Portfolio Analytics

Description

Portfolio Analytics allows for a comprehensive, in-depth examination of a portfolio's performance, enabling investors to make informed and strategic decisions. This tool provides an array of key indicators such as Wealth Index, Sortino Ratio, Monthly Returns, and Drawdowns, providing valuable insight into the financial health and risk management of the portfolio. Furthermore, Portfolio Analytics efficiently tracks the weightings of various stocks within a portfolio and their value on specific dates.

This is illustrated with stocks like Microsoft (MSFT), Apple (AAPL), General Electric (GE), Enphase Energy (ENPH), Tesla (TSLA), American Airlines (AAL), Boeing (BA), NIO Inc (NIO), and Visa (V), each represented with a specific percentage of stock weight and value at given timeframes. Essential metrics like Value at Risk, Portfolio Volatility, and Positive Period are also part of this analysis, each of them contributing to a more thorough understanding of portfolio performance. Central to this analysis is the Efficient Frontier Chart Report. This visual representation provides an idea about the best possible return that can be achieved for a set level of risk. It also aids an investor in selecting a portfolio with optimal risk-reward characteristics. The data also includes key risk and performance measures like the Compound Annual Growth Rate (CAGR), Portfolio Beta, Treynor Ratio, Sharpe Ratio; and Maximum Drawdown, providing the full detail of return rate in relation to the risks taken.

Importantly, potential investors could see the results of an optimized allocation model, which is demonstrated here by the AIPortfolioOptimize results. This kind of detailed Portfolio Analytics is a powerful tool for both portfolio managers and individual investors, providing unparalleled insights into portfolio performance, risk, and potential returns. Armed with this knowledge, they can make well-informed decisions about portfolio adjustments and strategy.

Template Screenshots

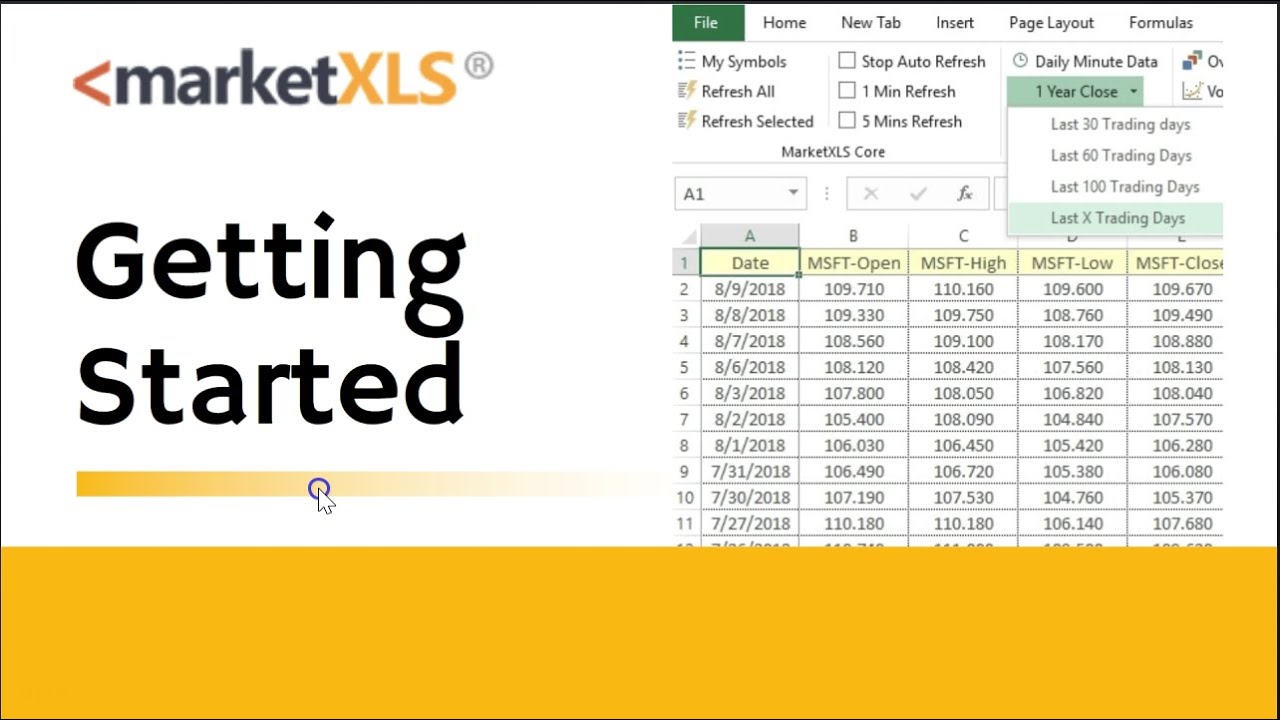

Get Access to 1 Billion Usable Market data points IN YOUR EXCEL SHEETS WITH EASY TO USE EXCEL FUNCTIONS

Get started today

Similar Templates

No similar templates found