How to Insert Stock Price in Excel for Real-Time Quotes

Inserting stock prices in Excel can simplify the daunting task of monitoring stock fluctuations. Excel becomes an incredibly powerful tool when combined with real-time data streaming capabilities. This article will guide you through easy methods to track real-time stock prices, automate updates, set up alerts, and use MarketXLS for enhanced functionalities. Dive in to make your stock tracking seamless and efficient!

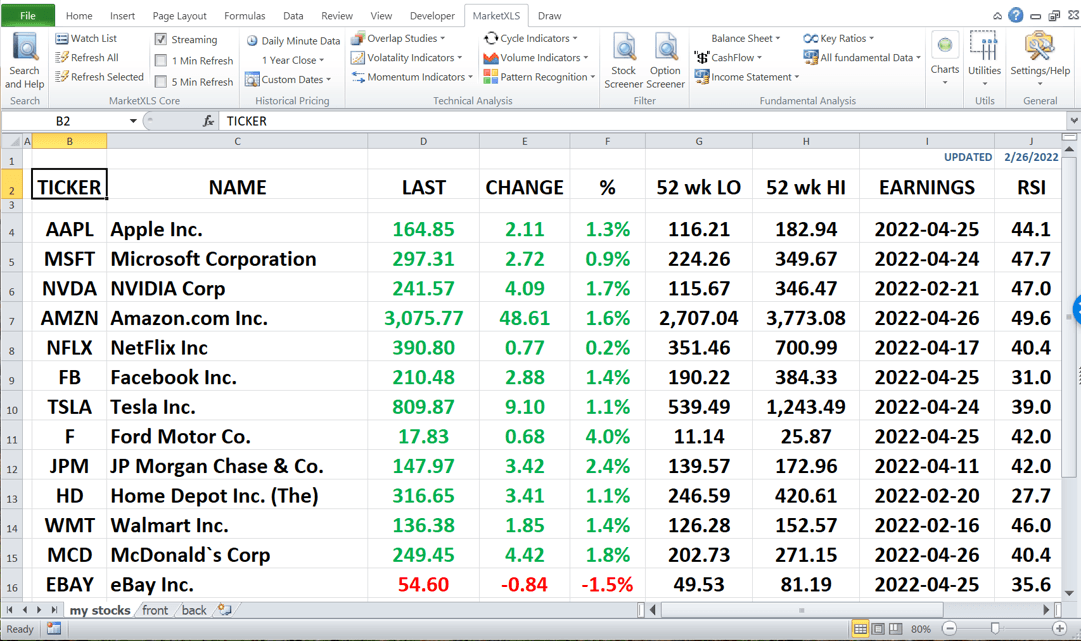

Excel Stock Tracking

How do I insert current stock price in Excel?

To insert stock prices in Excel, you have several options depending on your needs and data sources.

Using Excel's built-in Stock data type: Start by opening a new spreadsheet and entering stock symbols into cells (like AAPL, MSFT, GOOGL). Navigate to the "Data" tab and select "Stocks" from the data types gallery. Excel will convert these symbols into linked data types that automatically pull current stock information. This method is convenient for basic tracking of specific stocks over time.

Using web data connections: Navigate to the "Data" tab and click on "Get Data." Choose "From Web," then enter the URL of a finance site with real-time stock prices. Click "OK" and wait for the data to load. Select the appropriate table containing the stock prices and click "Load." The data will populate your Excel sheet.

Using MarketXLS for real-time streaming: For professional-grade real-time data streaming, MarketXLS provides dedicated functions that connect to live market data feeds. This requires the MarketXLS Advanced Plan and offers the most comprehensive real-time tracking capabilities.

