Table of Contents

- Introduction

- What is enterprise value ?

- What components are included in the enterprise value calculation?

- Why is enterprise value important for investors?

- How does enterprise value compare across different industries?

- How does enterprise value impact valuation during mergers and acquisitions?

- What are the differences between enterprise value and equity value?

- How does enterprise value affect stock price valuation?

- What are some common mistakes in calculating enterprise value?

- How does enterprise value differ from market capitalization?

- How does enterprise value account for a company’s capital structure?

- What are the limitations of using enterprise value?

- How is enterprise value calculated?

- How do we calculate Enterprise value using MarketXLS?

- Summary

Introduction

Ever wondered what a company is really worth? Welcome to the world of Enterprise Value (EV), a financial metric that provides a complete picture of a company’s total value. Unlike market capitalization, EV includes not just the share price multiplied by the number of shares, but also total debt and minus cash reserves. It’s a crucial number for investors, especially when considering potential acquisitions.

What is enterprise value ?

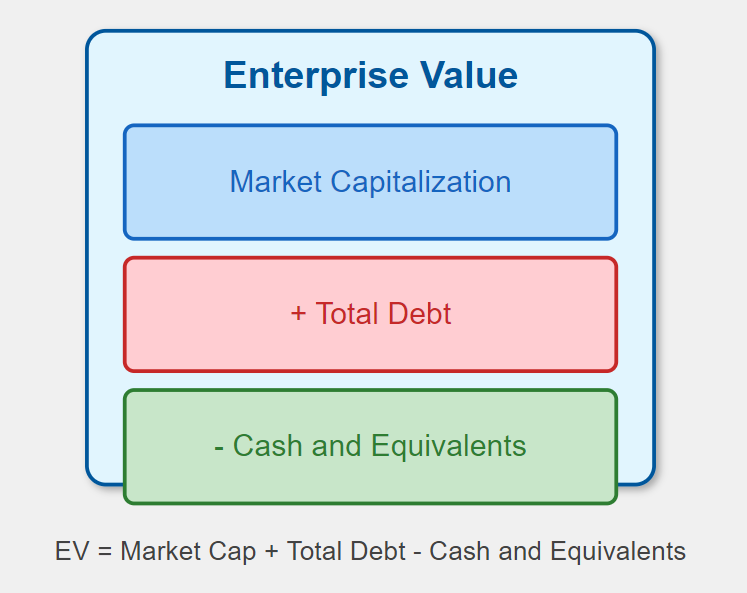

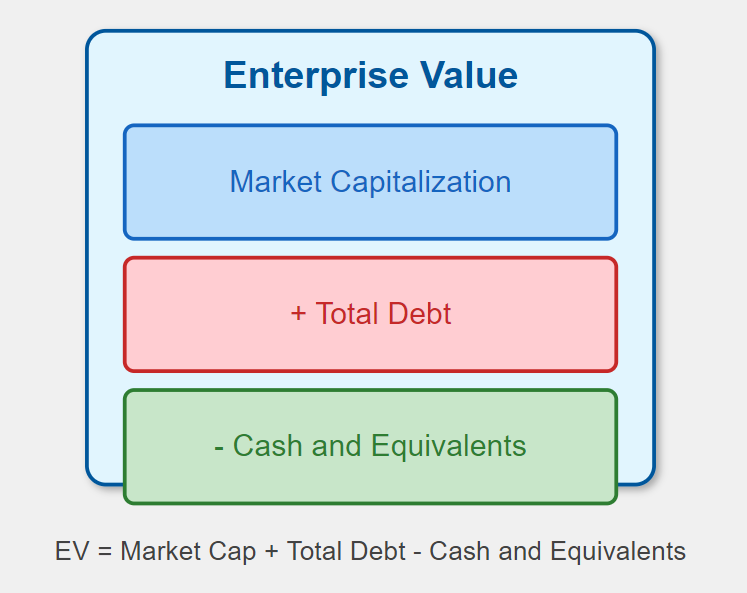

Enterprise value (EV) is a financial metric used to measure a company’s total value. It includes the market capitalization, debt, and cash reserves. Essentially, it provides a comprehensive estimate of a business’s worth to all stakeholders. To calculate EV, you add the company’s market cap and total debt and subtract any cash and cash equivalents. Investors use this figure to evaluate a company’s potential purchase price. It is an important metric in mergers, acquisitions, and financial analysis. EV is preferred over market capitalization because it accounts for debt and cash, giving a more accurate picture of a firm’s financial health.

What components are included in the enterprise value calculation?

