What is a Bull Call Spread?

A bull call spread is an options strategy that consists of buying a call option with a lower strike price and at the same time selling a call option with a higher strike price. Both the call options should be of the same underlying asset and expiry date. Traders can build the bull call spread when they have a bullish outlook for the stock.

A bull call spread is a limited profit and limited risk strategy. That means both the profit and loss in this strategy are capped. Maximum gain realizes when the stock price moves up at or above the short strike price (higher strike) on or before the expiration date. The short call will expire worthless at the higher strike price, and the value of the long call increases.

Maximum loss occurs if the stock price goes down at or below the long strike price (lower strike). Both the calls will expire worthless at the long strike price. The difference between the premium of the contracts is the maximum loss.

Let’s build a Bull Call Spread in Excel using the MarketXLS template.

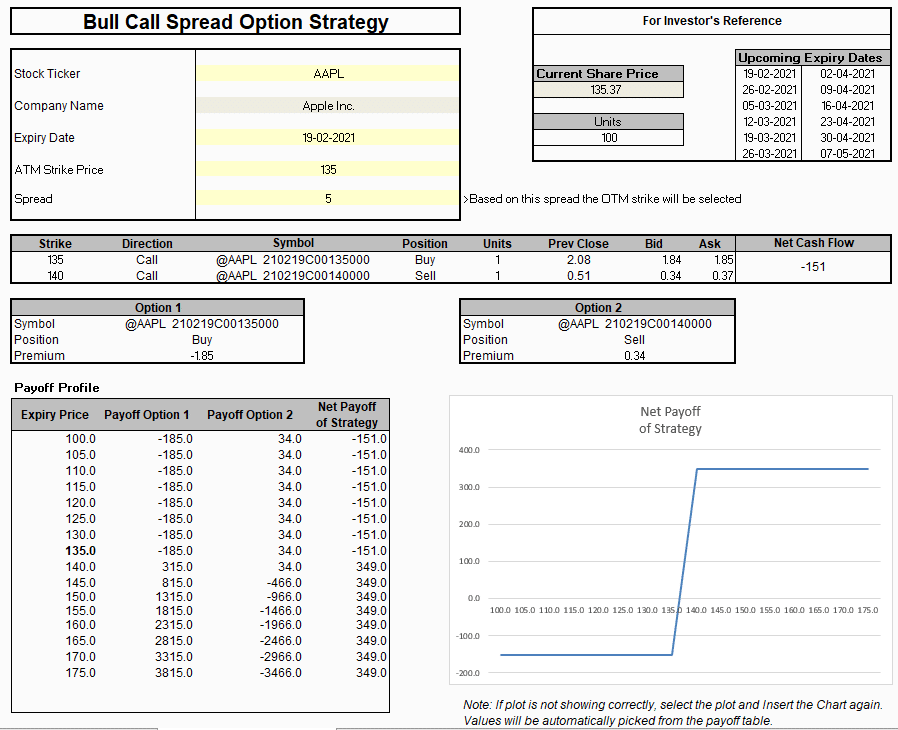

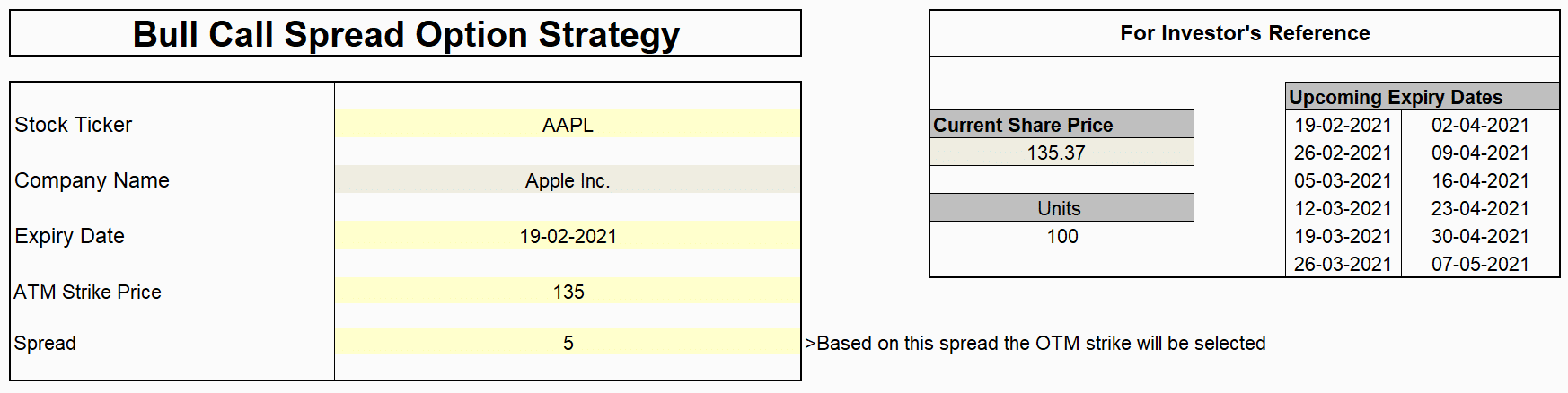

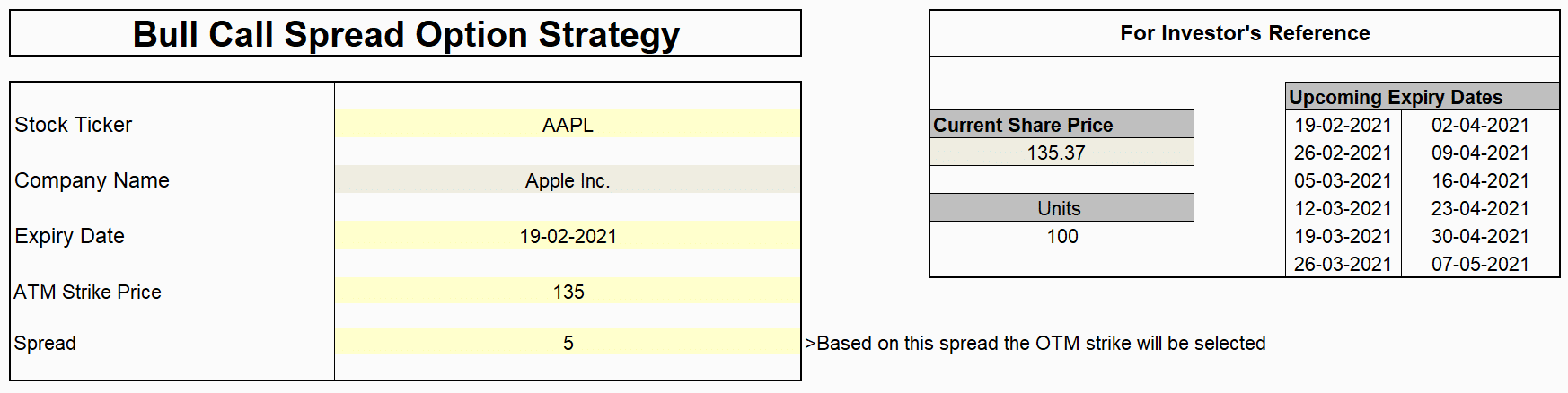

Step-1: provide the inputs

Provide the Stock Ticker, Expiry Date, ATM strike price, and Spread (higher strike – lower strike) for the strategy. Upcoming expiry dates are available for reference.

Here, we have built a bull call spread with APPL. Currently, APPL is trading at $135.37. We have selected an ATM strike of $ 135 and a spread of $5. Both the contracts will expire on 19-02-2021.

