Imagine what happens when the buyer or seller has more information than the other? Well, in that case, the law of supply and demand doesn’t work as expected as the price of assets is skewed. More simply put it can lead to market failure. This imperfect knowledge with one party is called information asymmetry.

Understanding asymmetry

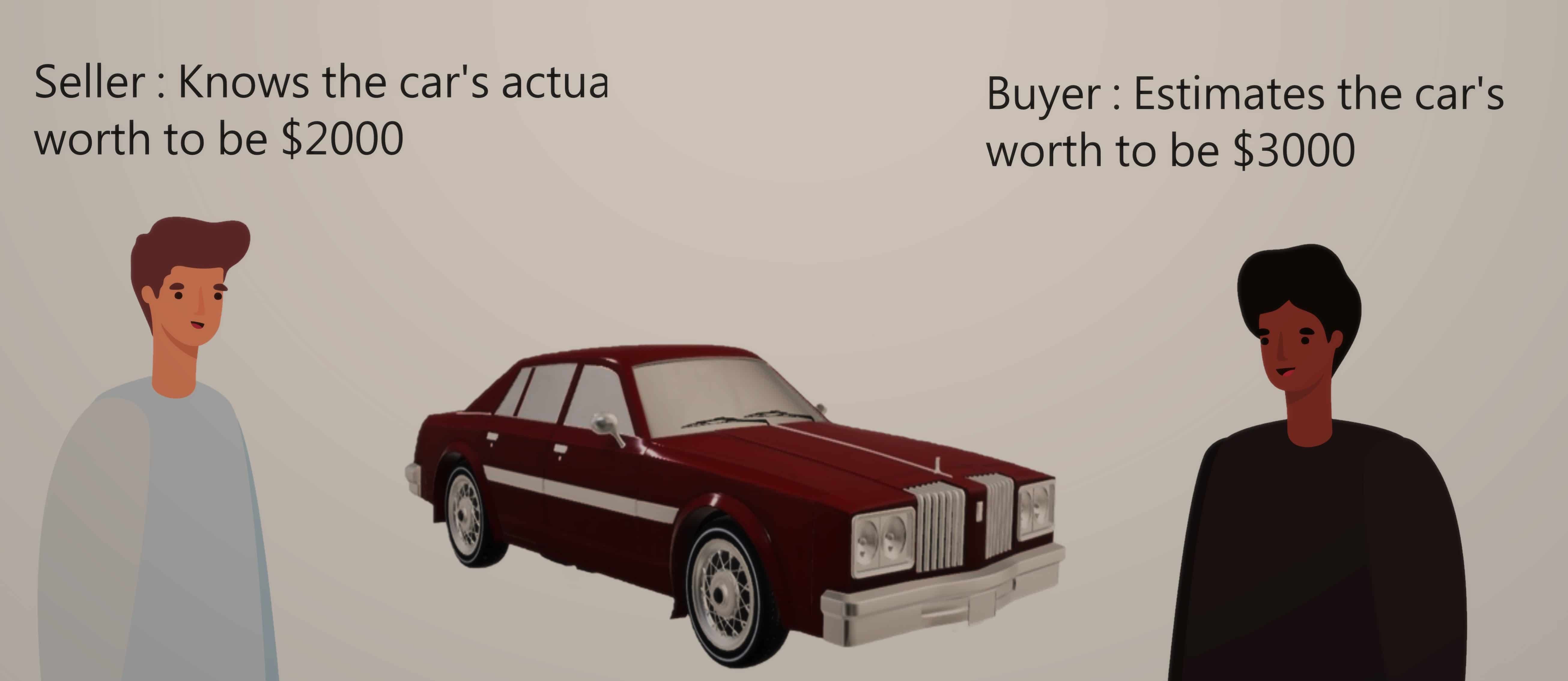

Let’s take an example where you are looking to buy a second-hand car. You do the initial research, check the car exterior and all looks good. You get the car for $2500. You feel it’s the fair value. However, the car starts malfunctioning in just a couple of months. The seller had known it all along and the fair value of the car was maybe somewhere about $2000. This is the classic example of asymmetry in the market.

Why is asymmetric information so crucial to an understanding of financial markets?

In the above example, if you don’t trust a used car salesman about the quality of a car, you can have it checked out by a mechanic. In most markets, reputation is also important.

In the financial world, such methods have often proven to be less reliable than for cars or houses. This had been made evident from the 2008 financial crisis. After the crisis, the credit rating agencies were labeled as key enablers of the financial meltdown.

Most people who buy and sell financial assets have no intrinsic desire for the asset itself. They only care about how its value to other people will change in the future. That means when it comes to financial markets, information is the product.

Of course, when the information is the product, asymmetric information becomes crucial to an understanding of financial markets.

Asymmetric information in financial markets

When today we debate issues like financial regulation or high-frequency trading, it helps to think about financial markets as being driven by differences in how much people know.

Financial professionals have far more access to market information than retail investors.

From the viewpoint of the efficient market hypothesis (EMH), the price of any asset in a market must fully reflect all of its relevant available information. In the capital market, the relevant information is that information that may affect the future cash flow of a company or the future expectations of investors. In an efficient market, asset prices provide adequate resource allocation signs because the information is symmetric.

If a particular market participant possesses private information of good news (a high signal) regarding a company, before the release of this information, he or she can acquire new shares in the company by issuing a buy order and thus obtaining abnormal gains with this investment.

The effect of this asymmetry in major economies is diversifiable because of the existence of a large number of traded assets, which diminishes the advantage of informed agents over uninformed ones with respect to certain assets, given a large number of deals. However, in emerging economies, where there is a large concentration of corporate capital among a few investors, there is a higher probability of abnormal gains by informed agents through obtaining private information.

With all this asymmetric information, why are financial markets so active?

A pair of papers in 1985 attempt to explain why. These studies by Lawrence Glosten, Paul Milgrom, and Albert “Pete” Kyle modeled the interaction between informed traders, market makers, and liquidity traders. The liquidity traders need to buy or sell immediately for reasons unrelated to the market, but the informed traders are trading because they know something about the asset’s fundamental value. The market-makers or the middlemen profit off of the former and lose money to the latter. But as some other researchers showed over a decade later, if the information is too complicated, this process can lead to bubbles and crashes.

Conclusion

Asymmetric information is at the core of finance. It’s key to the way traders, including high-frequency traders, make their profits. And it’s probably at the root of why markets break down and crash.

Some of the powerful technical indicators and screeners have been present mostly with some of the seasoned traders. Technological advances make it very difficult for the investing public to compete in short-term trading. During the past few years, Excel has evolved into a powerful analytical tool that can be used for complex statistical analysis and to create new indicators and custom charts.

By using tools such as MarketXLS, it is possible to crunch data, analyze it, and get answers to the most complex questions thereby resulting in increased profits.

For more information on options trading using excel spreadsheets and its benefits, click here.

References

http://www.scielo.br/scielo.php?pid=s1519-70772014000100004&script=sci_arttext&tlng=en

https://blogs.cornell.edu/info2040/2016/12/01/asymmetric-information-in-the-stock-market/

Disclaimer

None of the content published on marketxls.com constitutes a recommendation that any particular security, portfolio of securities, transaction, or investment strategy is suitable for any specific person.

The author is not offering any professional advice of any kind. The reader should consult a professional financial advisor to determine their suitability for any strategies discussed herein.

the article is written for helping users collect the required information from various sources deemed to be an authority in their content. The trademarks if any are the property of their owners and no representations are made.