Table of Contents

- Introduction

- What does IV crush mean?

- What happens after IV crush?

- How can you avoid IV crush?

- How to measure IV crush?

- What causes IV crush in options trading?

- How does IV crush impact options pricing?

- How does the timing of an earnings report affect IV crush?

- How do different asset classes experience IV crush differently?

- How does IV crush affect long and short options positions?

- What is the role of market sentiment in IV crush?

- How do implied volatility models predict IV crush?

- How does IV crush influence the Greeks (Delta, Gamma, Theta, Vega)?

- Can IV crush impact stock prices?

- What is the relationship between IV crush and volatility skew?

- How do professional traders hedge against the risks of IV crush?

- How do you calculate IV Crush with MarketXLS? What are the relevant functions available?

- Summary

Introduction

Picture this: You’ve been anticipating a company’s earnings report for weeks, and the big day finally arrives. You’ve made strategic options trades, hoping for a substantial market movement. But instead of seeing your options soar, you witness a rapid decline in their value. What just happened? Welcome to the world of IV crush.

What does IV crush mean?

IV crush refers to a significant drop in an option’s implied volatility. This often occurs after a major event, such as earnings reports or product launches. When IV decreases sharply, the prices of options usually fall, even if the underlying stock’s price doesn’t change much. Traders might see their options lose value quickly due to this contraction. It’s crucial for traders to anticipate such moves to minimize potential losses. Understanding IV crush can help in choosing better entry and exit points for options trades.

What happens after IV crush?

After IV crush, option premiums decrease significantly due to reduced implied volatility. This reduction happens often after major events like earnings releases. Traders holding options may face losses if the drop in volatility outweighs other factors. New buyers might find options more attractively priced. Additionally, the market stabilizes as uncertainty diminishes. Traders must reassess their positions and strategies. It’s common for new opportunities to arise in the calmer post-event environment.

How can you avoid IV crush?

IV crush, or implied volatility crush, happens when an option’s implied volatility sharply drops, usually after an earnings announcement or major event. To avoid IV crush, consider trading options well before or after such events to minimize risk. Look for options strategies that are less sensitive to changes in implied volatility, like vertical spreads. Stay informed about upcoming events that might impact the underlying asset’s volatility. Avoid buying options right before earnings reports, as the IV is typically high then and likely to drop significantly afterward. Being mindful of these tactics can help protect your option investments from unnecessary losses due to IV crush.

How to measure IV crush?

Measuring IV crush typically involves specific procedures to ensure accurate and consistent results. First, select a suitable standardized tool designed for measuring inner and outer diameters of IV lines. Clean the IV line to remove any residue or debris. Use a micrometer or caliper to measure the diameter at various points along the line. Make sure to take at least three measurements to check for consistency. Record the smallest diameter as this reflects the extent of the crush. Repeat the process if necessary to confirm accuracy. Document all findings in a log for future reference or analysis. Consistency in methodology ensures reliable data, essential for addressing the issue effectively.

What causes IV crush in options trading?

IV crush in options trading is primarily caused by the resolution of uncertainty around a significant event, such as earnings announcements or major economic reports. As the event approaches, implied volatility (IV) tends to rise because traders anticipate sharp price movements. After the event passes, the actual movement may be less than anticipated, leading to a sharp decrease in IV. This drop is known as IV crush. Essentially, the high pre-event IV gets “crushed” once the anticipated catalyst is no longer a factor. Consequently, options prices fall, often resulting in losses for traders who bought options expecting substantial volatility.

How does IV crush impact options pricing?

IV crush, or Implied Volatility crush, significantly impacts options pricing by reducing the extrinsic value of options. When IV drops suddenly, usually after an anticipated event like earnings announcements, the premium that traders pay for the option decreases sharply. This happens because implied volatility is a key component in an option’s price. As IV falls, the market adjusts for the reduced uncertainty. Traders holding options before the event often face substantial losses if the price movement doesn’t offset the reduction in IV. Therefore, understanding IV crush is crucial for options traders aiming to maximize gains and minimize risks.

