With great excitement, we announce the release of MarketXLS Version 9.3.4.7 today (October 17th, 2022). As highlighted below, this update includes new implied volatility for option functions, a new spreadsheet builder, and many other changes.

Key Updates Summary:-

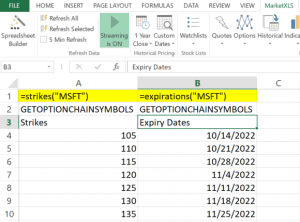

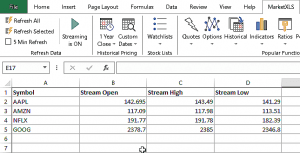

- New Functions to get all the strikes and expiration dates for the underlying symbol. =Strikes(“MSFT”), =

Expirations(“MSFT”)

- 18 New IV Functions and IV Rank functions. for example =ImpliedVolatility(“MSFT”), =ImpliedVolatilityRank1m(“

MSFT”)

- New Spreadsheet Builder tool inside MarketXLS. Select stocks and metrics and click a button to create a starter MarketXLS Sheet

- New Function to get top options. For example =TopOptionsByVolume(“

MSFT”), =TopOptionsByOpenInterest(“ MSFT”)

- New GetOptionChain Function optimization. The system now adds a blank row at the end of the Options chain to represent the end of the chain.

- “Streaming Off” button optimization – This button will now completely disconnect the streaming service.

- Historical Prices on weekends with =CloseHistorical Functions – we have updated the functions to return the value of the last working day before the weekend.

- New Reverse Iron Condor Template

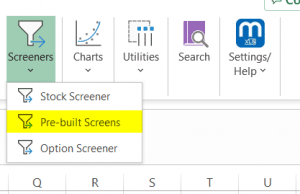

- New 100 pre-built screeners on the website, and you can access them inside excel from the pre-built screener button under the screener tab.

Here are the new updates:-

1) Get all the strikes and expiration dates for the underlying symbol

The gap in strike prices of underlying symbols of all options may differ. In response to requests from our Reddit community, this version contains the following new functions.

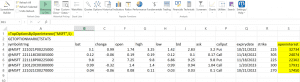

2) New Implied Volatility functions and Earnings Implied Volatility functions

We are introducing IV Rank functions in this release. Our results have been tested against multiple platforms, and we are satisfied with them. Sometimes, our IV Ranks may differ from other platforms, like TOS, Barchart, etc. Each function is explained below. We also summarized them in a blog post here. We would appreciate any feedback you may have on these functions.

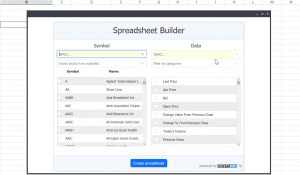

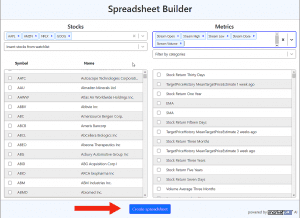

3) New Spreadsheet Builder

We are happy to offer an automated way to create the initial MarketXLS Starter spreadsheet.

Once you download the latest version, it will be available for you.

Choose your stocks and metrics, then click a button to generate a fully automated spreadsheet with formulas updating the stocks in a column. MarketXLS’s spreadsheet builder is located on the first tab of the menu, as shown below.

It has been designed intuitively based on the user’s feedback.

- The left column allows you to select an initial list of symbols (up to 40). The symbols can be searched by company name or symbol.

- Choose metrics in the right column, then use the function or categories to narrow your search.

- After clicking “Create the Spreadsheet”, you can save and customize it.

Instantly generate the entire spreadsheet filled with data using MarketXLS.

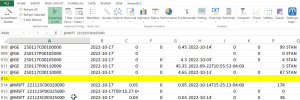

4) Get Top Options

This version contains the following new functions to get top options by volume and open interest quickly

5) Get Options Chain Optimization

Option chain records differ for different stocks and ETFs; results pasted as a table sometimes overwrite the previous data. To help you recognize the new table, we added a blank row at the end. By pressing CTRL + Down arrow, you will reach the table’s end.

6) Streaming Off Button Optimizations

In this release, we have optimized the streaming Off/On button to stop streaming when the Streaming Off button is completely clicked. The spreadsheet should keep the last number but perform any calculations in the background. If you have both streaming and non-streaming functions in your spreadsheet, this should make it faster.

7) Historical Data on Weekends

Now the open, close, low, and high functions used to return #N/A on the weekends in the past. We have updated the functions in this update to return the value of the last working day before the weekend.

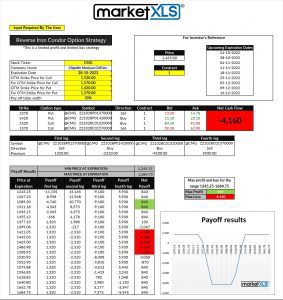

8) New Reverse Iron Condor Template

We have updated the previous Reverse Iron Condor Template formatting and functions for a better user experience. Please feel free to use it. Download Now.

9) Pre-built Stock Screens

We have added about 100 pre-built screens on the MarketXLS.com website, and you can also access these inside excel from the pre-built screener button under the screener tab, as shown below.

Our team has also performed minor optimizations to run MarketXLS smoothly. Email us at support@marketxls.com with any concerns or issues you face.

Click here to join our Reddit community and engage with other MarketXLS users.

MarketXLS is focused on delivering the best Excel experience to its users; help us make MarketXLS better by sharing your feedback.