifty. It diligently showcases a plethora of information for every option, such as the last presented price, transaction volume, past closure, price fluctuation, and percentage variance. What's more, the spreadsheet encompasses vital data related to the strike prices and expiry dates for all options. Here's a lucid summary:

In the category of Calls, the option flaunting the symbol @NIFTY:IN231130C18800000, which wields a strike price of 18800 and is set to expire on the 30th of November 2023, concluded at 708.65. This indicates a decrease from its earlier closure by -8.9, corresponding to a change ratio of -1.24%. On the other hand, under Puts, the @NIFTY:IN231130P19200000, which has a strike price of 19200 and the same expiration date, terminated at 81.10, reflecting a price alteration of -3.95 and a percentage deviation of -4.64%.

It's crucial to keep in mind that these options shed light on the projections of Nifty's market participants with regards to its impending price shifts. They grant investors the dual benefits of the right and obligation to purchase (under Calls) or dispatch (under Puts) the underlying asset – in this instance, the Nifty Index. For real-time updates and the most recent information, please visit the official Nifty website.

This spreadsheet serves as an invaluable instrument for investors, enabling them to decipher the convoluted nature of the financial market. It embodies the complex nuances of options trading in a simplified, readily digestible format.

Significantly, this option chain also calls for the integration of AngelOne. With this integration, the spreadsheet will offer an extended array of features and benefits, enhancing the investors' experience. The integration with AngelOne not only consolidates the options chain but also streamlines the process for investors, making it a more insightful and impactful resource for market participants.

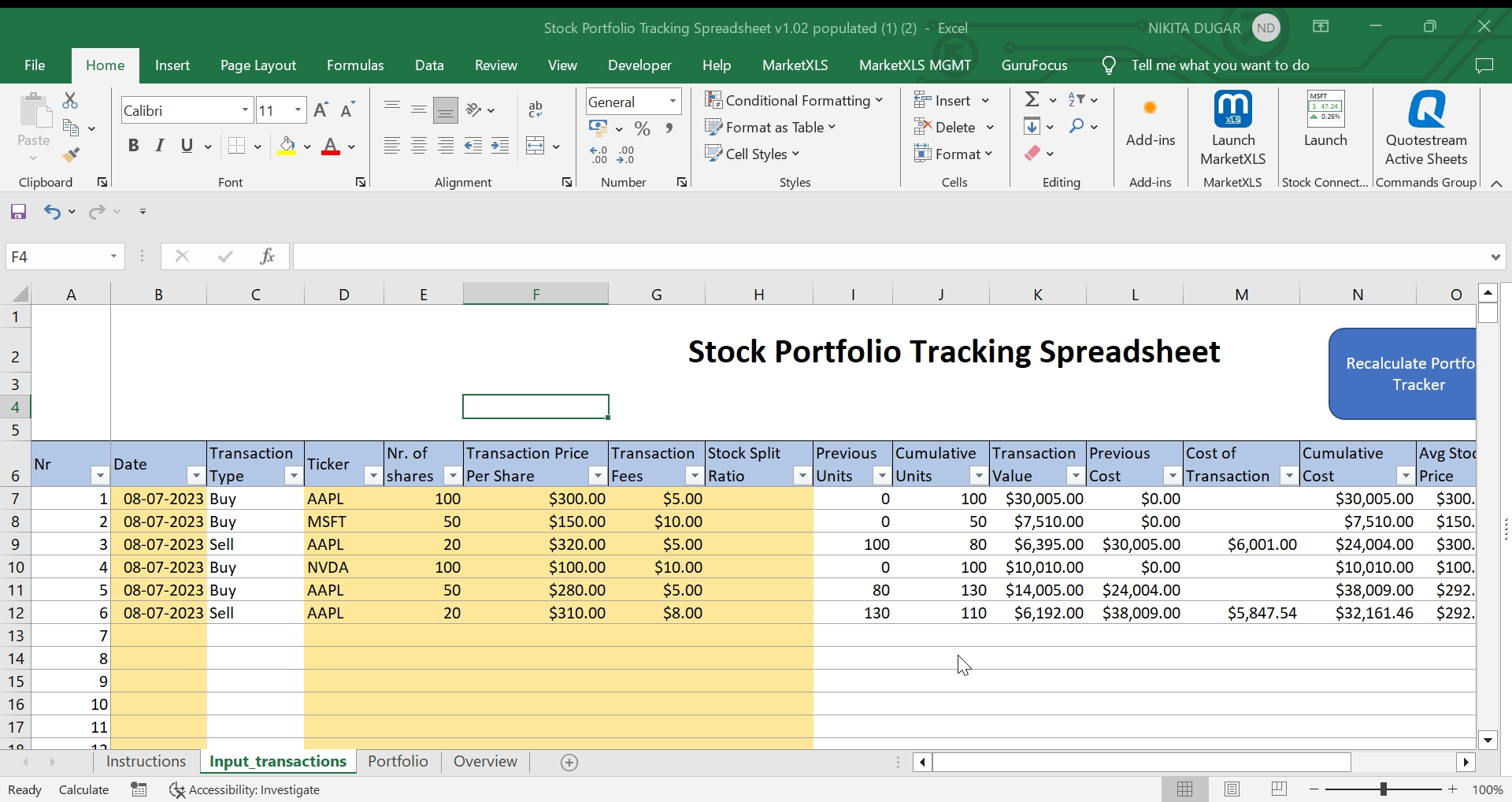

Created by: Nikita

I invite you to book a demo with me or my team to save time, enhance your investment research, and streamline your workflows.