Table of Contents

- What is Max pain?

- How max pain helps option buyers and sellers?

- Max pain in context of Option Buyers

- Max pain in context of Option Sellers

- What is Max pain point?

- How do you calculate Max Pain?

- How to use MarketXLS to calculate MAX pain of Bank Nifty?

- Summary

Let’s dive into the world of options trading and learn about max pain, which is a significant deal for traders. Max pain helps traders decide what to do by showing them where the most losses might happen. We’ll see how max pain can help traders make smarter choices in the complicated market. We’ll also find out how to figure out max pain for Bank Nifty using MarketXLS, a handy tool that makes analyzing easier and helps improve trading strategies. With MarketXLS, you can make better decisions and increase your chances of success in options trading.

What is Max pain?

“Max pain” is a commonly discussed concept in the domain of options trading. It represents the price level where options traders collectively face the greatest potential financial loss or “pain.” This moves to the strike price where, upon expiration, the stock price would inflict maximum losses on option holders. Referred to as the “maximum pain point” or “maximum option pain,” this notion stems from the observation that stocks tend to gravitate towards this particular strike price on expiration day, thereby minimizing the value of options. While not a definitive theory or model, traders often utilize max pain as a predictive tool, though its accuracy is not guaranteed. Max pain aids both buyers and sellers in decision-making regarding their options positions.

How max pain helps option buyers and sellers?

Option buyers aim for the stock price to move in a direction that allows them to profit upon exercising their options. Conversely, option sellers prefer the stock price to remain distant from the strike price of the options they’ve sold, enabling them to retain the premium received from the sale.

Max pain in context of Option Buyers

Max pain theory can help option buyers by guiding them to buy options at prices that have a high chance of causing the most financial pain to option sellers. The theory suggests that the market will gravitate towards the price, called the ‘Max Pain strike price’, where the maximum number of options (put and call combined) will expire worthless. For example, on Nifty 50 if data shows the max pain point is at 14,000 meaning a majority of options will be valueless at this point. Option buyers, to take advantage, can buy options under the assumption that Nifty 50 may migrate towards the 14,000 mark, reducing the financial pain.

Call option holders hope for the Bank Nifty index to close above the strike price of their options. However, if the index ends near the max pain point, it could lead to a decrease in their profits or even result in losses.

Max pain in context of Option Sellers

Max pain helps option sellers predict the market. It shows where the stock price will close on the expiry day, causing maximum loss for option buyers. This aids sellers by minimizing their risk. For example, with Nifty 50, if max pain is at 15000, sellers will try to keep the price near this level. If the price moves away, they will adjust their trades. This way, max pain helps them manage risk while aiming for profit.

Put option holders anticipate the Bank Nifty index to close below the strike price of their options. Similar to call option holders, if the index settles near the max pain point, it may limit their profits or increase potential losses.

Overall, both call and put option holders aim for favorable movements in the Bank Nifty index relative to their options’ strike prices. However, the max pain point represents a level where the combined value of all options contracts expires Valueless. potentially impacting the profitability of option holders’ positions. Traders may monitor the market closely, especially as expiration dates approach, to assess the likelihood of the Bank Nifty index reaching the max pain point and adjust their strategies accordingly.

What is Max pain point?

The max pain point represents the price at which all options would be worthless upon expiration, marking the level where option traders would incur the most significant losses. Understanding the max pain point can aid traders in decision-making. If the current stock price significantly deviates from the max pain point, some traders may anticipate a movement towards this level as expiration nears.

Simply put, max pain highlights the scenario where traders could face the utmost financial distress should the stock price reach a particular level by the options’ expiration. While not a guarantee, this concept is considered by some traders alongside other analytical tools and data.

At its core, the max pain theory posits that options sellers aim to maximize their gains by steering options contracts towards expiring worthless, while options buyers hope for their contracts to be in the money at expiration. This theory focuses on identifying the strike price where the highest number of options contracts would expire valueless, resulting in the maximum financial “pain” for traders with these positions. Max pain suggests that market forces might push the price of the underlying asset towards this strike price as the expiration date of the options draws closer.

How do you calculate Max Pain?

To estimate Max Pain point, you need to examine the open interest of each strike price of an option, considering both calls and puts. These quantities are multiplied by their respective strike prices, then all the products are added together. The final sum is then divided by the total open interest. The resulting value is the Max Pain point, where the market participants would suffer the maximum financial loss. It’s a useful tool for traders to estimate potential market movements.