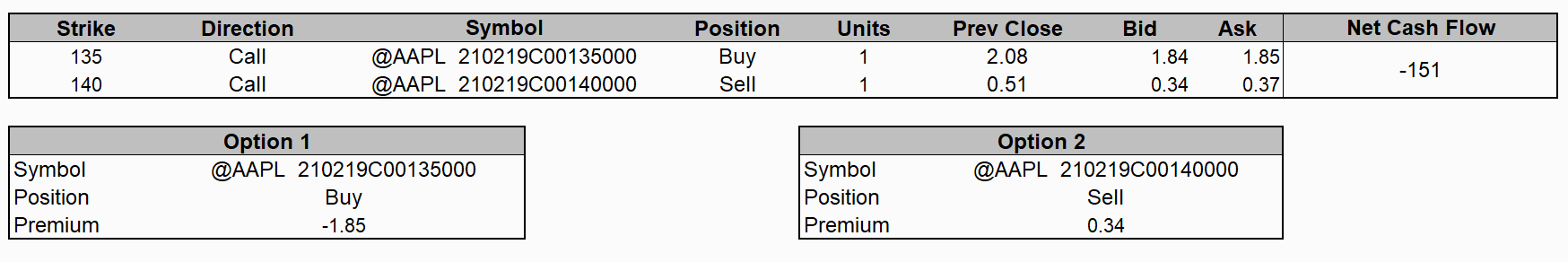

Step-2: Setup of the Bull Call Spread strategy

Bought 1 ATM $135 call option contract of APPL at $185 (1.85*100).

Sold 1 OTM $140 call option contract of APPL at $34 (0.34*100).

Net cost = $151 ($185 – $34).

We have built the net debit strategy and paid $151 upfront to enter into the trade.

