← Back to Templates

Collar Option Strategy

Description

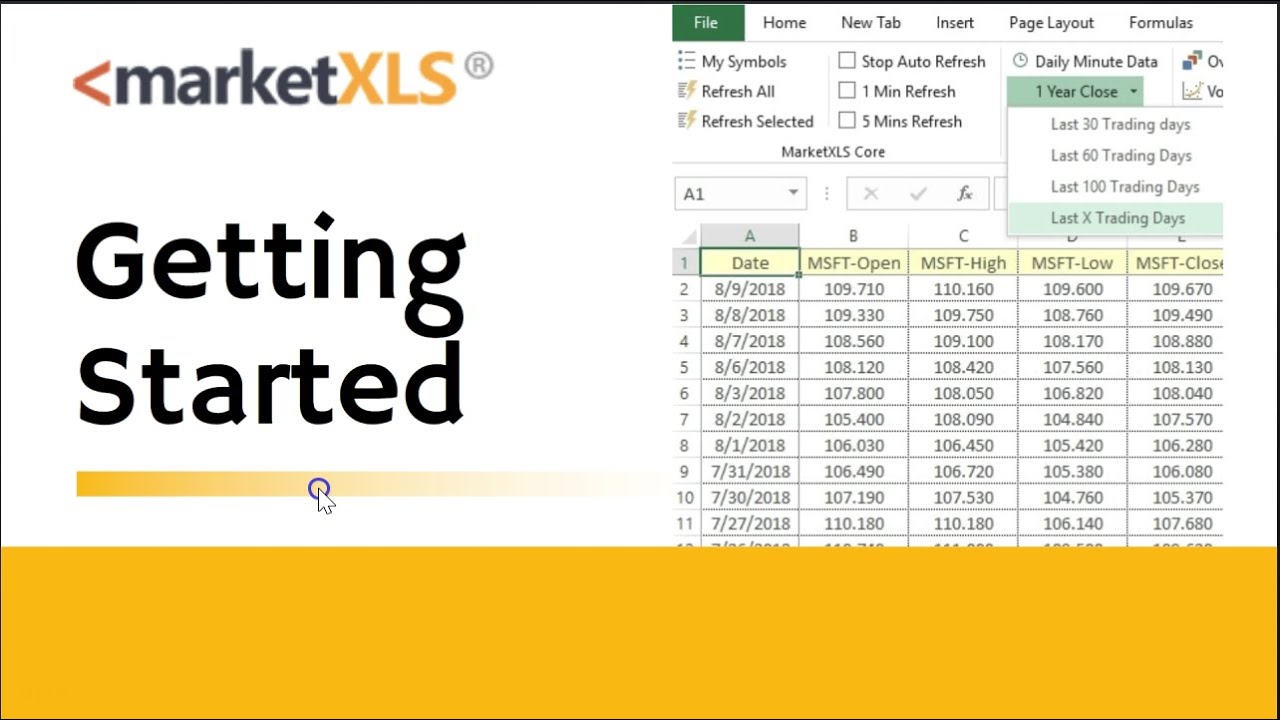

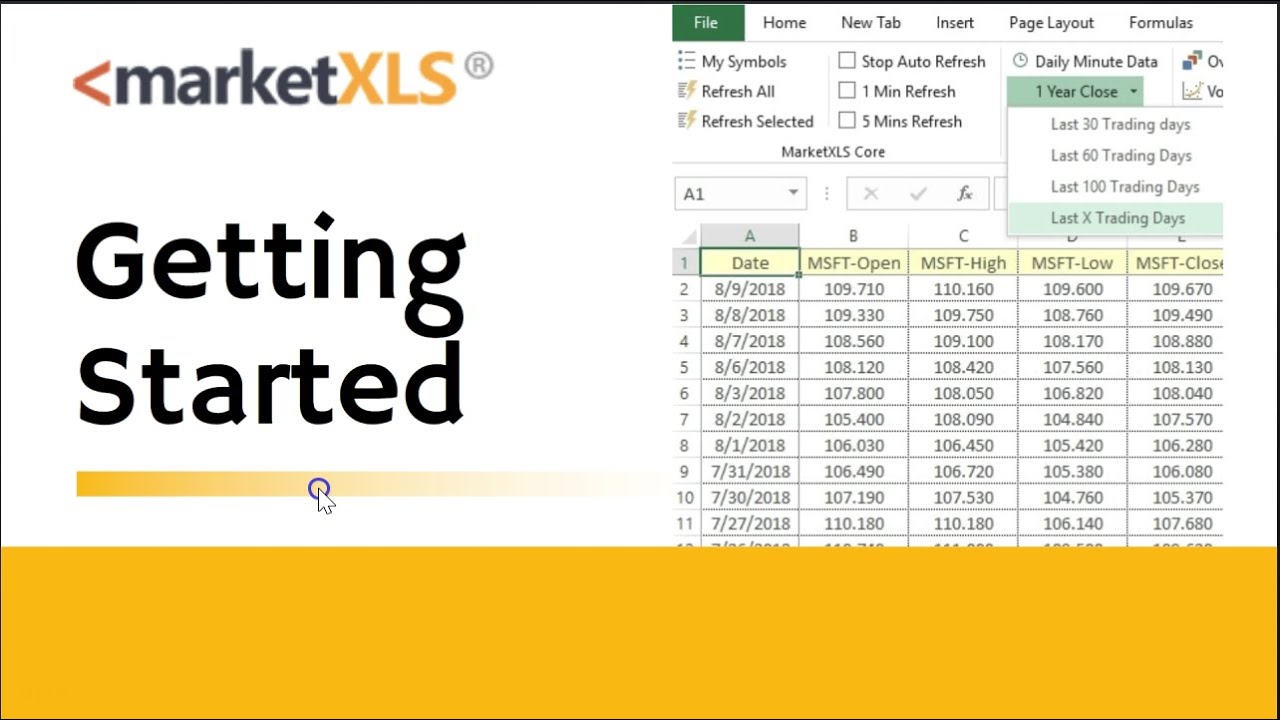

Template Screenshots

Get Access to 1 Billion Usable Market data points IN YOUR EXCEL SHEETS WITH EASY TO USE EXCEL FUNCTIONS

Get started today

▶

How does MarketXLS work? Watch Demo

Similar Templates

No similar templates found