How does the timing of an earnings report affect IV crush?

The timing of an earnings report plays a crucial role in influencing implied volatility (IV) crush. When a company announces its earnings, the uncertainty surrounding its financial performance often causes an increase in IV. Traders anticipate potential price swings after the report. As the earnings date approaches, IV typically rises due to this anticipated uncertainty. However, once the results are announced, a substantial portion of this uncertainty is resolved. This leads to a rapid decrease in IV, known as IV crush. The magnitude of the IV crush can vary depending on whether the earnings met, exceeded, or fell short of expectations. Generally, the closer to the report date, the more pronounced the IV crush tends to be. In essence, the timing directly impacts the level of uncertainty and, consequently, the volatility premium priced into options.

How do different asset classes experience IV crush differently?

Different asset classes experience implied volatility (IV) crush in unique ways. For equities, IV crush typically occurs after major events like earnings reports. In anticipation of such events, IV rises, but it drops sharply once the event has passed. Options on individual stocks often see the most pronounced IV crush. Commodities, on the other hand, may experience IV changes due to geopolitical events or supply-demand shifts. IV crush in forex options is usually less dramatic but can occur after major economic announcements. Real estate investments, like REITs, aren’t as affected by IV crush because they don’t have options markets as active as stocks or forex. Each asset class responds to different triggers, leading to varying degrees of IV crush.

How does IV crush affect long and short options positions?

IV crush refers to a rapid decrease in implied volatility, often occurring after major events like earnings announcements. This drop can significantly impact both long and short options positions. For long option holders, who purchased calls or puts, IV crush is typically detrimental. It leads to a sharp decline in the option’s premium, resulting in losses even if the underlying asset’s price moves as predicted. Conversely, short option holders, who sold options, usually benefit from IV crush. They collect premiums and can repurchase the options at a lower price after volatility drops. This effect emphasizes the risk and reward dynamics of trading options around significant market events.

What is the role of market sentiment in IV crush?

Market sentiment plays a crucial role in IV crush. Implied volatility (IV) often spikes ahead of significant events, capturing market anticipation. Once the event concludes, uncertainty dissipates. This causes a sharp decline in IV, known as an IV crush. Positive or negative shifts in market sentiment amplify this effect. If the event meets or defies expectations, sentiment-driven changes in IV are more pronounced. Investor emotions and crowd behavior can also exaggerate IV movements. This makes timing and sentiment analysis key for options traders. Understanding market mood helps predict the magnitude of IV crush.

How do implied volatility models predict IV crush?

Implied volatility (IV) models help predict IV crush by analyzing how much volatility is expected in the future. These models use historical price data, market trends, and upcoming events like earnings reports. They assess the current level of volatility priced into options and compare it to historical norms. When the models detect an unusually high IV, it suggests that the market expects significant movement. Once the event passes without much actual movement, the high IV is no longer justified, leading to an IV crush. Traders use these models to identify potential opportunities for profit. Accurate predictions can help in making informed decisions on options strategies.

How does IV crush influence the Greeks (Delta, Gamma, Theta, Vega)?

IV crush, or a rapid decrease in implied volatility after an event like earnings, significantly impacts the Greeks. Delta, which measures the sensitivity of the option’s price to the underlying asset’s price, becomes less pronounced as options are typically closer to their intrinsic value post-crush. Gamma, reflecting the rate of change of Delta, also drops since options are now less responsive to small movements in the underlying asset. Theta, indicating time decay, can increase because the extrinsic value of the option is diminished, leaving less premium to erode over time. Vega, which measures sensitivity to volatility changes, decreases substantially since lower implied volatility reduces the option price. This comprehensive shift in the Greeks influences trading strategies and risk management post-IV crush.

Can IV crush impact stock prices?

