Option Profit Calculator

Options Profit Calculator provides a special path to identify the returns and profit and loss of any stock options strategies.

The Feature Highlights

Scan for options like a pro. Find top ranked options ordered as per your own criteria and weights.

Scan and Filter

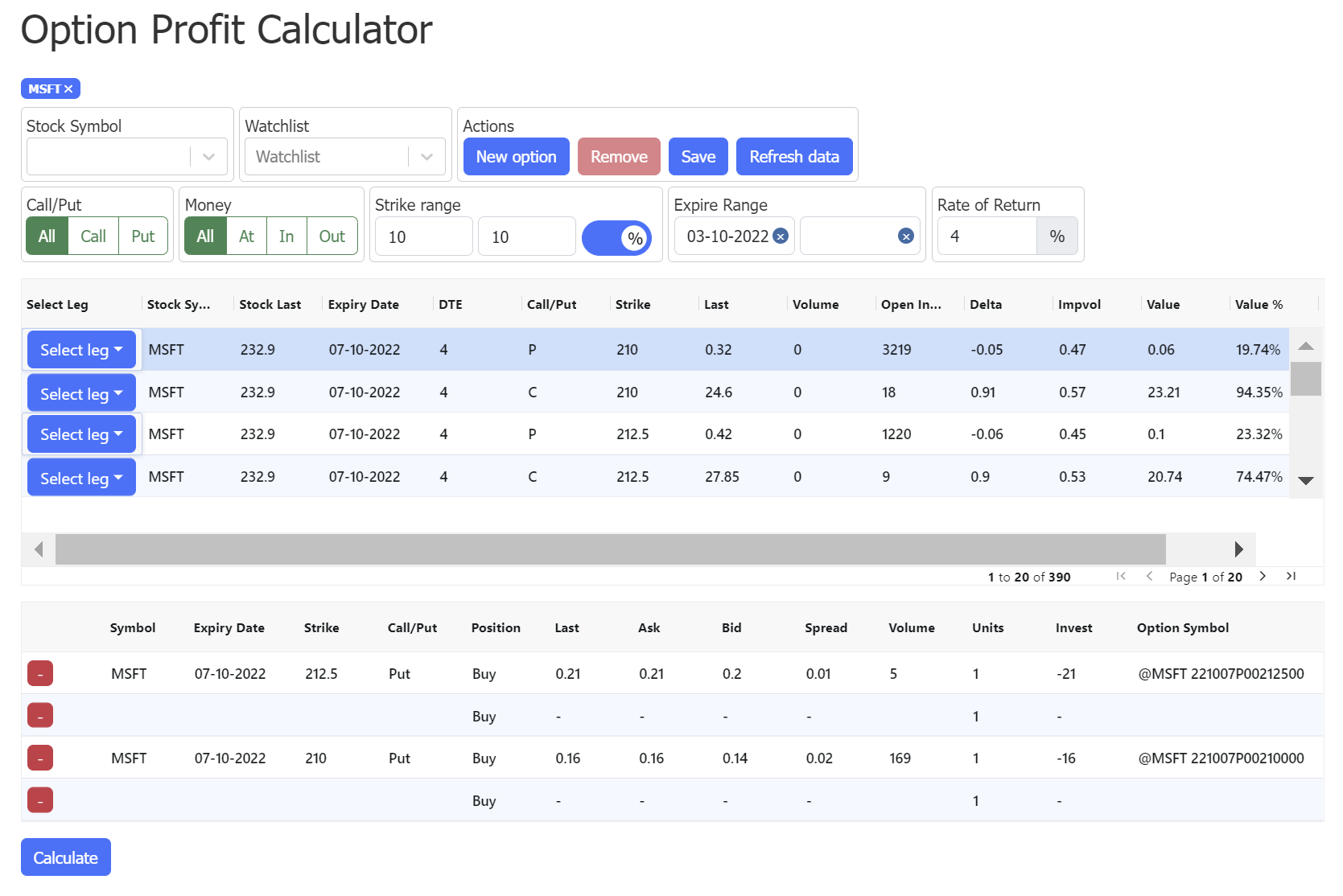

Our platform allows you to scan and filter thousands of options across multiple tickers with real-time streaming prices and greeks. You can easily filter options based on strike price, expiration date, current stock price, market volatility, and other criteria to find the options that meet your specific needs. Whether you're looking for high-profit potential or low risk, our platform's advanced filtering options and powerful analytics tools can help you find the right options to fit your trading strategy. You can also use our options profit calculator to calculate potential profits and losses based on the options you select, giving you greater insight into the risk and reward of your trades.

Examples

- Give me all options where the strike price if less than x percent of the underlying price and more than y percent of the underlying price.

