Introduction

Are you intrigued by the fast-paced world of trading zero-day options but wary of their complexities? Excellent. In this article, we’ll delve into the concept of ‘0DTE theta decay‘—the time decay in zero-days-to-expiration options. Imagine your investment like an ice cube on a hot day; as time ticks away, so does its value. We’ll explore how this time decay can both challenge and reward traders in exciting ways. Understanding 0DTE theta decay is crucial for anyone dealing with these rapidly expiring options. Let’s dive in and uncover the nuances of this phenomenon, providing you with the insights needed to navigate this high-stakes trading terrain.

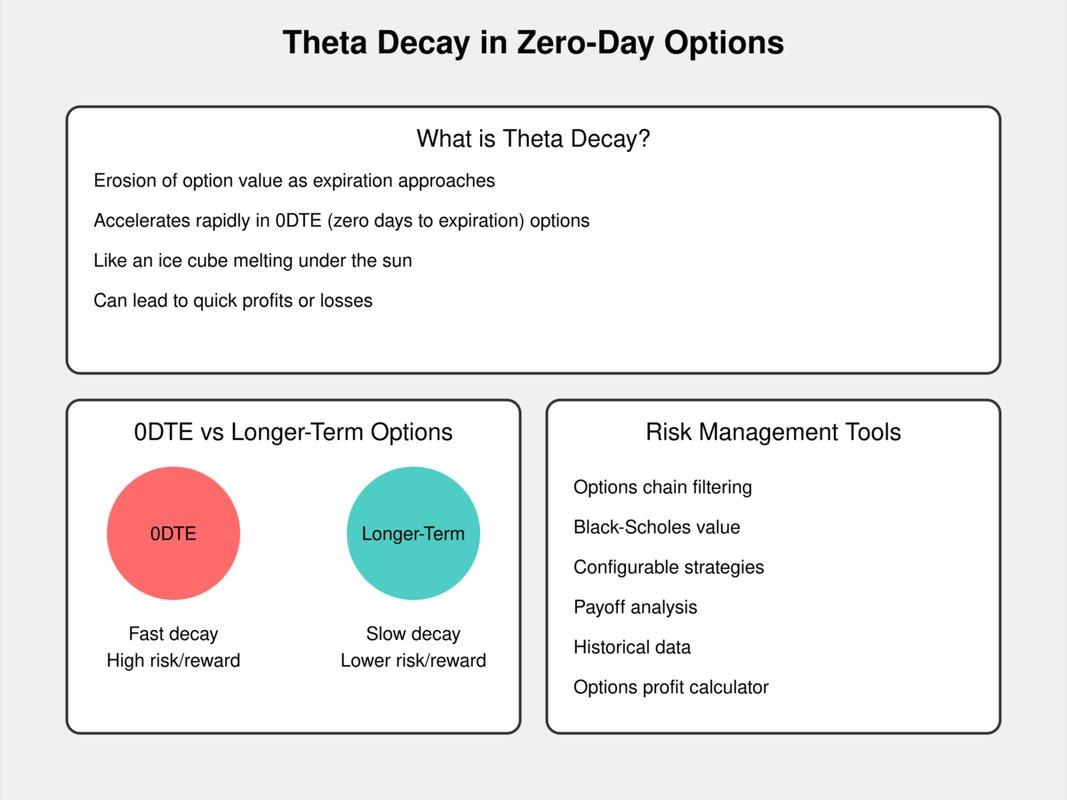

What is theta decay in zero day options?

Theta decay in zero-day options is a phenomenon every trader should comprehend. Imagine an ice cube melting under the sun; as time ticks by, its value diminishes. Similarly, theta decay refers to the erosion of an option’s value as it approaches expiration. Zero-day options, expiring the same day they’re traded, undergo this time decay at an accelerated rate. When you hold such an option, especially if it’s out-of-the-money, each passing hour can significantly erode its premium. This time-sensitive nature can be both thrilling and perilous, offering opportunities for keen traders to capitalize on rapid value shifts.Understanding theta decay’s impact on zero-day options requires a closer look at how options are priced. The time component, ‘theta’, is a crucial piece of the pricing puzzle alongside intrinsic value and volatility. As the clock winds down, theta exerts a more potent influence, often outstripping other factors. It’s like watching sand slip through an hourglass—inevitable and relentless. For example, if an option has a theta of -0.05, it loses $0.05 in value every hour. On the day of expiration, this effect intensifies, turning the final hours into a race against time for traders seeking profit. So, if you’re dabbling in zero-day options, keep a vigilant eye on the clock; it’s both your ally and adversary in this high-stakes game.

