Iron Condor (Excel Template)

Meet The Ultimate Excel Solution for Investors

- Live Streaming Prices Prices in your Excel

- All historical (intraday) data in your Excel

- Real time option greeks and analytics in your Excel

- Leading data in Excel service for Investment Managers, RIAs, Asset Managers, Financial Analysts, and Individual Investors.

- Easy to use with formulas and pre-made sheets

The Iron condor is a limited risk, non-directional option trading strategy designed to have a significant probability of earning a small limited profit when the underlying security is perceived to have low volatility. The iron condor strategy can also be visualized as a combination of a bull put spread and a bear call spread.

Construction

The iron condor is an improvisation over the short strangle. The iron condor is a four-legged option setup.

- Sell 1 OTM Put

- Buy 1 OTM Put (Lower Strike)

- Sell 1 OTM Call

- Buy 1 OTM Call (Higher Strike)

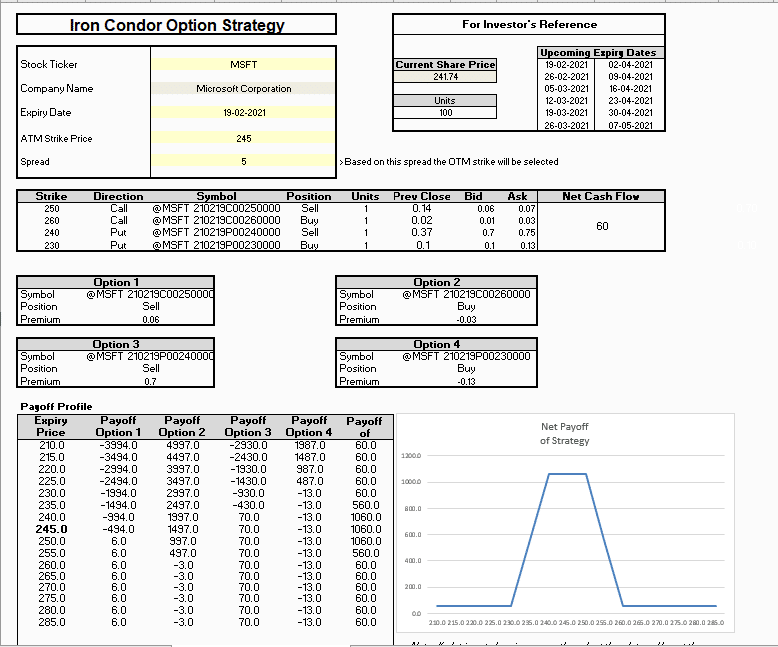

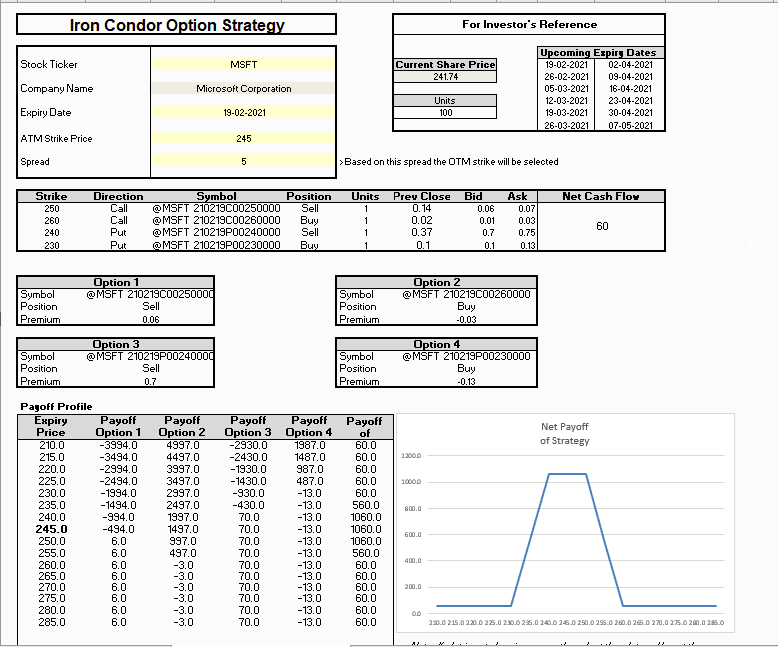

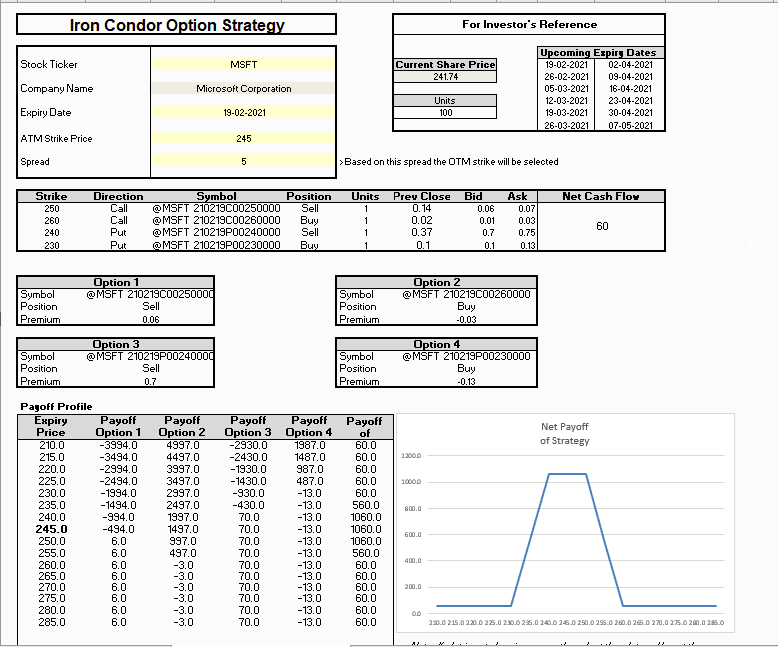

I’ve used the MarketXLS template to set up Iron condor. As can be seen from the figure above, it has limited profit potential and limited downside risk.

How to use this template?

In the active template:

1. Mention the Stock symbol.

2. Enter the Expiry date. A list of upcoming expiry dates has been provided adjacent to the input.

3. Enter the ATM Strike price.

4. Enter the Spread (Difference between higher and lower strike price).

Benefits

While trading options, if you hedge your position, then the risk of losing capital reduces drastically. If your capital loss is minimal, then it implies that your broker’s risk is also minimum. Now, if the risk for the broker reduces, it also means the risk for the exchange reduces.

Generally speaking, the lesser the risk you carry, the lower the margin requirement. Higher the risk, the higher the margin requirement.

Therefore, this means whenever you initiate a hedged strategy, the margins blocked by your broker is less compared to the margin required for a naked position.

When to use this strategy?

This strategy lets you retain the premium as long as the stock price stays within a range. Besides, this is also a great way to trade volatility. Whenever you think the volatility has shot up and therefore the option premiums, then you’d want to be an options seller and pocket the high premiums. Short strangles is perfect for such trades.

