Demystifying Monte Carlo Excel Simulations

Have you ever wanted to understand Monte Carlo Excel simulations but don’t know where to start? There is a lot of complexity to Monte Carlo simulations, but don’t let that discourage you. This guide is here to help you understand what Monte Carlo simulations are and how they can be used to analyze risk and make decisions.

What is Monte Carlo Simulation?

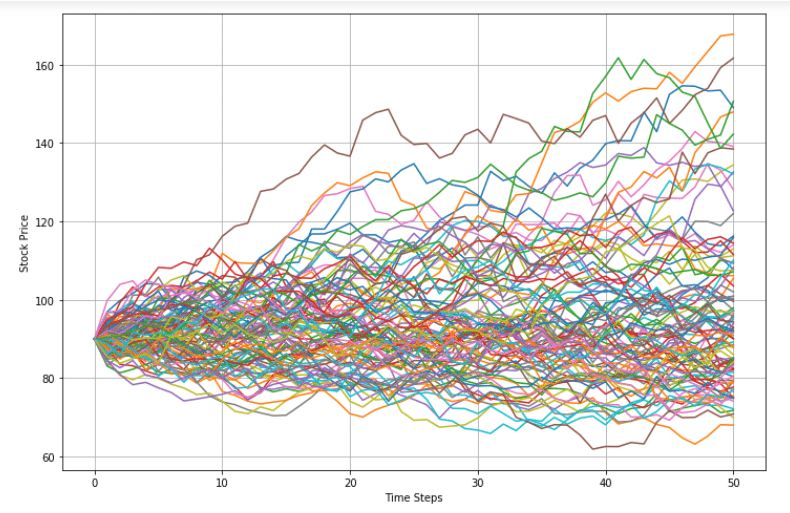

Monte Carlo Simulation is a computer-based mathematical approach used to generate possible outcomes of a decision or to determine the risk associated with a decision. The process involves using probabilities, statistics, and algorithms to analyze a problem. It works by using data sampling methods to create “what-if” scenarios and then generates a series of outcomes for each scenario. This allows for a broad range of possible outcomes to come to light, which can then be used to make more informed decisions.

How Does It Affect Excel Spreadsheets?

Monte Carlo simulations can be used to optimize the use of Excel spreadsheets. Excel spreadsheets are often used to build financial models or to calculate the maximum return on investments. With Monte Carlo simulations, the range of possible outcomes of the spreadsheet can be explored. This can provide much more accurate data and results than traditional methods. It also helps shed light on the possible risk associated with the decisions being made.

How Is It Used in Risk Analysis and Decision Making?

When it comes to risk analysis, Monte Carlo simulations are incredibly useful. The simulations can generate thousands of possible outcomes based on different sets of assumptions. This gives an incredibly accurate picture of how the multiple variables involved in the decision-making process can interact. This can provide a more holistic view of the possible risk associated with the decision and the necessary steps for mitigating that risk.

When it comes to decision making, Monte Carlo simulations can help to quantify the expected value of a decision. By running different sets of assumptions thousands of times, the simulations can generate a range of outcomes and calculate the expected value of the decision. This can help inform the stakeholders in the decision process and make the best possible decision.

What Are the Benefits of Monte Carlo Simulations?

The main benefit of using Monte Carlo simulations is that they are highly accurate. By using probability and statistics, a wide range of outcomes can be generated and analyzed. This allows for a more in-depth view of the risk associated with the decision and helps identify which variables have the greatest influence on the outcome of the decision.

Another benefit is that Monte Carlo simulations are highly reproducible. This means that the same set of assumptions can be run multiple times and the same outcomes will be generated. This helps ensure that all stakeholders have access to the same data and can reach the same conclusions when it comes to the decision process.

How Can MarketXLS Help?

MarketXLS provides a comprehensive suite of tools to help users understand the power of Monte Carlo simulations. With features such as Risk Analysis, Probability Distribution, and Modeling Strategies, users are equipped with the knowledge they need to make an informed decision. In addition, MarketXLS’s Option Premium tool allows users to quickly and easily generate data that can be used to formulate the assumptions required to run Monte Carlo simulations and make informed decisions.

Monte Carlo simulations are complex but powerful tools that can greatly enhance decision-making and risk analysis. The key is to understand the math behind it and use it to your advantage. With MarketXLS, users are able to gain a comprehensive understanding of the power of Monte Carlo simulations and use it to analyze risk and make the best possible decisions.

Here are some templates that you can use to create your own models

Search for all Templates here: https://marketxls.com/templates/

Relevant blogs that you can read to learn more about the topic

Monte Carlo Simulation Excel