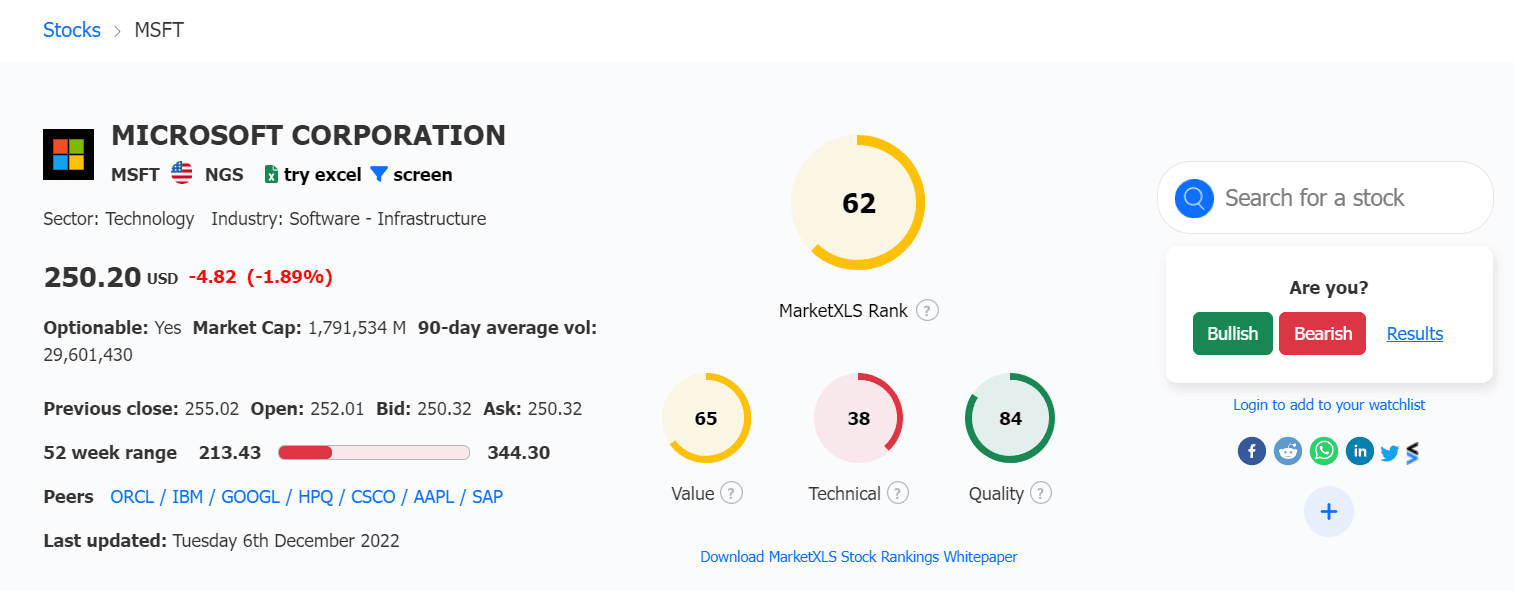

MarketXLS Stock Landing Page

How can I track multiple stock prices in a single Excel workbook?

To track multiple stock prices in a single Excel workbook, start by listing the stock symbols in one column. You can use Excel's built-in "Stock" data type feature for basic tracking by selecting the stock symbols, going to the "Data" tab, and clicking "Stocks." Excel will convert these symbols into live stock data.

Create additional columns for attributes like current price, change, and volume. Use the "Refresh All" option in the "Data" tab to update the data regularly.

For historical data, use Excel's "Get & Transform" tool to import data from financial websites. Set up conditional formatting to highlight certain price changes, making it easier to spot significant movements at a glance.

You can create informative charts with the data for visual analysis. Save the workbook to maintain all your tracked information in one place.

For professional users who need true real-time streaming data with millisecond updates, MarketXLS provides specialized streaming functions that continuously update without manual refreshing.

Stock Streaming

How do I refresh stock prices in Excel automatically?

To refresh stock prices in Excel automatically using the built-in features, you can use Excel's "Stock" data type. Select the cells where you want the stock data to appear, input the stock tickers, and convert these cells to the "Stock" data type. Excel will pull in the latest stock prices and related information.

To ensure the data is updated regularly, set your workbook to refresh at a desired interval. Go to "Data" > "Queries & Connections" and set the background refresh properties. This allows Excel to connect to online sources and update without manual intervention. Remember, you need an active internet connection for automatic updates.

For truly automatic real-time updates that don't require manual refreshing, MarketXLS streaming functions automatically update as new market data becomes available, providing continuous live data flow directly into your spreadsheet.

How can I set up stock price alerts in Excel?

You can set up stock price alerts in Excel using a combination of formulas and conditional formatting. First, import stock data into your Excel sheet using the "Data" tab and "Get Data" from the web feature, or use MarketXLS streaming functions for real-time data.

Next, identify the specific cell where the stock price is located. Create a new cell for your alert threshold and enter the desired price. Use a formula, such as =IF(Cell_with_stock_price>=Alert_threshold, TRUE, FALSE) to check if the condition is met.

Then, apply conditional formatting to the stock price cell. Use the "Conditional Formatting" tool to highlight the cell if the formula results in TRUE. This will change the cell's background or font color when the stock price hits your alert level.

For more dynamic alerts, you can also link Excel to an external source using VBA or Power Query to update data in real-time. This setup ensures you are instantly aware when prices reach your specified thresholds.

How do I link live stock prices from an external data source to Excel?