However, the margin requirements for short strangle can be really high. An iron condor improvises a short strangle by plugging in the open ends. The risk in iron condor is completely defined. You have clear visibility on the worst-case scenario.

Hence, the strategy can be summarised as below-

- Spread – The difference between the sold strike and its protective strike.

- Max Profit = Net Premium Received – Commissions Paid

- Max Profit Achieved When Price of Underlying is in between Strike Prices of the Short Put and the Short Call

- Max Loss = Strike Price of Long Call – Strike Price of Short Call – Net Premium Received + Commissions Paid

- Max Loss Occurs When Price of Underlying >= Strike Price of Long Call OR Price of Underlying <= Strike Price of Long Put

- Upper Breakeven Point = Strike Price of Short Call + Net Premium Received

- Lower Breakeven Point = Strike Price of Short Put – Net Premium Received

Natural calendar spread, long put butterfly and iron butterfly are some of the similar strategies you might be interested in if you like Iron condor.

Disclaimer

None of the content published on marketxls.com constitutes a recommendation that any particular security, portfolio of securities, transaction, or investment strategy is suitable for any specific person. The author is not offering any professional advice of any kind. The reader should consult a professional financial advisor to determine their suitability for any strategies discussed herein. The article is written to help users collect the required information from various sources deemed an authority in their content. The trademarks, if any, are the property of their owners, and no representations are made.

References

To learn about short strangle, click here

To learn about long straddle, click here

Get Market data in Excel easy to use formulas

- Real-time Live Streaming Option Prices & Greeks in your Excel

- Historical (intraday) Options data in your Excel

- All US Stocks and Index options are included

- Real-time Option Order Flow

- Real-time prices and data on underlying stocks and indices

- Works on Windows, MAC or even online

- Implement MarketXLS formulas in your Excel sheets and make them come alive

- Save hours of time, streamline your option trading workflows

- Easy to use with formulas and pre-made templates

I invite you to book a demo with me or my team to save time, enhance your investment research, and streamline your workflows.