How to use MarketXLS to calculate Bank Nifty max pain?

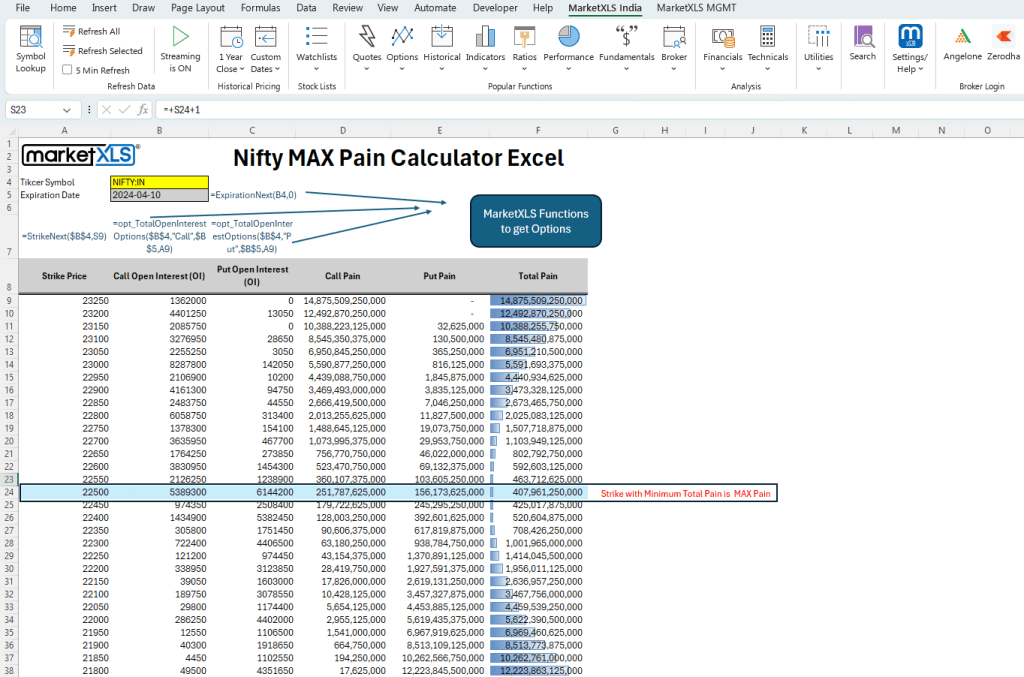

MarketXLS can be used to calculate max pain in Excel.

At MarketXLS, we have developed an Excel template that enables you to calculate the Max Pain for Nifty or any other Indian stock or index. The template utilizes specific formulas to process option data:

=StrikeNext($B$4,S9): This formula is likely designed to identify the next strike price relevant to the calculations or the next expiration date based on the current stock/index symbol referenced in cell B4.

=opt_TotalOpenInterestOptions($B$4,”Call”,$B$5,A9): This MarketXLS function calculates the total open interest for call options for the given ticker symbol and expiration date. It’s a custom function that aggregates open interest data for all call options at different strike prices.

=opt_TotalOpenInterestOptions($B$4,”Put”,$B$5,A9): Similar to the previous function but for put options, this MarketXLS function calculates the total open interest for put options.

=ExpirationNext(B4,0): This formula finds the next expiration date for the options of the stock or index symbol provided in cell B4.

Using these MarketXLS functions, the template fetches the latest open interest data across various strike prices and calculates the respective “pain” for call and put options. The Max Pain point is determined by finding the strike price where the sum of pain for calls and puts is minimized, suggesting a price level where the most options expire worthless.

Traders can use this template by inputting the ticker symbol and expiration date, and the template will display the calculated Max Pain, helping to inform their trading decisions based on this popular theory. It is a powerful tool for those looking to understand potential market movements around option expirations.

MarketXLS simplifies these tasks with its in-built functions and data importing capabilities.

Summary

Max Pain plays a vital role in options trading because it helps figure out the price where option holders might lose the most when their options expire. Even though it’s not always right, it’s helpful for traders to make smart choices. To find the Max Pain point, traders look at how many options are open for each strike price. This helps traders predict how the market might move. MarketXLS makes it easy to calculate the Max Pain for Bank Nifty by sorting out all the data you need.