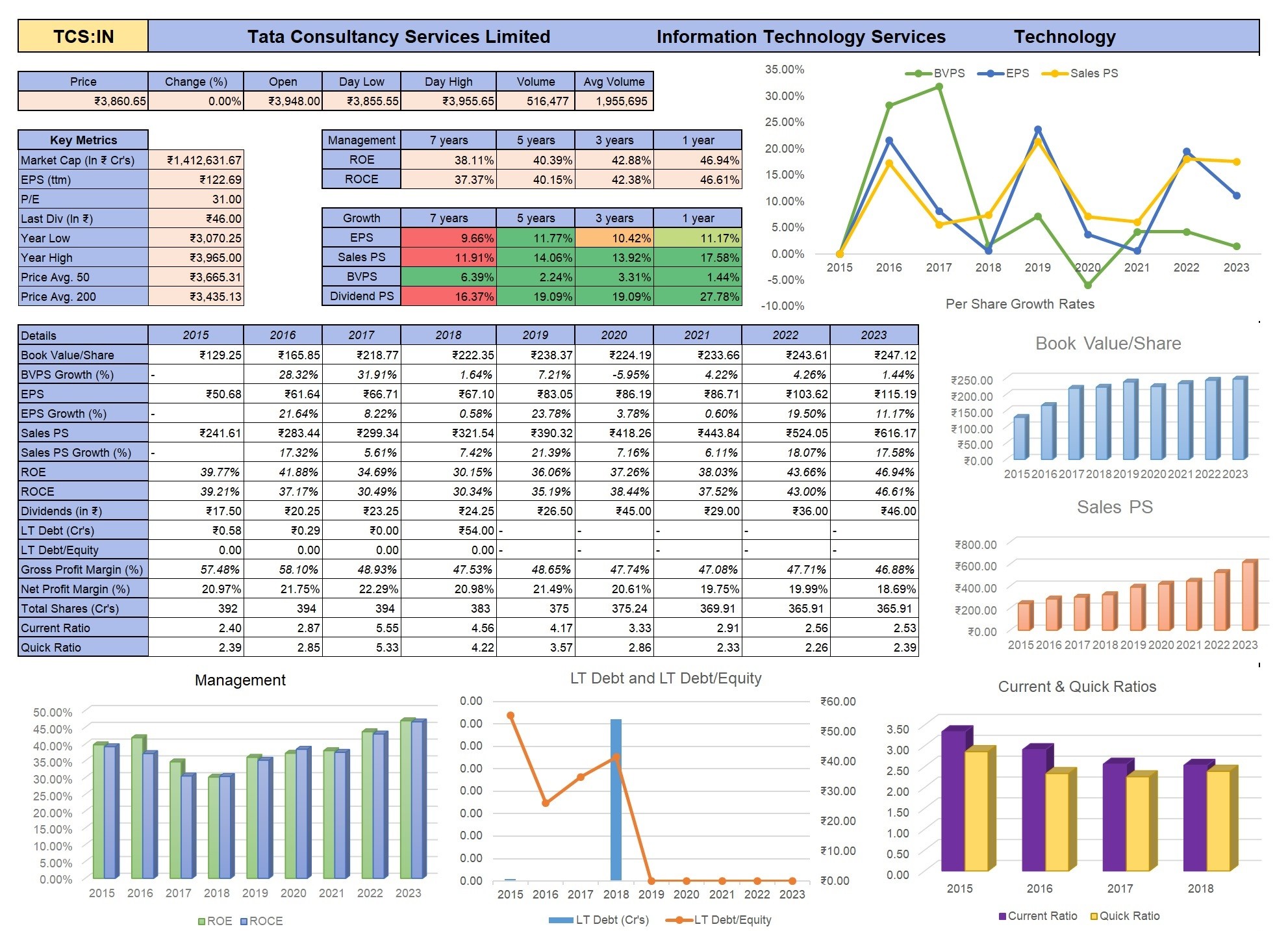

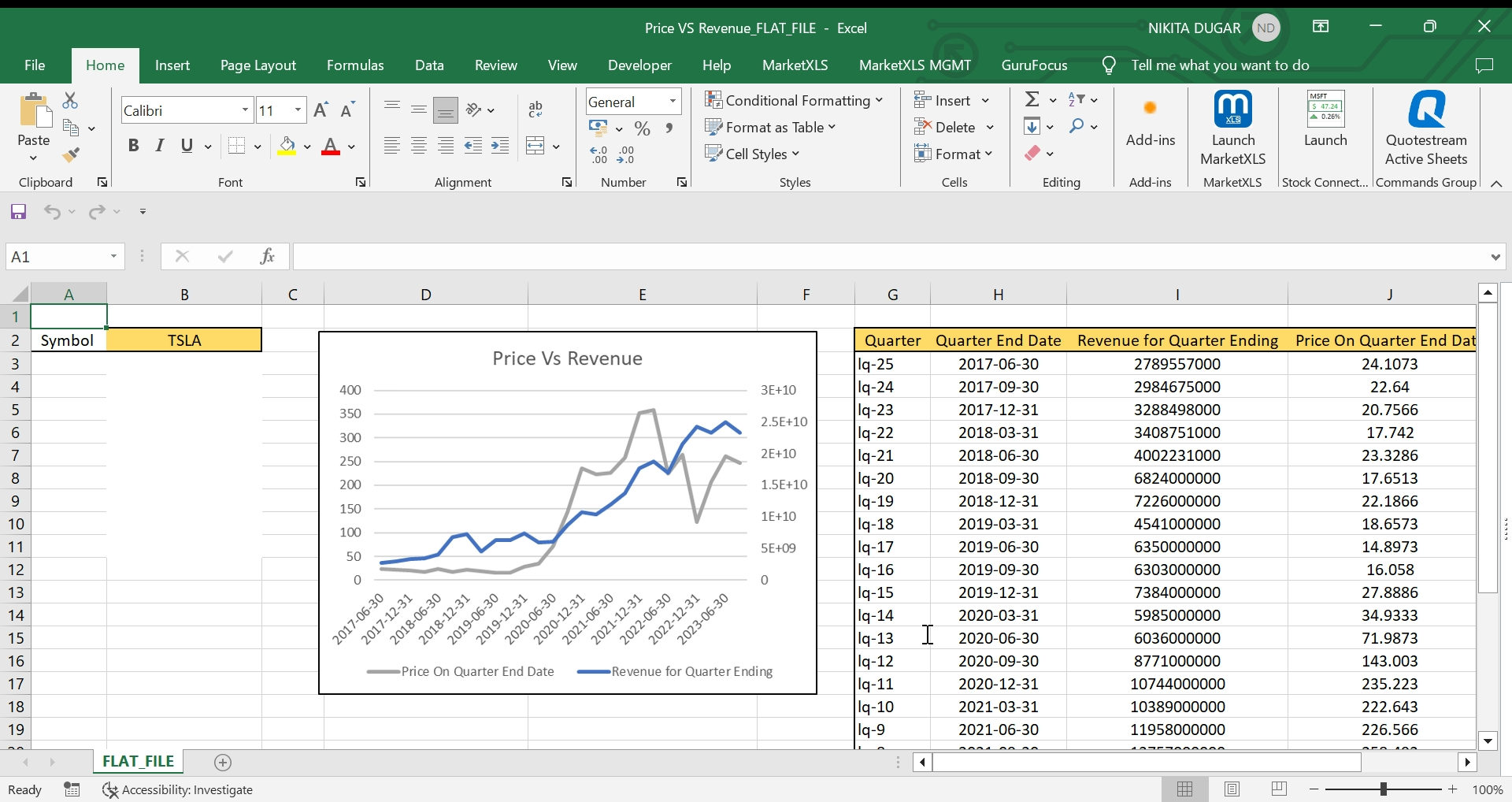

Comparative Analysis of Price Vs Revenue

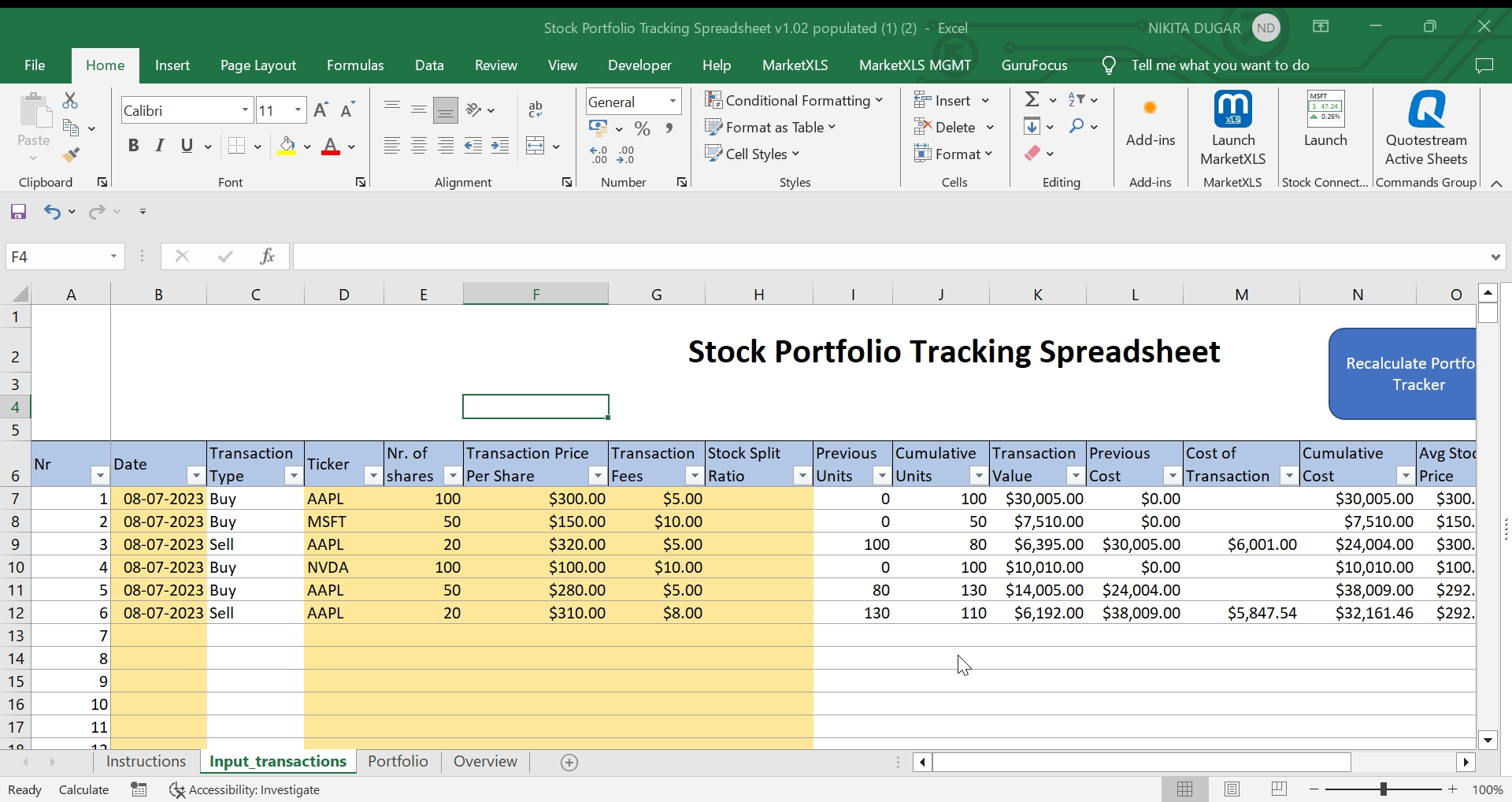

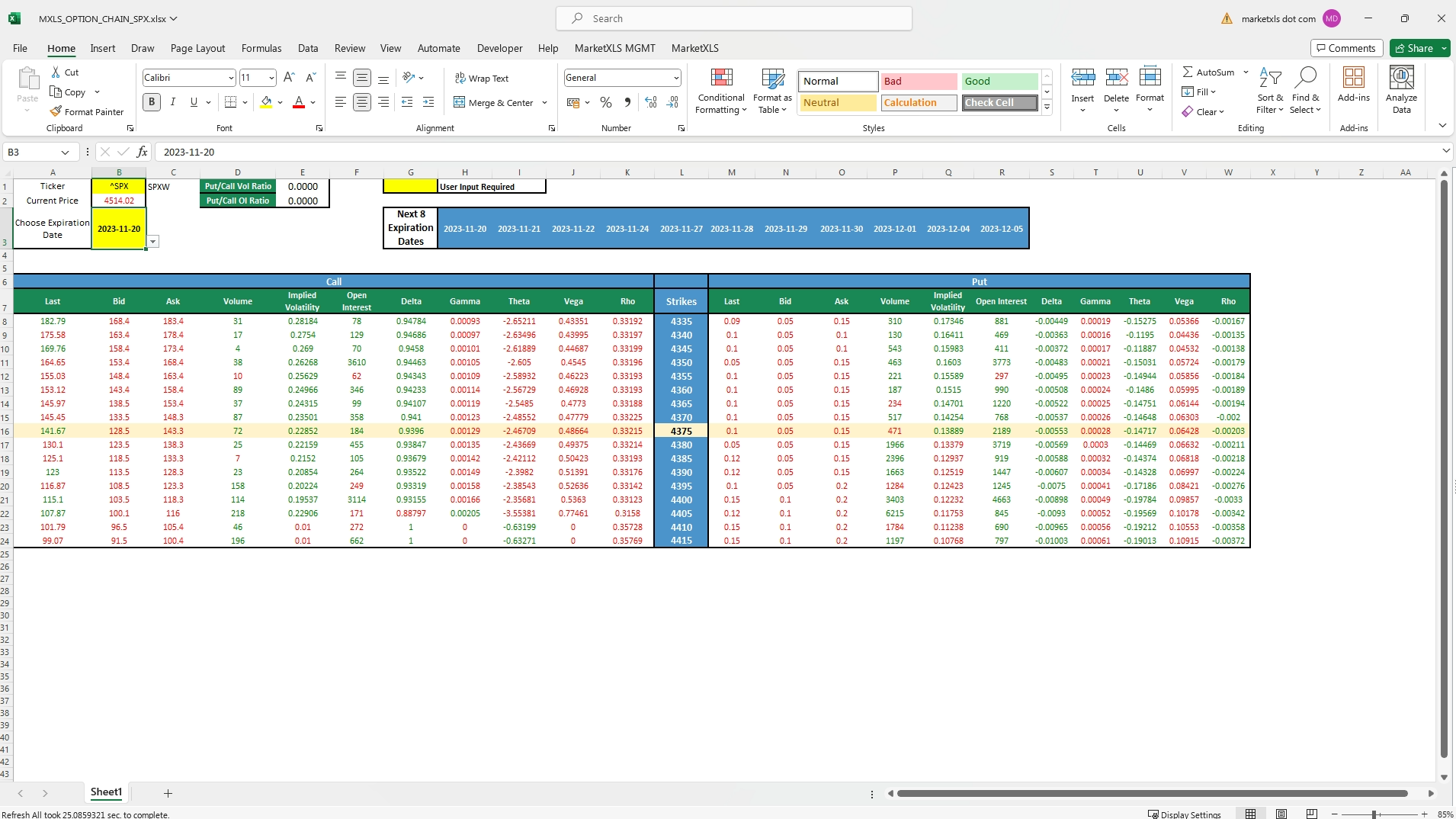

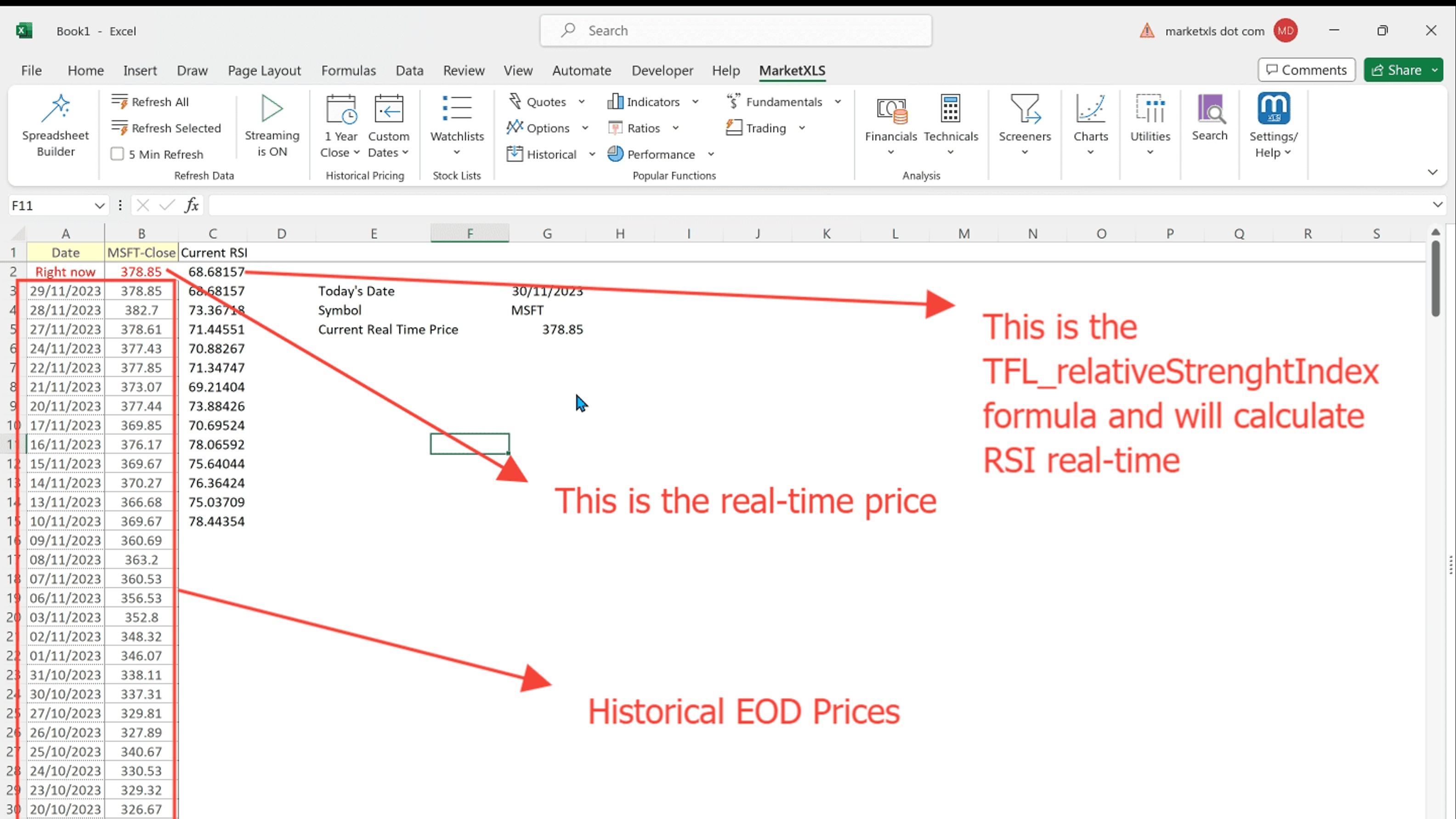

The comprehensive data set presented offers a meticulous study of TSLA's quarterly revenue trends from the second quarter of 2017 up to the third quarter of 2023. The data explicitly includes the revenue accrued within each quarter, the final date of the quarter, and the corresponding stock price. Furthermore, dating from the second year