NDX100 Options Matrix: Comprehensive Risk-Weighted Analysis for Optimal Option Selection across All

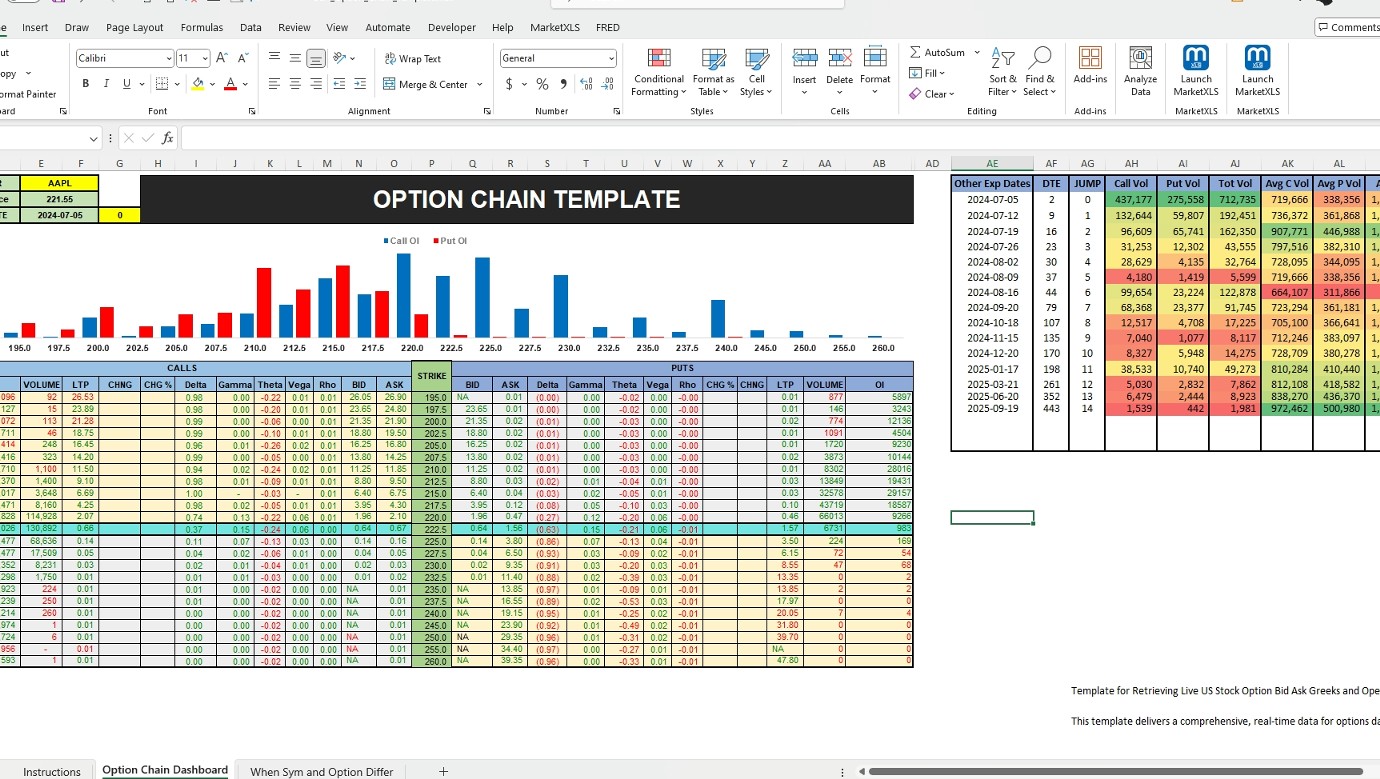

This template offers an all-inclusive grid, detailing every expiration date and strike price to promote meticulous and prompt examination of prospective discontinuities. It equips users with the ability to identify which combinations of date and strike price can yield greater profit margins. Furthermore, it provides an integrated perspective of the bid/ask spread, aiding users in strategically boosting their initial position. The template can be customized to cater to your stock symbol; personally, I have created it to suit my usage of NDX.

Created by: Robin

Interested in building, analyzing and managing Portfolios in Excel?

Download our Free Portfolio Template

Call: 1-877-778-8358

Welcome! I'm Ankur, the founder and CEO of MarketXLS. With more than ten years of experience, I have assisted over 2,500 customers in developing personalized investment research strategies and monitoring systems using Excel.

I invite you to book a demo with me or my team to save time, enhance your investment research, and streamline your workflows.

I invite you to book a demo with me or my team to save time, enhance your investment research, and streamline your workflows.