Enterprise value (EV) reflects the total value of a company, including both equity and debt. To calculate EV, start with the market capitalization, which is the current share price multiplied by the number of outstanding shares. Next, add total debt, which includes both short-term and long-term liabilities. Cash and cash equivalents are subtracted from this sum because they reduce the net cost of acquiring the business. You might also include minority interest and preferred equity to get a fuller picture. EV offers a more comprehensive valuation than market capitalization alone, factoring in all aspects of the company’s financial obligations and available assets.

Why is enterprise value important for investors?

Enterprise value is crucial for investors because it provides a comprehensive measure of a company’s total worth. Unlike market capitalization, enterprise value includes debt and excludes cash, offering a more accurate picture of a firm’s financial health. This metric helps investors assess potential acquisition targets and compare companies with varying capital structures. It also aids in evaluating the profitability and risk profile of potential investments. By considering enterprise value, investors can make more informed decisions, ensuring they understand the full financial implications of their investments. This leads to better risk management and investment strategies.

How does enterprise value compare across different industries?

Enterprise value (EV) varies significantly across different industries due to factors like growth prospects, capital requirements, and market conditions. High-growth industries, such as technology and biotechnology, often have higher EVs because investors expect substantial returns. These industries typically attract significant investment, driving up their values. In contrast, more stable and mature industries like utilities and consumer goods usually have lower EVs. This is because their growth is slower, and they generate steady but predictable cash flows. Additionally, capital-intensive industries, such as manufacturing and transportation, might also have higher EVs due to substantial asset bases. However, market dynamics and economic conditions can also impact EV across all sectors. Therefore, it is essential to consider industry-specific factors when evaluating enterprise value.

How does enterprise value impact valuation during mergers and acquisitions?

Enterprise value (EV) is crucial in mergers and acquisitions (M&A) as it provides a holistic metric for valuation. It encompasses a company’s market capitalization, debt, and cash, offering a clearer picture of its actual worth. Buyers look at EV to understand the total investment needed, including debt obligations they will assume. Sellers use it to gauge their market position more accurately. By considering EV, both parties can negotiate better and align their expectations. This metric reduces the risk of overlooking significant liabilities or assets, making it essential for a smooth M&A process. Ultimately, a well-assessed EV ensures fair valuation, aiding in successful deal closures.

What are the differences between enterprise value and equity value?

Enterprise value and equity value are key metrics used in financial analysis. Enterprise value represents the total value of a company, including debt, equity, and cash reserves. It provides a comprehensive picture by considering both equity and debt holders’ claims. Equity value, on the other hand, only reflects the value of shareholders’ equity. It does not take into account the company’s debt or cash on hand. Enterprise value is often used in acquisition scenarios to assess a company’s worth. Equity value is mostly employed for calculating metrics like Earnings Per Share (EPS). Understanding the distinction is crucial for accurate financial evaluations.

How does enterprise value affect stock price valuation?

Enterprise value (EV) plays a crucial role in stock price valuation as it provides a comprehensive snapshot of a company’s total value. EV encompasses market capitalization, debt, and cash, making it a more holistic measure than market cap alone. When assessing a company’s stock price, investors consider EV to understand the firm’s true economic worth. High EV often signals potential overvaluation, while low EV may indicate undervaluation. Additionally, acquisition decisions hinge on EV, influencing stock price movements. Therefore, investors and analysts constantly monitor EV to make informed decisions about buying, holding, or selling stocks. This metric helps compare firms irrespective of differences in capital structures. By including debt and excluding cash, EV offers a more accurate reflection of a company’s worth.

What are some common mistakes in calculating enterprise value?

One common mistake in calculating enterprise value (EV) is neglecting to include all forms of debt, such as capital leases and convertible securities. Often, analysts focus only on traditional forms of debt and miss these crucial components. Additionally, failing to subtract cash and cash equivalents from the total can lead to an inflated EV. Another frequent error involves misjudging minority interest and equity stakes in other businesses, which should be accurately accounted for. Overlooking these elements can result in significant inaccuracies in the valuation. Lastly, not keeping up with the current market value of equity can also distort the final EV calculation.

How does enterprise value differ from market capitalization?

Enterprise value and market capitalization are both metrics used to assess a company’s worth, but they are distinct. Market capitalization is simply the total value of a company’s outstanding shares of stock. It’s calculated by multiplying the current stock price by the number of outstanding shares. In contrast, enterprise value provides a broader measure of a company’s total value. It includes market capitalization but also factors in debt, minority interest, and preferred shares, while subtracting cash and cash equivalents. This gives a more comprehensive view of the company’s valuation. Essentially, enterprise value accounts for the company’s capital structure, whereas market capitalization focuses solely on equity. This difference makes enterprise value a useful metric for potential buyers assessing acquisition costs.