onwards, a calculation of the trailing twelve months' (TTM) revenue has been provided. To illustrate, as of June 30, 2017, TSLA's revenue was recorded at a significant amount, commensurate with a distinct stock price. Fast forward to September 30, 2023, the revenue had escalated to a hearty sum alongside a specified stock price level. This chronological overview unveils patterns in revenue and price trends pertinent to the years under inspection. A chart, titled "Comparative Analysis of Price Vs Revenue," delivers a holistic portrayal of these tendencies, with the graphical representation serving as a potent tool in fully capturing the fluctuation in TSLA's revenue growth and stock price over the designated period.

For investors, this rigorous data structure yields considerable relevance. It unveils not just the financial growth and overall stability of TSLA throughout a lengthy period but also unravels the intricate interplay between the company's revenue and stock price. By examing the revenue fluctuations alongside the attendant stock price changes, investors can make knowledgeable consternations about buying, disposing of, or holding the stock. Further, by monitoring the revenue trajectory, they can potentially prognosticate future expansion potential, thereby facilitating strategic planning. Essentially, this all-embracing analysis is key in formulating investment strategies and financial planning, thus equipping investors with the necessary tools to maneuver through the capricious landscape of stock market investments with heightened confidence.

Even though the data pertains specifically to TSLA, this in-depth analysis can be replicated for any stock as an investment. Understanding the complicated nexus among a company's revenue, stock price, and overall financial well-being is integral to fruitful investing. By employing a data-rich approach, investors can forge judicious decisions that are congruent with their financial aspirations.

Please note, even though we've used TSLA as an example, this analytical blueprint is universally applicable and effective for all stocks. The objective is to help investors leverage comprehensive data to make informed decisions and build robust strategies.

Created by: Nikita

I invite you to book a demo with me or my team to save time, enhance your investment research, and streamline your workflows.