Black Scholes Excel

Keep your sheets updated with live Stock Quotes in Excel. Streaming market data for stocks, ETFs, options, mutual funds, currencies refreshed or refresh on demand

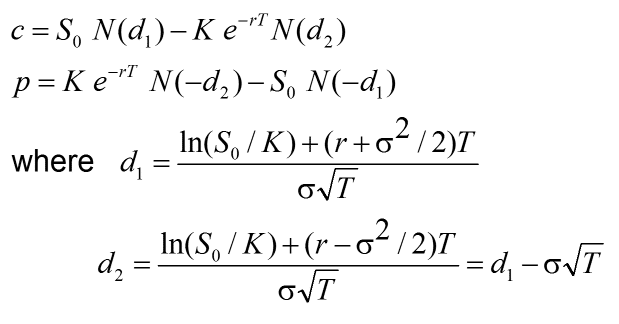

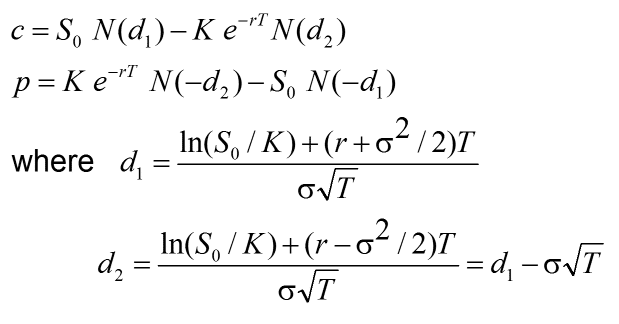

The black sholes formula

Black Scholes Excel model as described in this article comes along with MarketXLS as a template. Black Scholes Excel model is perhaps the most famous formula in all of the finance. The Black-Scholes Formula is sometimes also called the Black-Scholes-Merton Formula

Blacksholes model puts an analytical framework and mathematical model to answer to question on how to value an option. Black Scholes Excel model is available with MarketXLS options data bundle.

The Black-Sholes formula has the following components, which are generally the ones an options trader would care about to get a sense the value of an option contract.

Stock Price – Price of the underlying assetExercise price – Strike price on the optionRisk-free interest rateTime to ExpirationStandard Deviation of the Log Returns (also known as the volatility) – this is essentially how volatile the stock is. Generally, the more volatile the underlying stock more valuable the option be.

Where :

c > Call Premium

So > Current Stock Price

T > Time to expiration

K > Option Strike price

r > Risk-free interest rate

N > Cumulative standard of normal distribution

e > Exponential Term

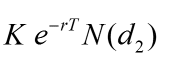

The second part of the Black Scholes Excel formula shown below discounts the strike price to the present value.

The second part of the Black Scholes Excel formula shown below discounts the strike price to the present value.

The probability that the stock price will be at or above the strike price when the option expires is calculated by the part below.

The future value of the stock if, and only if, the stock price is above the strike price at expiration is calculated as shown below

Options trading gives you great advantages over trading any other kind of financial instruments. However, with the leverage that the options provide also comes with risks. Use MarketXLS Option Templates along with your own Excel calculations and real-time options data to get the advantage in the markets.

The Black Scholes Option model tries to calculate the fair value of the Option Contract.

In MarketXLS you can calculate the model value in a very simple way.

=BlackScholesOptionModelValue(“Option Symbol”)

this function will return the value as per the model based on the dividend yield on the underlying asset, historical 7 trading day volatility and an expected rate of return of 5%.In most cases, you would notice that the value this function returns for an option contract will be pretty close to the last price of the option in the market.

If you would like to use your assumptions of volatility and rate of return the function below will allow you to get the calculation Black Scholes Options Model Value.

Check out MarketXLS Plans here.

Call: 1-877-778-8358

Welcome! I'm Ankur, the founder and CEO of MarketXLS. With more than ten years of experience, I have assisted over 2,500 customers in developing personalized investment research strategies and monitoring systems using Excel.

I invite you to book a demo with me or my team to save time, enhance your investment research, and streamline your workflows.

I invite you to book a demo with me or my team to save time, enhance your investment research, and streamline your workflows.

Implement "your own" investment strategies in Excel with thousands of MarketXLS functions and templates.

MarketXLS provides all the tools I need for in-depth stock analysis. It's user-friendly and constantly improving. A must-have for serious investors.

I have been using MarketXLS for the last 6+ years and they really enhanced the product every year and now in the journey of bringing in AI...

MarketXLS is a powerful tool for financial modeling. It integrates seamlessly with Excel and provides real-time data.

I have used lots of stock and option information services. This is the only one which gives me what I need inside Excel.