Introduction

MarketXLS is a community of professional and institutional option traders who use the platform for analysis, monitoring and journaling. The active members regularly share their winning strategies, best-in-class tools and learning opportunities within the community.

In a recent survey the members discussed the best brokers for options traders. The members primarily valued their commission structure, range of tradable assets, research tools, customer service, ease of use, and overall reputation.

Key Takeaways

-

The top pick among MarketXLS users is “Interactive Brokers”, admired for its broad selection of assets and competitive pricing structure.

-

Interactive Brokers, TD Ameritrade, E*TRADE, Charles Schwab, Fidelity, and Robinhood offer a wide range of trading options.

-

No base commission for options trades at Interactive Brokers, TD Ameritrade, E*TRADE, Charles Schwab, Fidelity, and Robinhood. Affordable fee structure at Ally Invest and TradeStation.

-

Interactive Brokers, TD Ameritrade, and E*TRADE offer comprehensive, intuitive platforms. Webull and Robinhood cater to younger, tech-savvy traders. TradeStation and Ally Invest offer innovative, customizable platforms.

-

Charles Schwab and Fidelity provide excellent customer service, with Fidelity offering 24/7 support.

-

Interactive Brokers, TD Ameritrade, and Charles Schwab offer robust research tools. Fidelity, TradeStation, and Ally Invest provide abundant learning resources.

-

All platforms receive high praise and recognition across various review sites.

-

Robinhood, Webull, and Merrill Edge stand out with commission-free trading.