Implied volatility (IV) crush can significantly impact stock prices, especially after major events like earnings reports. When the anticipated event is over, IV often drops sharply. This decline can lead to decreased option prices, impacting investor sentiment. As a result, traders who had bet on significant price moves might sell their positions, affecting the stock price. If many investors were holding options, the sudden IV crush can lead to a flurry of activity in the underlying stock. However, the extent of this impact varies depending on other market conditions and the overall economic environment. Therefore, while IV crush can influence stock prices, it’s one of many factors that traders need to consider.

What is the relationship between IV crush and volatility skew?

IV crush and volatility skew are related concepts in options trading. IV crush refers to a sudden drop in implied volatility, often occurring after an anticipated event like an earnings report. This can lead to a sharp decrease in options premiums. On the other hand, volatility skew describes the pattern where options with different strike prices have varying implied volatilities. Typically, out-of-the-money options have higher implied volatility compared to at-the-money options. When IV crush happens, it can distort the existing volatility skew. Traders need to be aware of this interaction to make informed decisions.

How do professional traders hedge against the risks of IV crush?

Professional traders hedge against the risks of IV crush by employing various strategies to minimize potential losses. One common tactic is to trade options with lower implied volatility or to create spreads that offset the impact of volatility drops. They might also diversify their portfolios to include both long and short positions. Additionally, some traders use advanced techniques like delta hedging to balance their overall risk. Others may employ protective puts or calls to safeguard against sudden volatility changes. By carefully analyzing market conditions, traders can adjust their strategies in real-time to stay ahead of IV crush risks.

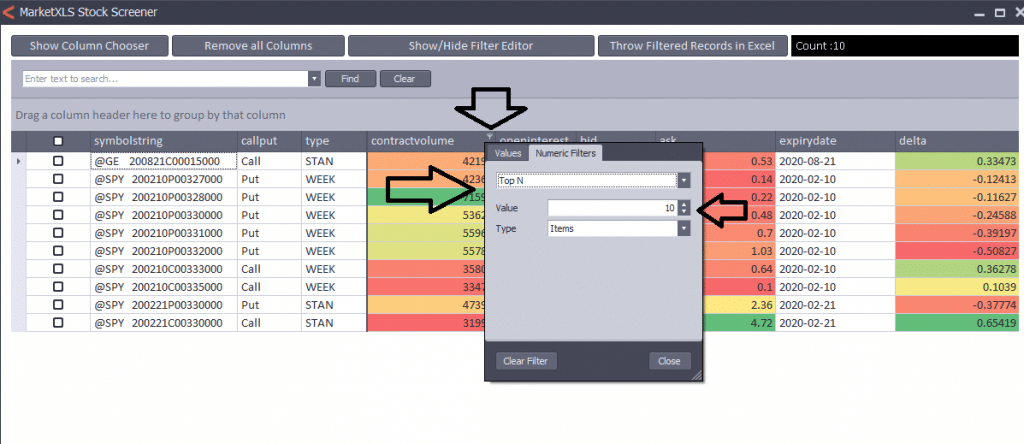

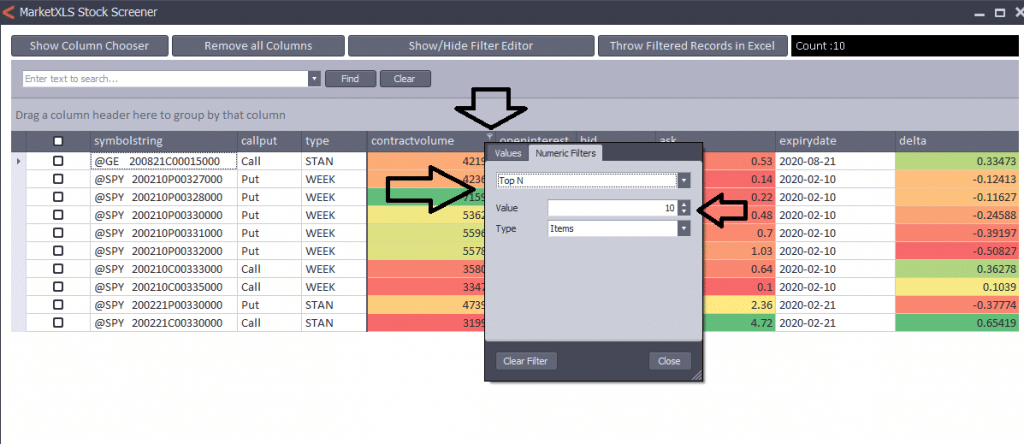

How do you calculate IV Crush with MarketXLS? What are the relevant functions available?