How does enterprise value account for a company’s capital structure?

Enterprise value (EV) provides a comprehensive measure of a company’s total value. It accounts for the company’s entire market capitalization, including both debt and equity. This inclusiveness reflects the true cost to acquire the business. EV factors in the capital structure by adding market value of debt to the market capitalization and subtracting cash or cash equivalents. This method ensures that variations in debt or cash do not distort the valuation. By considering both equity and debt, EV gives a more accurate picture than market capitalization alone. It allows for better comparisons between companies with different capital structures. This holistic view aids investors and analysts in making informed decisions.

What are the limitations of using enterprise value?

Enterprise value (EV) is a useful financial metric, but it has limitations. One issue is that EV can be affected by accounting policies, making cross-company comparisons difficult. It also does not consider the operational nuances or future growth prospects of a company. EV relies on market values for debt and equity, which can fluctuate and may not always reflect true value. This metric can be less effective for companies with high levels of intangible assets or non-operating investments. Additionally, EV does not account for the varying tax environments across different regions, potentially skewing results. Another limitation is that it overlooks the company’s cash flow potential and depends heavily on current financial statements. These factors can lead to misleading conclusions.

How is enterprise value calculated?

Enterprise value (EV) is a measure of a company’s total value. It is calculated by adding market capitalization, debt, and minority interest. Then, subtract cash and cash equivalents. Market capitalization is derived from multiplying the current stock price by the number of outstanding shares. Debt includes both short-term and long-term borrowings. Minority interest represents the portion of a subsidiary not owned by the parent company. Cash and cash equivalents are subtracted because they can be used to pay down debt. EV provides a comprehensive valuation by including debt and excluding cash, providing a clearer picture of a company’s value.

How do we calculate Enterprise value using MarketXLS?

To calculate the Enterprise Value (EV) using MarketXLS, you can use the built-in functions provided by MarketXLS. Here’s a detailed guide to accomplish this:

Functions for Enterprise Value

1. Enterprise Value Function:

– Syntax: =EnterpriseValue(Symbol)

– Example Usage: =EnterpriseValue("MSFT")

– Description: Returns the total value of a business, including its equity and debt, but excluding its cash and cash equivalents.

– Calculation: It is calculated by adding the market value of equity and debt and then subtracting cash and cash equivalents.

2. Enterprise Value (Key Ratios) Function:

– Syntax: =qsEnterpriseValue("Symbol:US")

– Example Usage: =qsEnterpriseValue("MSFT")

– Description: Returns the enterprise value for the specified symbol.

Detailed Calculation of Enterprise Value

Enterprise Value (EV) is generally calculated using the formula:

\[ \text{EV} = \text{Market Capitalization} + \text{Total Debt} – \text{Cash and Cash Equivalents} \]

Using MarketXLS to Retrieve Components of EV

1. Market Capitalization:

– Function: =MarketCap(Symbol)

– Description: Returns the market capitalization of the specified company.

2. Total Debt:

– Function: =TotalDebt(Symbol)

– Description: Returns the total debt of the specified company.

3. Cash and Cash Equivalents:

– Function: =CashAndEquivalents(Symbol)

– Description: Returns the cash and cash equivalents of the specified company.

Example Calculation in Excel

Suppose you want to calculate the Enterprise Value for Microsoft (symbol: “MSFT”), you can follow these steps:

1. Market Capitalization:

=MarketCap("MSFT")Store the result in cell A1.

2. Total Debt:

=TotalDebt("MSFT")Store the result in cell A2.

3. Cash and Cash Equivalents:

=CashAndEquivalents("MSFT")Store the result in cell A3.

4. Calculate Enterprise Value:

=A1 + A2 - A3Store the result in cell A4.

Alternatively, you can directly use:

=EnterpriseValue("MSFT")or

=qsEnterpriseValue("MSFT")Remember that the EnterpriseValue functions will provide the EV value directly without needing to compute it manually.

Historical Enterprise Value

If you want to analyze historical enterprise values, you can use the historical functions:

– Syntax: =hf_Enterprise_Value(Symbol, year, Optional quarter = "1", Optional TTM = "")

– Example Usage: =hf_Enterprise_Value("MSFT", 2022) (Returns the EV for Microsoft for the year 2022).

By using these functions, you can efficiently calculate and analyze the Enterprise Value for any company using MarketXLS.

Summary

Enterprise Value (EV) is a financial metric showing a company’s total worth, including market capitalization, debt, and subtracting cash.