The Top 10 Options Trading Brokers Ranked

-

Interactive Brokers

-

TD Ameritrade

-

E*TRADE

-

Charles Schwab

-

Fidelity

-

Robinhood

-

Ally Invest

-

TradeStation

-

Webull

-

Merrill Edge

Unique Features and Benefits of Each Broker

**1. Interactive Brokers **

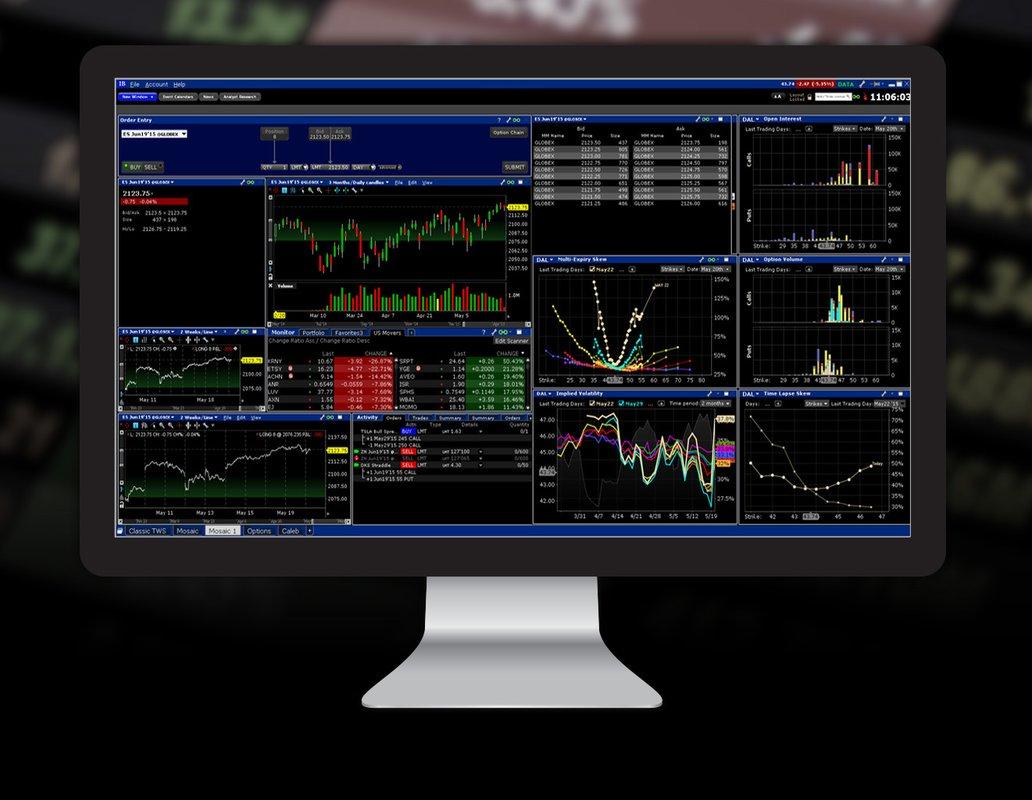

Global Trading Platform - IB Trader Workstation | Interactive Brokers LLC

The top pick for MarketXLS traders is undoubtedly Interactive Brokers, an esteemed platform providing a wide array of assets and competitive pricing, along with an all-encompassing trading platform.

Here’s what makes it a stellar choice:

-

Trading Opportunities: Interactive Brokers offers an extensive collection of tradable assets, offering innumerable opportunities for options traders. Whether you’re a professional trader or just starting, the range of offerings enables you to diversify and enhance your portfolio effectively.

-

Cost-Effective Trading: The pricing structure at Interactive Brokers is designed to support all traders, irrespective of their trading volumes. The cost ranges from no base commission with 65 cents per contract (IBKR Lite), to no base commission with 15 to 65 cents per contract depending on the commission structure, with a volume discount available (IBKR Pro).

-

Resource-Rich Platform: Its trading platform is recognized for its comprehensive features and user-friendly navigation, making trading a smoother and more effective process for users.

-

Recognition: Interactive Brokers has been lauded by various platforms for its services, with a 5-star rating on nerdwallet.com, 4.2 on investopedia.com, 4.5 on stockbroker.com, and a stunning 4.9 on brokerchooser.com.

-

Education and Research: Interactive Brokers offers a wealth of educational resources and robust research tools. The emphasis on continued learning and staying informed makes it a favored platform for both beginners and advanced traders.

From its diverse offerings to its cost-effective structure, Interactive Brokers solidifies its place as a top choice for options traders in MarketXLS. Get a free trial using the link: Free Trial" ###**2. TD Ameritrade **

Online Trading Platforms & Tools | TD Ameritrade

TD Ameritrade holds a significant position as a broker in the field of options trading, offering a comprehensive platform that brings numerous benefits to its users.

Here’s why TD Ameritrade is worth considering for options traders:

-

Impressive Trading Platform: TD Ameritrade’s stand-out trading platform, thinkorswim, is highly regarded for its wide-ranging functionalities. It offers a multitude of trading tools and comprehensive market research resources that cater to both beginners and experienced traders alike.

-

Robust Technical Analysis: The platform is equipped with advanced technical analysis capabilities, providing traders with a deep insight into market trends.

-

Cost-Effective Trading: TD Ameritrade charges no base commission for option trades. Each contract costs only $0.65, a competitive rate in the market.

-

Recognized Excellence: TD Ameritrade enjoys high ratings from trusted financial platforms. Nerdwallet, Stockbroker and Brokerchooser all awarded it a perfect 5-star rating. Investopedia also rated it highly with a 3.8 score.

-

A Treasure Trove of Knowledge: TD Ameritrade serves as an educational hub for traders, offering extensive research tools and resources.

-

Fair Pricing: Keeping trader affordability in mind, TD Ameritrade, with its user-centric pricing model, is akin to an easily accessible service, with no hidden charges.

-

Suitability: Whether you are just starting your trading journey or an experienced trader looking for an advanced platform, TD Ameritrade caters to all with its wide range of offerings and easy-to-navigate interface.