Calculating Implied Volatility (IV) Crush with MarketXLS involves using a combination of implied volatility functions and comparing them to historical data around earnings announcements or other significant market events. The following functions in MarketXLS can be used to analyze and calculate IV Crush:

Relevant Functions:

1. Implied Volatility Functions:

– =ImpliedVolatility("Symbol", "Date"): Returns the interpolated 30-day implied volatility for the given symbol and date.

– =ImpliedVolatilityRank1m("Symbol"): Measures the implied volatility compared to its past 1-month values. The formula used is \( (\text{Current IV} – \text{1 month Low IV}) / (\text{1 month Max IV} – \text{1 month Min IV}) \).

– =ImpliedVolatilityPct1m("Symbol"): Provides a percentage rank of the current IV compared to the past 1 month’s values.

– =ImpliedVolatilityRank1y("Symbol"): Compares the current IV against its highest and lowest values over the past year.

– =ImpliedVolatilityPct1y("Symbol"): Shows where the current IV stands compared to its entire range over the past year as a percentile.

Steps to Calculate IV Crush:

1. Get Current Implied Volatility: Use the =ImpliedVolatility("Symbol", "Date") function to get the current IV value just before an earnings announcement or any major event.

2. Historical Implied Volatility: Use functions like =ImpliedVolatilityRank1m("Symbol") and =ImpliedVolatilityRank1y("Symbol") to understand how the current IV compares to historical IV levels over different periods.

3. Post-Event Implied Volatility: After the event, use the =ImpliedVolatility("Symbol", "Date") function again to get the new IV value.

4. Calculate the IV Crush: Calculate the IV Crush by comparing the IV values before and after the event. The formula would be:

\[

\text{IV Crush} = \text{Pre-Event IV} – \text{Post-Event IV}

\]

Example:

Suppose you want to calculate the IV Crush for Microsoft (MSFT) around an earnings event:

1. Current IV Before Earnings:

=ImpliedVolatility("MSFT", "2023-01-20")This gives you the IV on January 20, 2023, just before the earnings announcement.

2. Historical Context:

=ImpliedVolatilityRank1m("MSFT")=ImpliedVolatilityPct1m("MSFT")=ImpliedVolatilityRank1y("MSFT")=ImpliedVolatilityPct1y("MSFT")These functions provide context on how current IV stands in comparison to past month and year values.

3. Post-Earnings IV:

=ImpliedVolatility("MSFT", "2023-01-25")This gives you the IV on January 25, 2023, after the earnings announcement.

4. Calculate IV Crush:

=PRE_EVENT_IV - POST_EVENT_IVIn summary, MarketXLS provides robust functionalities to calculate and analyze IV Crush by offering real-time and historical IV data, enabling users to make informed decisions around significant market events like earnings announcements.

For further details on the functions and their parameters, you can refer to the sources .

Here is the template you might want to checkout and marketxls has 100s of templates to get you started easily and save you time.

– Template for IV Crush Calculation

For further details and a variety of useful templates, you can also check out this PDF that contains an extensive list of useful templates provided by MarketXLS.

Summary

IV crush, or Implied Volatility crush, is a sudden drop in an option’s implied volatility, usually after significant events like earnings reports. This drop in IV leads to a decrease in options prices, resulting in potential losses for traders. To avoid IV crush, trade options away from major events and use strategies less sensitive to IV changes, such as vertical spreads. After IV crush, option premiums drop, which can benefit new buyers. Understanding and mitigating IV crush risks are crucial for making informed trading decisions. Tools like MarketXLS help traders calculate IV crush by comparing pre- and post-event IV using specific functions.