Guru Screen Functions are used to filter out stocks based on the winning investment strategies of stock market legends such as Warren Buffet, Benjamin Graham, Robert Piotroski etc. They are a part of MarketXLS since its foundation has been laid down. These screens are of immense value to the customers and users of MarketXLS. These screens are naturally embedded with hundreds of years of acumen and experience in stock market. A company needs to meet specific predetermined criteria and certain parameters to be accepted on these screens. They aid in quick decision-making.

What’s New?

In this release, we have added many advanced Guru Screen functions. There are 17 new guru screen functions in this update.

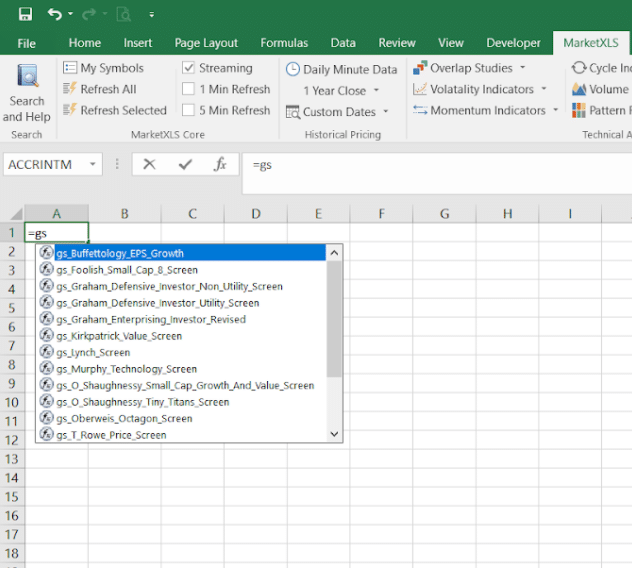

You might have noticed that all the functions start with the letter “gs”. The letters “gs” are the abbreviation of the words guru screen. The significance behind using these two words is that it helps the user in easy identification of functions. All the functions starting with “gs” fall under the category of guru screen functions.

Step-by-step procedure of using MarketXLS to perform analysis on stocks using guru screens

Step 1: Open a new excel workbook and enter the formula of the Zweig Screen function as shown in the image below. You can see, as you type “=gs”, a list of guru screen functions automatically appear in the built-in drop-down suggestion list of functions of excel. Thus, MarketXLS provides you with a wide range of options to select from to perform analysis on stocks.

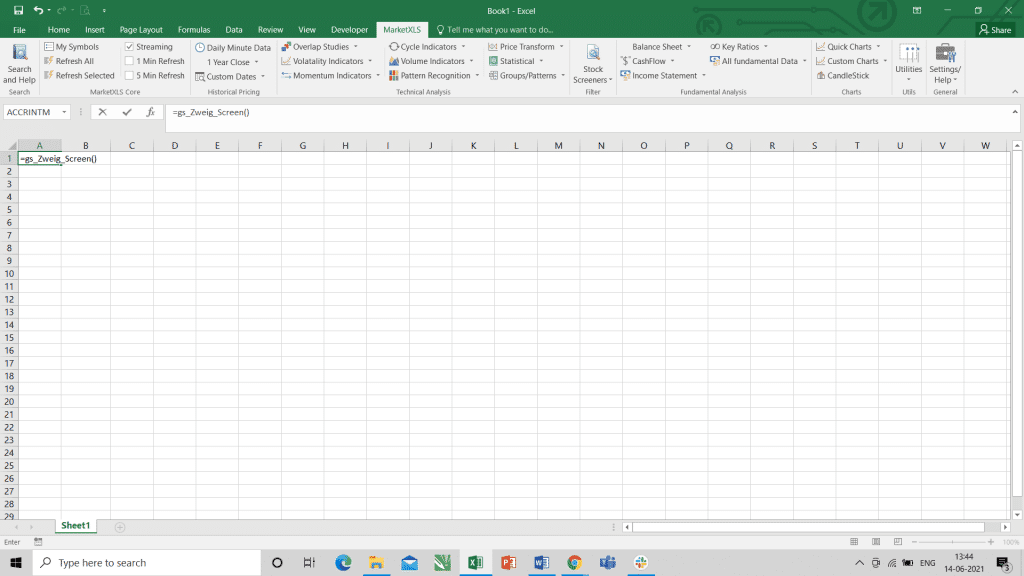

Step 2: Enter the formula of Zweig Screen – “=gs_Zweig_Screen” or select the function of Zweig Screen from the drop-down list. Open and close the parenthesis without entering any values in between them. The software will automatically pull the values, criteria and parameters of the screen.