- Give me all options where the implied volatility is less than x.

- Give me all undervalued (Blackscholes options value) put options expiring this week.

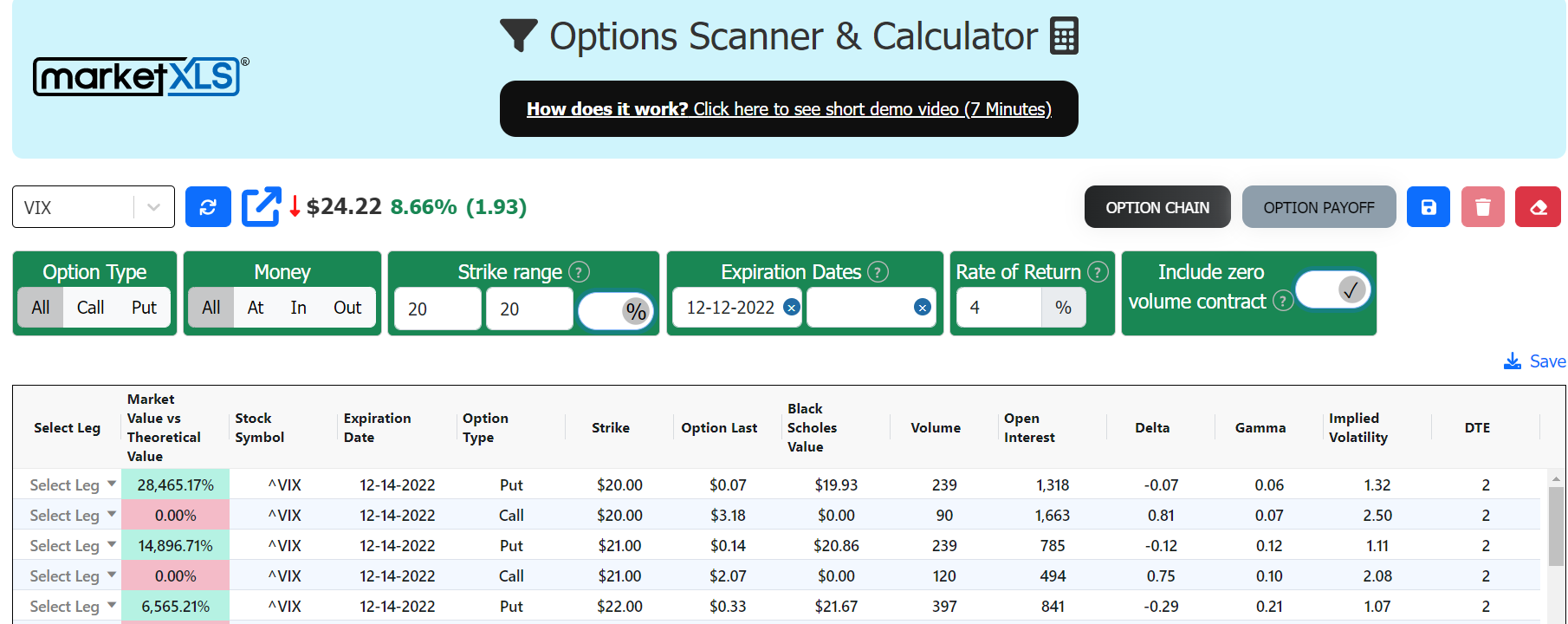

Comparing Market Value to Theoretical Value

Comparing the market value of stocks to their theoretical value is an essential aspect of options trading. By using an options pricing model like Black-Scholes, you can calculate the theoretical value of options based on factors such as the stock price, strike price, time to expiration, and implied volatility. This calculation can help you determine whether a stock is undervalued or overvalued. Our platform offers a Black-Scholes options value calculator that allows you to compare the theoretical value of options to their current market price. This feature can help you identify potential opportunities for profit and make more informed trading decisions.