How fast does theta decay on 0DTE?

Theta decay on 0DTE (zero days to expiration) options is nothing short of a rollercoaster ride. Picture theta as the slow burn of a candle wick: in most cases, it’s burning steadily, allowing you to predict its eventual end. But on 0DTE, that wick is suddenly fed a gust of wind, causing it to fizzle out in moments. In the morning, theta might still have a gentle slope; but as the hours pass, especially after noon, the decay accelerates dramatically. By the time the market is nearing close, often the difference between 20 minutes can mean a substantial loss or gain, hinging upon the tiniest segment of time left.Consider an at-the-money option on a volatile stock. At the beginning of the trading day, its premium might still hold significant value due to residual time and volatility. However, as the day progresses, the realistic chance for the stock to make a meaningful move diminishes with each passing second, causing the option’s value to collapse swiftly—sometimes within the last 15 minutes. Think of it like an ice cube in the midday desert; it melts slow at dawn but fast under the noon sun. Hence, traders must be agile; a misstep in timing could cost them dearly or make them a fortune in a blink. This hyper-accelerated decay underscores the unique risk and reward profile of 0DTE options, making them a tactical playground for the bold and the swift.

What is the risk of 0DTE options?

The risk of 0DTE (zero days to expiration) options lies in their extreme volatility and the rapid decline in time value, which can lead to substantial financial losses in a very short period. These options, expiring on the same day they are traded, offer a high reward potential but at the cost of magnified risk. Essentially, trading 0DTE options is like playing with dynamite; the smallest market move can result in significant profits or catastrophic losses due to their high sensitivity to underlying asset price changes. This risk is compounded by the fact that there’s virtually no time for the trader to recover from an adverse price movement.Consider a scenario where a trader purchases a 0DTE call option on a stock anticipating a price surge from positive earnings reports. If the stock price doesn’t move as expected—perhaps it even drops contrary to the trader’s anticipation—the option could rapidly lose all its value, leaving the trader with a total loss. Additionally, the lack of time to manage or adjust their position increases the pressure on traders to predict short-term market movements accurately, which is notoriously difficult even for seasoned investors. Managing these options demands rigorous discipline and risk management strategies, otherwise, the financial repercussions can be swift and devastating.

Comparison of theta decay in 0DTE options vs. longer-term options

Theta decay, or the erosion of an option’s value over time, behaves markedly differently in 0DTE (zero days to expiration) options compared to those with longer terms. In the realm of 0DTE options, theta decay accelerates aggressively. Imagine watching ice cubes melt in the sun; as the expiration date approaches, the value of these options evaporates at a breathtaking pace. For traders, this represents both a potential windfall and a significant risk. On one hand, the rapid decay can lead to lucrative gains from premium collection strategies if the market behaves as expected. On the other hand, the compressed timeline leaves little room for error, making these options akin to ticking time bombs.In contrast, longer-term options exhibit a more gradual theta decay. Think of a slow-burning candle; while the passage of time still erodes value, it does so more predictably and less dramatically. This slower rate allows traders to develop and execute more complex strategies involving time spreads or straddles, providing a cushion against sudden market moves. For investors eyeing longer-term options, the extended timeline offers the chance to benefit from strategic adjustments and earns positional advantages over an extended horizon.

Underlying factors influencing theta decay in 0DTE options

Theta decay, especially in 0DTE (zero days to expiration) options, is predominantly influenced by time decay’s relentless march towards the expiration bell. When holding a 0DTE option, the race against the clock becomes palpable; each passing minute erodes the premium’s time value. Picture options as melting ice cubes on a hot sunny day. As the day progresses, those ice cubes—representing the time value—become smaller and smaller. The closer an option gets to its expiration, the faster its time value diminishes—a phenomenon known as accelerated time decay.Another critical factor at play is volatility. On a 0DTE option, the market’s perception of the underlying asset’s potential volatility becomes intensely focused. Higher implied volatility can temporarily inflate premiums, but as the trading day wanes and actual movement is observed, volatility often drops, compounding theta decay. Have you ever come across a brewing storm that ultimately dissipates, leaving barely a drizzle? This scenario mirrors the decreasing implied volatility as the unpredictable potential diminishes into reality, resulting in sharp declines in option value. Additionally, proximity to the strike price intensifies theta decay. OTM (out-of-the-money) options face a steep uphill battle to expire ITM (in-the-money), making theta’s bite much more aggressive. In contrast, ITM options see their intrinsic value safe but are not immune to the ravages of theta on their time value. Understanding these underlying forces helps traders navigate the ephemeral world of 0DTE options with sharper insight.

