← Back to Templates

Calculating Expected Stock Movement with MarketXLS: A Comprehensive Guide

Description

Basic Stock Information

- Current Stock Price:

Last(ticker)Returns the latest price for the specified stock ticker - Example: For MSFT at $422.37

- ATM Strike Price:

StrikeNext(ticker, 0)Identifies the nearest strike price - Example: For MSFT, strike of $422.50

- Expiration Date:

ExpirationNext(ticker, 0)Determines the next option expiration date - Time to Expiration:

ExpirationDate - TODAY()

Option Symbol Generation

- Call Option:

OptionSymbol(ticker, strike, "Call", expDate)Creates the symbol for the ATM call option - Example: MSFT 422.5 Call

- Put Option:

OptionSymbol(ticker, strike, "Put", expDate)Creates the symbol for the ATM put option - Example: MSFT 422.5 Put

Implied Volatility Calculation

- Call IV:

opt_ImpliedVolatility(ticker, callPrice, expDate, "Call", strike, 0.05)Calculates implied volatility for the call option - Example: MSFT Call IV = 0.318185

- Put IV:

opt_ImpliedVolatility(ticker, putPrice, expDate, "Put", strike, 0.05)Calculates implied volatility for the put option - Example: MSFT Put IV = 0.295719

- Average IV:

AVERAGE(CallIV, PutIV)Combines call and put IV for a balanced measure - Example: MSFT Average IV = 0.306952

Expected Move Formula

Copy Expected Move = CurrentPrice × AverageIV × √(DaysToExpiration/365)

In Excel format:

excel Copy =Last(ticker) * AVERAGE(CallIV, PutIV) * SQRT(DTE/365)

Example Calculation

For Microsoft (MSFT):

- Current Price: $422.37

- Days to Expiration: 2

- Average IV: 0.306952

- Expected Move: $9.5969

This means the stock is expected to move up or down by approximately $9.60 before expiration.

Notes

- All prices should be current market prices

- The 0.05 in the implied volatility calculation represents the risk-free rate

- The calculation uses calendar days, not trading days

- The expected move is symmetrical (same magnitude up or down)