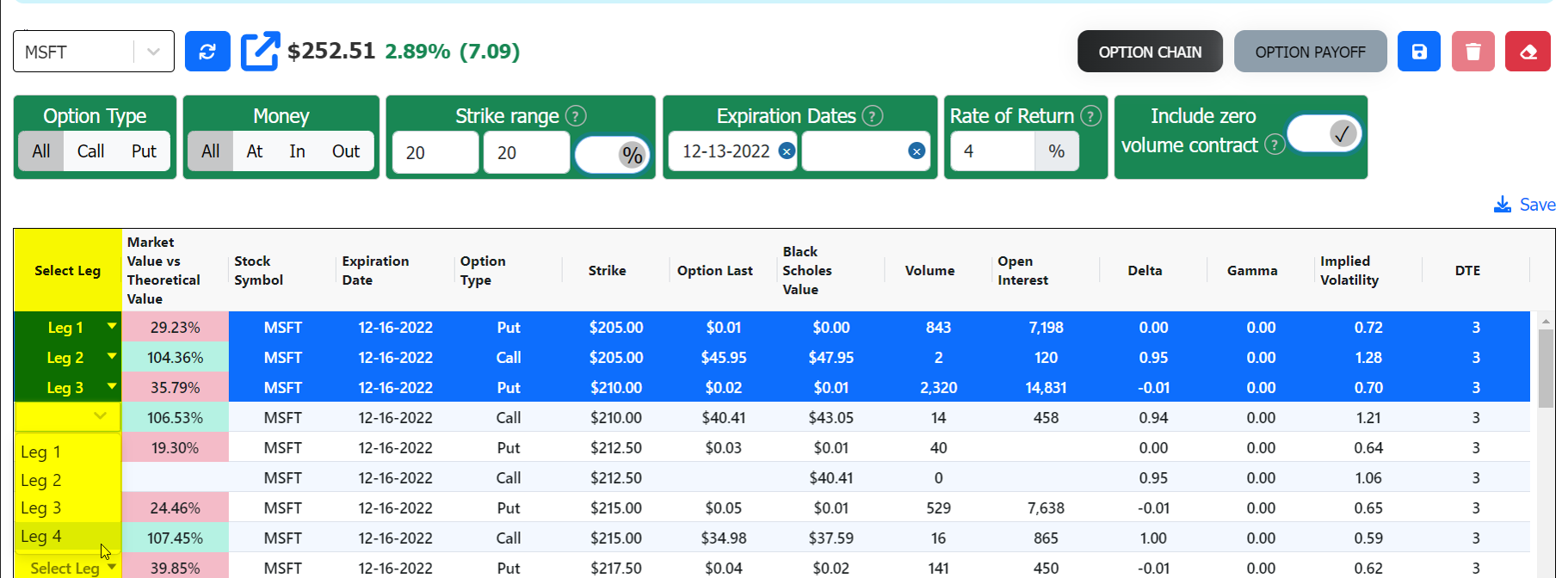

Configure and Analyze Trades

Configure and analyze option trades with multiple options to maximize your profit potential. Our platform provides a suite of tools and analytics to help you create customized trade scenarios, analyze potential outcomes, and adjust your strategies as needed. You can use our daily payoff graphs to analyze the daily payoff until expiry across multiple prices, and create "profit boxes" to determine the number of possibilities for the trade ending up in profit. Our payoff graphs for individual legs and the trade as a whole can also assist you in making informed decisions.

Examples

- Show me the daily payoff untill expiry across multiple prices

- How me how many possibilities are there for the trade ending up in profit. "We call them Profit Boxes"