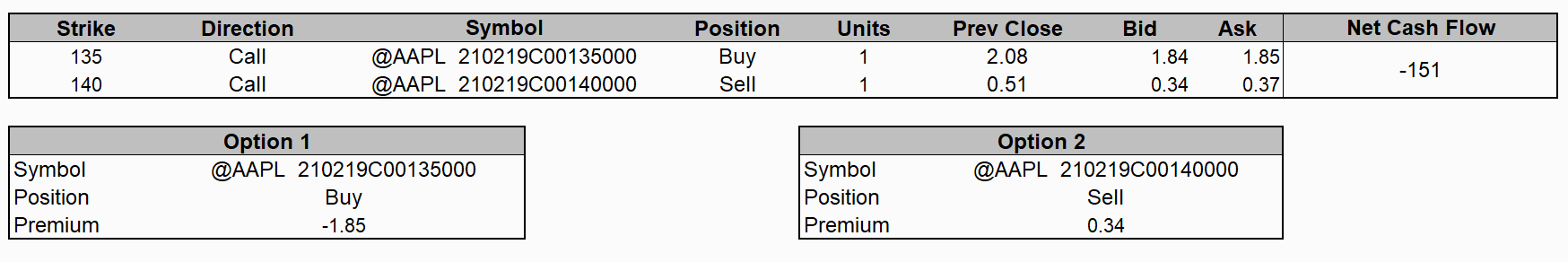

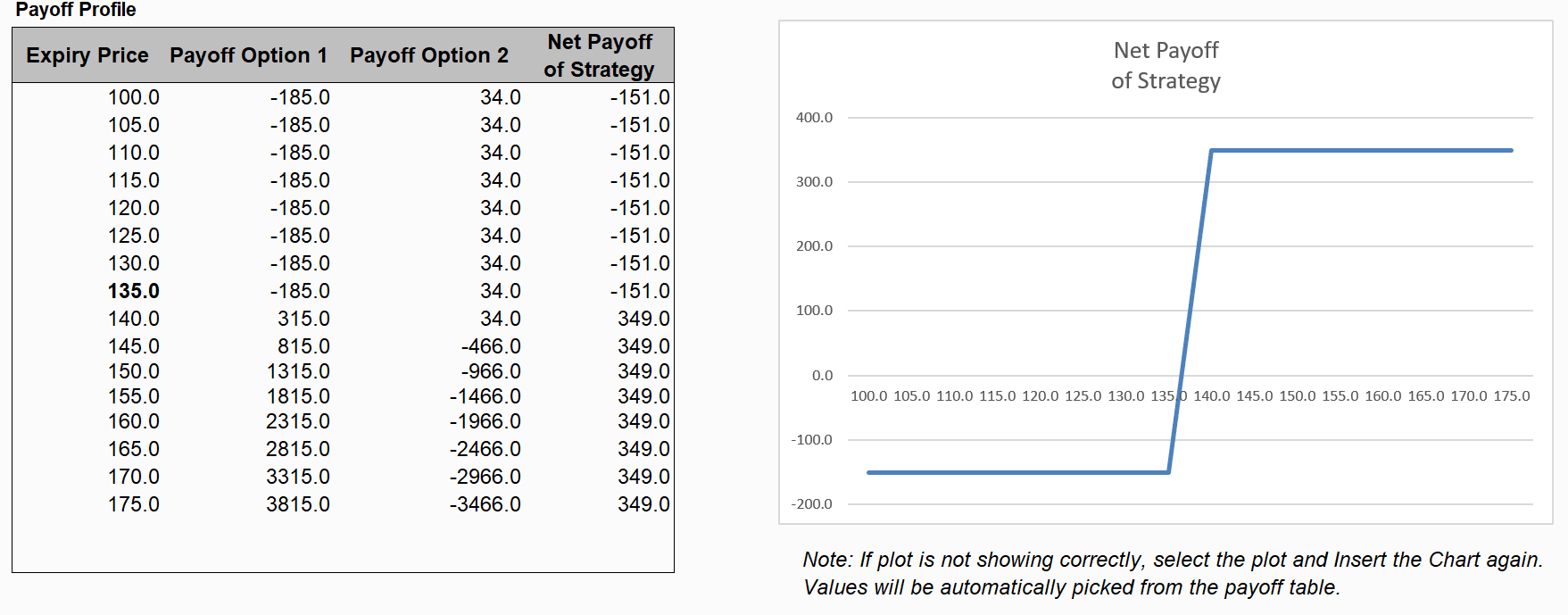

Step-3: Payoff Schedule and diagram at the expiration date

Here you will find the payoff schedule and payoff diagram alongside. The maximum loss of $151 incurs if the stock price falls at or below $135. And the maximum gain of $349 realizes if the underlying stock goes up at or above $140. The profit and the loss are limited in this strategy as the short call’s loss offsets the long call’s benefit if the underlying stock goes up.

Maximum profit

Maximum profit is equal to the difference between the higher strike and the lower strike minus the net cost incurred (excluding commissions).

Maximum profit= ($5 – $1.51)* 100 = $239.

Maximum Loss

Maximum loss is equal to the spread’s cost—the amount paid to enter into the trade. Therefore, the total risk is limited to the amount you paid upfront while entering into the transaction.

Maximum loss= $151.

Break-even

Breakeven is the point of zero profit and zero loss. The underlying stock should move up to a long call strike plus the net premium paid on each share to achieve break-even.

Hence, if the underlying stock closes at $136.51 ($135 + $1.51) on the expiration, there would neither profit nor loss on our bull call spread.

Bottom line

If the trader expects the stock to remain within the particular range till the expiration date, then bull call spread can be a good deal. Selling an OTM call contract helps to reduce the cost of the trade. The risk in bull call spread is lesser than buying a call contract alone because some of the cost finances by selling a call option. Both profit and loss are fixed in this strategy, and we can square off our position as soon as our stock price hits the target.

Disclaimer

None of the content published on marketxls.com constitutes a recommendation that any particular security, portfolio of securities, transaction, or investment strategy is suitable for any specific person.

The author is not offering any professional advice of any kind. The reader should consult a professional financial advisor to determine their suitability for any strategies discussed herein.

The article is written to help users collect the required information from various sources deemed authority in their content. The trademarks, if any, are the property of their owners, and no representations are made.

Reference

To know more about options trading, click here.

To know more about bull call spread, click here.