To link live stock prices from an external data source to Excel, you first need a reliable data provider. Services like Alpha Vantage, Yahoo Finance, or Bloomberg offer API access for basic data.

Go to the Data tab in Excel and select "Get Data" or "From Web". Enter the URL provided by your data source. You might need API keys for authentication, which you can add in the query settings. Once connected, you can format and refresh the queries to fetch real-time data. Use Excel's "Data" tab to set the refresh rate. Ensure your internet is stable to continually update stock prices.

For professional-grade real-time streaming, MarketXLS connects to institutional-quality data feeds that provide continuous updates without the need for manual refreshing or API configuration.

How do I import stock prices from websites like Yahoo Finance into Excel?

Importing stock prices from websites like Yahoo Finance into Excel is a straightforward process. First, open Excel and select the "Data" tab. Click on "Get Data" and choose "From Web" in the drop-down menu. Enter the URL of the Yahoo Finance page that features the stock prices you need.

Once the web page loads in the Navigator window, select the table or data you want to import. Click "Load" to bring the data into your Excel worksheet. The information will now appear in your spreadsheet, and you can refresh it whenever needed. This method ensures that your data stays up to date without manual entry. Additionally, you can create charts and analyses based on the imported data.

How to insert stock price in excel with MarketXLS?

To insert stock prices in Excel using MarketXLS, follow these steps:

1. Install and Set Up MarketXLS

Ensure MarketXLS is installed and properly set up. For real-time streaming functions, you'll need the MarketXLS Advanced Plan with access to live data feeds.

2. Using MarketXLS Streaming Functions

MarketXLS provides comprehensive real-time streaming functions that continuously update with live market data. These functions use the QM_Stream_ prefix and connect to institutional-quality data feeds.

3. Examples of Real-Time Streaming Functions

Current Last Price: To get the real-time last traded price of a stock:

=QM_Stream_Last("MSFT")

This function streams the current last traded price for Microsoft stock, updating continuously during market hours.

Bid and Ask Prices: To get real-time bid and ask prices:

=QM_Stream_Bid("AAPL")

=QM_Stream_Ask("AAPL")

These functions show the current bid and ask prices for Apple stock.

High and Low Prices: To track the day's high and low:

=QM_Stream_High("GOOGL")

=QM_Stream_Low("GOOGL")

These return the highest and lowest prices reached during the current trading day.

Opening and Closing Prices: To get opening and closing prices:

=QM_Stream_Open("TSLA")

=QM_Stream_Close("TSLA")

The Open function shows the price at which the stock first traded when the market opened at 9:30 AM EST, while Close shows the closing price.

Volume Data: To track trading volume:

=QM_Stream_Volume("MSFT")

This streams the real-time volume of shares traded in the current session.

Price Changes: To monitor price changes and percentage changes:

=QM_Stream_Change("AAPL")

=QM_Stream_PercentageChange("AAPL")

These functions show the dollar change and percentage change from the previous close.

Pre-Market and Post-Market Data: To track extended hours trading:

=QM_Stream_PreMarketLast("MSFT")

=QM_Stream_PreMarketVolume("MSFT")

=QM_Stream_PostMarketLast("MSFT")

=QM_Stream_PostMarketVolume("MSFT")

These functions stream data from pre-market and post-market trading sessions.

Options Greeks: For options traders, MarketXLS streams real-time options Greeks:

=QM_Stream_Delta("@MSFT 220114C00300000")

=QM_Stream_Gamma("@MSFT 220114C00300000")

=QM_Stream_Theta("@MSFT 220114C00300000")

=QM_Stream_Vega("@MSFT 220114C00300000")

=QM_Stream_ImpliedVolatality("@MSFT 220114C00300000")

These functions provide critical options metrics for sophisticated trading strategies.

Advanced Metrics: Access additional market metrics:

=QM_Stream_Vwap("AAPL")

=QM_Stream_Twap("AAPL")

VWAP (Volume-Weighted Average Price) and TWAP (Time-Weighted Average Price) are essential for institutional traders.

4. Insert the Function

In your Excel sheet, click on the cell where you want the stock price to appear. Type the relevant MarketXLS streaming function and press Enter. The cell will immediately begin streaming live data.

5. Automatic Updates

MarketXLS streaming functions automatically update as new market data becomes available. There's no need to manually refresh. The data updates continuously during market hours, providing real-time tracking of price movements.