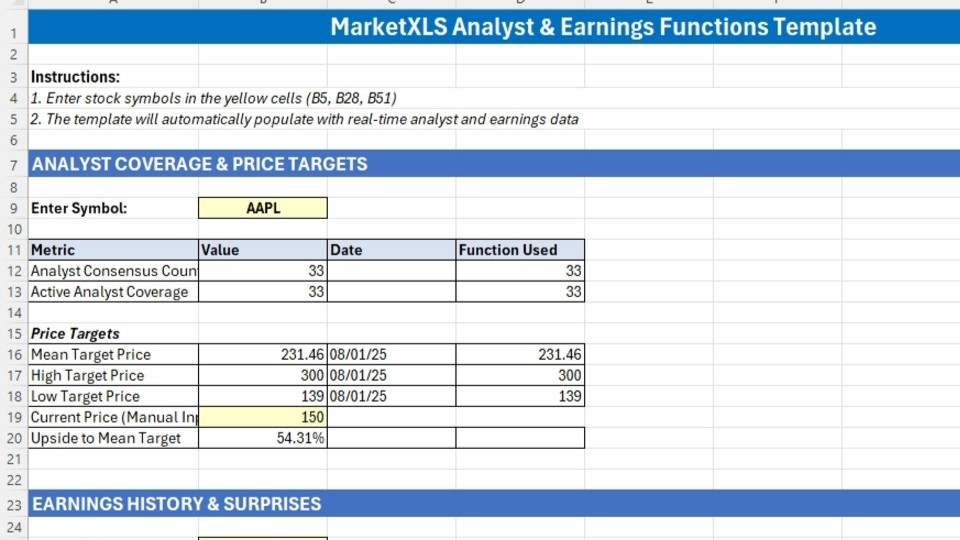

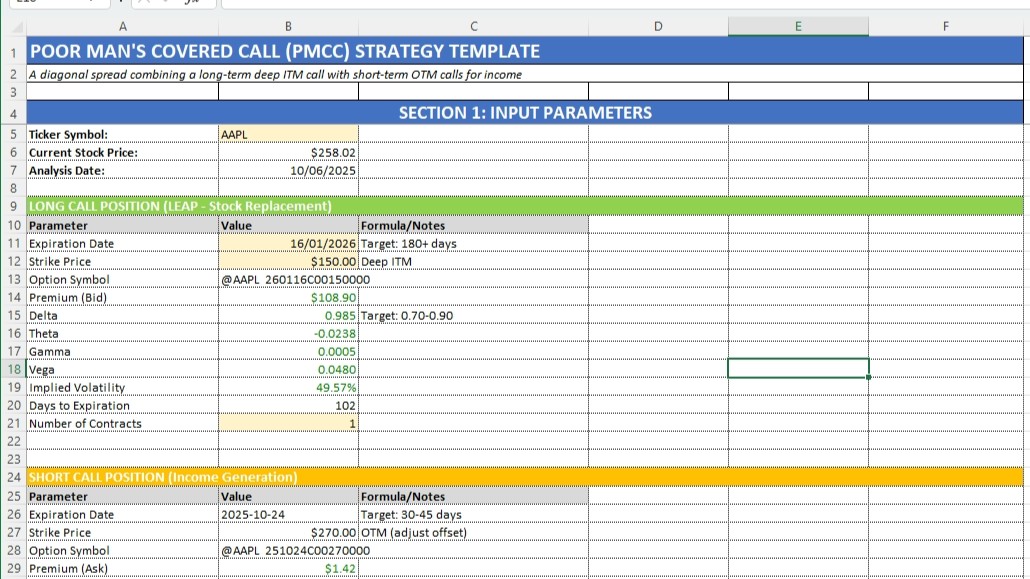

Implement "your own" investment strategies in Excel with thousands of MarketXLS functions and templates.

MarketXLS provides all the tools I need for in-depth stock analysis. It's user-friendly and constantly improving. A must-have for serious investors.

I have been using MarketXLS for the last 6+ years and they really enhanced the product every year and now in the journey of bringing in AI...

MarketXLS is a powerful tool for financial modeling. It integrates seamlessly with Excel and provides real-time data.

I have used lots of stock and option information services. This is the only one which gives me what I need inside Excel.

Meet The Ultimate Excel Solution for Investors

Live Streaming Prices in your Excel

All historical (intraday) data in your Excel

Real time option greeks and analytics in your Excel

Leading data service for Investment Managers, RIAs, Asset Managers

Easy to use with formulas and pre-made sheets