The Iron condor is a limited risk, non-directional option trading strategy designed to have a significant probability of earning a small limited profit when the underlying security is perceived to have low volatility. The iron condor strategy can also be visualized as a combination of a bull put spread and a bear call spread.

Construction

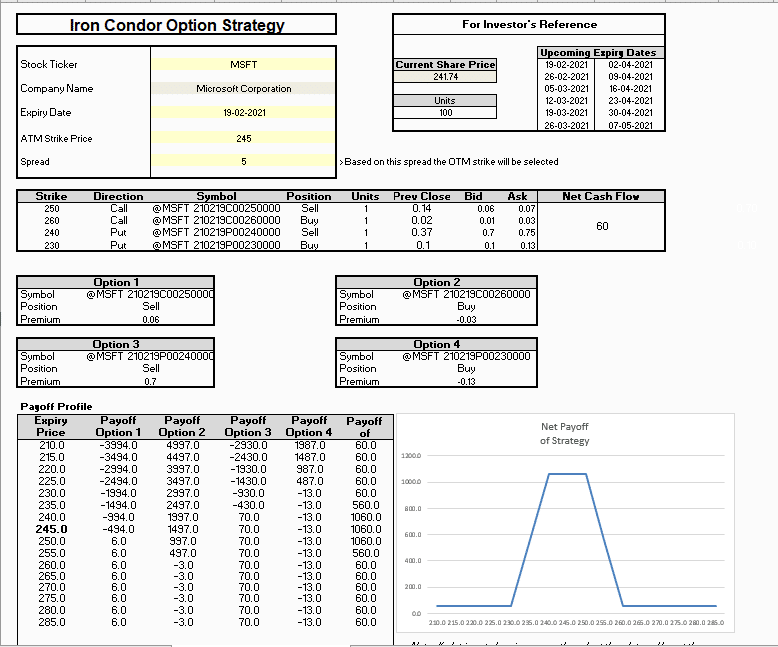

The iron condor is an improvisation over the short strangle. The iron condor is a four-legged option setup.

- Sell 1 OTM Put

- Buy 1 OTM Put (Lower Strike)

- Sell 1 OTM Call

- Buy 1 OTM Call (Higher Strike)

I’ve used the MarketXLS template to set up Iron condor. As can be seen from the figure above, it has limited profit potential and limited downside risk.

How to use this template?

In the active template:

1. Mention the Stock symbol.

2. Enter the Expiry date. A list of upcoming expiry dates has been provided adjacent to the input.

3. Enter the ATM Strike price.

4. Enter the Spread (Difference between higher and lower strike price).

Benefits

While trading options, if you hedge your position, then the risk of losing capital reduces drastically. If your capital loss is minimal, then it implies that your broker’s risk is also minimum. Now, if the risk for the broker reduces, it also means the risk for the exchange reduces.

Generally speaking, the lesser the risk you carry, the lower the margin requirement. Higher the risk, the higher the margin requirement.

Therefore, this means whenever you initiate a hedged strategy, the margins blocked by your broker is less compared to the margin required for a naked position.

When to use this strategy?

This strategy lets you retain the premium as long as the stock price stays within a range. Besides, this is also a great way to trade volatility. Whenever you think the volatility has shot up and therefore the option premiums, then you’d want to be an options seller and pocket the high premiums. Short strangles is perfect for such trades.

However, the margin requirements for short strangle can be really high. An iron condor improvises a short strangle by plugging in the open ends. The risk in iron condor is completely defined. You have clear visibility on the worst-case scenario.

Hence, the strategy can be summarised as below-

- Spread – The difference between the sold strike and its protective strike.

- Max Profit = Net Premium Received – Commissions Paid

- Max Profit Achieved When Price of Underlying is in between Strike Prices of the Short Put and the Short Call

- Max Loss = Strike Price of Long Call – Strike Price of Short Call – Net Premium Received + Commissions Paid

- Max Loss Occurs When Price of Underlying >= Strike Price of Long Call OR Price of Underlying <= Strike Price of Long Put

- Upper Breakeven Point = Strike Price of Short Call + Net Premium Received

- Lower Breakeven Point = Strike Price of Short Put – Net Premium Received

Natural calendar spread, long put butterfly and iron butterfly are some of the similar strategies you might be interested in if you like Iron condor.

Disclaimer

References

To learn about short strangle, click here

To learn about long straddle, click here