- Payoff graphs for individual legs and the trade as a whole

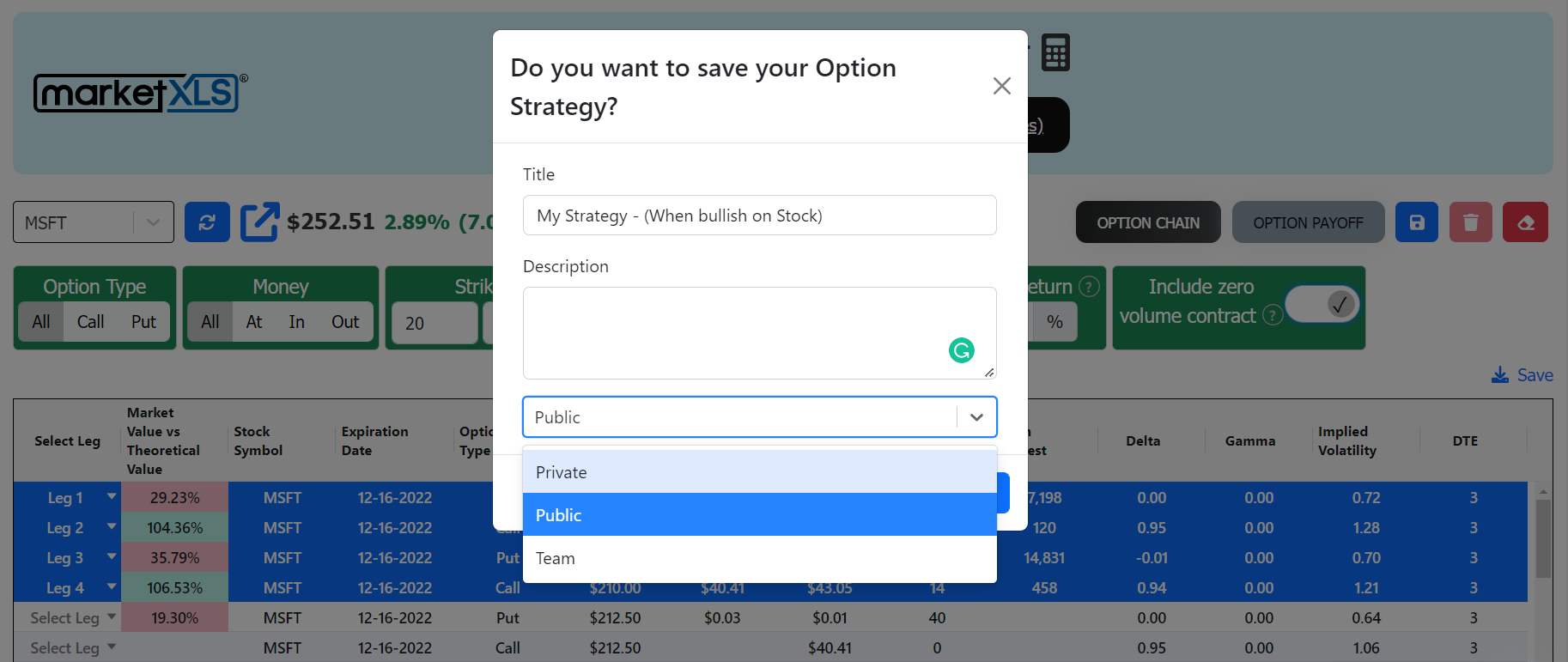

Save for later and share your trade screens with your friends

Easily save your favorite stocks and associated options screens for later with our platform. This feature allows you to keep track of stocks that interest you and compare options across different stocks. You can save your screens as private or public and share them with your team or friends. Additionally, you can quickly access your saved screens and make informed trading decisions based on your preferred criteria.

Examples

- Save as a Private Screen - Keep your strategy to yourself.

- Save as a Public Screen - Show the screen to the world

- Save as a Team Screen - Only share your stragies and filters to your group of trades.

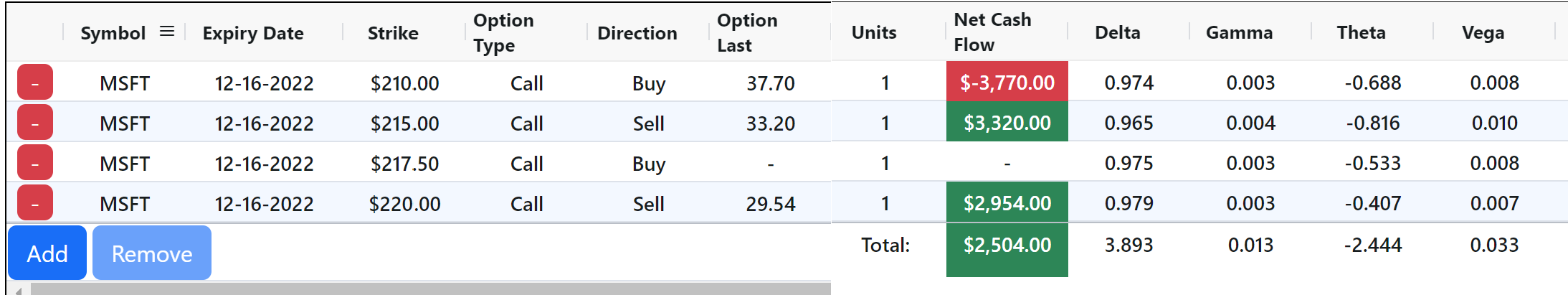

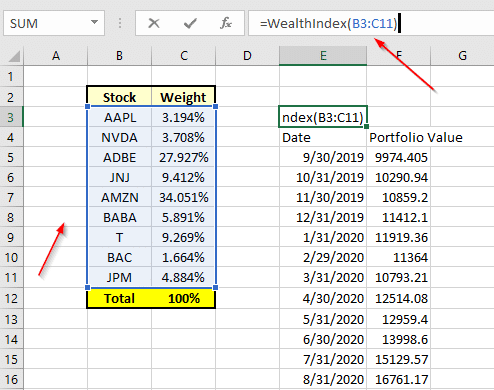

[OPTIONAL ADDON] Manage your Option Trades in Excel

Take control of your option trades with our Excel add-in product. Our add-in offers hundreds of options and stock functions, allowing you to manage your option trades with ease. You can use our Excel templates to quickly calculate potential profits and losses and analyze different trading scenarios.

Examples

- Hundreds of Excel templates

- Thounsands of Custom Excel functions to get market data in flexibile and innovative ways

- Checkout more on the Home page