TD Ameritrade continues to innovate and evolve, meeting the evolving needs of options traders and setting high standards in the options trading industry. You can open your account using the link: TD Ameritrade – Open Your Account – Start Your Application

###3. E*TRADE

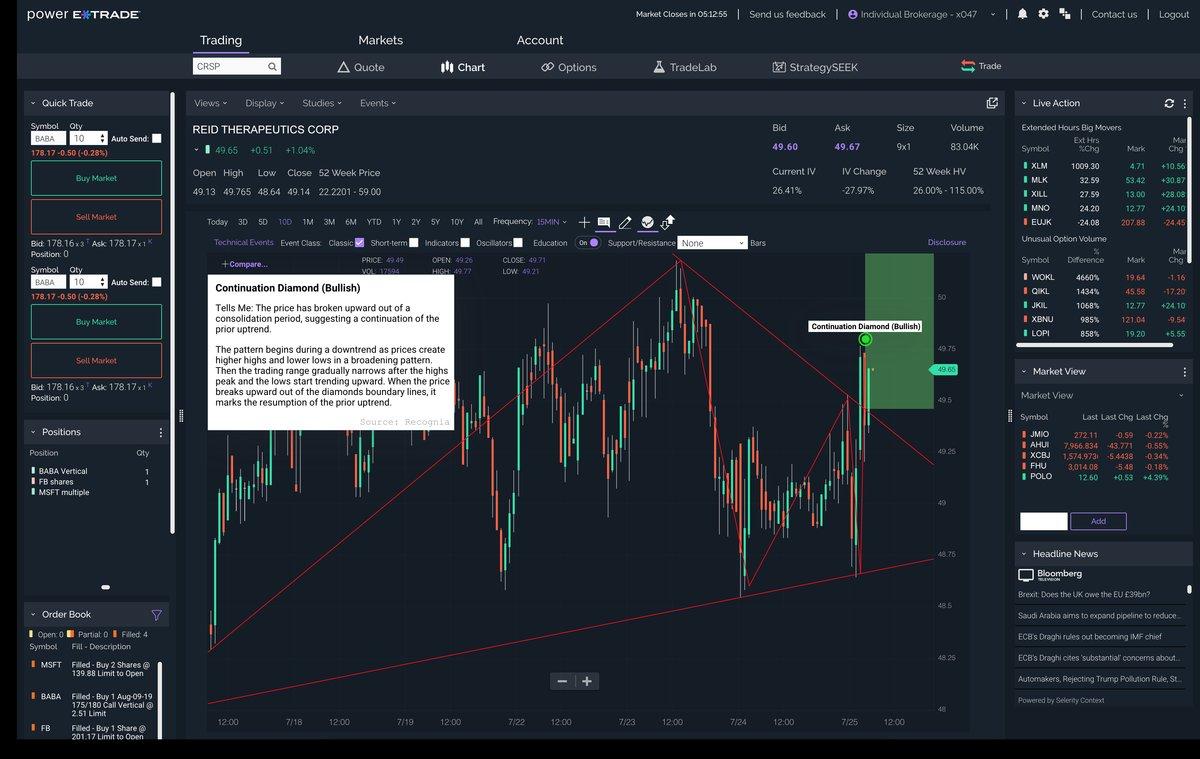

Power E*TRADE Platform

E*TRADE is a popular platform for options trading, known for its wide range of investment options and advanced trading platforms.

Here’s why it’s an exceptional choice:

-

Diverse Trading Opportunities: E*TRADE offers a wide array of investment options, including a multitude of options trades, making it a versatile platform for all types of traders.

-

Trading Platforms: It provides best trading platforms that include real-time data and advanced charting tools. This enhances trading efficiency and offers users a comprehensive view of the market.

-

Live Bloomberg TV: The platform also features live Bloomberg TV, a feature that ensures traders stay up to date with real-time market news and trends.

-

Power E*TRADE: The Power E* TRADE platform is specifically known for its options trading features, making it a top choice for options traders.

-

Cost-effective Pricing: E*TRADE charges no base commission for options trades, and a charge of $0.65 per contract. There is a discounted fee of $0.50 per contract for active traders who trade 30 or more times per quarter.

