Long calendar spread

A long calendar spread is a two-legged low volatility options strategy, which means a trader indulges in executing two option contracts while trading with this strategy. In the first leg, a trader writes option contracts, and the second leg involves buying option contacts at the same strike price. However, the expiry dates are different on both legs. The long trade has an expiry farther in-the-money than the short trade. This is how the strategy got its name. Long, because the long put option is farther in-the-money, and calendar spread depicts the expiry dates’ gap. Option strategies tend to have names that exactly defines their feature. The same is the case with the long calendar spread.

But why different expiry dates? That’s because the trader is betting against volatility and his losses will be humongous if the stock fluctuates a lot irrespective of the direction. He will be benefited the most when the stock hovers around the strike. The expiry date gap serves as a buffer for the volatility to recede and move back as near as possible to the strike price.

Normally, I like to explain option strategies with MS excel templates that our website provides. The long calendar spread concept will be much more precise in this article’s execution and payoff segments.

Trading with MS excel

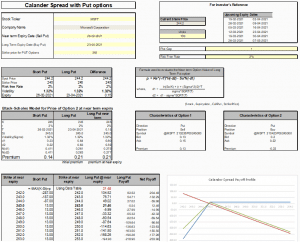

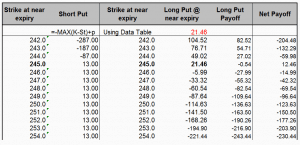

Below is a screenshot of the complete excel template that marketXLS provides for this strategy. This template has five major components. Let’s break them down one by one.

Input by user

In this section, you put the stock ticker and the expiry for the option of that underlying. You can select the expiry from the section “for investor’s reference.” Here, we have taken the example of MSFT (Microsoft Corporation) with an expiry of 26-02-2021 for short put contracts and 23-04-2021 for long put contracts.

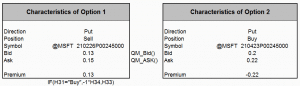

Execution

A long calendar spread with put involves two legs- selling and buying contracts at a different expiry. As I am writing this article, MSFT shares are trading at around $231. Hence, the first leg will be selling puts at a strike $245 expiring on 26-02-2021, and the second leg will involve buying puts at the same strike expiring on 23-04-2021. As a result, a net debit spread of $7(422-413) is created, which the trader will pay to open this trade. This is the premium you will pay to open this trade.

Payoff

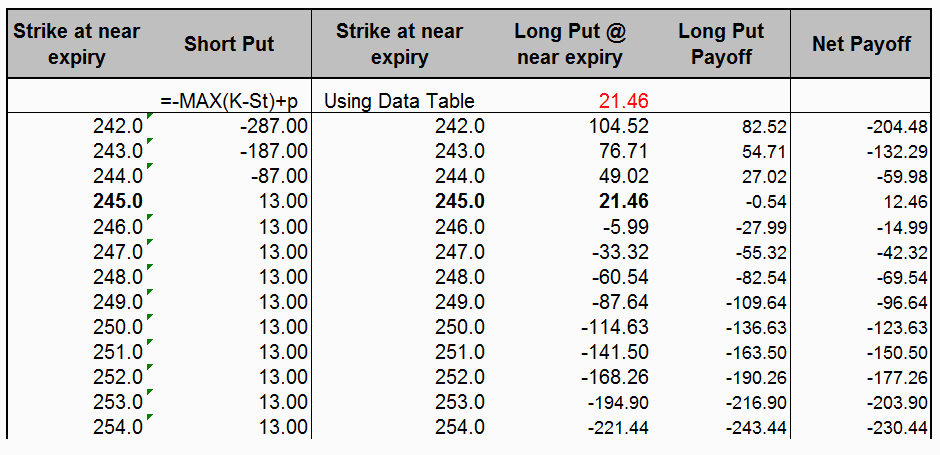

Below is an analysis of how the payoffs would pan out at different prices of the underlying. As you can see from the picture, the maximum loss is unlimited on either side. However, the losses are minimized to a certain extent because of the introduction of one more leg. The maximum profit is when the stock ends up around the strike price, which $12. The slightest move of the stock on either direction would turn the trade around. Therefore, one has to be very sure about the stock’s volatility and only look at reliable sources.

Key takeaways

• The Long calendar spread involves executing two legs- writing puts and then buying puts at the same strike price but with different expiry dates.

Disclaimer

None of the content published on marketxls.com constitutes a recommendation that any particular security, portfolio of securities, transaction, or investment strategy is suitable for any specific person.

The author is not offering any professional advice of any kind. The reader should consult a professional financial advisor to determine their suitability for any strategies discussed herein.

the article is written for helping users collect the required information from various sources deemed to be an authority in their content. The trademarks if any are the property of their owners and no representations are made.

References

Learn more about the long calendar spread here.