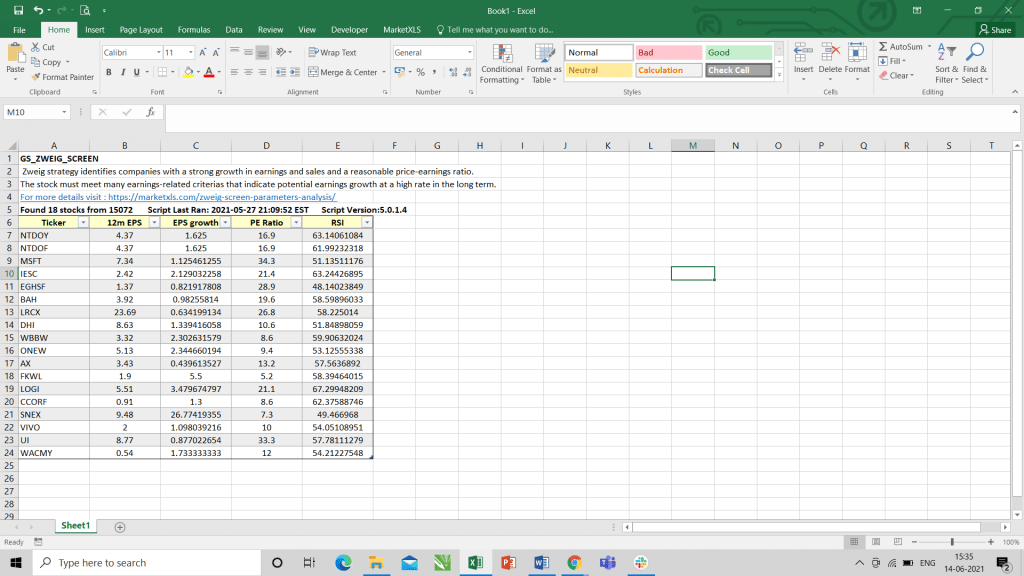

Step 3: The software pulls the data of all the stocks whose parameters match with the criteria of the screen. In this case, the software has pulled 18 stocks out of 15072 stocks. These 18 stocks match with the criteria set by the Zweig Screen.

How to find whether a particular stock falls under the criteria of the Guru Screen or not?

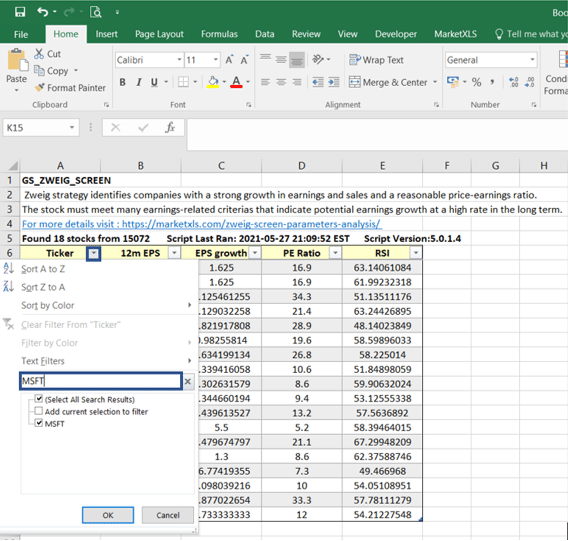

Step 4: This will help you to ascertain whether the stocks, which you are looking for, are accepted by the Zweig Screen or not. You can search for the stock ticker, which you are looking for, in the filter dropdown provided. If you find the ticker available in the dropdown, that particular stock is accepted by the screen. For example, in this case, we searched the ‘MSFT’ stock in the filter dropdown, and we found it. This means that the Zweig Screen accepts the Microsoft stock. You can apply the same procedure for other stocks and other screens.

Disclaimer

None of the content published on marketxls.com constitutes a recommendation that any particular security, portfolio of securities, transaction, or investment strategy is suitable for any specific person. These templates should not be considered as an advertisement or advice, professional or otherwise. You are requested to consider all the risk factors, including your financial condition, suitability to risk-return profile, and other similar conditions. These templates do not account for any professional advice but are merely some guidelines to explain the concept. The author is not offering any professional advice of any kind. The reader should consult a professional financial advisor to determine their suitability for any strategies discussed herein.

Image Source

TCIiNgpDMlvECFQAAAAAdAAAAABAP”>https://www.google.com/url?sa=i&url=https%3A%2F%2Fwww.businessinsider.com%2Fstock-market-rally-jpmorgan-2-charts-that-are-signaling-big-rebound-2019-1&psig=AOvVaw3vIYhnCNHgPuQBfJbmZhf2&ust=1623741891385000&source=images&cd=vfe&ved=0CA0QjhxqFwoTCIiNgpDMlvECFQAAAAAdAAAAABAP