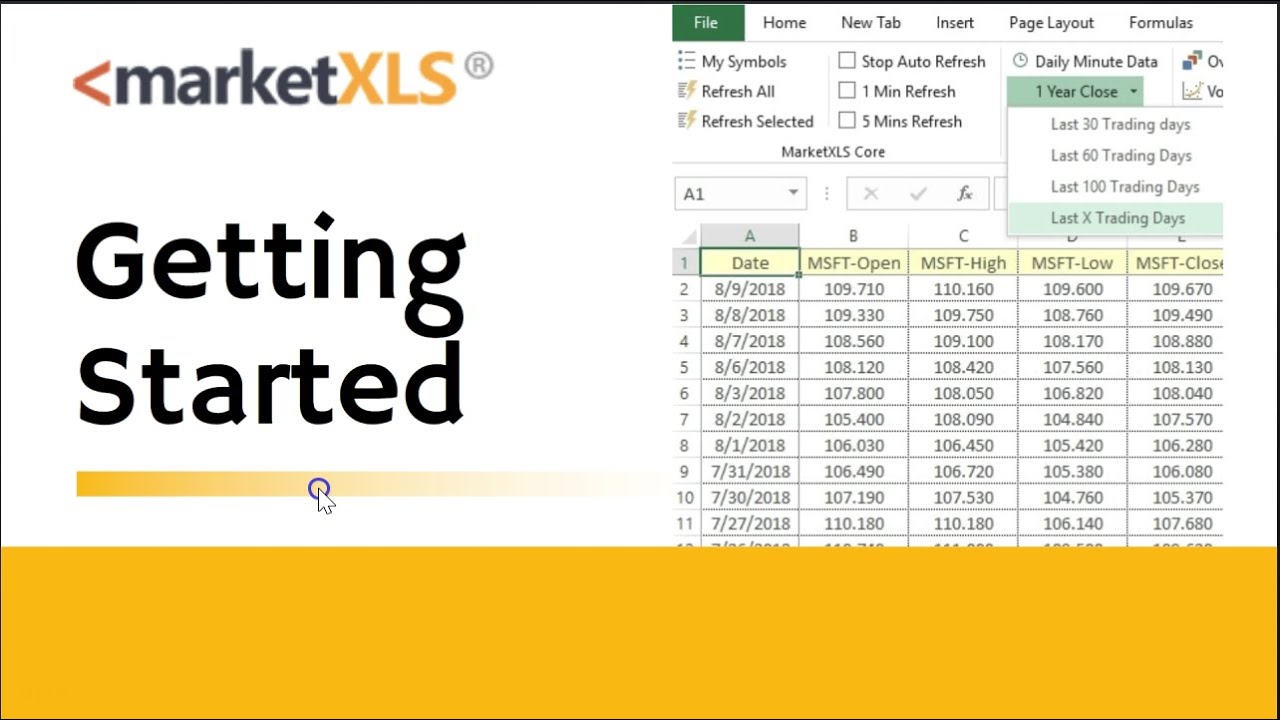

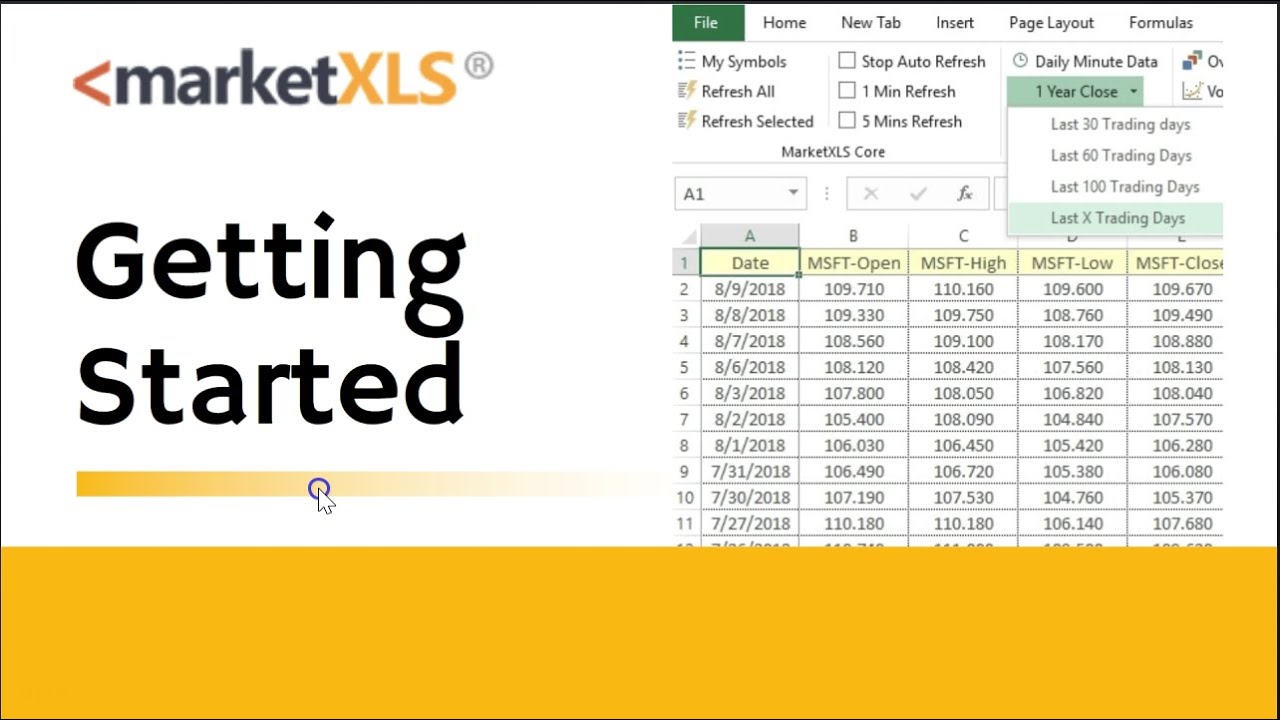

Template Screenshots

Get Access to 1 Billion Usable Market data points IN YOUR EXCEL SHEETS WITH EASY TO USE EXCEL FUNCTIONS

Get started today

▶

How does MarketXLS work? Watch Demo

Similar Templates

No similar templates found