-

Impressive Ratings: E*TRADE gets high ratings across several review sites, including a 5-star rating on nerdwallet.com and stockbroker.com, a 4.1 on investopedia.com and a solid 4.7 on brokerchooser.com.

In short, with its diverse offerings, advanced platforms, and cost-effective pricing, E*TRADE remains a leading choice for options traders. You can open an account using the link: Online Brokerage Account | Open an Account | E*TRADE (etrade.com)

**4. Charles Schwab **

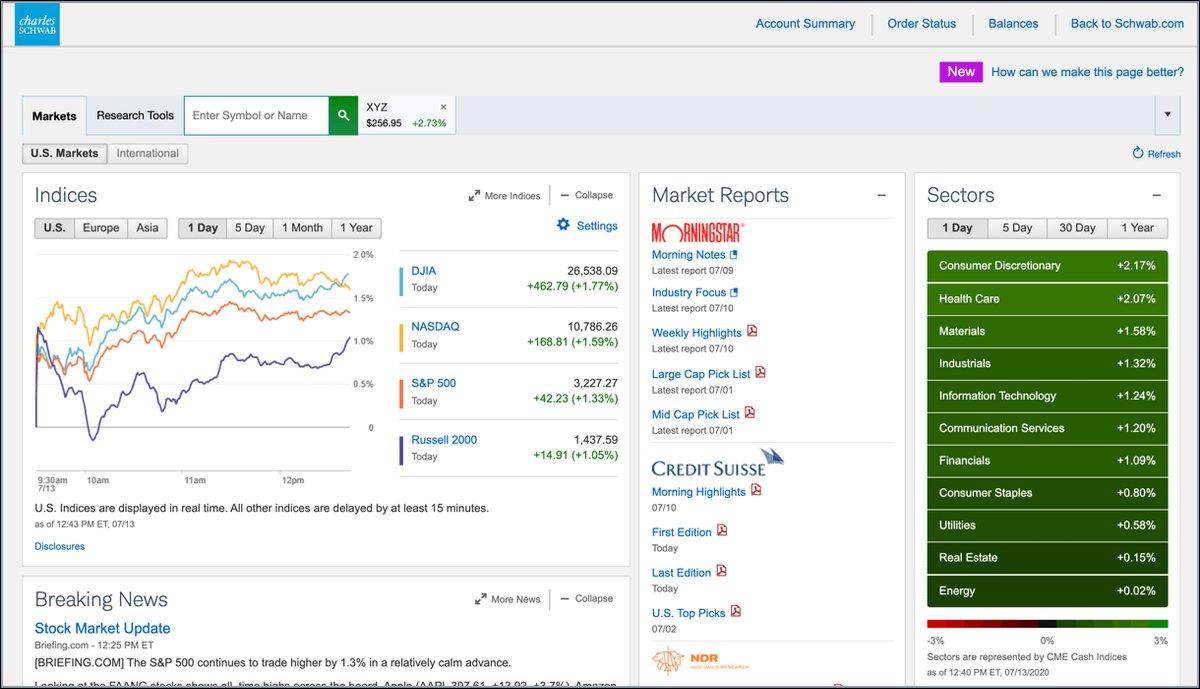

Online Stock Trading Tools | Web Trading Tools | Charles Schwab

Charles Schwab stands out as a significant brokerage in the options trading sector.

Here’s why it’s worthy of note:

-

Versatile Trading Options: Charles Schwab presents a broad range of investment options, including numerous options trades. This variety allows for enhanced portfolio diversification.

-

Cost Structure: Schwab’s approach to options trading fees is trader-friendly, with no per-trade commission and a standard contract fee of $0.65.

-

High-quality Customer Service: Known for its excellent customer service, Charles Schwab ensures a smooth and hassle-free trading experience for its users.

-

Cutting-edge Trading Platform: Schwab’s trading platform, StreetSmart Edge, is robust and equipped with advanced features, enabling efficient and intelligent trading.