Risk Management Tools for 0DTE Trading

To effectively manage risk when engaging in zero days to expiry (0DTE) trading, MarketXLS offers several powerful tools and strategies. Below are some essential risk management tools and functionalities provided by MarketXLS for 0DTE trading:

1) Options Chain Filtering

MarketXLS allows you to filter option chains by various criteria such as expiration dates, strike ranges, and moneynesses (e.g., options with strike prices that are within a specific percentage of the underlying price). This is essential for identifying suitable options to trade 0DTE.

2) Black-Scholes Value

The Black-Scholes model is used in MarketXLS to calculate the fair value of European call-and-put options. It considers the underlying stock’s value, strike price, time to expiration, volatility, and interest rate risk. This helps in identifying undervalued or overvalued options, thereby enabling more informed trading decisions.

3) Configurable Option Strategies

MarketXLS enables traders to utilize up to 8 legs in their options trading models. This flexibility allows for complex 0DTE strategies that can be analyzed for risk and reward. For instance:

– Real-time options tracking with Greeks

– Adding underlying buy/sells to view covered call trade results

– Taking snapshots of trade configurations over time in CSV files.

4) Payoff and Results Analysis

Once an options strategy is configured, MarketXLS provides tools to compare the payoff across different legs, adjust volatility, and model different market scenarios. This functionality helps in estimating the potential payouts of an options strategy and saving the results for future reference and backtesting.

5) Saving and Accessing Scans

Traders can save their trade configurations and scanning criteria in MarketXLS. These scans can be saved privately, publicly, or for a team, allowing easy access and continuous improvement based on historical performance.

6) Options Profit Calculator

The Options Profit Calculator in MarketXLS helps estimate potential profits or losses for any options trade. By considering various factors like underlying stock price, strike price, and option expiration date, it ensures a comprehensive analysis of risk and reward.

7) Historical Option Data

MarketXLS provides functionalities to retrieve and analyze historical option data. Functions like opt_HistoricalOptionChain allow users to backtest their strategies by retrieving complete option chains from past dates. This can be particularly useful in understanding how different scenarios might impact 0DTE trades.

Additional Tools

– **Unusual Option Open Interest (OI) Scan **: Identifies significant deviations in open interest, alerting to potential market sentiment shifts.

– High Volume Underlying Scan: Highlights underlying assets with substantial trading volumes, providing clues to market activity.

– ** Put/Call Ratios and Other Greeks**: Offering insights into market sentiment and volatility, aiding better risk assessment.

By leveraging these tools and functionalities in MarketXLS, traders can effectively manage the risks associated with 0DTE trading and make more informed trading decisions. For detailed guidance on using these tools, you may refer to the tutorials and templates available within MarketXLS.

Here is the template you might want to checkout, and MarketXLS has 100s of templates to get you started easily and save you time:

• Template for Accessing Real-Time Data on US Stock Option Bids, Greeks, Open Interest, and Unusual Options Activity**

Link to the template: MarketXLS Template for Accessing Real-Time Data

Image URL of the template:

Template Image

Summary

The article discusses the fast-paced trading of zero-day options and demystifies theta decay. Theta decay erodes an option’s value as it nears expiration, accelerating rapidly in 0DTE options. This fast decay can lead to quick losses or gains, like an ice cube melting under the sun. Understanding this time decay is crucial for zero-day options trading.

Theta decay in 0DTE options intensifies, especially afternoon hours, making timing crucial. Risks include extreme volatility and rapid loss in value, likened to playing with dynamite. Comparing 0DTE to long-term options, 0DTE has faster decay, like ice cubes melting under the sun, versus a slow-burning candle for longer-term options.

Risk management tools are vital, and MarketXLS offers functionalities like options chain filtering, the Black-Scholes value for fair pricing, configurable strategies, payoff analysis, and historical data. These tools help traders make informed decisions and manage the heightened risks in 0DTE trading.

0dte theta decay

0dte theta decay