6. Additional Data

Besides prices, you can retrieve other real-time data such as:

- Bid and Ask sizes:

=QM_Stream_BidSize("AAPL"),=QM_Stream_AskSize("AAPL") - Last trade size and time:

=QM_Stream_LastTradeSize("MSFT"),=QM_Stream_LastTradeTime("MSFT") - Trade counts:

=QM_Stream_TradeCount("GOOGL") - Accumulated volume and price data:

=QM_Stream_AccumulatedVolume("TSLA")

By following these steps, you can easily insert and manage real-time streaming stock prices, as well as other financial data, directly within your Excel sheets using MarketXLS.

Get started quickly with templates: MarketXLS has hundreds of templates to get you started easily and save you time. Check out the Equity Research Dashboard Template for a comprehensive setup.

Why MarketXLS is a perfect solution to track markets in real-time

MarketXLS is designed to be a comprehensive solution for tracking markets in real-time, providing several key functionalities that make it particularly effective for investors and traders:

Live Data Streaming

MarketXLS streams live stock data directly into Excel, enabling users to monitor real-time changes without switching between multiple platforms. The Advanced Plan provides access to streaming functions like QM_Stream_Last, QM_Stream_Volume, QM_Stream_High, and many others, covering live stock quotes, bid/ask prices, trade volumes, and more.

Real-Time Stock and Options Prices

Besides streaming live stock prices, MarketXLS also streams real-time options prices, which are crucial for options trading strategies. This includes metrics like option delta, gamma, theta, vega, rho, and implied volatility, allowing comprehensive options analysis.

Pre-Market and Post-Market Trading

Track extended hours trading with dedicated functions for pre-market and post-market sessions. Monitor price movements, volume, and percentage changes before the market opens and after it closes.

Options Filtering and Scanning

MarketXLS includes functions for filtering and scanning different options to spot trading opportunities. This is essential for identifying the best trades based on specific criteria such as volume, open interest, and unusual activity.

Historical Data

Users have access to historical stock and options data, enabling backtesting and analysis of past market performance to make informed decisions.

Portfolio Management

The software allows tracking and managing investment portfolios directly within Excel, offering tools to monitor performance, calculate investment ratios, and generate detailed reports on portfolio analytics.

Crypto Data Integration

For crypto enthusiasts, MarketXLS also supports real-time cryptocurrency data, integrating it seamlessly with traditional market data for a complete market overview.

Enhanced Analysis Functions

MarketXLS provides an array of enhanced functions for both stock and options trading, including Put/Call ratios, total volume, open interest, and various technical indicators, which are crucial for deep market analysis.

In summary, MarketXLS integrates a robust suite of tools for real-time market tracking, options and stock data analysis, portfolio management, and historical data analysis, all within the familiar interface of Excel. This makes it a powerful solution for investors seeking to streamline their decision-making process and enhance their market analysis capabilities in real time.

Visit the MarketXLS Portfolio Manager to explore comprehensive portfolio tracking capabilities.

Summary

Excel simplifies tracking stock prices with multiple methods available depending on your needs. Here's a comprehensive guide:

Insert Stock Price in Excel: Open a new sheet, go to "Data", select "Get Data", and choose "From Web". Enter a finance site URL and load the real-time stock prices. Alternatively, use the built-in "Stocks" data type for basic updates.

Track Multiple Stock Prices: List stock symbols and convert them using "Stock" data type under the "Data" tab. Refresh data regularly and use conditional formatting for easy monitoring.

Automatic Price Refresh: Use stock tickers and convert to "Stock" data type. Set refresh intervals in "Queries & Connections" for automatic updates.

Set Price Alerts: Import stock data and use formulas and conditional formatting to create alerts for specific price points.

Link Live Prices from External Sources: Use APIs from providers like Alpha Vantage. Go to "Data", select "Get Data", and authenticate with API keys for continuous updates.

Import Yahoo Finance Data: Visit "Data" and choose "From Web". Enter the Yahoo Finance URL, select the desired table, and load it into Excel.

MarketXLS for Advanced Real-Time Tracking: Install MarketXLS with an Advanced Plan subscription. Use streaming functions like =QM_Stream_Last("AAPL") for real-time last price, =QM_Stream_Volume("MSFT") for volume data, and dozens of other streaming functions for comprehensive market data. MarketXLS auto-updates data continuously and offers various financial metrics including options Greeks, pre-market/post-market data, and advanced analytics.

MarketXLS Benefits:

- Streams live stock and options data continuously

- Provides pre-market and post-market trading data

- Supports portfolio management and crypto data integration

- Offers enhanced analysis functions for comprehensive market tracking

- Includes hundreds of ready-to-use templates

- No manual refreshing required with Advanced Plan streaming functions

Enhance your stock tracking with Excel and MarketXLS for seamless efficiency and professional-grade real-time market data.