-

Comprehensive Research Tools: Schwab offers a suite of in-depth research tools ideal for traders interested in thorough market analysis, providing crucial insights for informed decision-making.

-

Industry Accolades: The platform has received high ratings across several review sites: a 5-star rating on nerdwallet.com, 4 on investopedia.com, 4.5 on stockbroker.com, and 4.8 on brokerchooser.com, reflecting its trustworthiness and efficiency.

From its wide array of investment options to its excellent customer service, Charles Schwab continues to maintain its strong presence in the market. You can open an account using link: Open a Schwab account online | Charles Schwab

###**5. Fidelity **

Fidelity is a major player in the options trading world, well-known for its value-driven approach and excellent service.

Here’s what makes it stand out:

-

Value-Driven Approach: Fidelity is recognized for its dedication to providing high-quality trading options and service at an excellent value.

-

Broad Investment Options: Fidelity offers a wide variety of investment options, providing a strong environment for traders. With so many choices, you can really diversify your portfolio.

-

Robust Trading Platform: Fidelity’s top-tier trading platform, combined with their in-depth research tools, makes it a great choice whether you’re a professional trader or just starting out.

-

Customer Service: Fidelity’s customer service is one of the best, offering 24/7 support and a handy online chat feature for those quick questions. They’re there when you need them!

-

Costs: No commission charges for options trades here – just a standard $0.65 contract charge.

-

Recognized Excellence: Fidelity has received high ratings from numerous review platforms, including a 5-star rating from nerdwallet.com and stockbroker.com and 4.8 from investopedia.com and brokerchooser.com.

In conclusion, Fidelity’s value-driven approach, wide variety of investment options, and stellar customer service all contribute to making it a significant broker in the options trading world. You can register using the link: Fidelity Investments | Verify Your Identity" ###**6. Robinhood **

Commission-free Stock Trading & Investing App | Robinhood

Robinhood has earned its reputation as a favored platform among the younger, tech-savvy traders.

Here’s why it’s noteworthy:

-

User-Friendly Platform: Robinhood’s mobile and web platforms are intuitively designed, making them simple to navigate even for beginners.

-

No Commission Fees: One of the main draws of Robinhood is its commitment to cost-effective trading. It offers commission-free trading, making it an attractive choice for traders of all levels.

-

Ideal for Beginners: With its streamlined interface and simple design, Robinhood serves as an excellent starting point for those new to options trading.

-

Positive Ratings: It has also garnered impressive ratings across various review platforms: 4.6 on nerdwallet.com, 2.7 on investopedia.com, 4 on stockbroker.com, and 4.5 on brokerchooser.com.

Overall, Robinhood offers a straightforward, modern trading experience that’s particularly suitable for newcomers to options trading. It’s a platform that effortlessly combines simplicity with functionality. You can sign up using the link: Create your login | Robinhood

###**7. Ally Invest **

Ally Invest is one of the renowned brokers in the world of options trading.

Here’s why it stands out:

-

Customizable and Affordable: Ally Invest is highly regarded for its customizable platform and competitive pricing structure, making trading accessible and tailored to individual needs.

-

Flexible Trading Options: Ally Invest offers a wide array of investment options. Its innovative platform supports various types of trades, allowing for greater portfolio diversification.

-

Innovative Tools: Ally Invest is equipped with sophisticated tools, like probability charts and a profit-and-loss graph, specially designed for options traders.

-

Affordable Fee Structure: Ally Invest doesn’t charge a base commission for options trades, and its per-contract fee is lower than many other brokers, at just $0.50 per contract.

-

Strong Industry Recognition: Ally Invest has earned impressive ratings across various review platforms – 4.9 stars on nerdwallet.com, 3.4 on investopedia.com, 4 on stockbroker.com, and 4.7 on brokerchooser.com.

In conclusion, Ally Invest, with its user-focused platform, comprehensive trading tools, and competitive pricing, offers a standout experience in the trading market. You can open an account using the link: Open Account (ally.com)

###**8. TradeStation **

TradeStation - Overview

TradeStation has powerful and flexible trading platforms. The platform’s capabilities attract both experienced technical traders and everyday investors, contributing to its broad appeal.

