What is the Capitalization of Earnings Method?

The Capitalization of Earnings Method is an income-oriented approach. This method is used to value a business based on the future estimated benefits, normally using some measure of earnings or cash flows to be generated by the company. These estimated future benefits are then capitalized using an appropriate capitalization rate. This method assumes all of the assets, both tangible and intangible, are indistinguishable parts of the business and does not attempt to separate their values. In other words, the critical component to the value of the business is its ability to generate future earnings/cash flows.

How is it calculated?

This method expresses a relationship between the following:

- Estimated future benefits (earnings or cash flows)

- Yield (required rate of return) on either equity or total invested capital (capitalization rate)

- The estimated value of the business

The anticipated profits of an organization are compared with the compared market value.

It is important that any income or expense items generated from non-operating assets and liabilities be removed from estimated future benefits prior to applying this method. The fair market value of net non-operating assets and liabilities is then added to the value of the business derived from the capitalization of earnings.

In simple terms, it can be stated that

1) If Calcualted value < Market value –> The stock is Overvalued

2) If Calculated value > Market value –> The stock is Undervalued

When to use the Capitalization of Earnings Method?

The Capitalization of Earnings valuation model can be used to assess the value of any company and know if the company is overvalued or undervalued. This method is more theoretically sound in valuing a profitable business where the investor’s intent is to provide for a return on investment over and above a reasonable amount of compensation and future benefit streams or earnings are likely to be level or growing at a steady rate.

How to use the MarketXLS template?

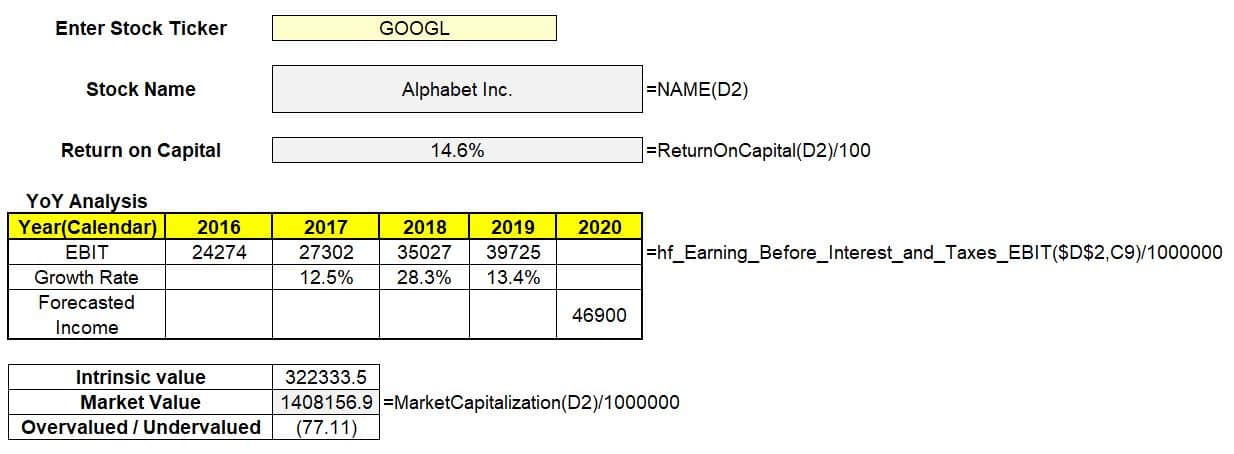

The Active Template Sheet is divided into two sections. First of all, you need to enter the Stock ticker at the Index Sheet and then the second section of the sheet calculates the firm’s value and compares it with the Current Market Value, and shows whether it’s undervalued or overvalued.

The workings with the formulae are shown in the above image. Since the market value of the company is greater than the intrinsic value, the company is overvalued.

Limitations of Capitalization of Earnings Method

Capitalization of future earnings can give you a business valuation that’s significantly different from the market valuation. The market valuation reflects the probable value of a company based on what similar companies are selling for. Capitalization of earnings can set a business price that is out of line with market prices.

A cost approach to business valuation determines the current value of assets vs. liabilities. Taking liabilities into account helps establish a realistic appraisal. Capitalization of future earnings does not take liabilities into account. In short, those future earnings may come at a price because of outstanding debt. Borrowing expenses could eat into earnings.

Disclaimer

None of the content published on marketxls.com constitutes a recommendation that any particular security, portfolio of securities, transaction, or investment strategy is suitable for any specific person. The author is not offering any professional advice of any kind. The reader should consult a professional financial advisor to determine their suitability for any strategies discussed herein. The article is written to help users collect the required information from various sources deemed an authority in their content. The trademarks, if any, are the property of their owners, and no representations are made.

Reference

https://www.valuadder.com/glossary/capitalization-of-earnings.html

https://www.accountingtools.com/articles/2017/5/14/capitalization-of-earnings