Congratulations! Your Data Feed is Ready.

Your Quotemedia real-time data feed is now live!

Next Steps

Using Windows?

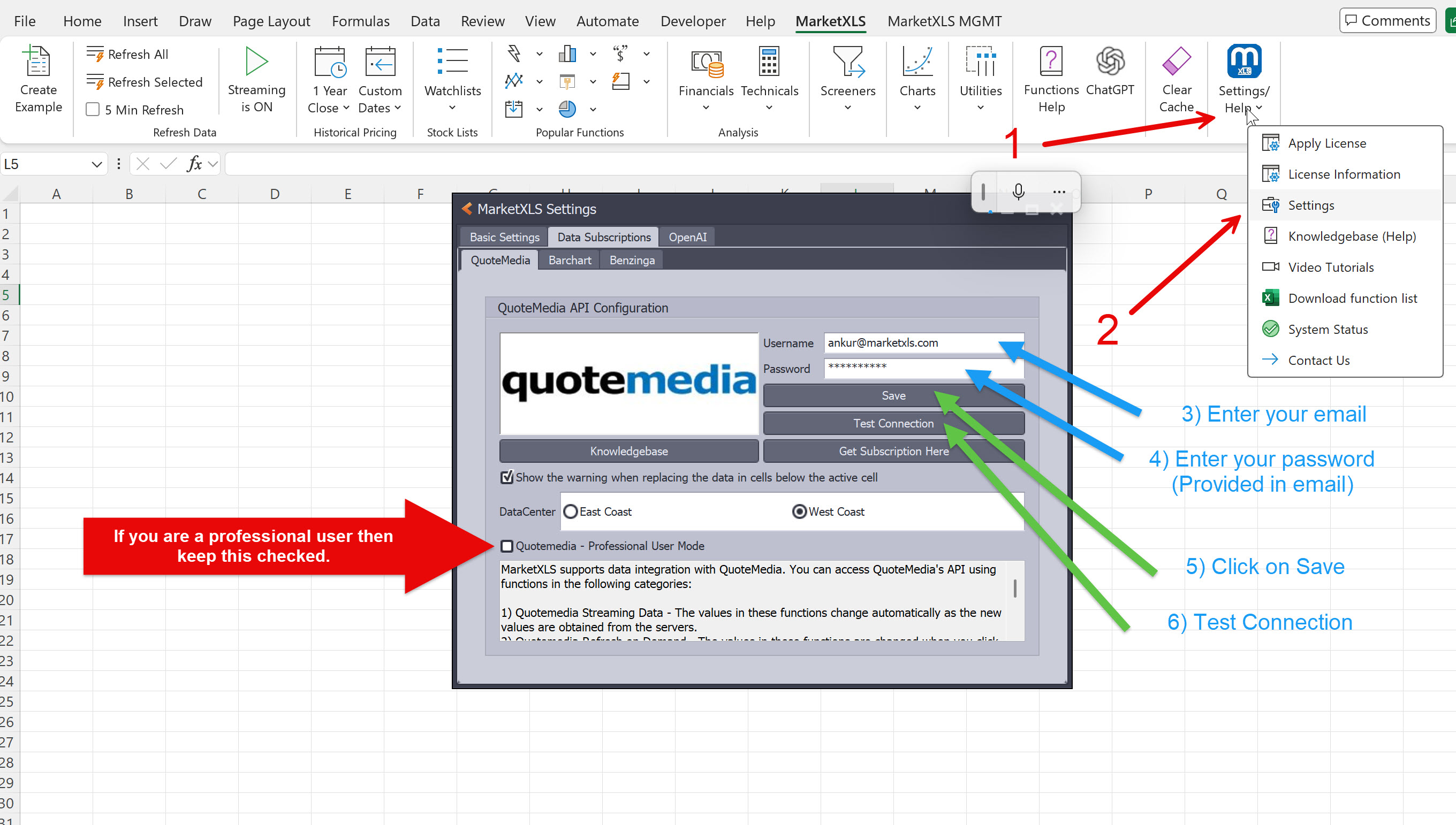

Enter your Quotemedia credentials (from email) in MarketXLS via Settings/Help >> Settings >> Data Subscription >> Quotemedia.

Remember to click "Test Connection" and "Save".

Important: Professional users must check the "Professional" box.

Using Mac or Excel Online?

You're all set! No credential entry needed. You can start using the =mxls. functions right away.

Using Your Data

Once set up (if needed), start using the dedicated functions directly in Excel. The prefix is typically =qm_ on Windows, but use =mxls. if you are on Mac or Excel Online.

Common Streaming Functions (using Windows prefix):

qm_stream_last("Symbol")- Last price (e.g.,qm_stream_last("MSFT"))qm_stream_ask("Symbol")- Ask price (e.g.,qm_stream_ask("MSFT"))

Explore the full range of functions (historical, options, etc.) here:MarketXLS Functions Guide

Need Help?

Need assistance getting started? Book a free onboarding call:Book Onboarding Call

Or, email us:support@marketxls.com