Here’s why you might want to consider TradeStation:

-

Flexible Pricing: TradeStation offers commission-free options trades, with a charge of just $0.60 per contract. For index options, there’s a charge of $1 per contract.

-

Top-Notch Platform: TradeStation has been designed to handle complex trading strategies, it’s a reliable choice for professional traders and beginner investors alike.

-

Wide Audience: TradeStation caters to a diverse audience. Whether you’re a beginner or an advanced trader, you’ll find resources to support your trading journey.

-

Education Focus: TradeStation offers a wealth of learning resources, making it a top pick for traders eager to expand their knowledge base.

-

Strong Reviews: The platform has received high reviews across several platforms, including a 4.6-star rating on nerdwallet.com, a 3.4 on investopedia.com, a 4 on stockbroker.com, and a 4.7 on brokerchooser.com.

In conclusion, TradeStation is a powerful trading platform that serves a broad audience. Its pricing model, educational resources, and robust platform make it an excellent choice for any trader. You can register using the link: Account Application – TradeStation

###**9. Webull **

The better place for traders to stock trading - Webull

Webull, a major player in the options trading arena, is well-regarded for its cutting-edge platforms and cost-efficient trading approach.

Let’s delve into why it’s worth considering:

-

Commission-Free Trading: Webull sets itself apart with its zero-commission stance on trades. This policy extends to options trading, making it an economically sound choice for traders.

-

High Rankings: Webull’s performance and user experience have earned it high ratings on multiple review sites. It boasts a 5-star rating on nerdwallet.com, a 3 on investopedia.com, a 4.5 on stockbroker.com and a 4.8 on brokerchooser.com.

-

Top-Notch Platforms: Both beginners and experienced traders will appreciate Webull’s user-friendly platforms. They’re known for their intuitive design, making it easier for traders to navigate the market.

-

Real-Time Market Data: Webull offers real-time market data, equipping traders with timely insights for their investment decisions.

-

Rich Analytical Tools: Webull provides a range of analytical tools to help traders assess the market effectively. These tools are particularly beneficial for making strategic decisions in options trading.

-

Versatile Mobile App: Webull’s mobile app is highly versatile and user-friendly, ideal for traders who prefer managing their investments on the go.

In a nutshell, Webull is a tech-friendly, cost-efficient trading platform with a wealth of resources for informed trading decisions. You can signup using the link: Welcome to Webull" ###** Merrill Edge**

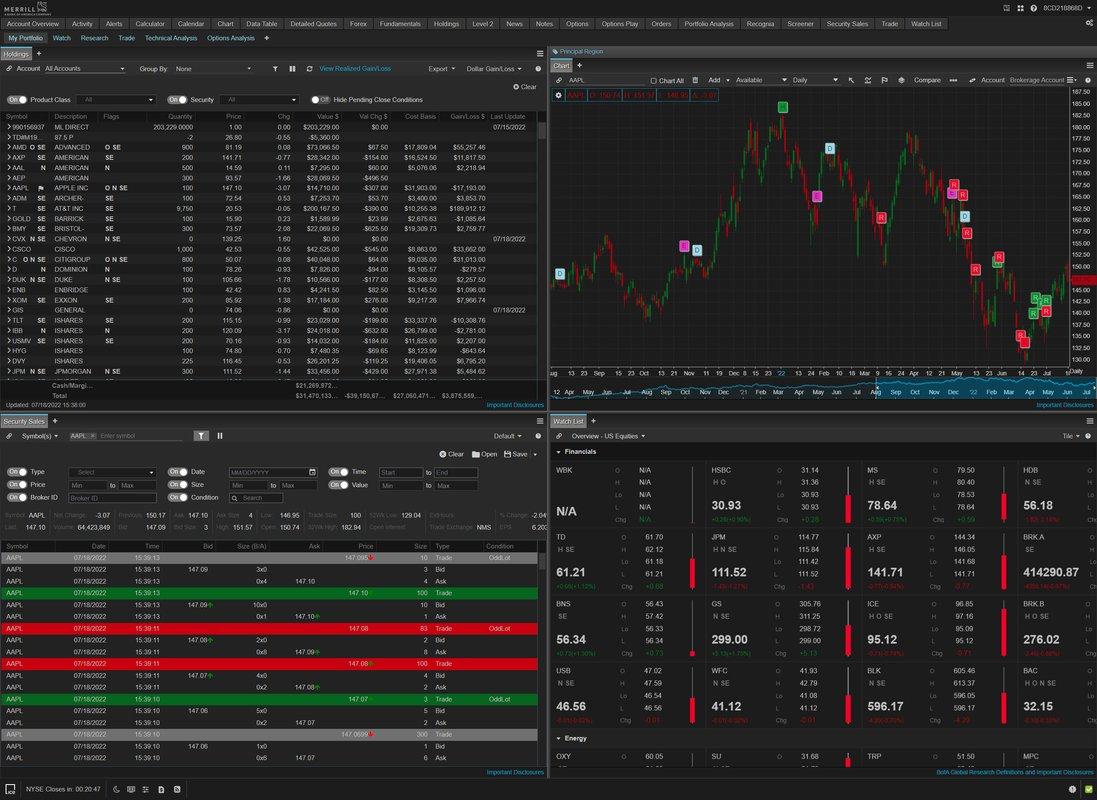

Getting Started with Merrill Edge MarketPro

Merrill Edge has carved out a solid reputation in the options trading field. Its blend of no-commission trades, superior resources, and top-notch customer service has made it a favorite among traders.

Here’s why it’s noteworthy:

-

No Commission Trades: At Merrill Edge, you won’t have to worry about paying per-trade commissions for options. There is, however, a standard per-contract fee of $0.65 that you’ll need to account for, which is a pretty typical charge in the brokerage world.

-

High Ratings Across the Board: Merrill Edge has been highly rated by multiple review sites, showcasing its commitment to quality service. It’s scored 4.7 stars on Nerdwallet, 4.2 on Investopedia, 5 on Stockbroker, and 4.8 on Brokerchooser.

-

Top-tier Platform and Research: With Merrill Edge, you get access to an impressive trading platform and comprehensive research options.

-

Seamless Integration with Bank of America: If you’re a Bank of America customer, you’ll love how Merrill Edge integrates smoothly with your existing accounts.

-

Outstanding Customer Service: Merrill Edge takes customer service seriously. They’re there to provide the support you need, helping to ensure that your trading journey is as smooth as possible.

In conclusion, Merrill Edge has set itself apart with its no-commission trading, exceptional customer service, and impressive trading platform, making it a reliable and attractive choice for both seasoned and beginner options traders. You can open an account using the link: Open an Investment or Trading Account with Merrill Edge

Conclusion: Choosing the Right Broker for Your Options Trading Journey

With the right broker, you can elevate your options trading experience. Look out for competitive pricing, robust trading platforms, quality customer service, and solid educational resources. Remember, it’s all about making well-informed choices that align with your trading style and needs.

Download from the link below, a sample spreadsheet created with MarketXLS Spreadsheet builder

Note this spreadsheet will pull latest data if you have MarketXLS installed. If you do not have MarketXLS consider subscribing here

Relevant blogs that you can read to learn more about the topic

Top 10 Conferences for Option Traders – MarketXLS

Top 10 Option Strategies Used by Options Traders – MarketXLS

The Top 10 News Sources for Options Traders (2023-24) – MarketXLS

Unlock the Power of Binomial Option Pricing Model in Excel with MarketXLS

Gain an Edge with These Effective Options Trading Strategies

Making Money with Trade Spy Options Trading

Options Profit Calculator

Options Profit Calculator